Physical Commodities Trading

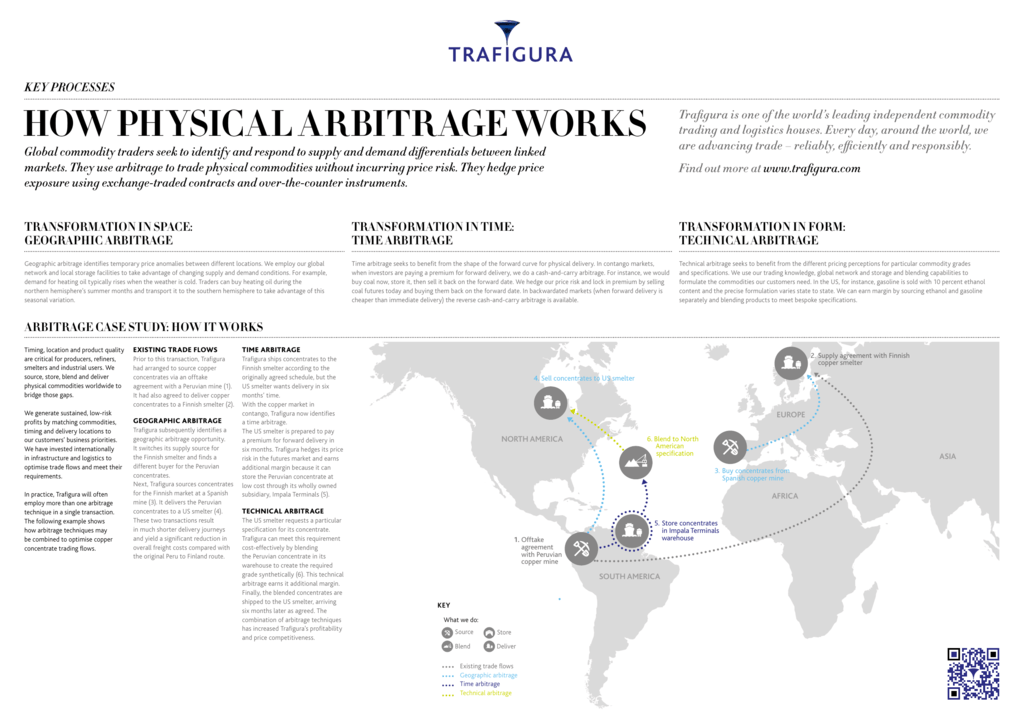

They use arbitrage to trade physical commodities without incurring price risk.

