Trading Pivot

Trade only at the london open or the 8 00 am gmt.

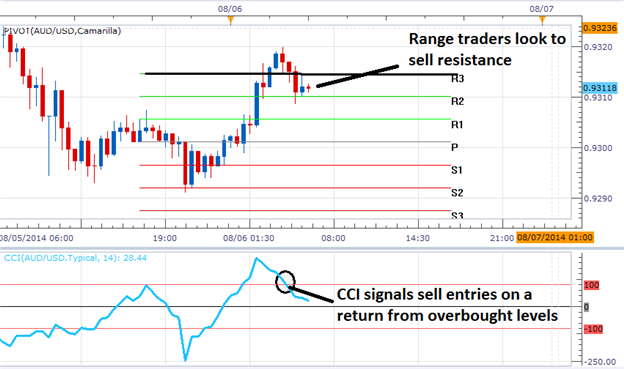

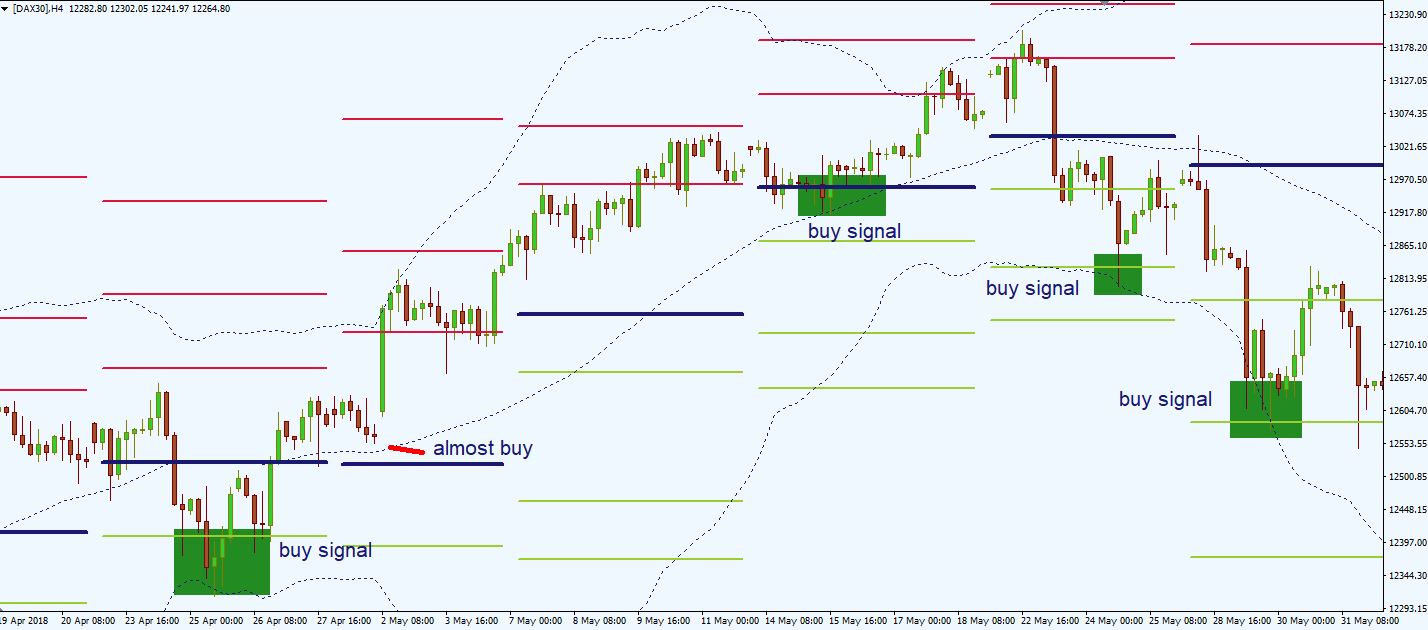

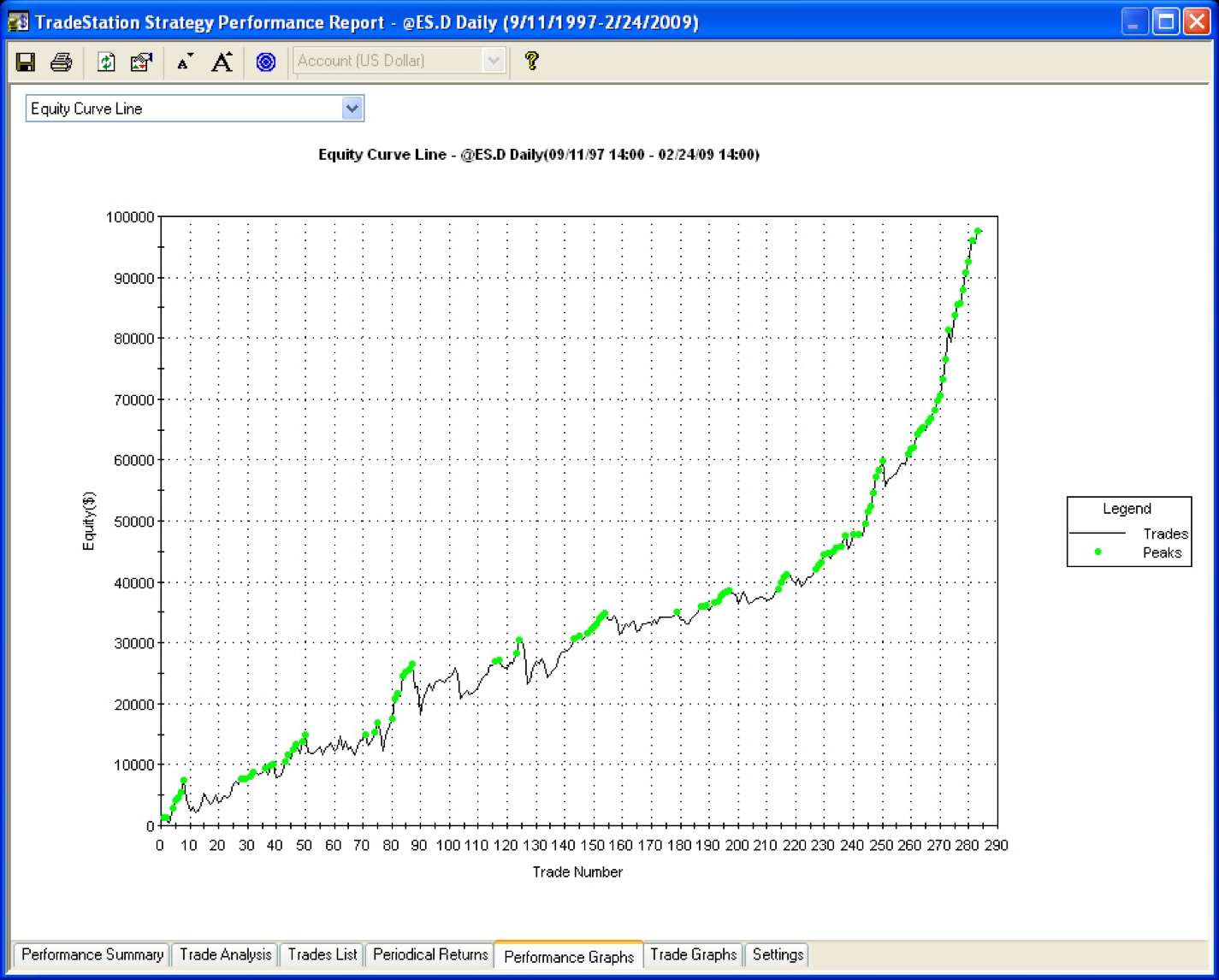

Trading pivot. This technique is commonly used by day traders though the concepts are valid on various timeframes. On the subsequent day trading above the pivot. The significance of.

