W Pattern Trading

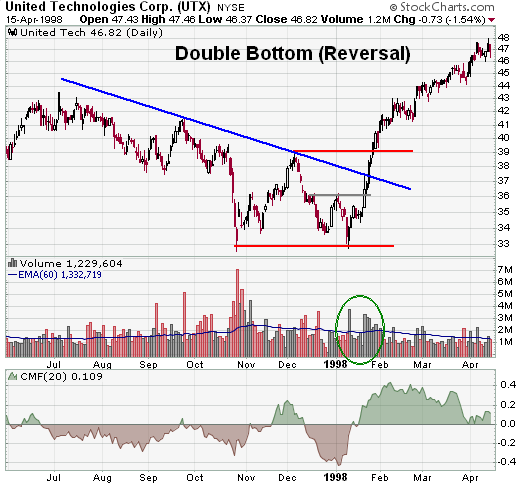

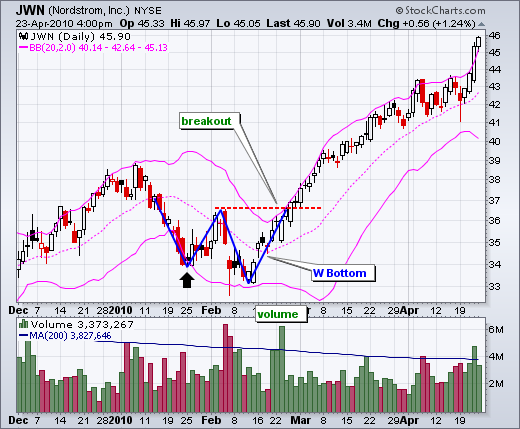

This pattern when drawn it looks like the w and this is why it is called as w pattern.