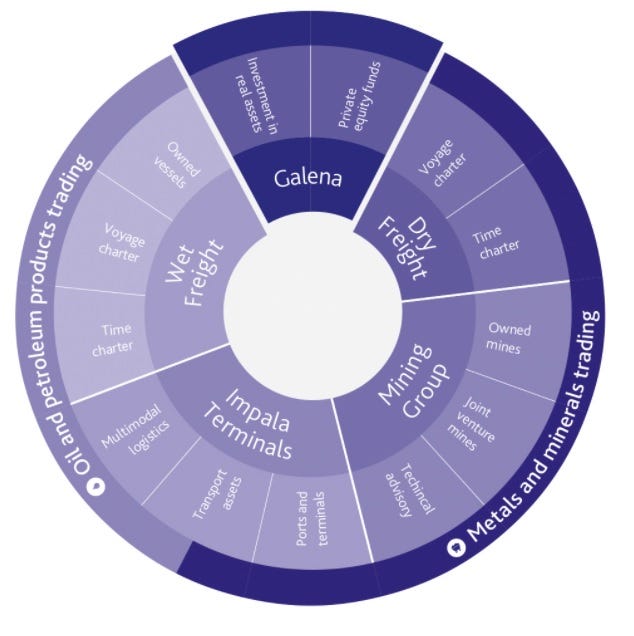

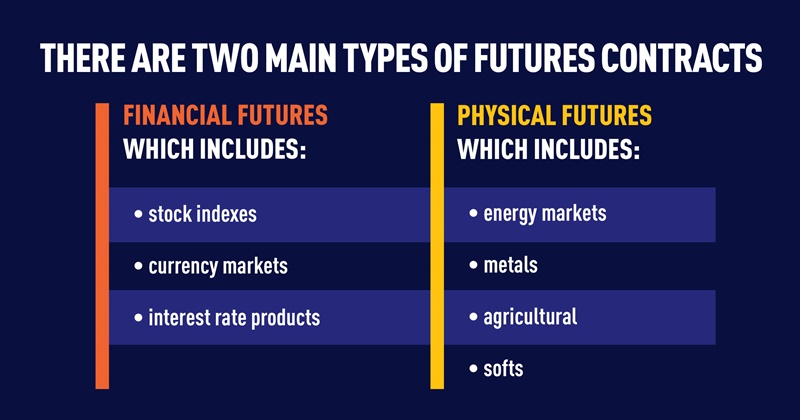

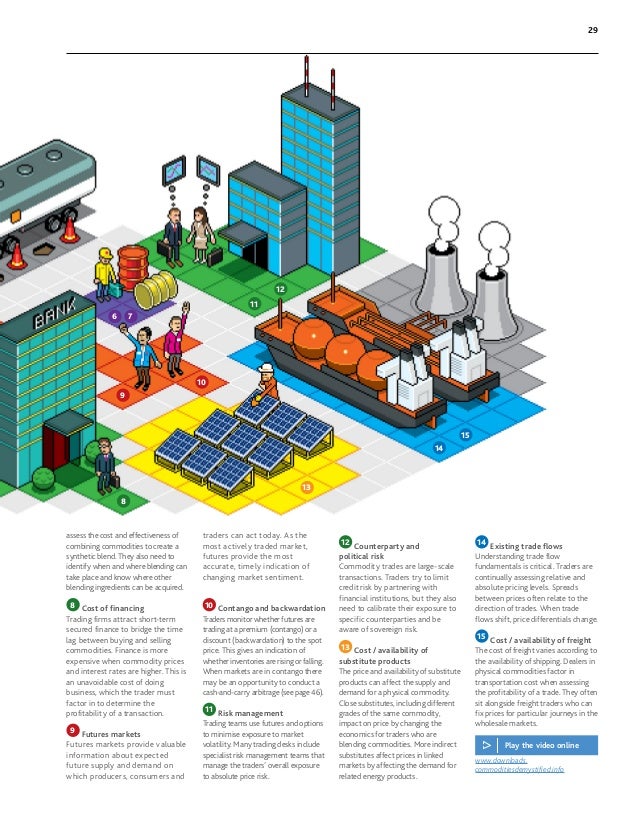

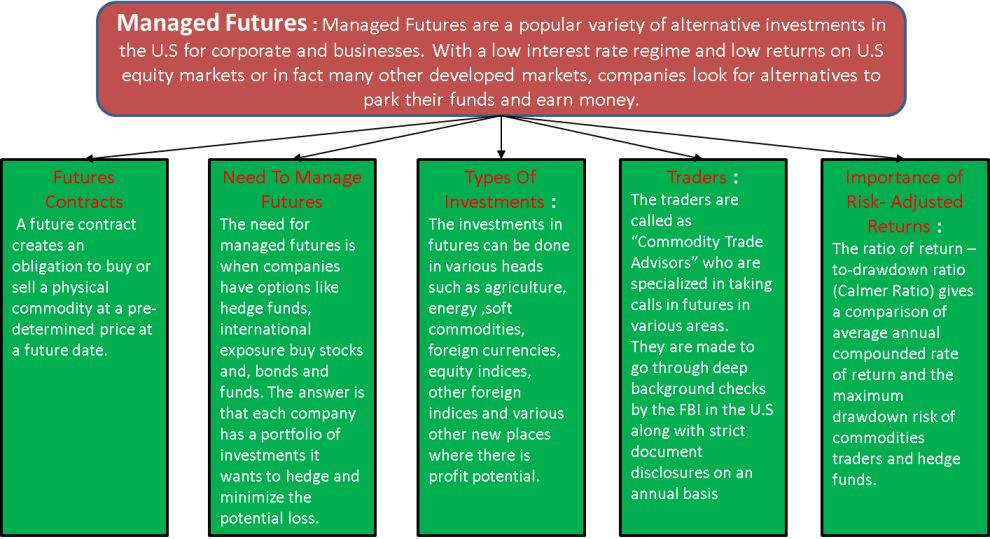

Physical commodities trading. Several online retail brokers offer trading in both of these types of securities however some brokers specialize in futures trading. Because you can literally take delivery of the product you are trading logistics are factored in as you own large parts of the value chain. A commodities exchange is a legal entity that determines and enforces rules and procedures for trading standardized commodity contracts and related investment products.