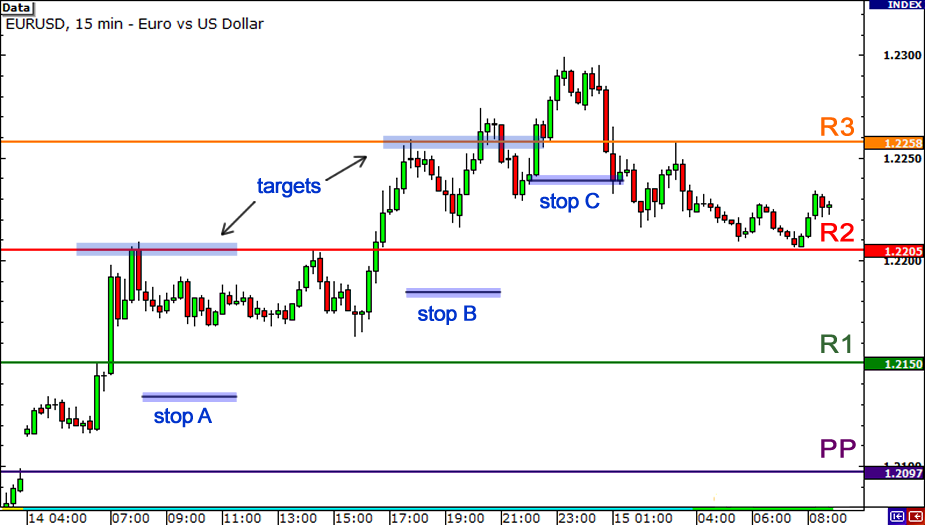

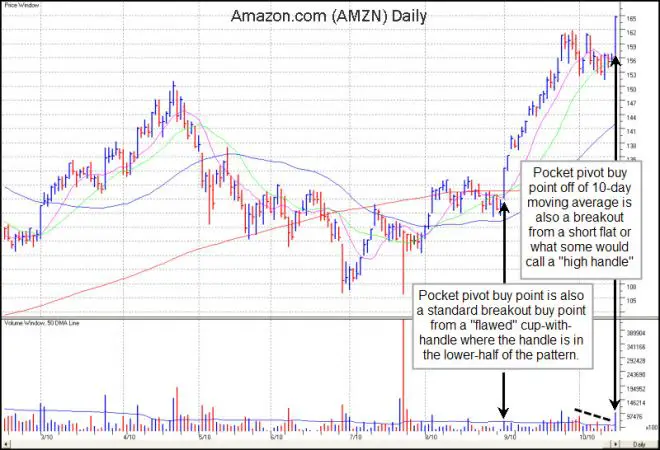

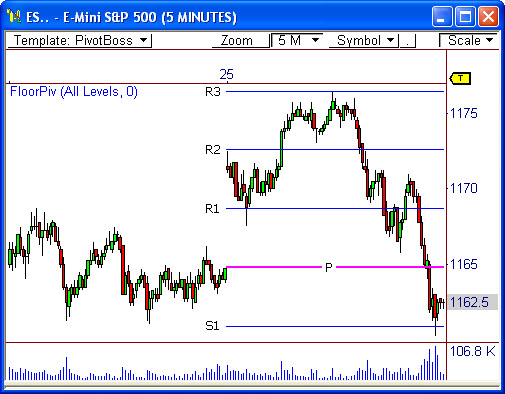

2 short time frames. If you see that a pivot level is holding this could give you some good trading opportunities. Hide your protective.

