Short Term Stock Trading

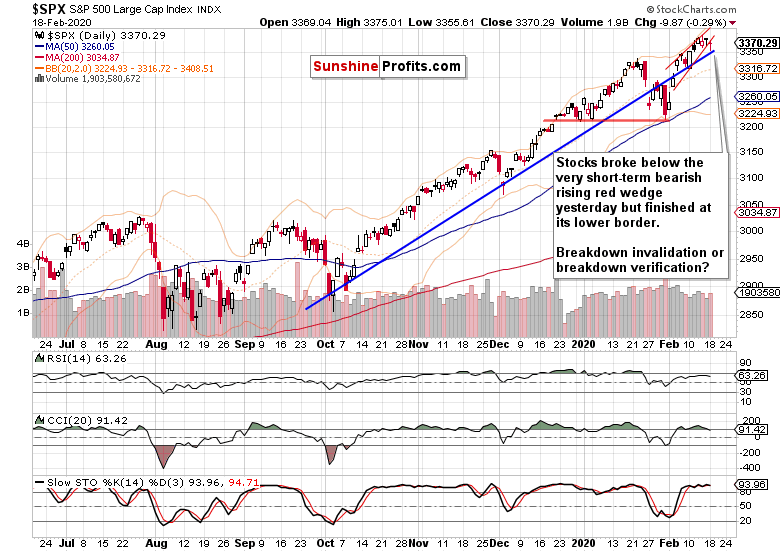

If there is no movement then better to quit.

