What Is Daily Trading In India

/day-trading-tips-for-beginners-on-getting-started-4047240_FINAL-e9aa119145324592addceb3298e8007c.png)

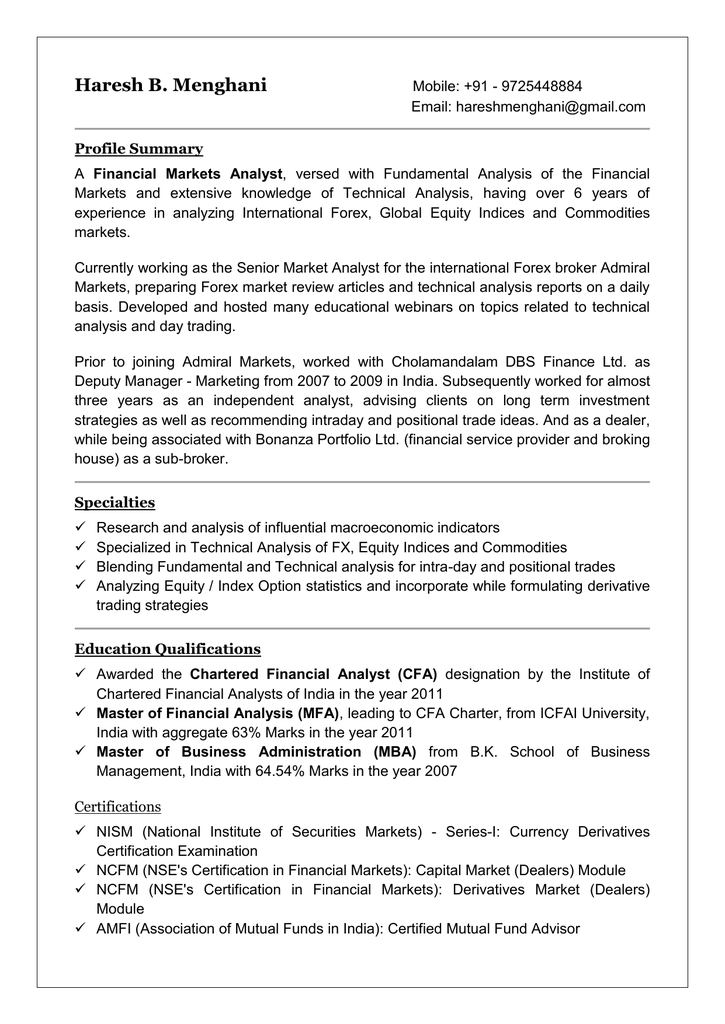