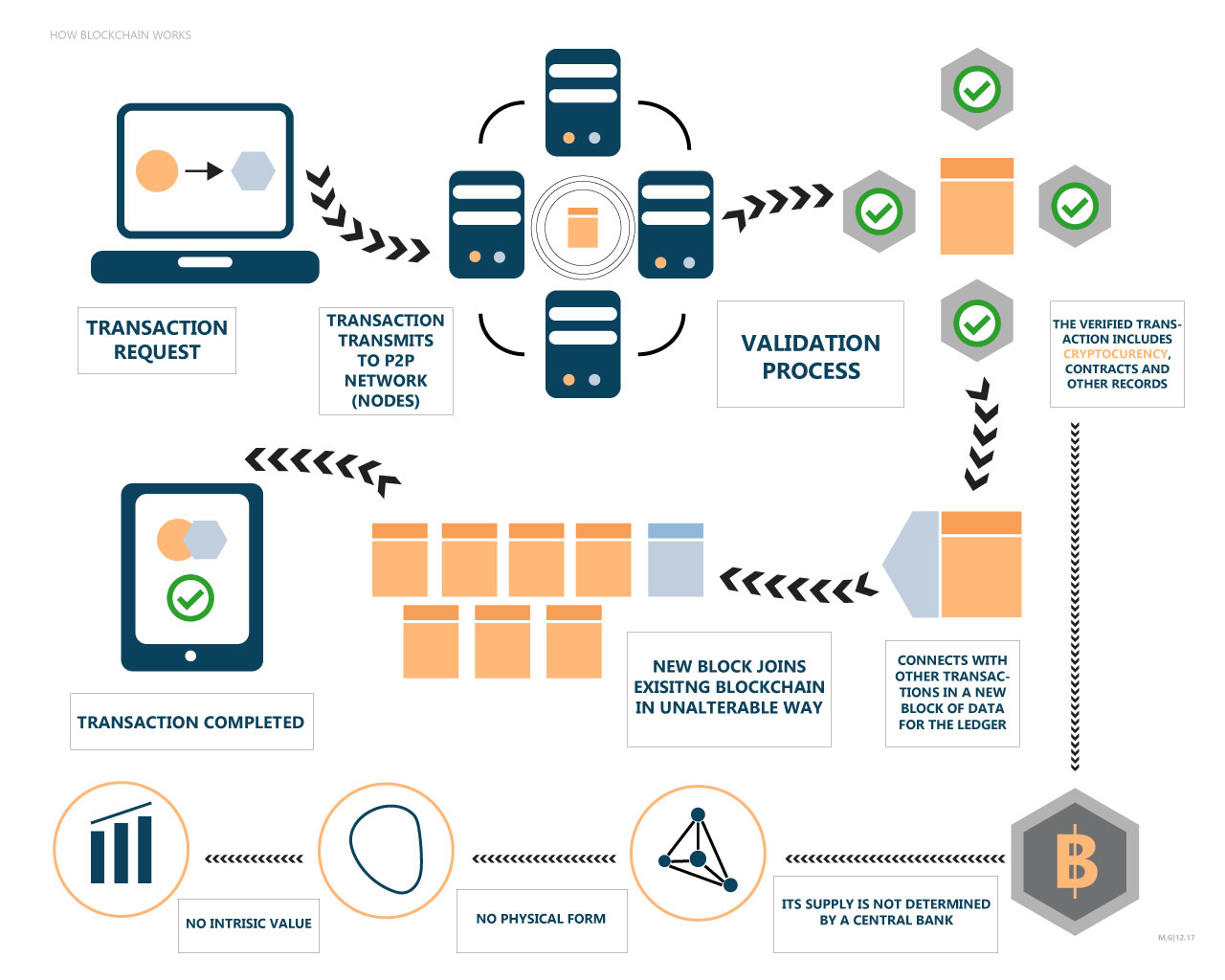

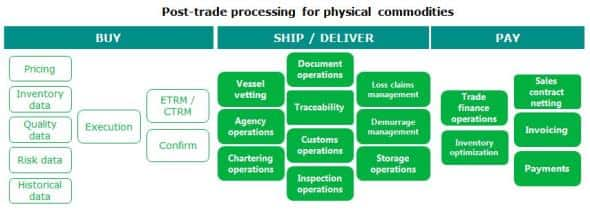

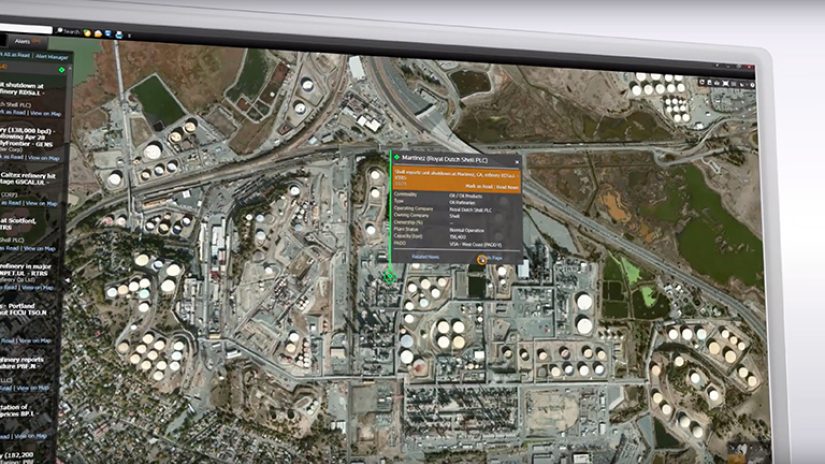

Global commodity traders seek to identify and respond to supply and demand differentials between linked markets. A decentralized commodities trading platform significantly transforms and enhances international physical commodity trading across its whole product life cycle. Coverage of shipping market segments crucial to physical commodities trade.