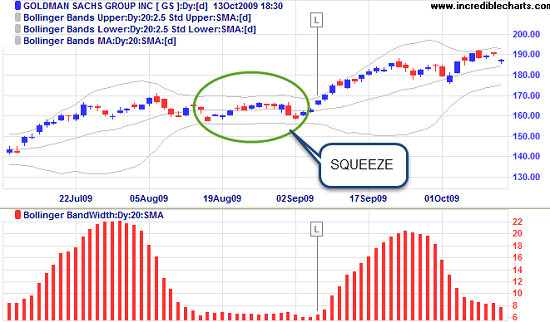

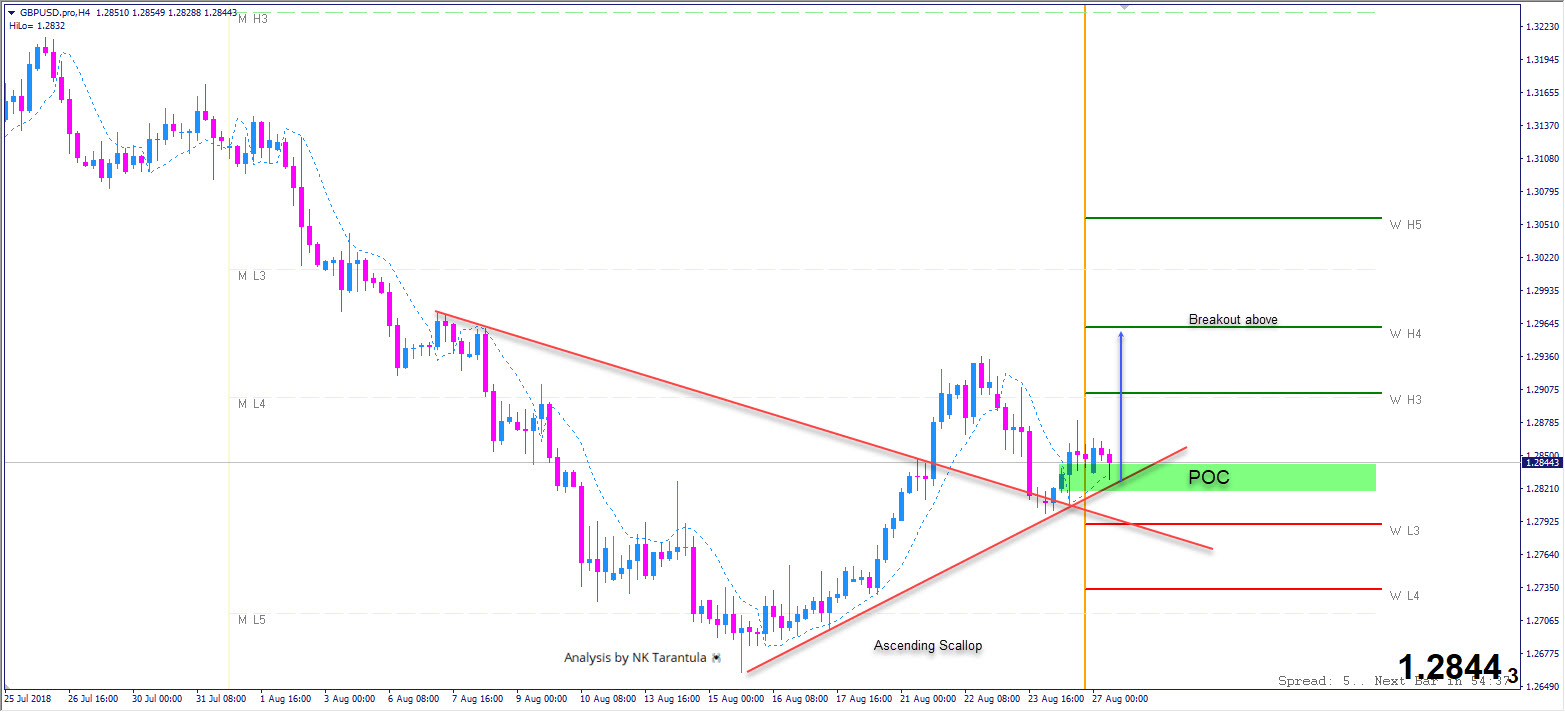

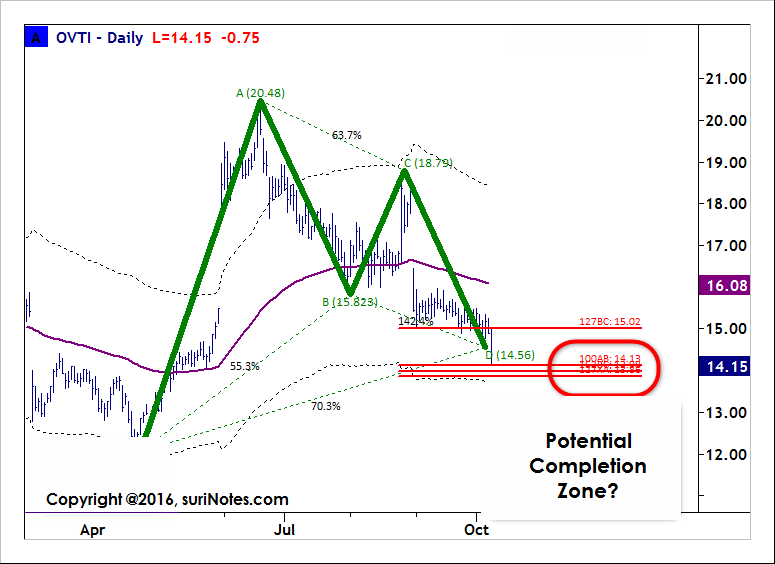

W pattern trading. The w pattern is indicative of a corrective or reversal move. This means that you don t have to wait day in and day out for a double top to form. Therefore when a w renko chart pattern is spotted we always take a short position as described below.