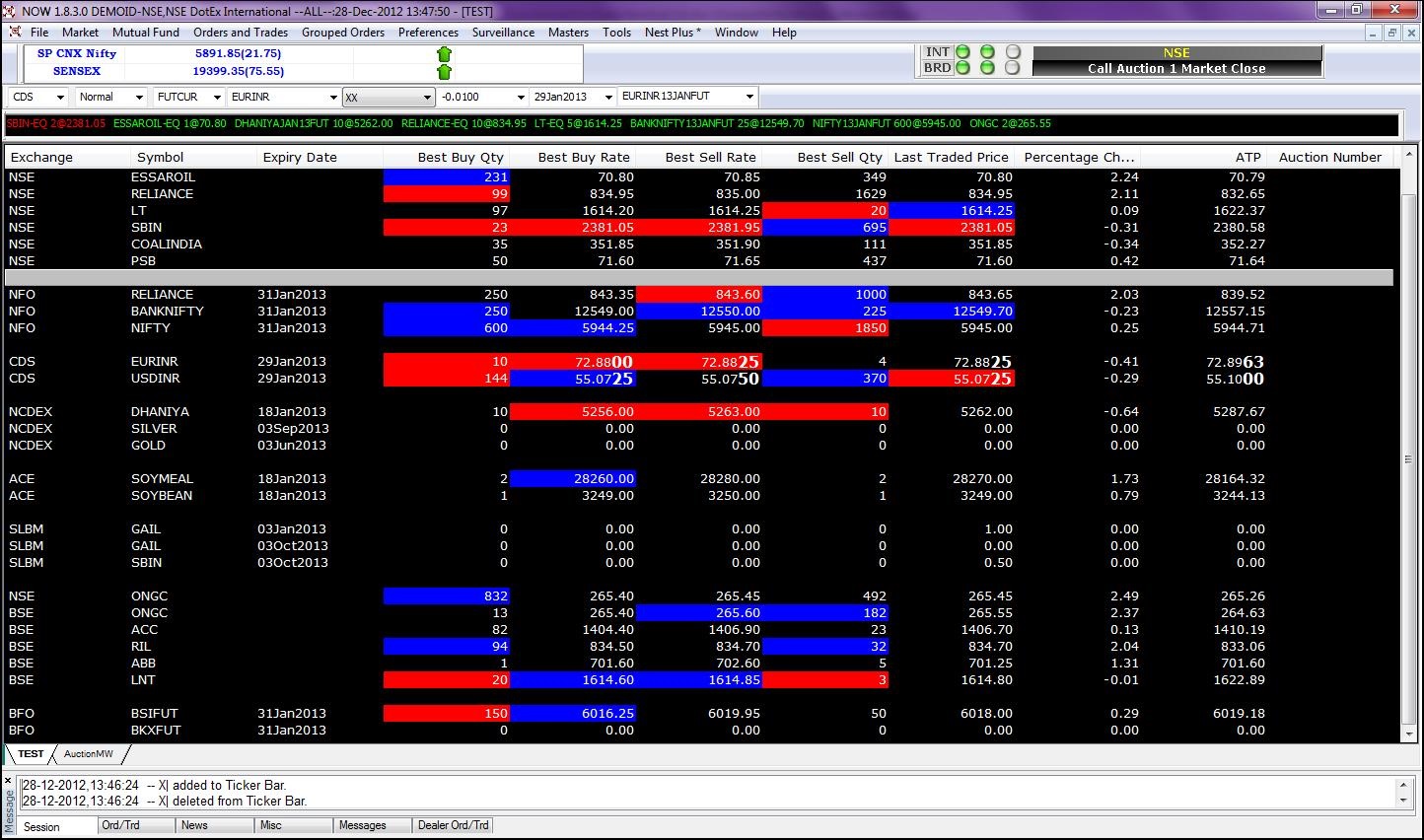

Buying or selling of shares some of them are quite popular like brokerage charge gst while there are many others that the traders and investors are not aware of.