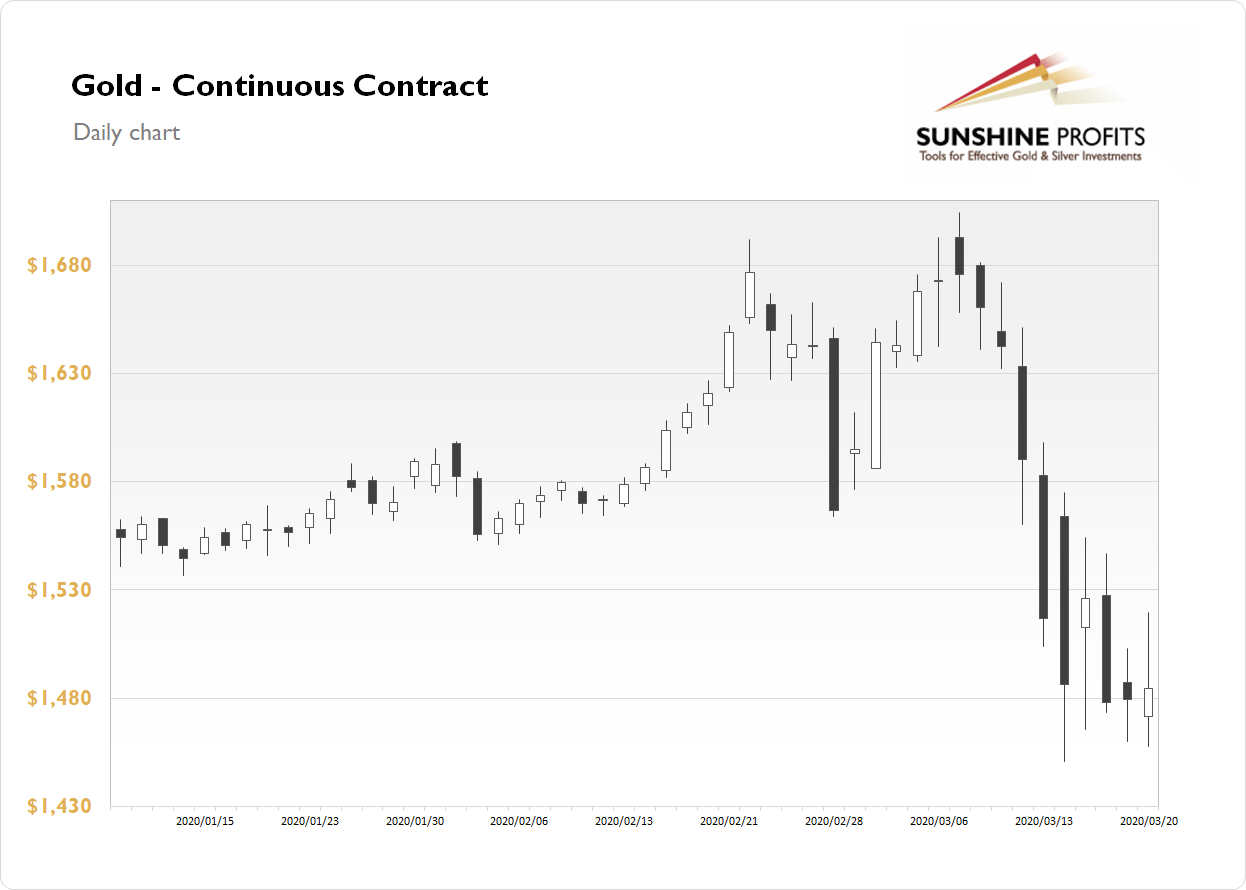

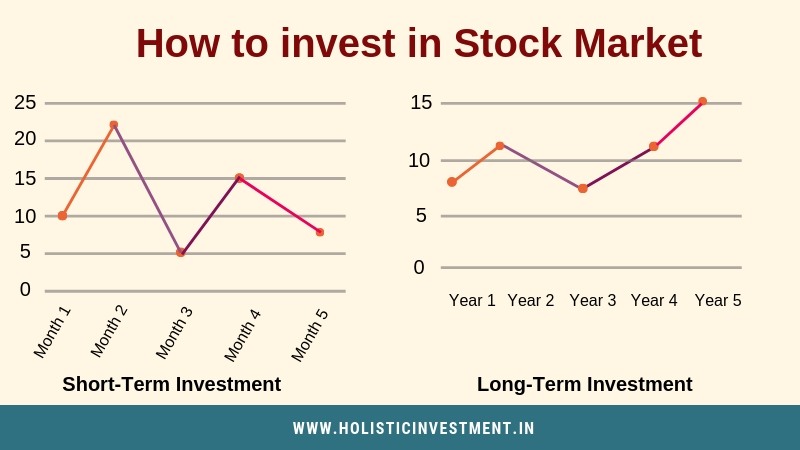

Short term stock trading. 2 a short trade is initiated by selling before buying with the intent to repurchase the stock at a lower price and realize a profit. Lastly short term trading is to buy stock expected to go up in short term because of momentum. The tax on those capital gains is deferred until the end of 2026 or earlier should you sell the investment.

