Strategy Of Option Trading

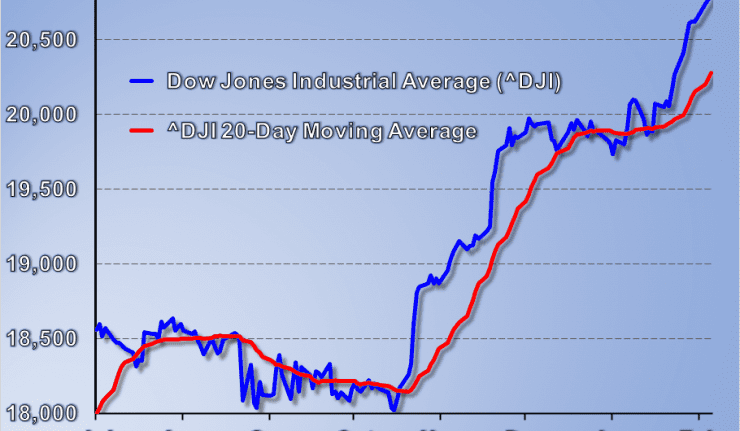

In the options trading strategy that we discussed above we were hoping that the.

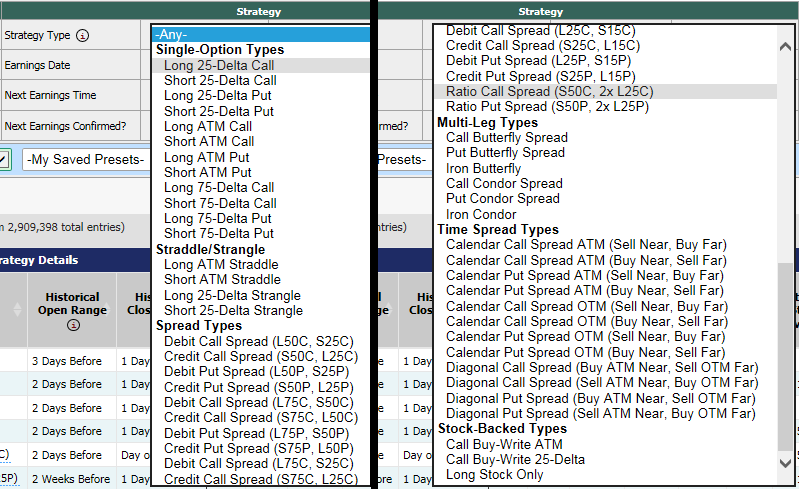

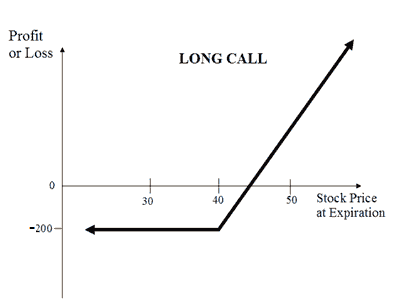

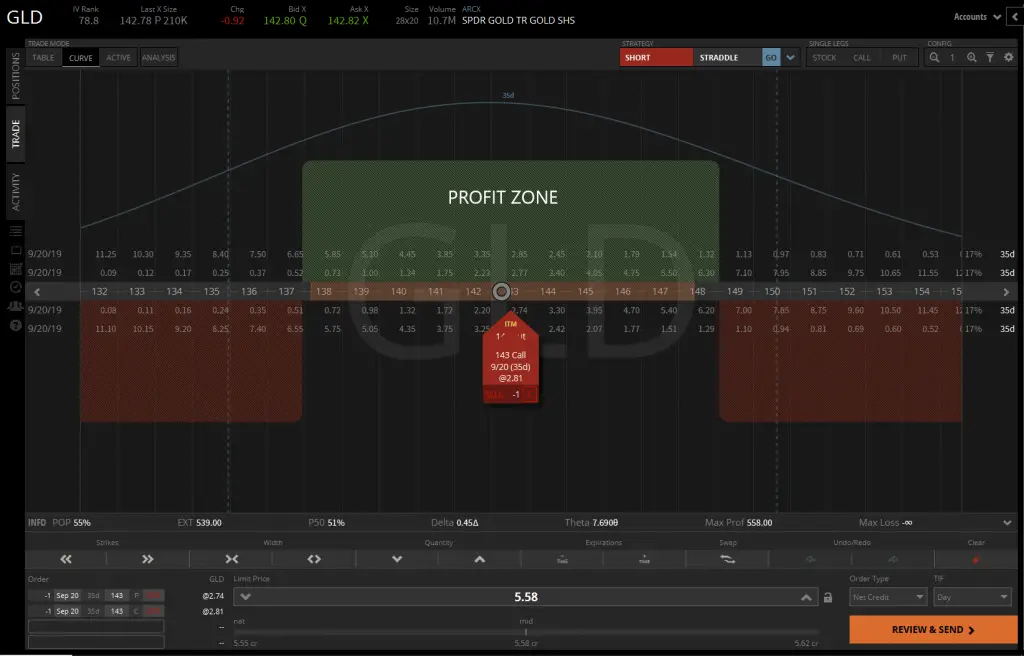

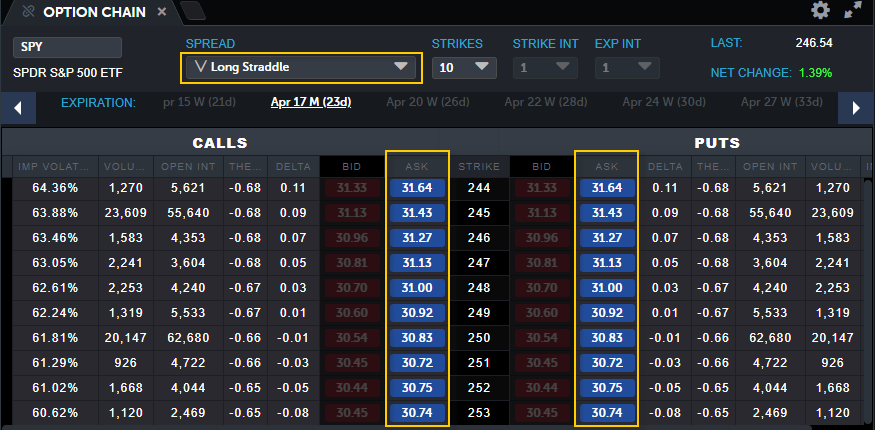

Strategy of option trading. 2 short call options trading strategy. The long call the long call is a strategy where you buy a call option or go long this straightforward strategy is a wager that the underlying stock will rise above the strike price by. Options trading especially in the stock market is affected primarily by the price of the underlying security time until the expiration of the option and the volatility of the underlying.

