What Is Insider Trading Why Is It Prohibited

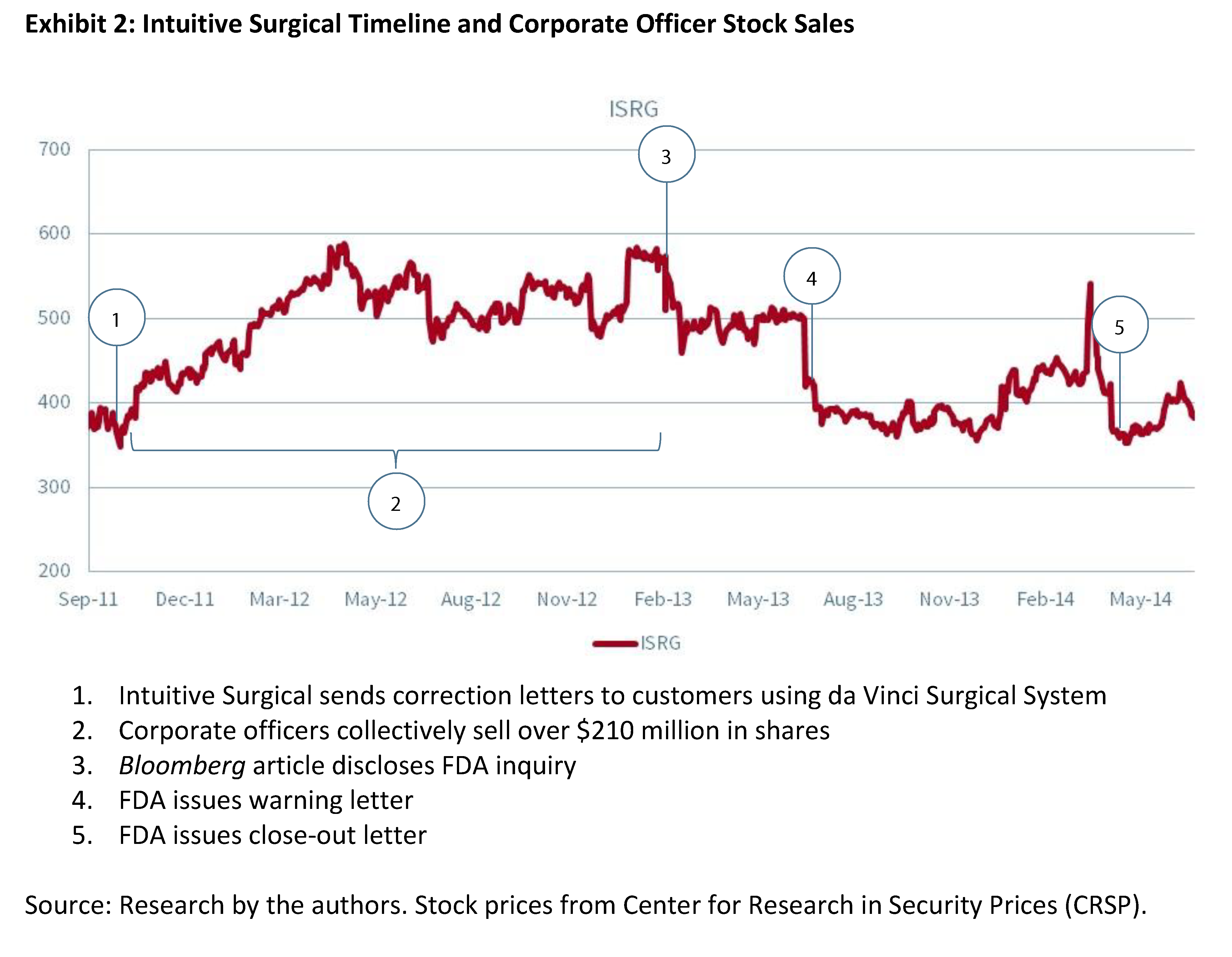

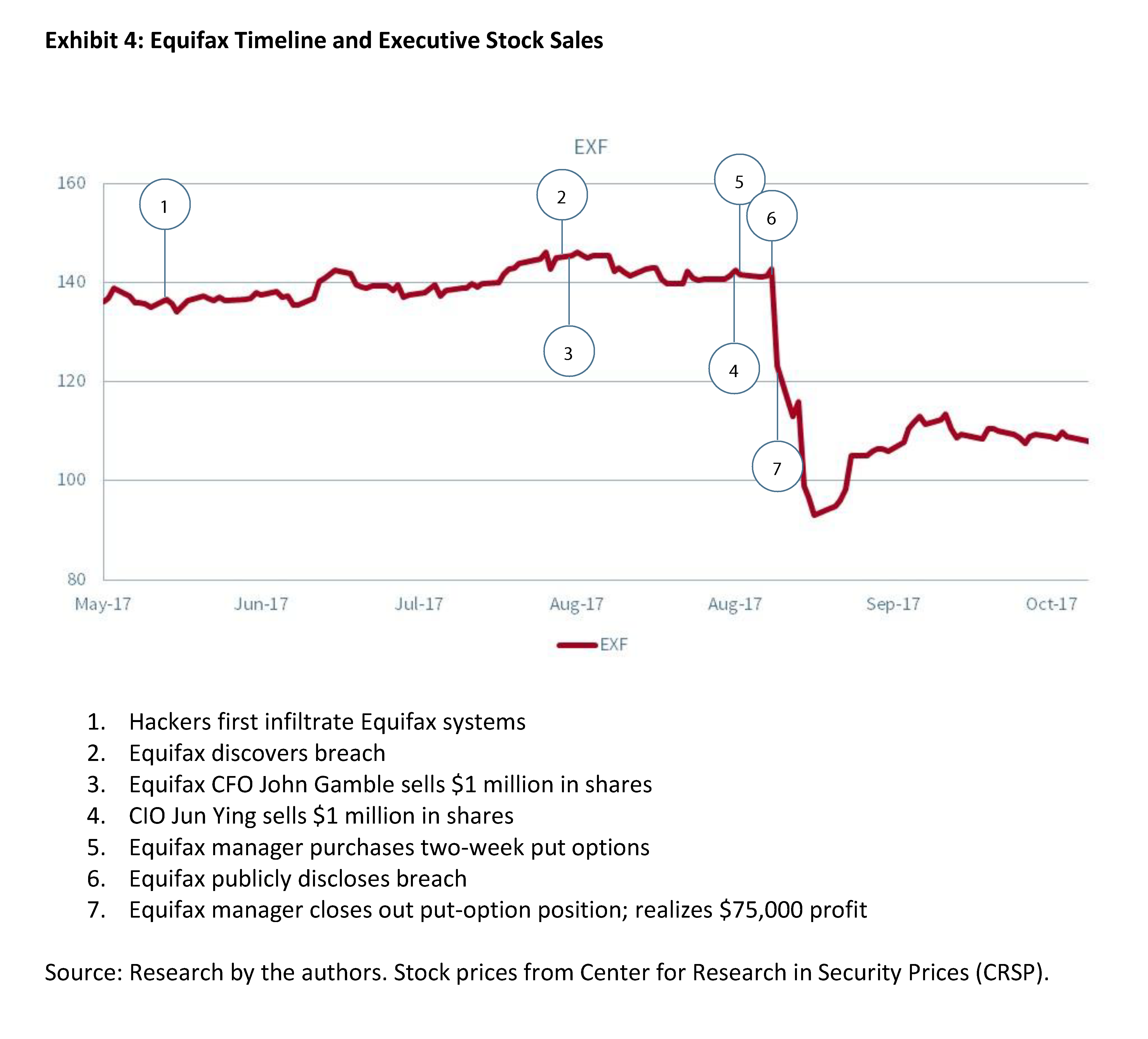

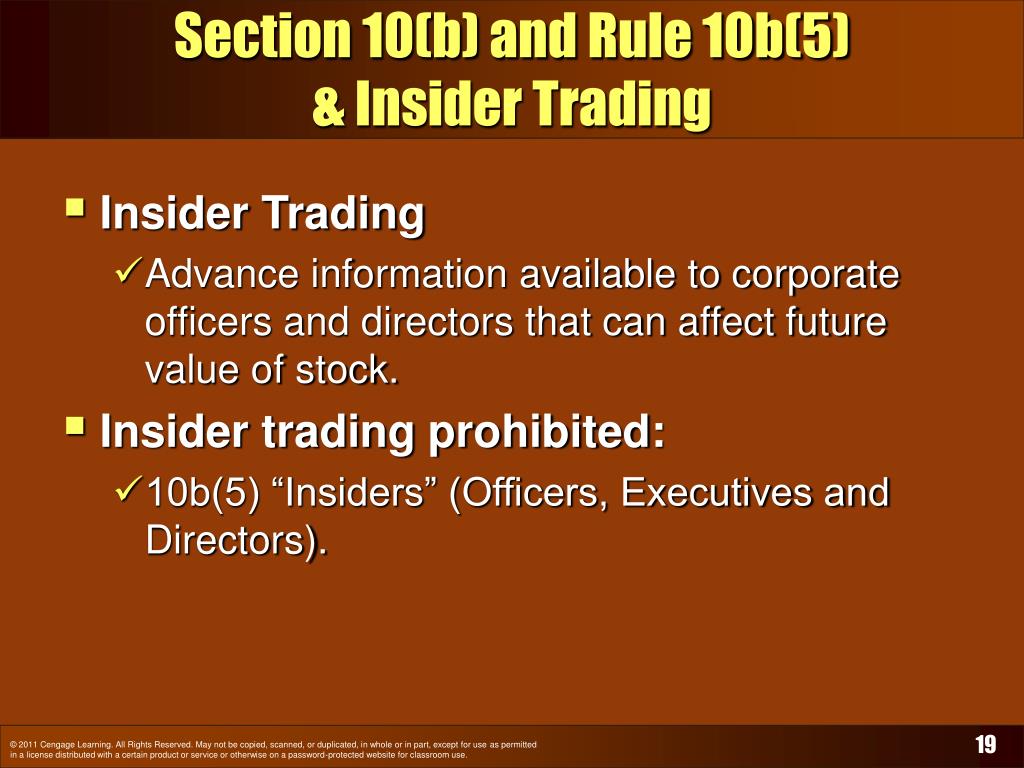

It involves a direct breach of fiduciary duty or other violation of trust in which the trader uses insider knowledge to benefit financially.