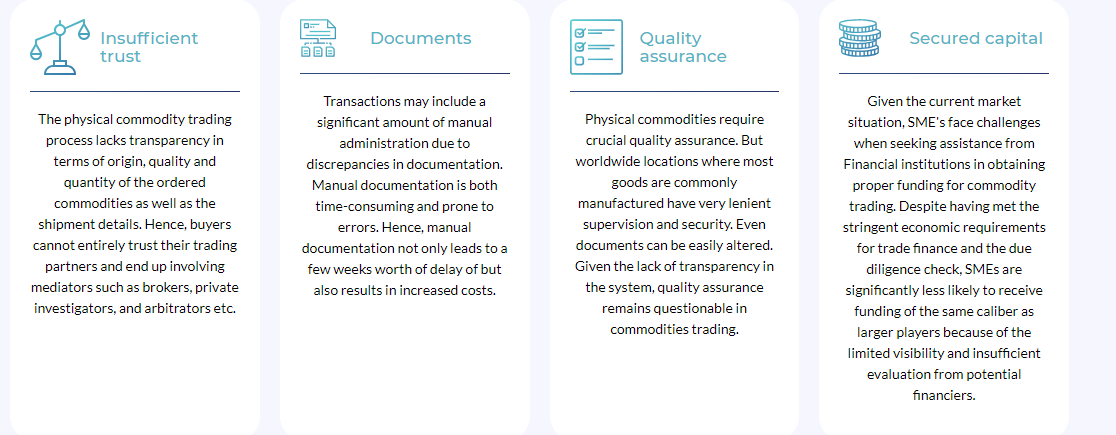

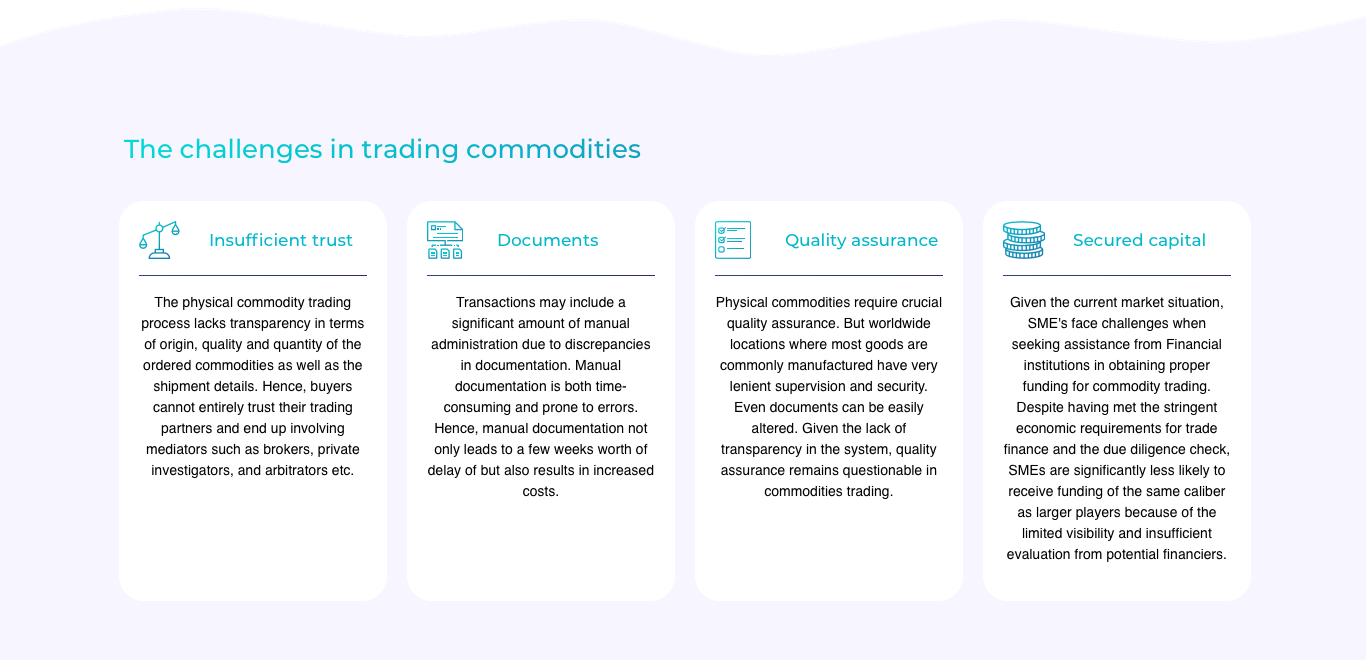

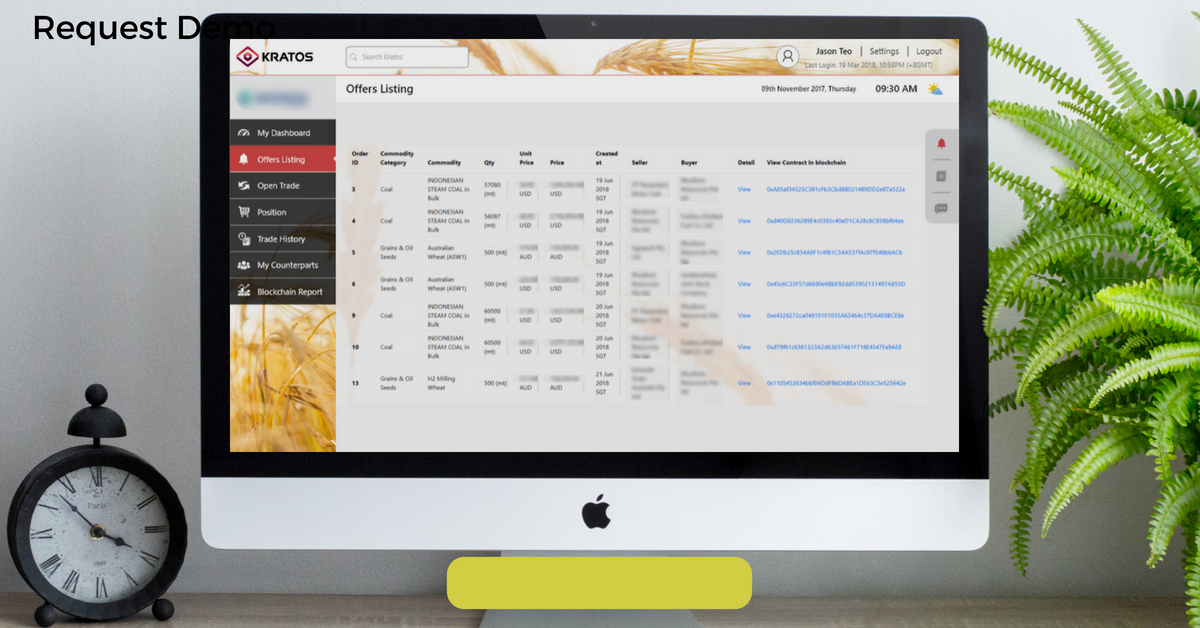

These problems often result in significant time delays and high cost. A commodities exchange refers both to a physical location where the trading of commodities takes place and to legal entities that have been formed in order to enforce the rules for the trading of. How physical arbitrage works.