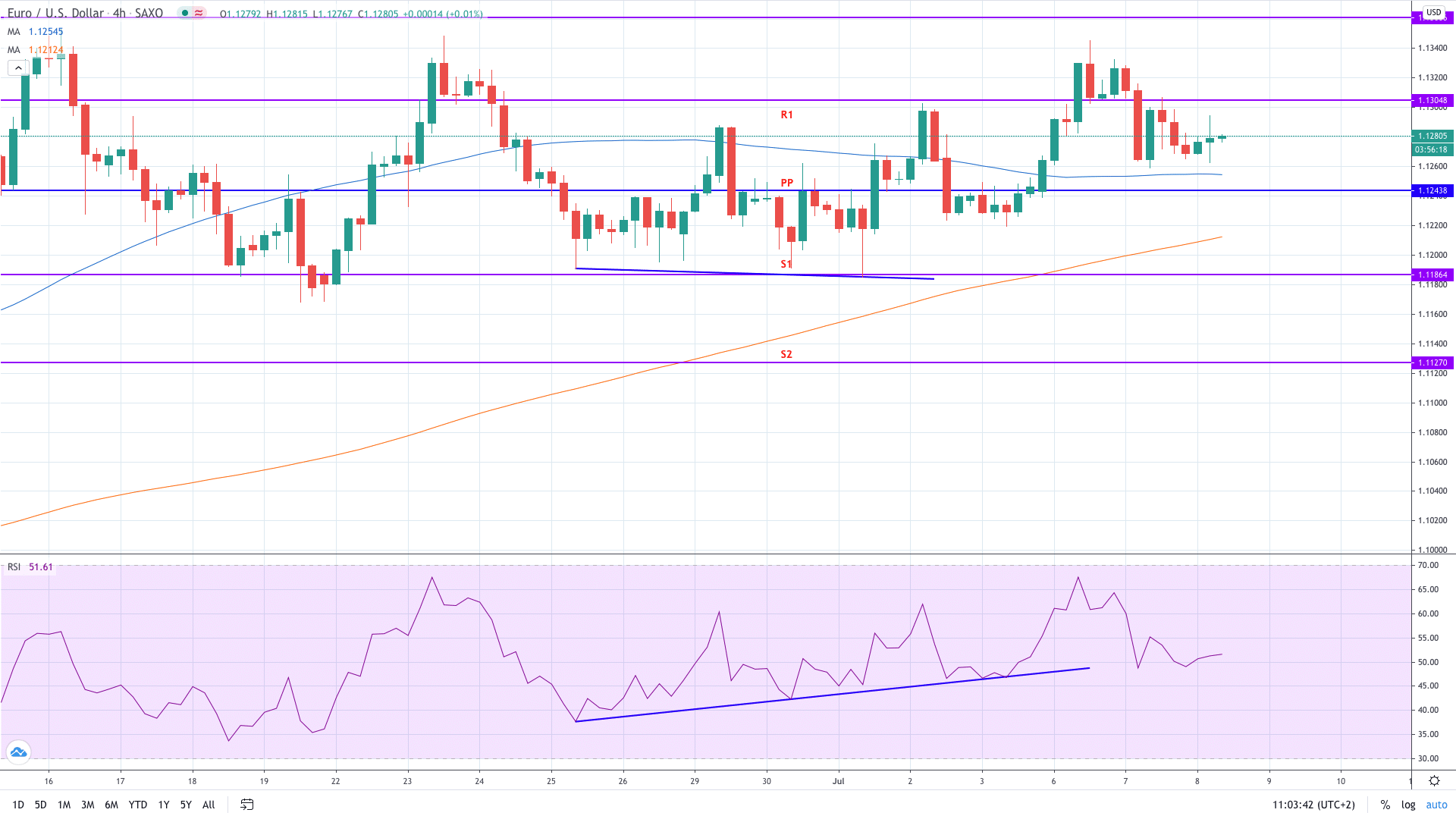

Pivot strategies for forex traders calculating pivot points. Pivot points are one of the most widely used indicators in day trading. If the price is nearing the upper resistance level you could sell the pair and place a stop just above the resistance.