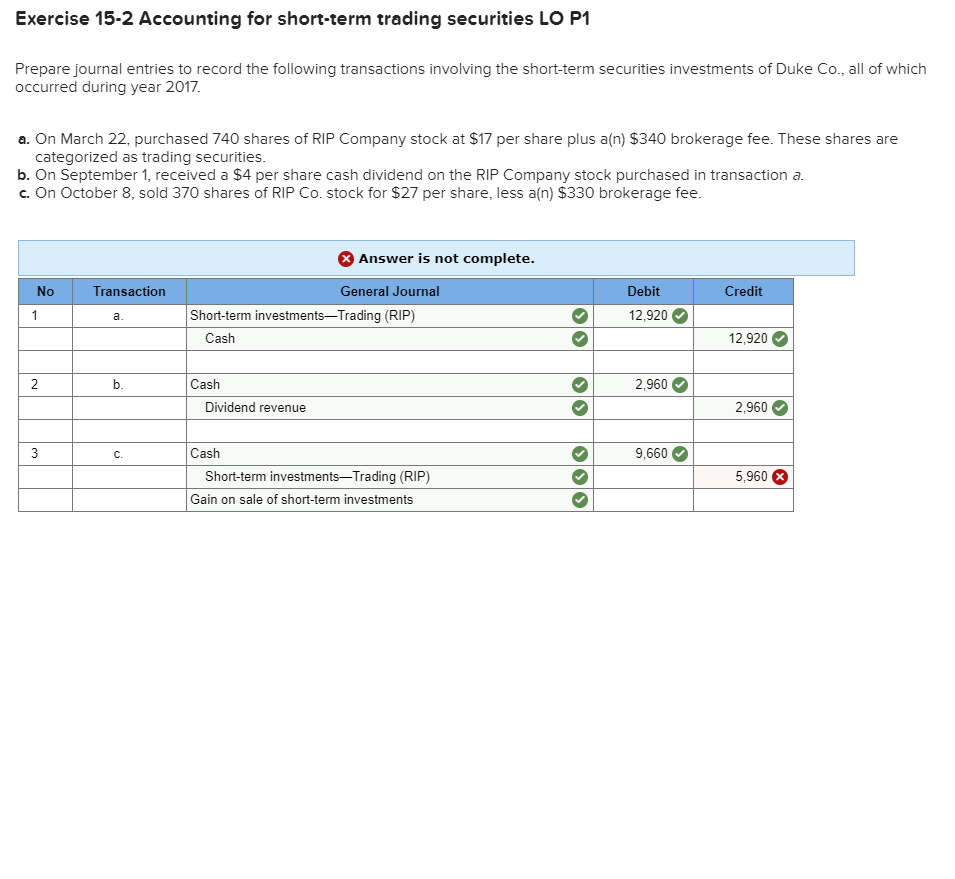

If you re holding shares of stock in a regular brokerage account you may need to pay capital gains taxes when you sell the shares for a profit. When it comes to stock market trading the terms long and short refer to whether a trade was initiated by buying first or selling first. The idea is to keep losses manageable so.

For realized but untaxed capital gains short or long term from the stock sale. Trading and making money is easier than you think. Simple stock trading is the key to making the big money.

For example let s say you purchase 10 000 of a particular stock in february then sell it for 15 000 in november of the same year. If you make a short term capital gain it s added to your income and taxed at your regular income tax rate. Short term trading refers to those trading strategies in which the time duration between entry buying and exit selling is within a range of few days to few weeks.

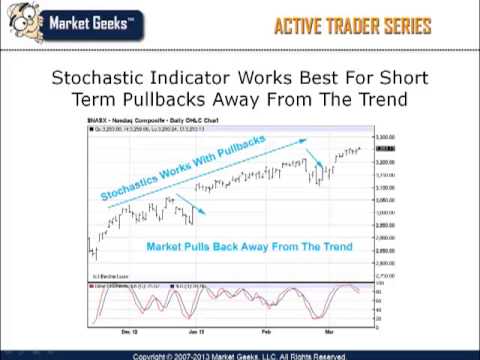

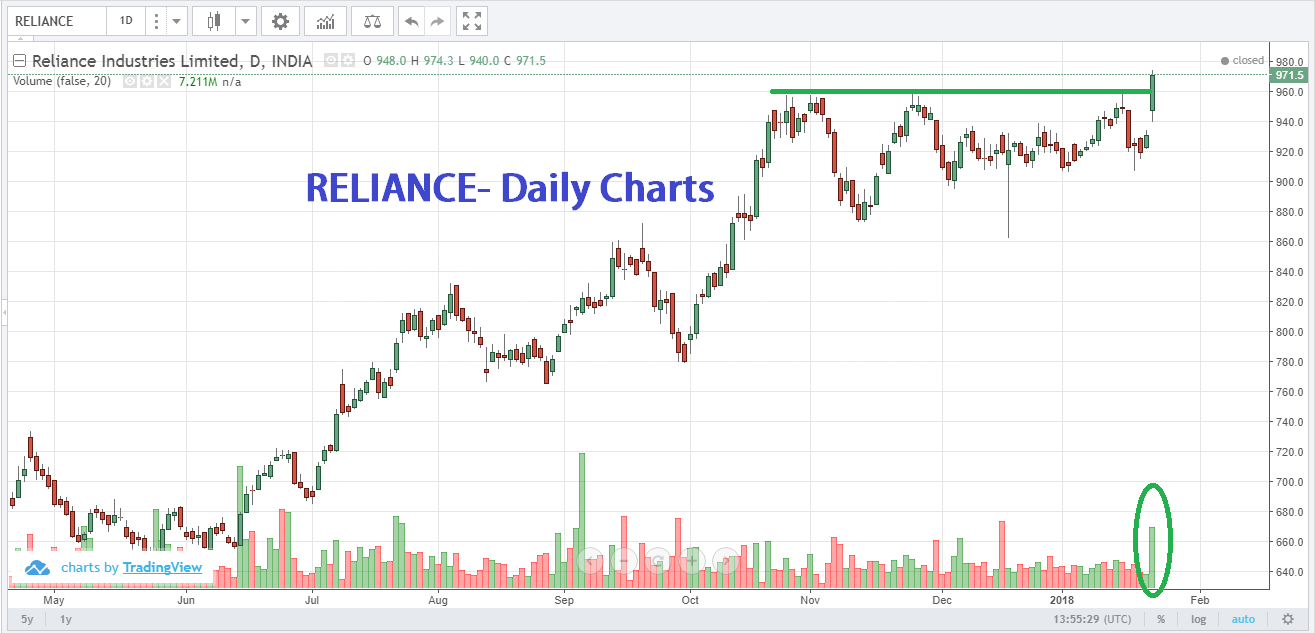

As a general rule in short term trading you want to set your sell stop or buy stop within 10 to 15 of where you bought the stock or initiated the short. Personally i wait for only 2 weeks. 1 a long trade is initiated by purchasing with the expectation to sell at a higher price in the future and realize a profit.