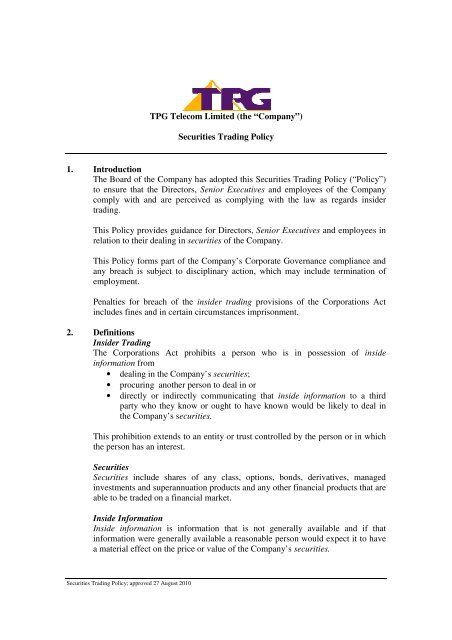

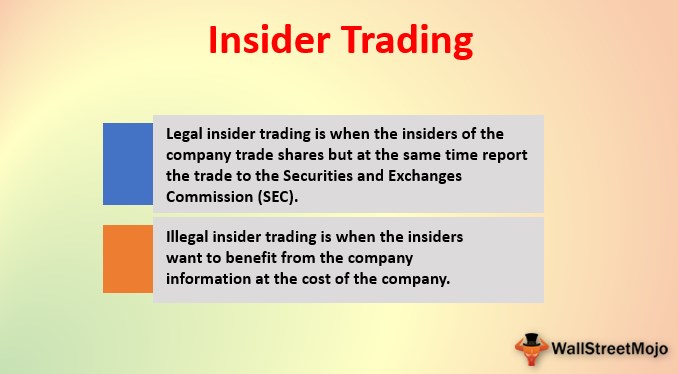

What is insider trading why is it prohibited. By definition this illicit form of insider trading is the illegal practice of trading on the stock exchange to one s own advantage through having access to confidential information. Illegal insider trading is when the insiders want to benefit from the company information at the cost of the company. Civilly the penalties can be as large as three times the gross profit on the trading.