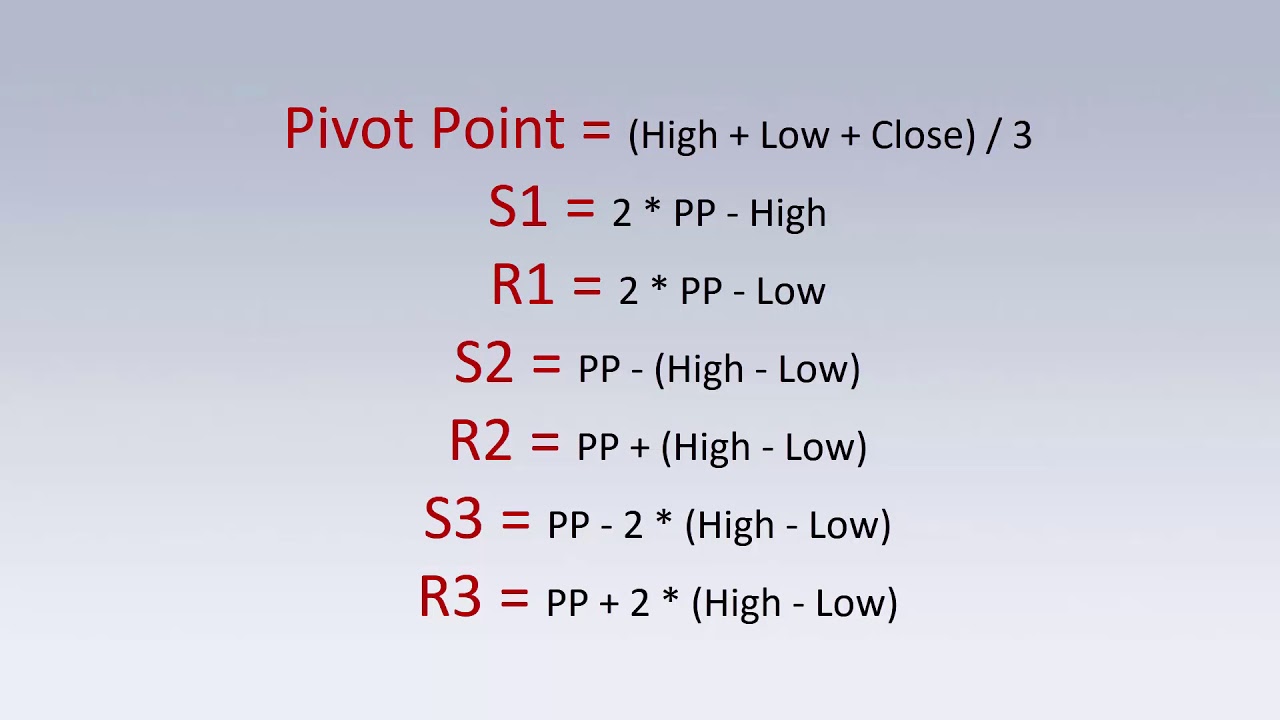

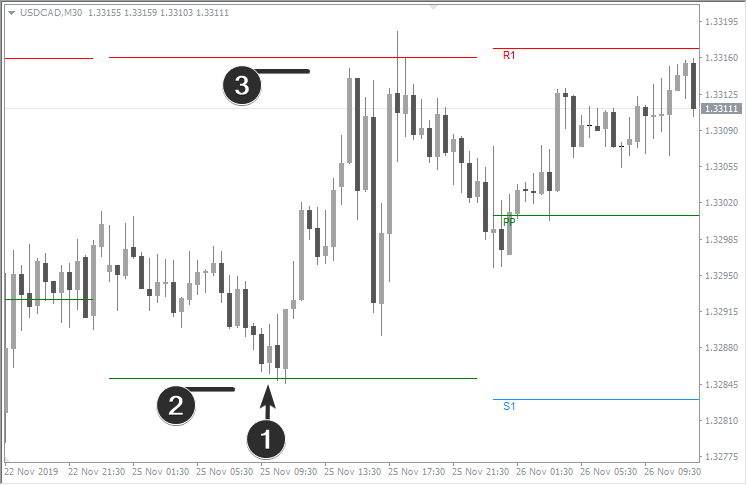

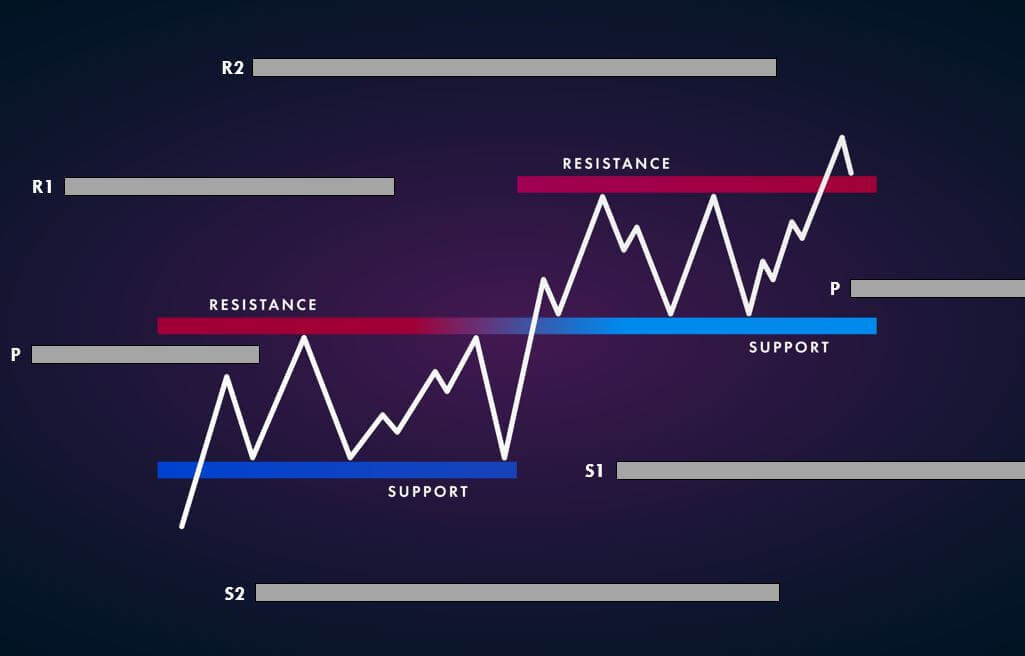

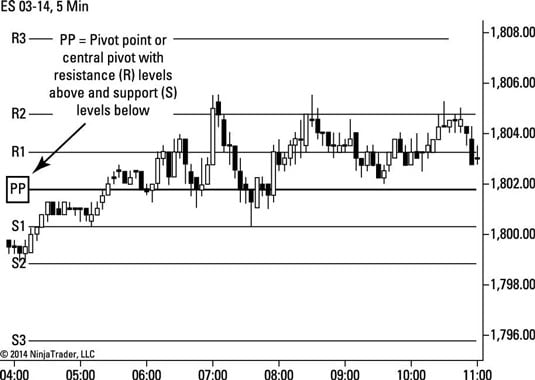

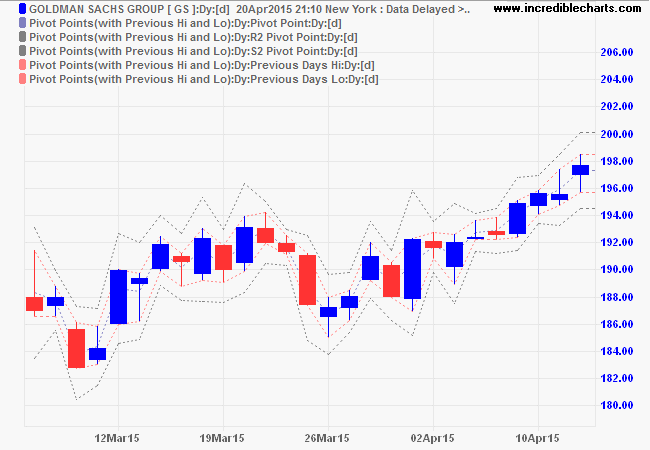

