Soybean Trading

Thu may 7th 2020.

Soybean trading. It is an attractive commodity to trade as a hedge for producers with most of the demand now seen from the emerging markets. Therefore it is not surprising to see that trading soybeans futures make for a lucrative proposition for futures traders. As for the contract months the cme assigns a code to each month.

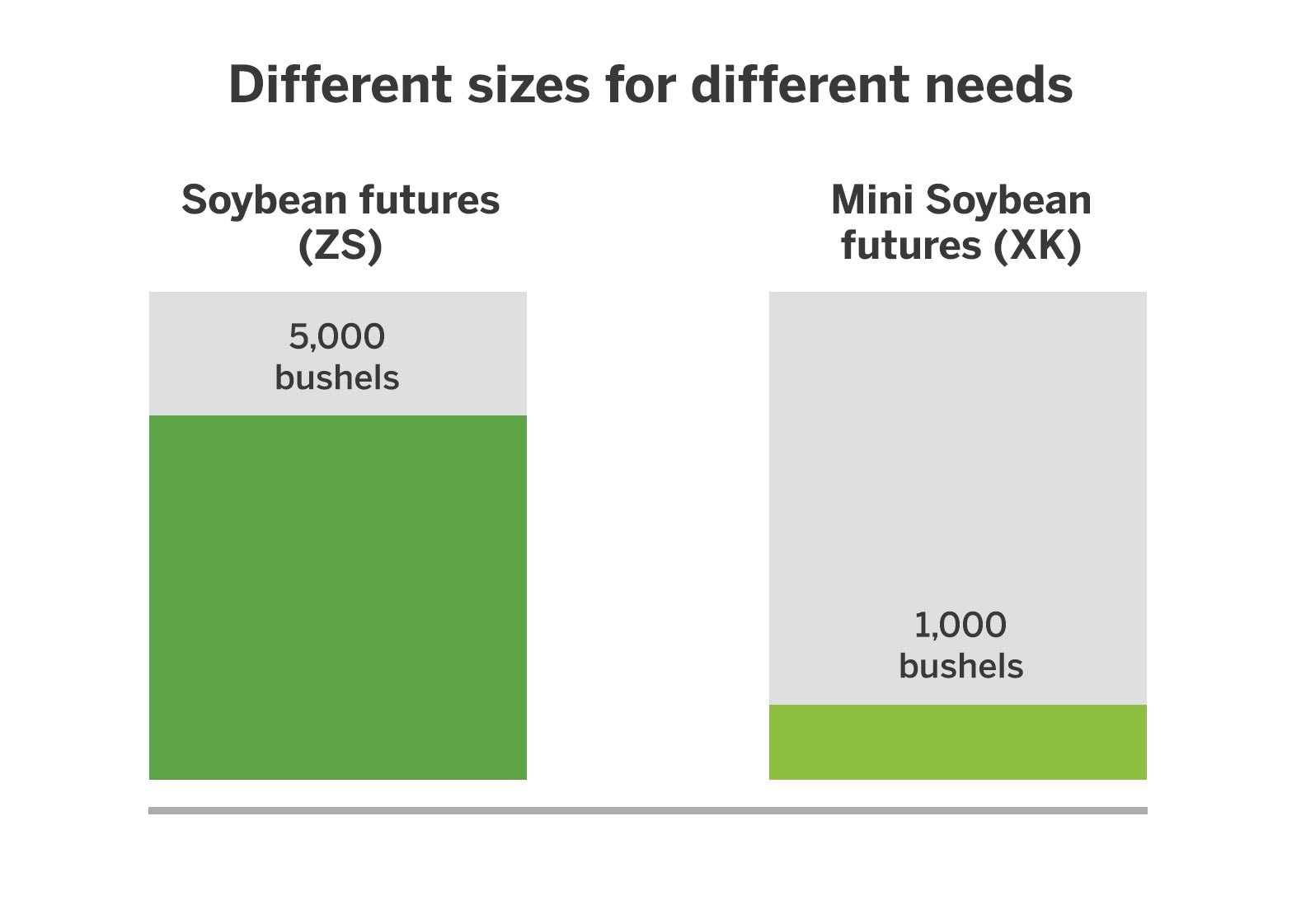

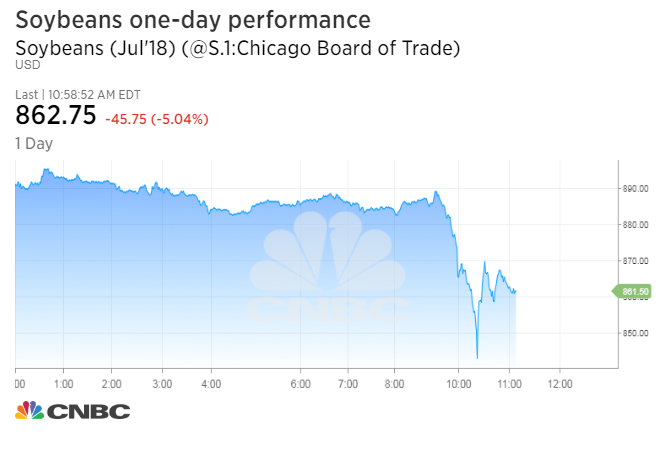

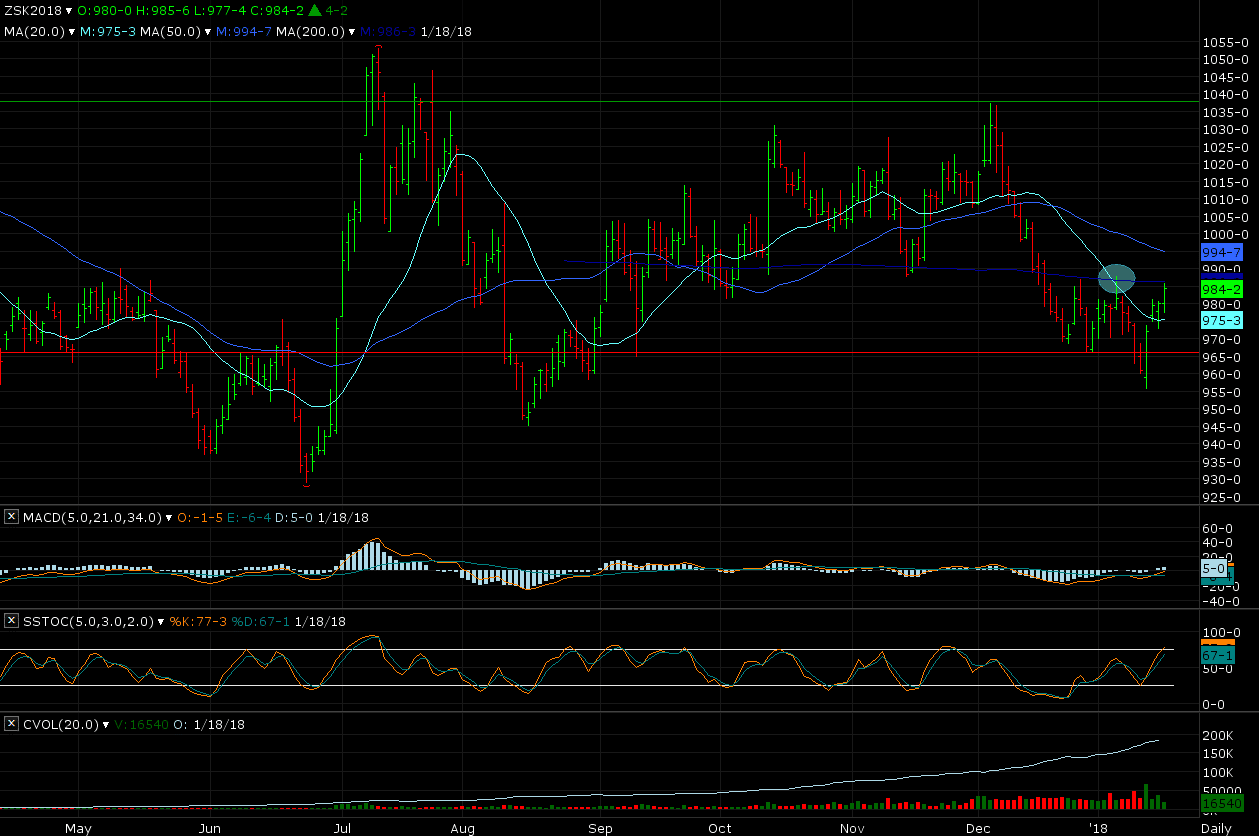

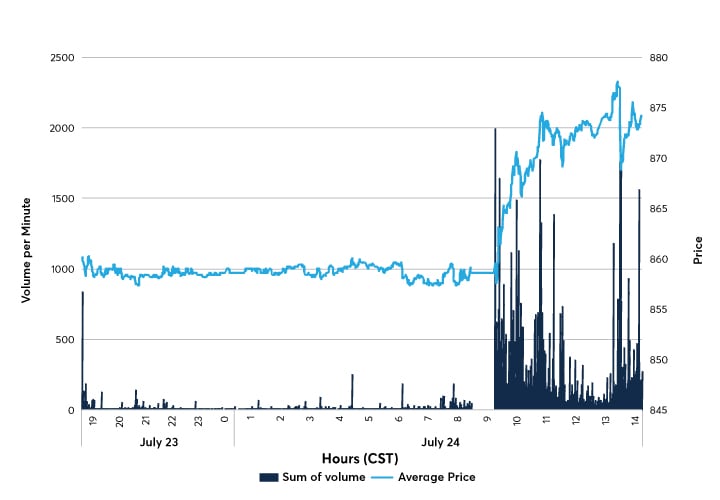

Grains corn soy to 6 month lows as wider markets sell. Each tick is equivalent to 6 25 so each one cent move in soybean prices equates to 50 per contract. 11 11am jun 19 2020.