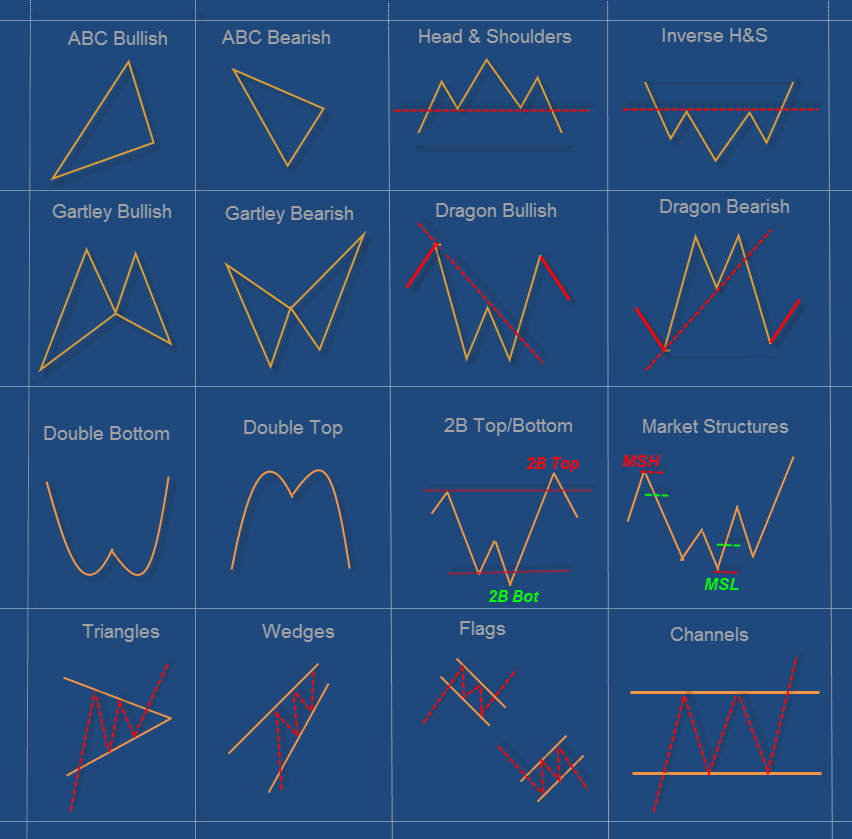

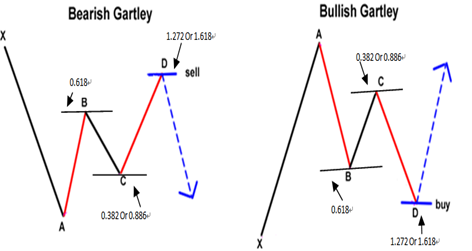

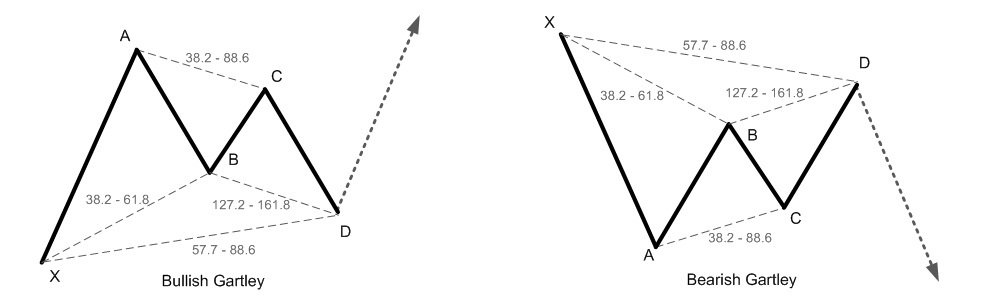

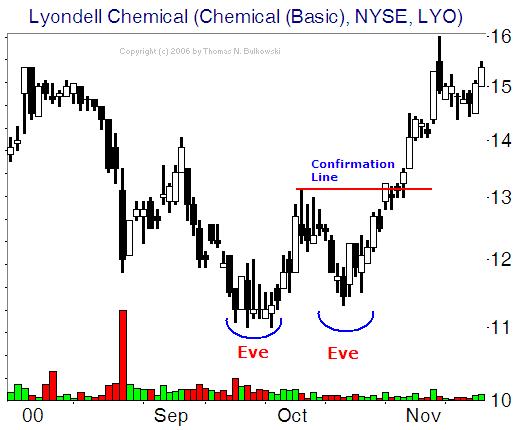

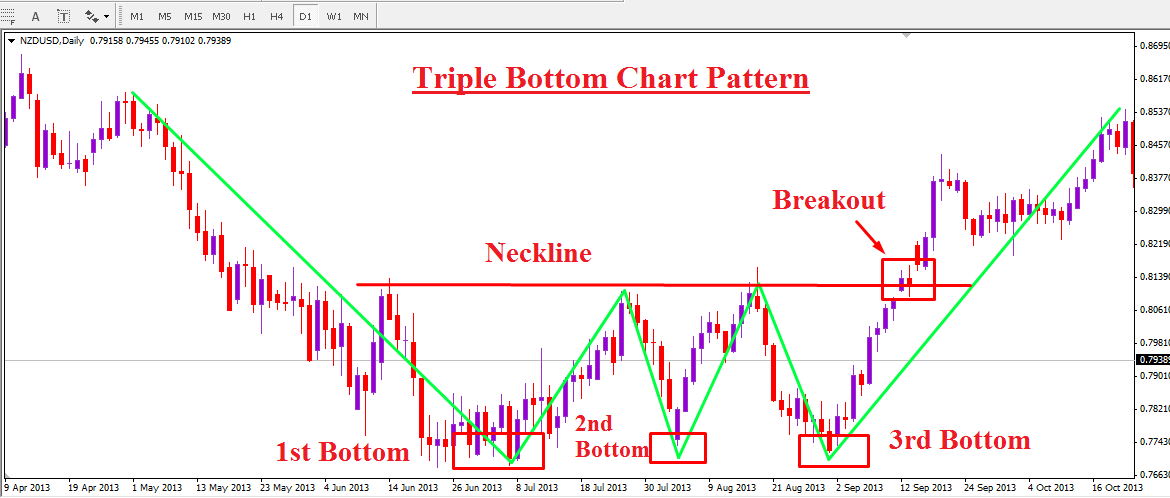

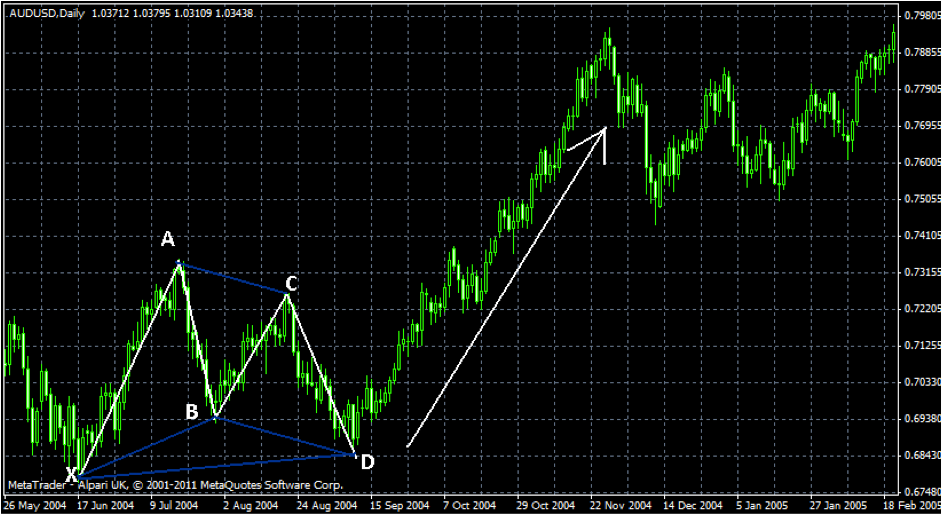

Unlike double or triple tops and bottoms m tops and w bottoms appear on a daily basis on the lower timeframe chart. When the w pattern is qualified after noticing bearish reversal renko bricks short at c. Chart patterns are the basis of technical analysis and require a trader to know exactly what they are looking at as well as what they are looking for.

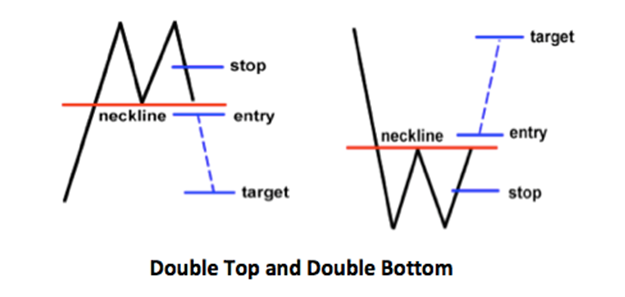

A double bottom pattern is a technical analysis charting pattern that describes a change in trend and a momentum reversal from prior leading price action. Sometimes patterns looks like w but it is not the exact w pattern and these patterns are called semi w patterns. A chart pattern is a shape within a price chart that helps to suggest what prices might do next based on what they have done in the past.

The m and w trading pattern is a great little pattern that occurs with enough frequency for you to add it to your trading tool bag. The article includes identification guidelines trading tactics and performance statistics by internationally known author and trader thomas bulkowski. Trading the w pattern w pattern is a price pattern also called double bottom.

Trading the w pattern with renko charts. The big w is a double bottom chart pattern with talls sides.

:max_bytes(150000):strip_icc()/dotdash_Final_Double_Top_and_Bottom_Feb_2020-01-568b13a6e22548a48c0f5251e2069db5.jpg)

:max_bytes(150000):strip_icc()/download2-5c58eb40c9e77c000102d153.png)

:max_bytes(150000):strip_icc()/CupandHandleDefinition1-bbe9a2fd1e6048e380da57f40410d74a.png)

.png)

/daytradingsetup1-596cf9333df78c57f4aaf265.png)

/dotdash_Final_Double_Top_and_Bottom_Feb_2020-01-568b13a6e22548a48c0f5251e2069db5.jpg)