Convergence Trading

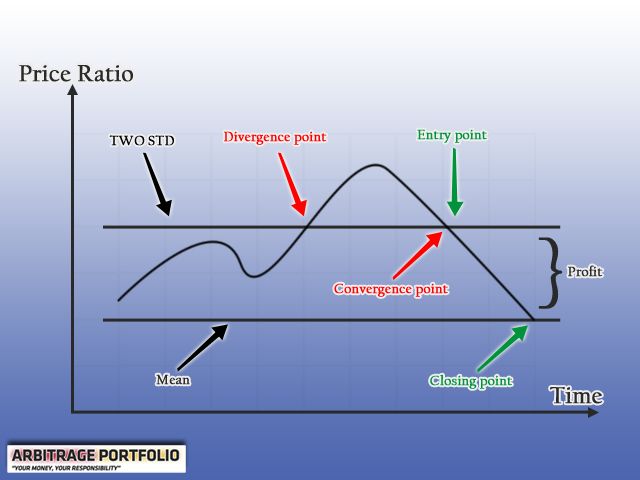

The aim is for the prices of the securities to converge resulting in profit.

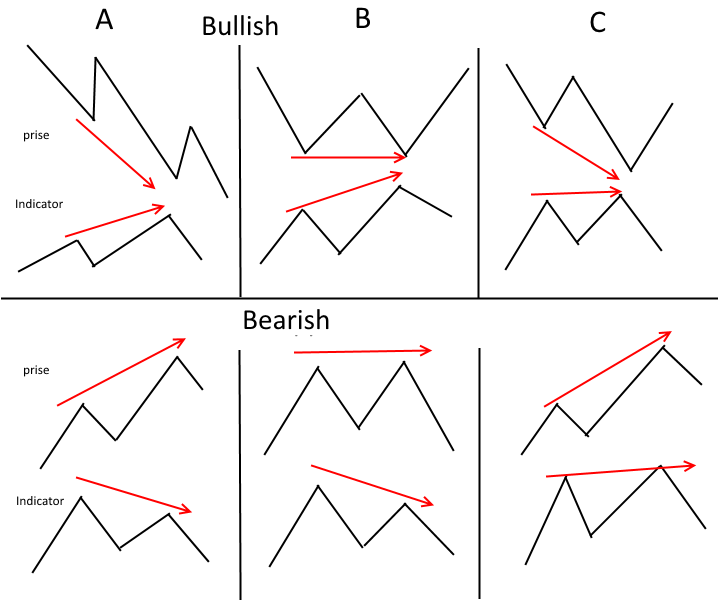

Convergence trading. Develop your trading skillset with our live convergence events webinars. For instance let s assume a situation in which market prices show an uptrend and so does our technical indicator. Convergence trade is a trading strategy consisting of two positions.