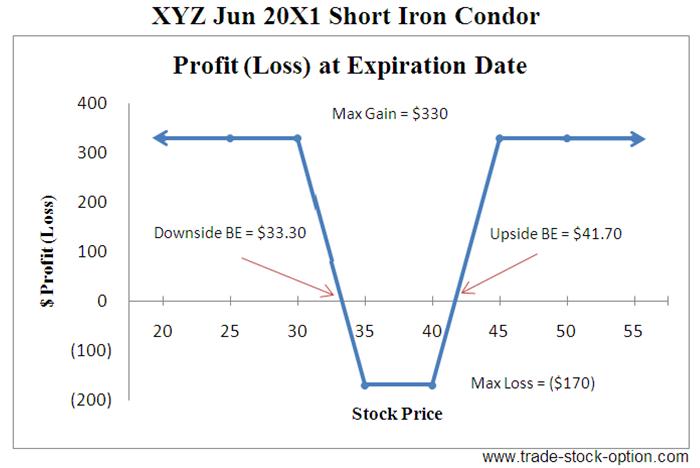

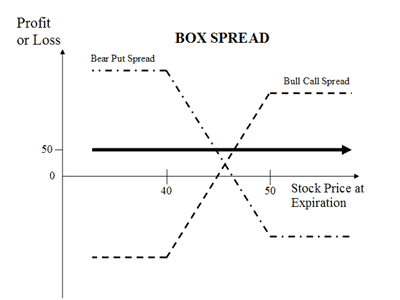

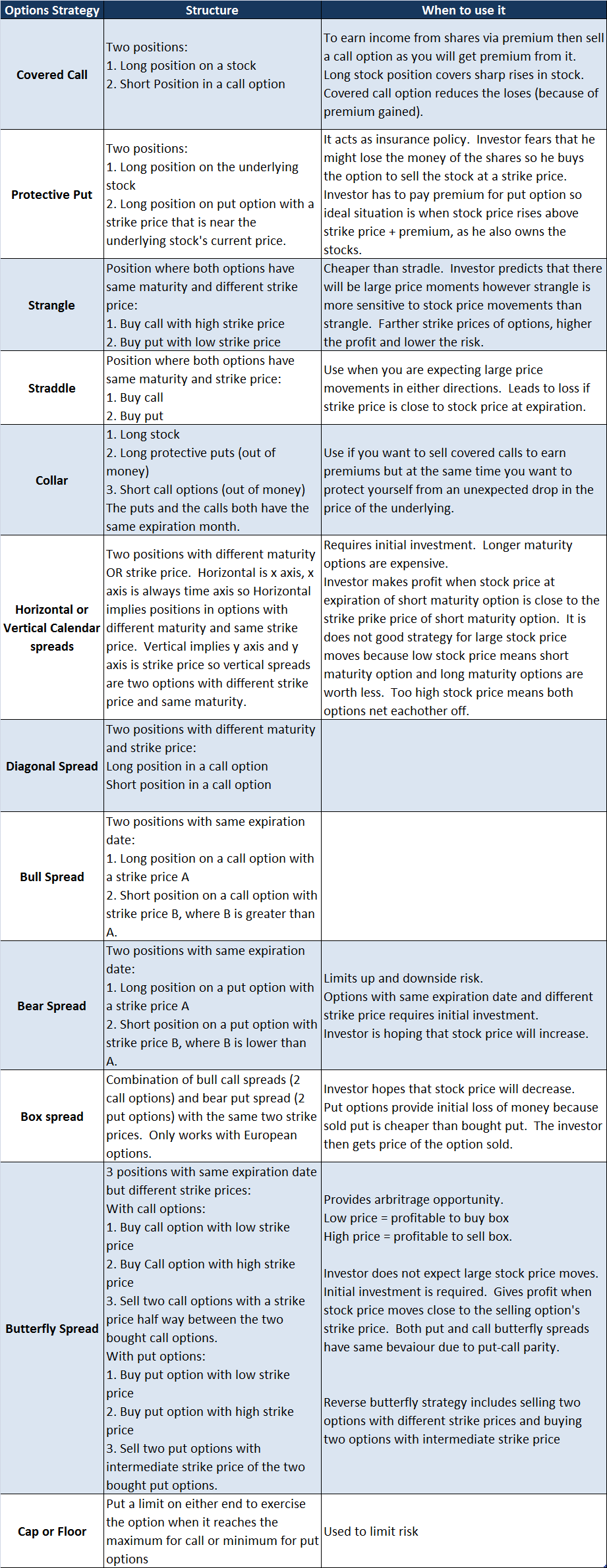

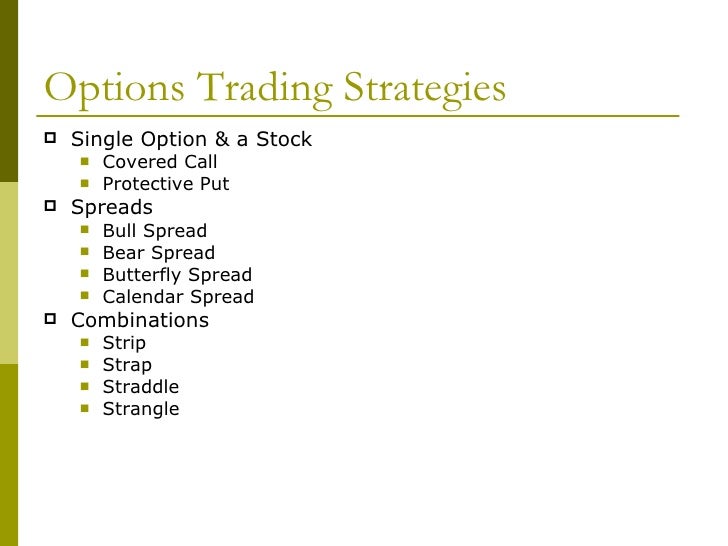

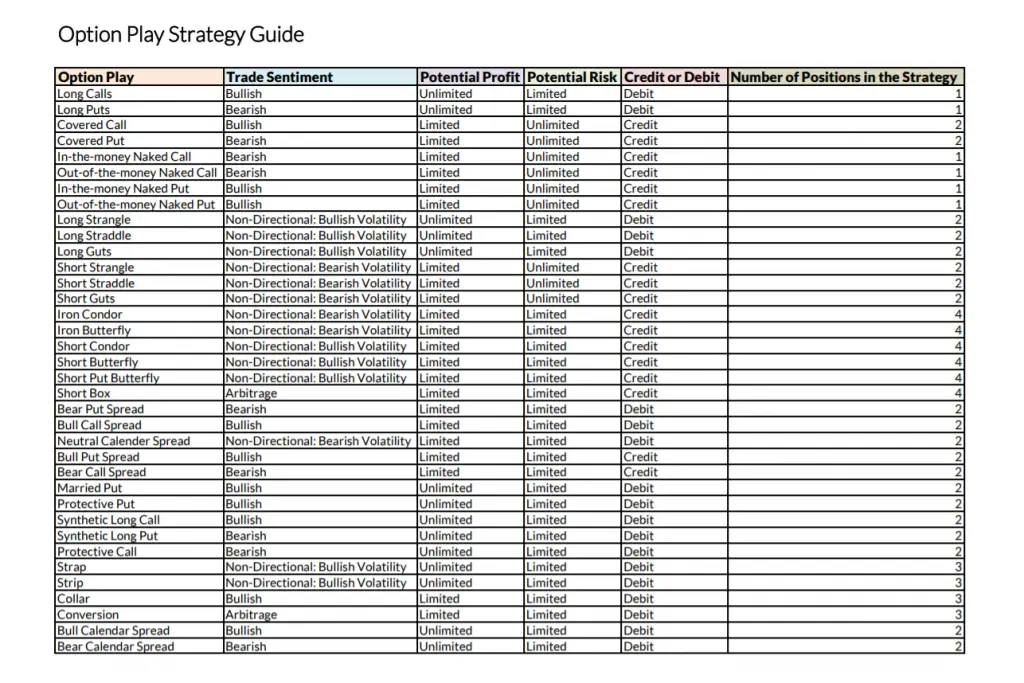

Broadly speaking option trading strategies can be categorized into one or more of the following frameworks. Options are leveraged instruments i e they allow traders to amplify the benefit by risking. This practical guide will share a powerful box spread option strategy example we cover the basics of bull call spread option strategy to help you hedge the risk and.

This is one of the option trading strategies for aggressive investors who are. List of top 6 options trading strategies 1 long call options trading strategy. You can also structure a basic covered.