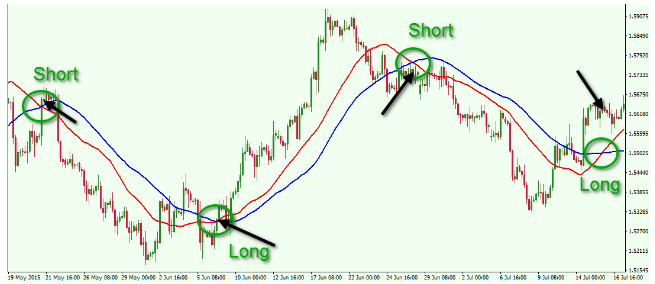

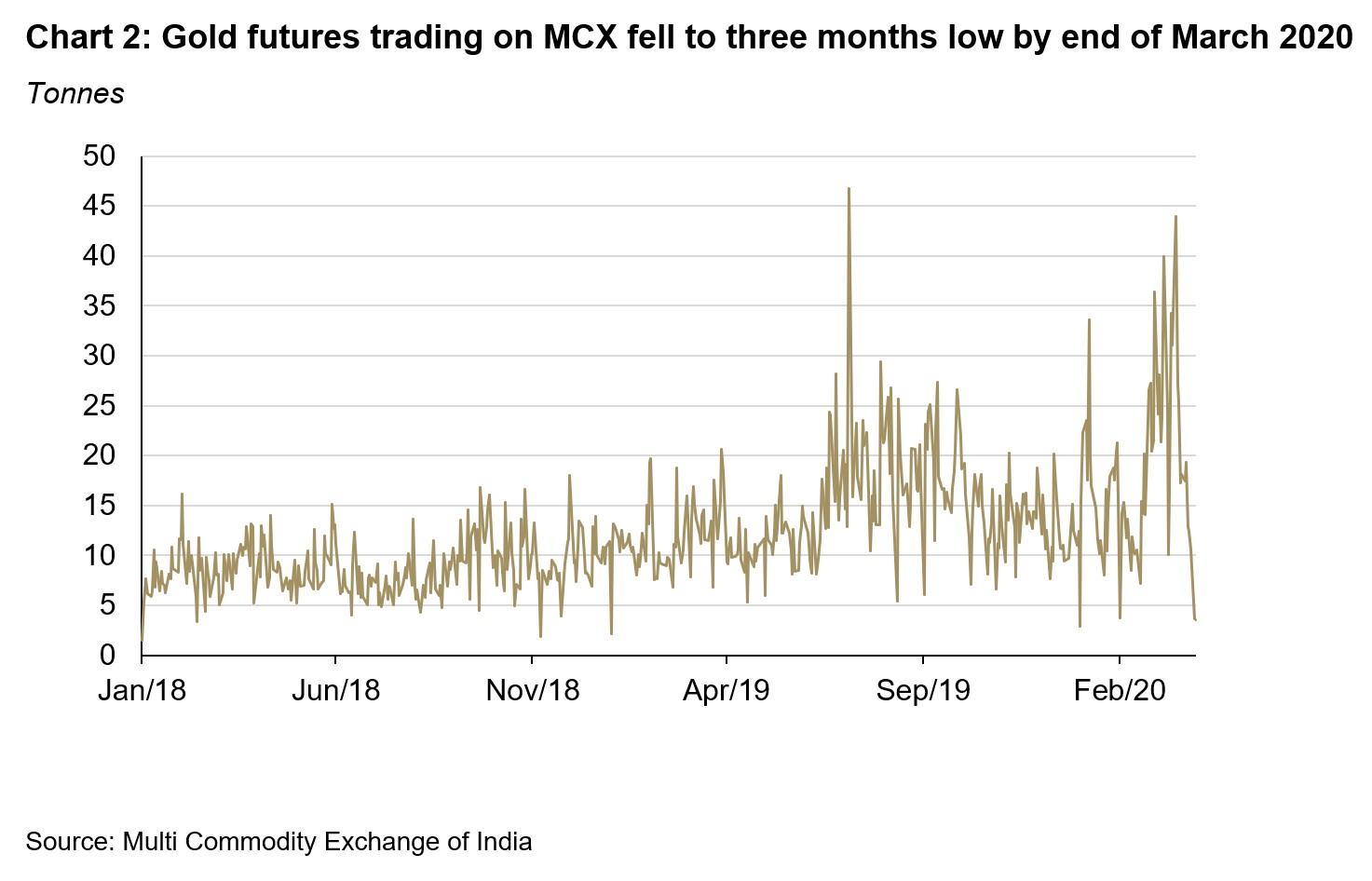

What is daily trading in india. So first gain experience by trading with small amount and then you can move on to earning rs 5000 daily profit. There are a number of charges and taxes involved while trading in india i e. For example if you purchase 50 shares of tata motors in the morning you ll have sold your position by the end of the trading day and then start from scratch the following morning.

Different charges on share trading explained. Intraday trading is the most popular thing in indian stock market specially amongst new generations. Important advice instead of looking for daily profits look for monthly profits so this will not force you to make daily unwanted trades and it will.