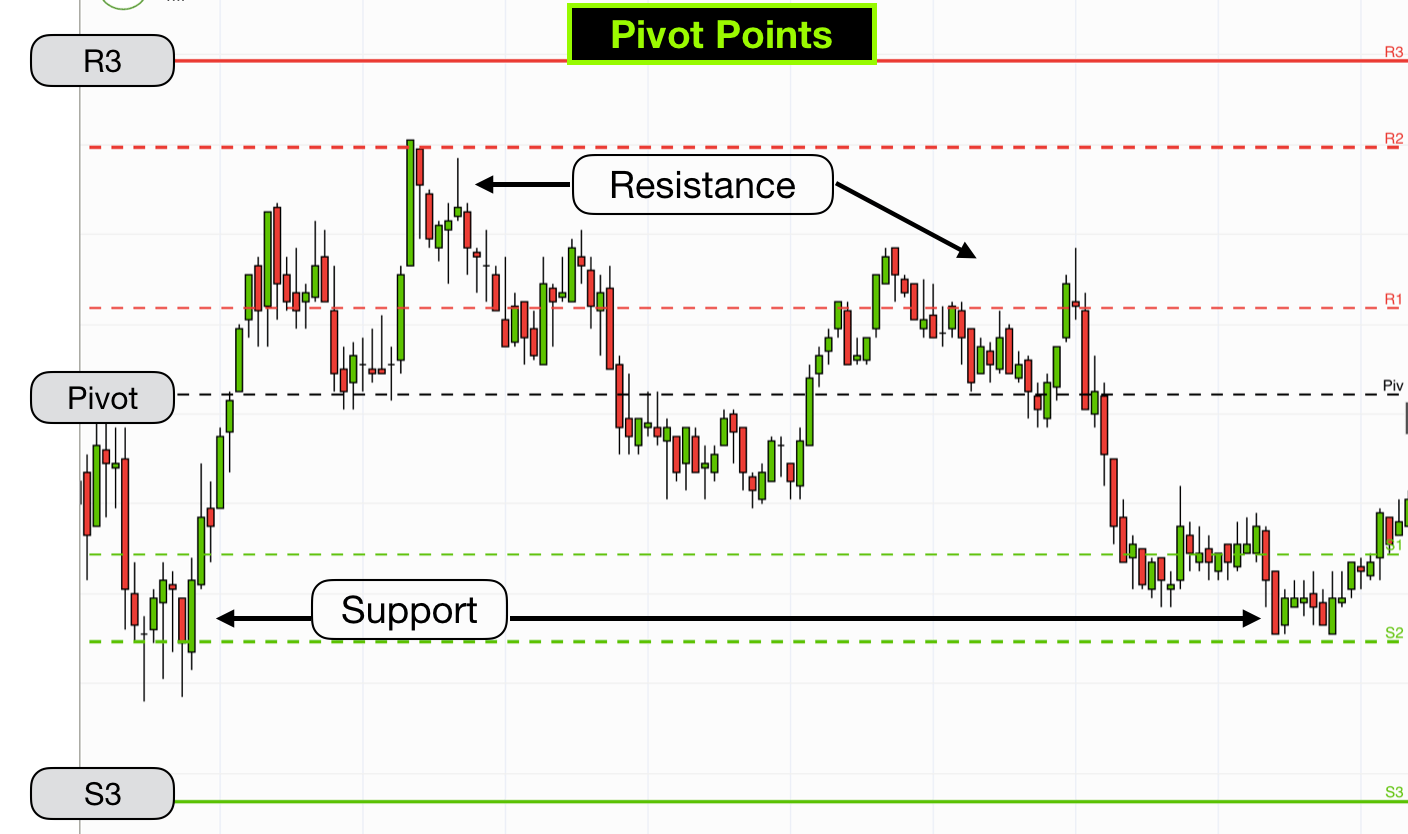

The tool provides a specialized plot of seven support and resistance levels intended to find intraday turning points in the market. Actually pivoting simply means reaching a support or resistance level and then reversing. The pivot point itself is simply the average of the high low and closing prices from the previous trading day.