But short term stock trading with a small portion of your overall investment portfolio can be a fun and very profitable venture to keep you engaged and renew your love for investing. Short term stock trading and market strategies along with automated stock trading software and short term stock trading systems to take trades everyday in the u s. Keep it simple stupid you have probably heard of kiss keep it simple stupid.

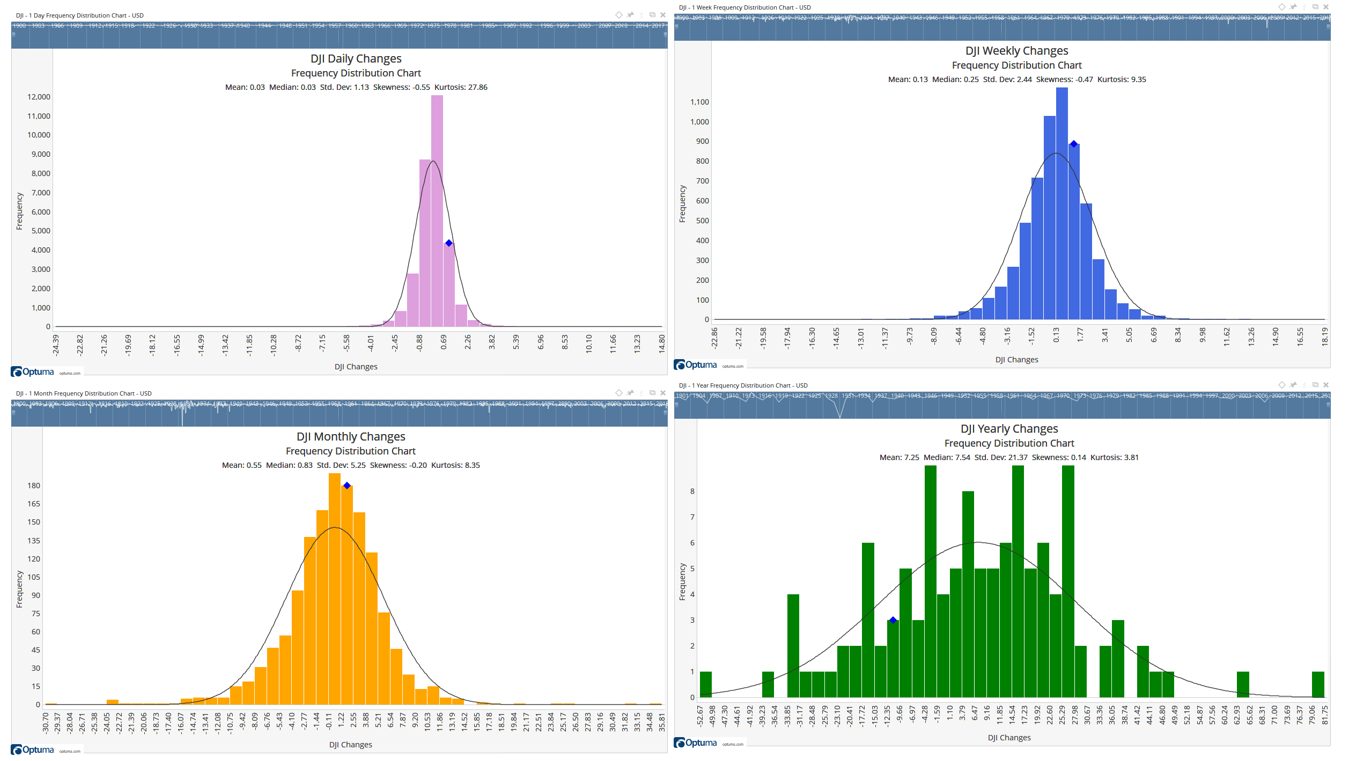

Another reason is i have limited capital to deploy and don t want to risk too much money. Here short term can be 1 day 3 days 5 days or even a month. There are two types of capital gains taxes.

It allows me to put short term cash investments to good use.

%2C445%2C291%2C400%2C400%2Carial%2C12%2C4%2C0%2C0%2C5_SCLZZZZZZZ_.jpg)

:max_bytes(150000):strip_icc()/HowToOutperformTheMarket2-29d6ef5a974741fda40aadb8163e3c35.png)