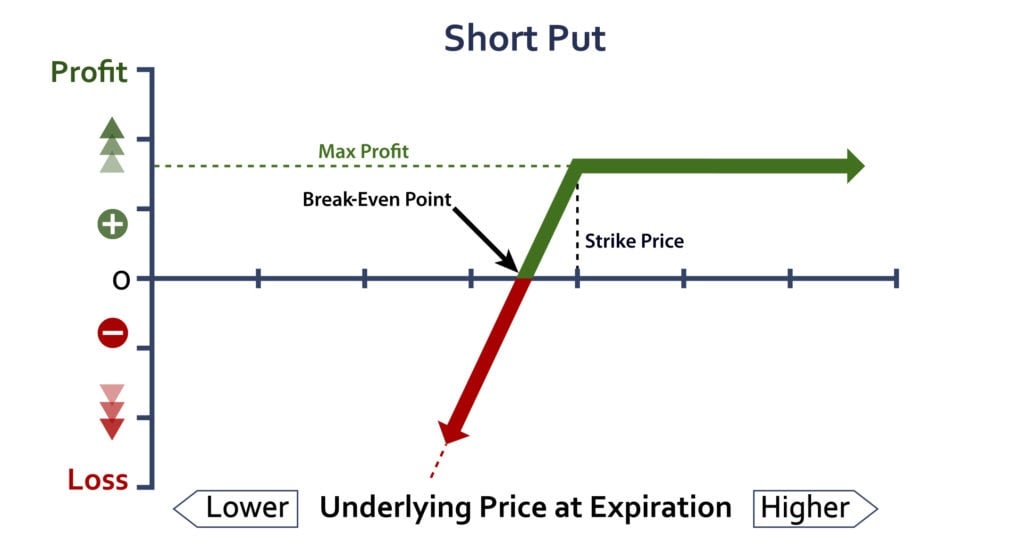

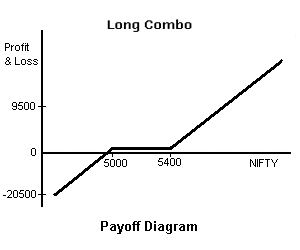

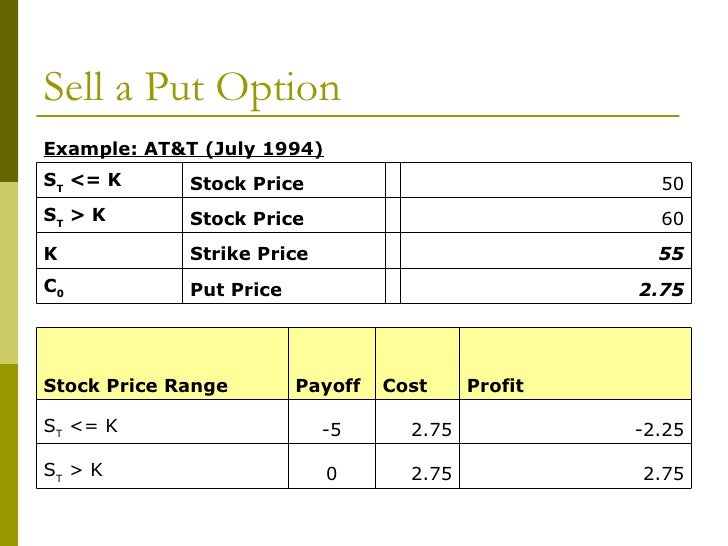

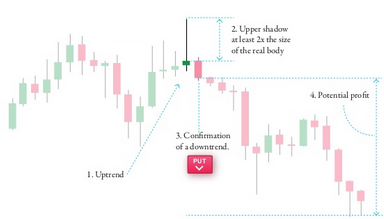

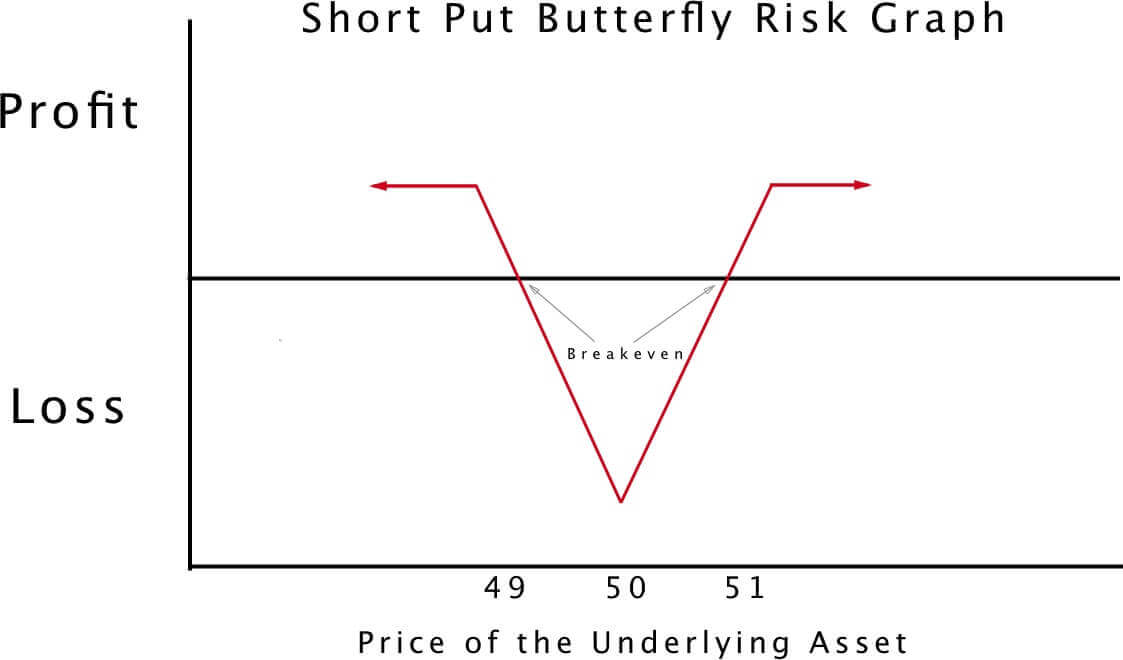

The market can make steep downward moves. The long put is an options strategy where the trader buys a put expecting the stock to be below the strike price before expiration. Protective strategies such as protective puts and collar strategies strategies to enhance option trades such as covered calls and cash covered puts.

A guide for beginners buying calls long call. Moderately bearish options traders usually set a target price for the expected decline and utilize bear spreads to reduce cost. A put option works the exact opposite way a call option does with the put option gaining value.

The basic strategies which include the long and short variations of call and put options. There is an endless amount of ways to trade options contracts from calls and puts to the premium received or the premium paid learning how to implement the best options trading strategy at the right time will result in massive profit potential for an investor. In a married put strategy an investor purchases an asset such as shares of stock and simultaneously.

The long put is a useful strategy when you expect the stock to decline and you want to earn large upside. These options spread strategies will help you overcome limit your exposure to risk and overcome the fear of losing out. 10 options strategies to know 1.

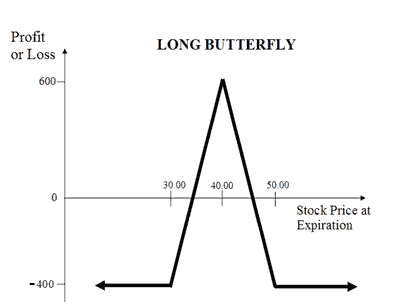

Options spread strategies make it significantly easier for your trading strategy to become more dynamic. Buying puts long put. With calls one strategy is simply to buy a naked call option.

:max_bytes(150000):strip_icc()/10OptionsStrategiesToKnow-01-5cbad2a9fe294e679f467f3ebc57890d.png)

/10OptionsStrategiesToKnow-01-5cbad2a9fe294e679f467f3ebc57890d.png)