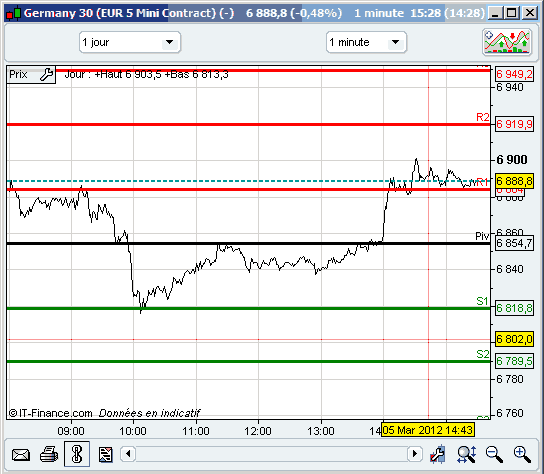

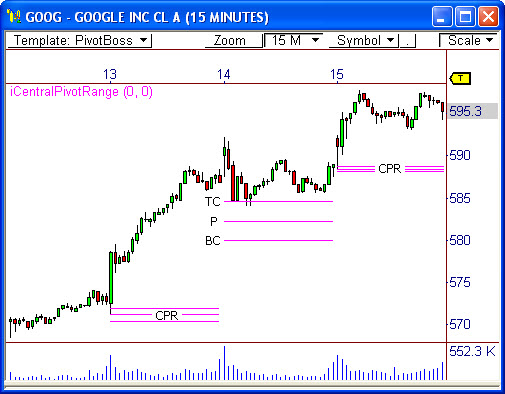

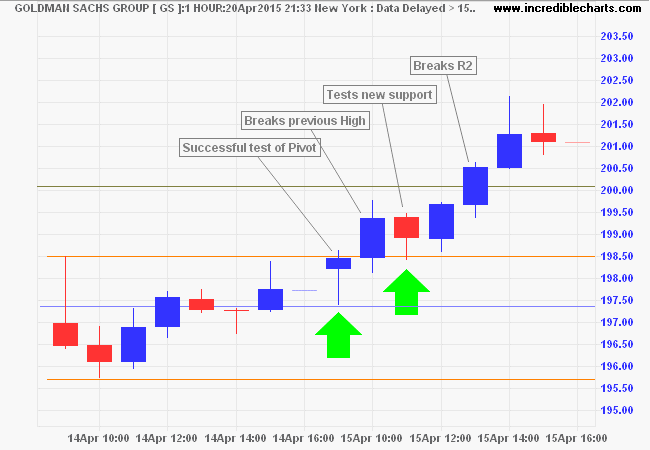

Below is a view of how they appear on a one hour chart of the aud jpy currency pair. From this pivot traders would then base their calculations for three support and three resistance levels. The pivot point bounce is a trading strategy or system that uses short timeframes and the daily pivot points.

The prices used to calculate the pivot. Key takeaways a pivot point is a technical analysis indicator or calculations used to determine the overall trend of the market over. 5 reasons why day traders love pivot points 1 unique for day trading.

There are several methods of identifying the exact points. Pivot points tend to function as support or resistance and can be turning points. The best time to trade the pivot points strategy is around.

By definition a pivot point is a point of rotation. Woody pivot points camarilla pivot points and fibonacci pivot points etc. Pivot point analysis is a technique of determining key levels that price may react to.

Since the pivot points data is from a single trading day the indicator could only be applied to. Pivot points simply took the high low and closing price from the previous period and divided by 3 to find the pivot. In trading stocks and other assets pivot points are support and resistance levels that are calculated using the open high low and close of the previous trading day.

The pivot points formula takes data from the previous trading day and applies it to the. All seven levels are within view. Applying pivot points to the fx market.

Generally speaking the pivot point is seen as the primary support or resistance. There are however other methods that can be used to calculate forex pivot points which include.

:max_bytes(150000):strip_icc()/PivotPoint-5c549c1246e0fb000164d06d.png)

/PivotPoint-5c549c1246e0fb000164d06d.png)