Related video with what is insider trading in stock markets. Updated july 29 2020 insider trading is the purchase or sale of stocks or other securities based on information that is not available to the general public. Insider trading the legal and illegal illegal insider trading is a serious securities law violation which carries potential civil and criminal penalties.

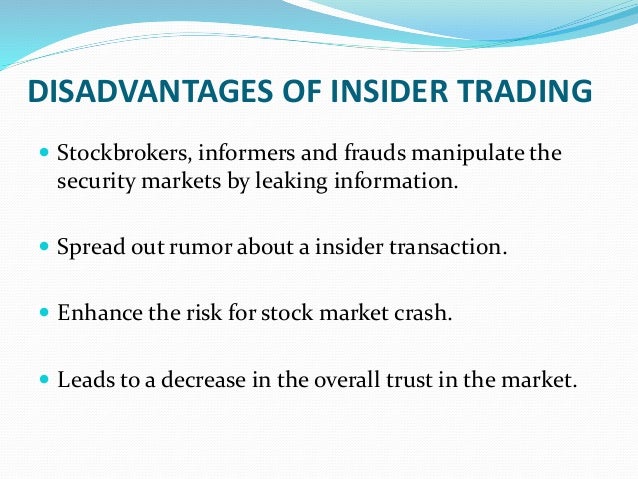

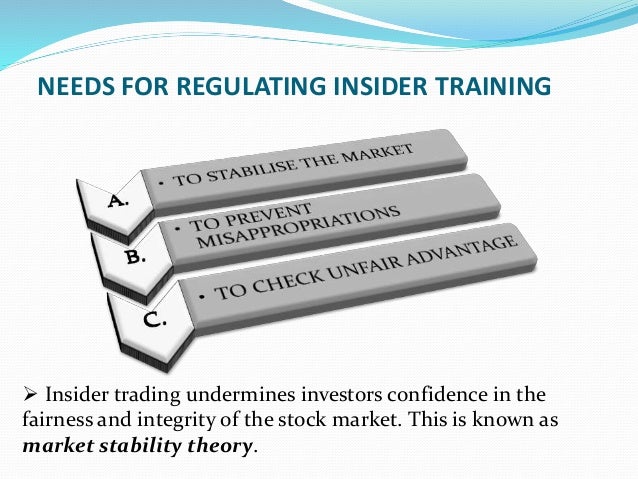

Prevent people from using and markets from adjusting to the most accurate and timely information. Obviously the reason insider trading is illegal is because it gives the insider an unfair advantage in the market puts the interests of the insider above those to whom he or she owes a fiduciary duty and allows an insider to artificially influence the value of a company s stocks. Legal vs illegal insider trading perfect storm brewing for gold.

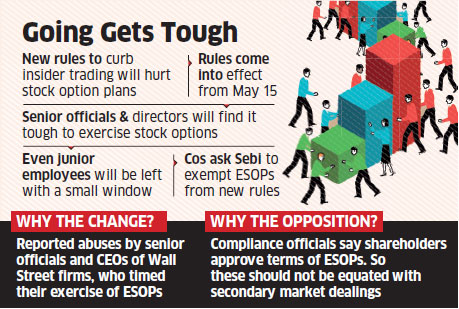

The rules target non public. The objective of insider trading laws is counter intuitive. Trading gold now with cnbc s melissa lee and the options action traders.

As for why it s illegal there is a fairly good argument that insider trading hurts entry into the stock market by outsiders which weakens the economy considerably. Gold has its worst week since november. Perfect storm brewing for gold.

Nobody would want to trade because they feel that they will never have the access to information that they need to make money off of everyone else.

/GettyImages-490556036-1f443237f9864342b101cd301a12aeec.jpg)

:max_bytes(150000):strip_icc()/GettyImages-1141708100-fbc532e65f1248ba9e5118aa2f5359e4.jpg)

/InsiderTrading-56ae797d5f9b58b7d0108a83.jpg)

:max_bytes(150000):strip_icc():saturation(0.2):brightness(10):contrast(5)/GettyImages-74579982-e0de5d285545443181845c483d92bfe0.jpg)