Soybean commodity market trades charts. Soybean is heading toward the 903 level. The market was able to bounce back from losses after the reopening after usda announced tuesday morning private exporters sold 132 000 metric tons to china for new crop delivery.

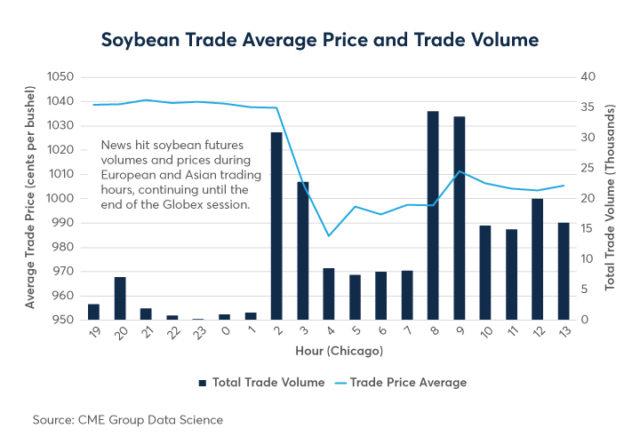

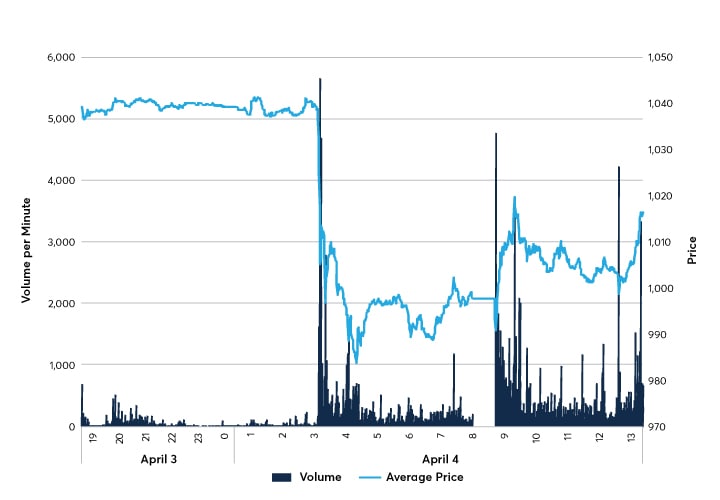

Whether you are a new trader looking to get started in futures or an experienced trader looking to hedge your risk in the agricultural markets soybean futures provide you with the opportunity you need. Soybeans and other grains trade in cents per bushel and the minimum tick trading increment is 0 00125 one eighth of a cent per contract. Analyst expects low demand for soft commodities to continue from virus outbreak.

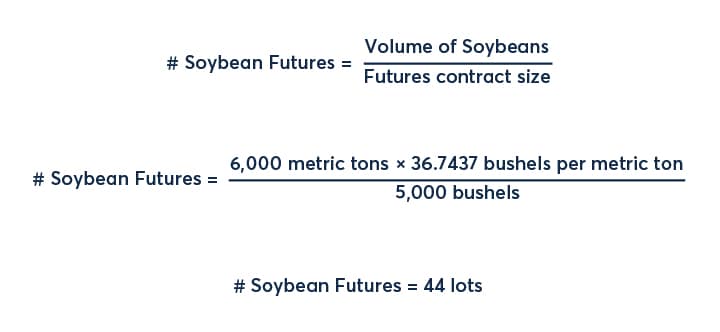

1 bushel 0 035 m soybeans price per 1 m 250 29 usd 1 bushel 35 239 liter. Soybeans make up the underlying asset or commodity for the soybeans futures contract. This price is very important for soybean market.

Soybean trading sourcing marketing your best source to buy soybeans soybean meal soybean oil non gmo ip organic soybeans any quantity to any destination. Here is the information to help you get started trading this contract. If it breaks it there is a high probability for it to test the pink trendline and even breaks it to attain the yearly high price of 961.

Electronic ticker cme globex. Soybean international is an independent agricultural trading and marketing firm specialized in the sourcing and marketing of soybeans non gmo soybeans and soybean products. To invest in soybean meal you can trade the soybean meal futures contract on the cme.

:max_bytes(150000):strip_icc():saturation(0.2):brightness(10):contrast(5)/GettyImages-881089394-5b3d1c4b46e0fb0036fabb36.jpg)

/cdn.vox-cdn.com/uploads/chorus_image/image/63848490/GettyImages_993512154.0.jpg)