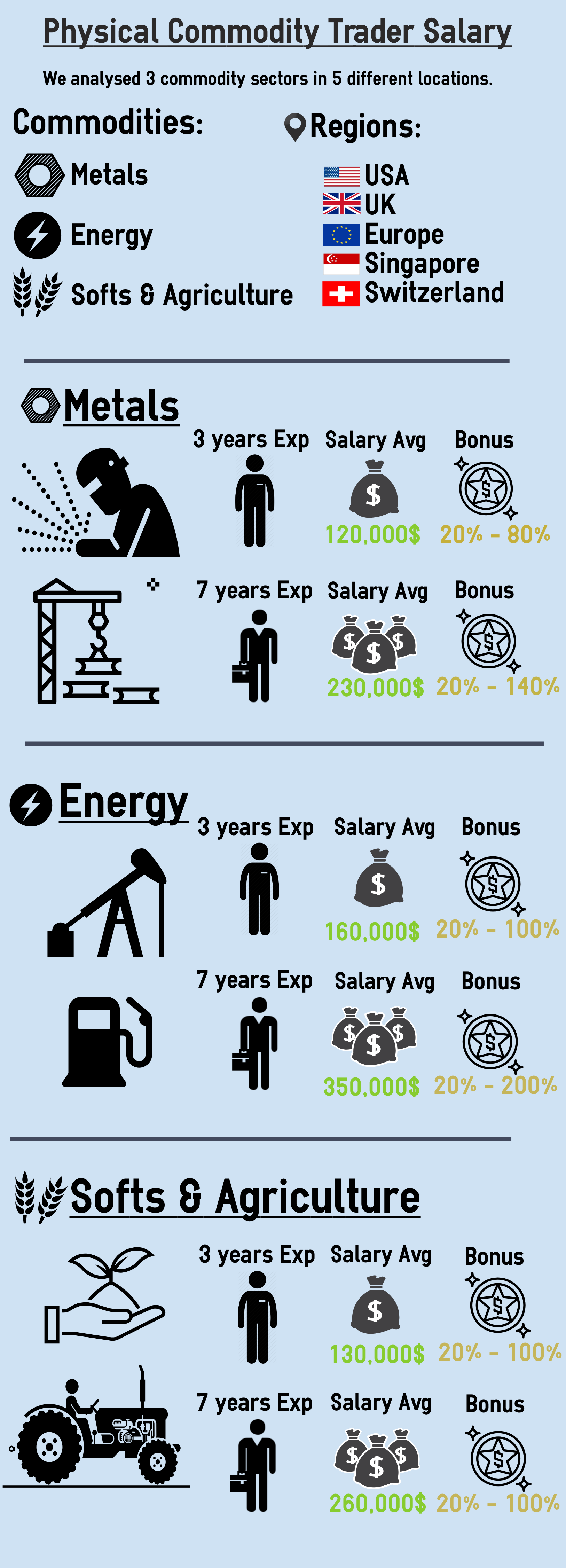

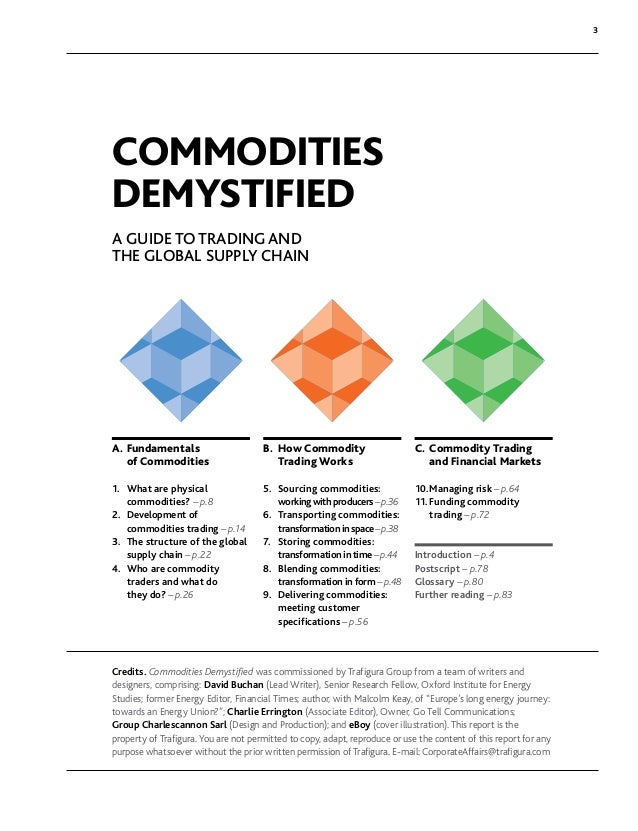

Quality of content unique perspective pragmatic approach sense of humor action oriented summaries and last but not least attention to physical side of commodities trade distinguish physical trader s reports from many others in commodities industry. They hedge price exposure using exchange traded contracts and over the counter instruments. They add value to the supply chain through their unique know how in the field of transportation financing and risk hedging.

Physical commodity trading broking we are a privately owned independent physical commodity trading broking house trading broking and financing of ferrous and non ferrous metals and minerals petrochemicals and petroleum trades. Commodity trading challenges include insufficient trust manual documentation and unnecessary intermediaries. Significantly different from the paper trading that banks mainly stick to the physical commodities trading space is a niche segment in terms of wall street careers.

/ATradersFirstBookonCommodities1-5b634a1d46e0fb00257f5cc0.jpg)

:max_bytes(150000):strip_icc()/commodities1-56a31b953df78cf7727bcfc3.jpg)