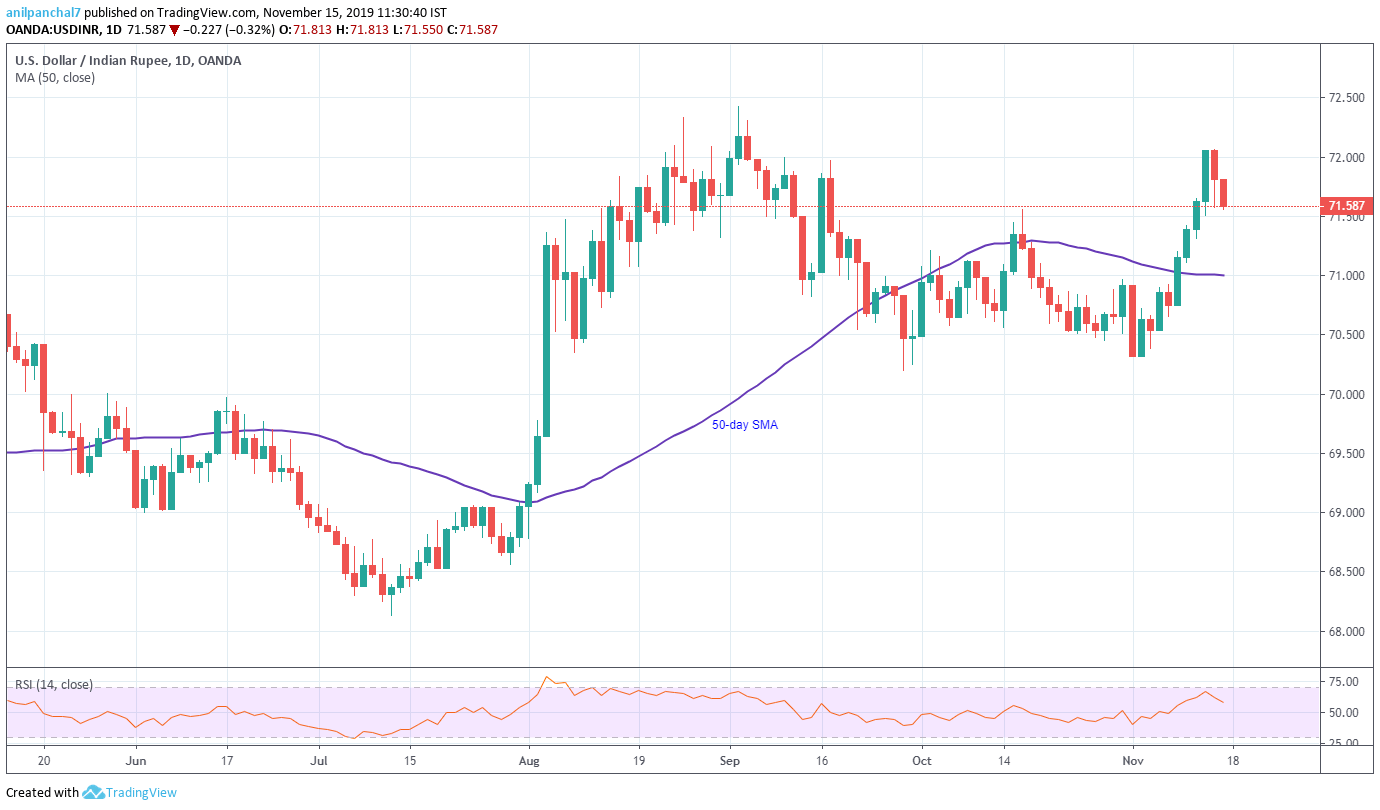

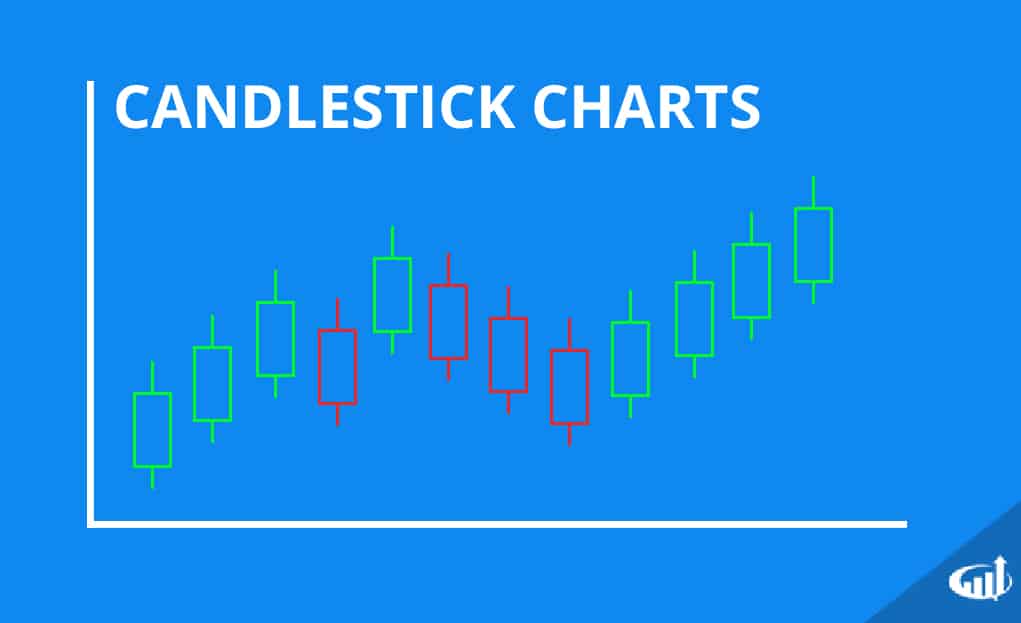

Day trading is the act of buying and selling a financial instrument within the same day or even multiple times over the course of a day. Stock market fluctuations every time gives trader surprises and therefore trader should be ready to accept and challenge the unexpected. Just come with small capital and use leverage to trade.

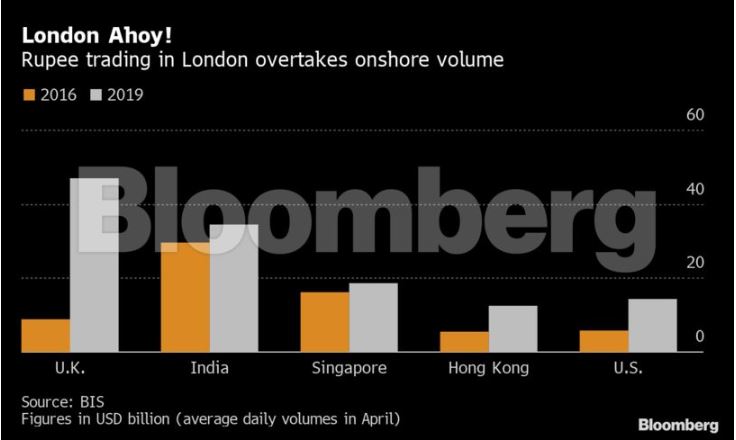

The bombay stock exchange bse and the national stock exchange nse. Taking advantage of small price moves can be a lucrative. Now it s very easy to maximize the daily profit using intraday trading techniques strategies in nse india.

Section 43 5 of the income tax act states that any such profits will be added to your other income. The bse has been in existence since. Most of the trading in the indian stock market takes place on its two stock exchanges.

Rather we suggest start earning small amount and slowly move to higher profits. An intra day trader is a particular type of stock trader. Any trade where you and buy and sell a security on the same trading day will count as a day trade.

The definition of day trading is the buying and selling of a security in a single trading day. Brokerage stt dp more updated.

/GettyImages-651455230-59b6e0a803f4020010c91fdb.jpg)

/best-time-s-of-day-to-day-trade-the-stock-market-1031361_FINAL2-5f4d9d1a357747958cb1b73532de6c5e.png)

/day-trading-versus-swing-trading-58d2b0783df78c5162052d77.jpg)