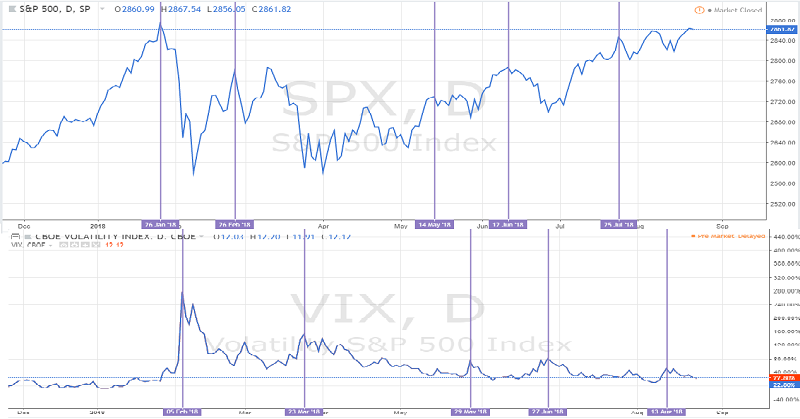

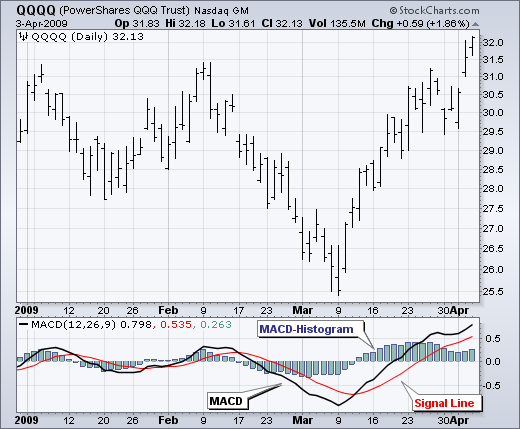

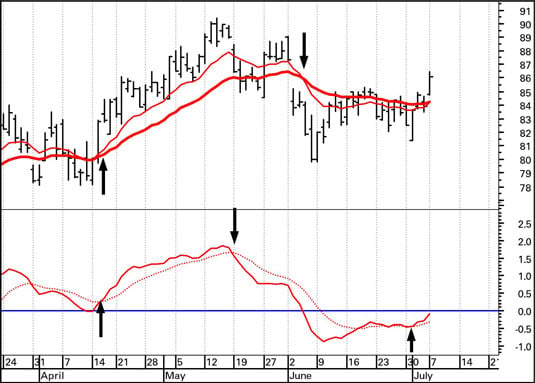

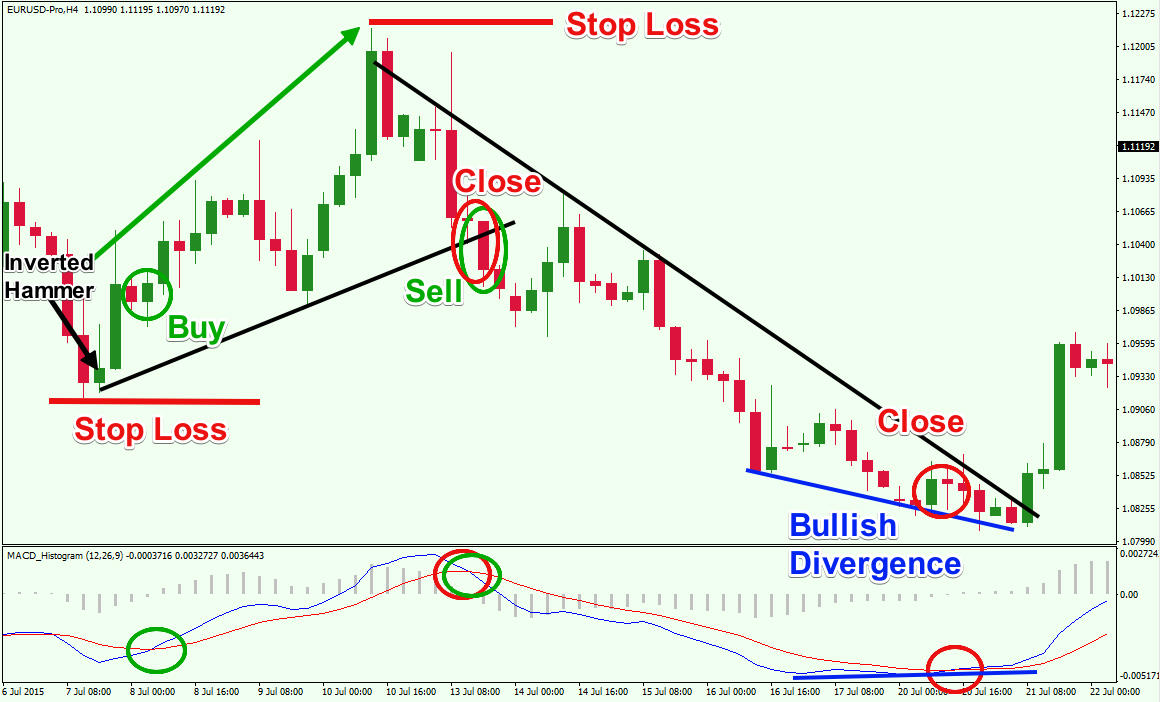

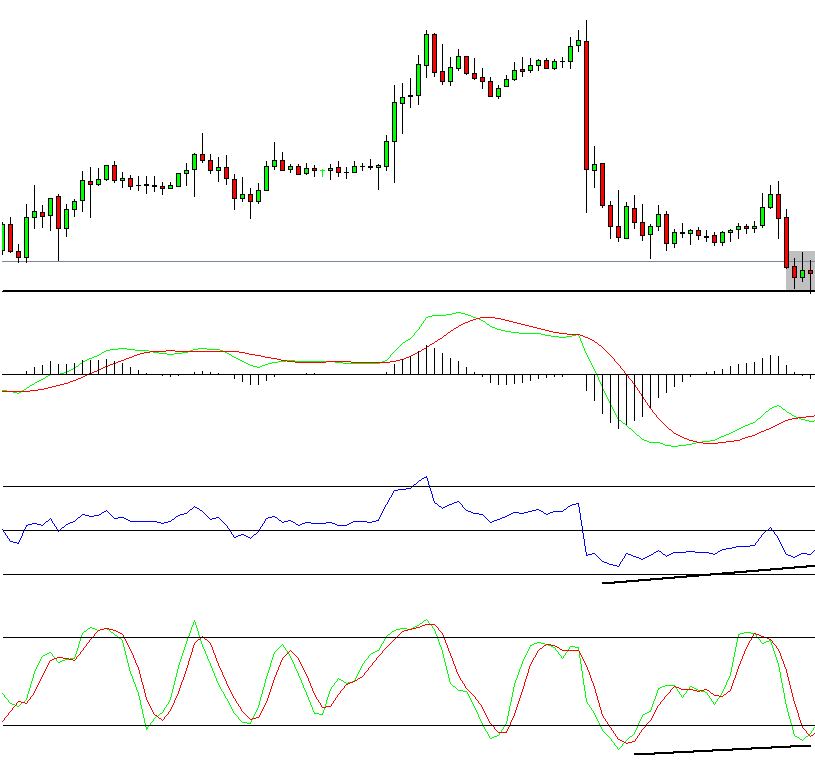

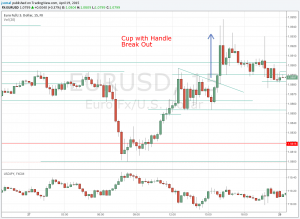

Notice the weakening momentum in moving average convergence divergence macd as price enters a range. Convergence trade is the practice of buying a security with a future delivery date for a low price and selling a similar security also with a future delivery date for a higher price. Access powerful chart definitions actionable market studies research and clear auction trade examples updated as they occur.

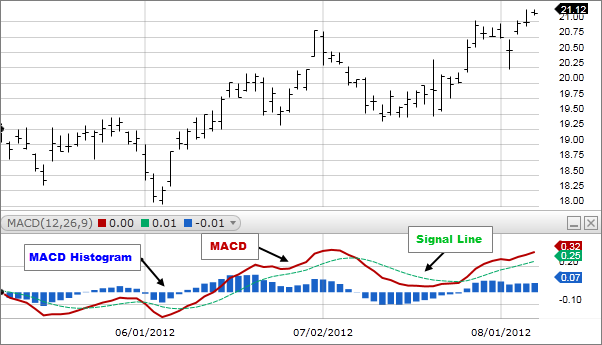

Convergence lms deliver cutting edge training with our flagship software and elearning platform. Opinions market data and recommendations are subject to change without notice. Macdie is the macd moving average convergence divergence indicator and is part of the keeping it simple series that have a similar color scheme.

Buying security going long the asset with a future delivery date or expiration date but for a low price. When price and the indicator are. Selling similar security going short the asset with a future delivery or expiration date but for a higher price.

Professional resources at your fingertips. Buying one asset forward i e for delivery in future going long the asset and selling a similar asset forward going short the asset for a higher price in the expectation that by the time the assets must be delivered the prices will have become closer to equal will have converged and thus one profits by the amount of convergence. Access exclusive trading resources.

Trading futures and options on futures involves substantial risk of loss and is not suitable for all investors. With any convergence lms option you ll be using the most advanced training tools on the market to automate workforce training increase knowledge and improve performance for you entire team. Convergence trading is an investing strategy that involves constructing two positions at the same time.

The macd can show trend and strength of an asset while also showing divergences. Past performance is not indicative of future results. Convergence is the movement in the price of a futures contract toward the spot or cash price of the underlying commodity over time.

Macd is based on the difference between two moving averages calculated for different periods typically 12 and 26. Where have you heard about convergence trade.

:max_bytes(150000):strip_icc()/Figure1-5c425ae246e0fb0001296aaf.png)

:max_bytes(150000):strip_icc()/Figure2-5c425aecc9e77c0001bc2f4f.png)