What Is Insider Trading Example

:max_bytes(150000):strip_icc():saturation(0.2):brightness(10):contrast(5)/GettyImages-74579982-e0de5d285545443181845c483d92bfe0.jpg)

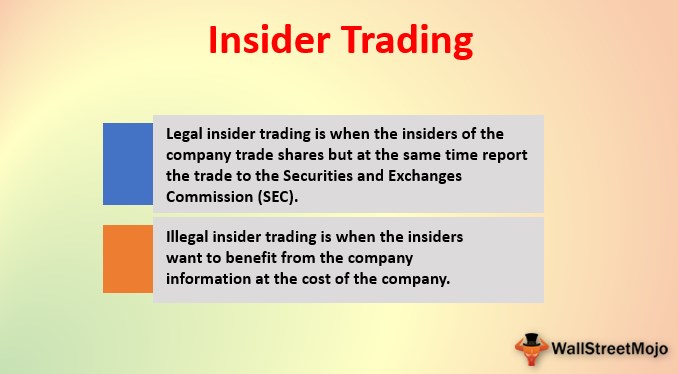

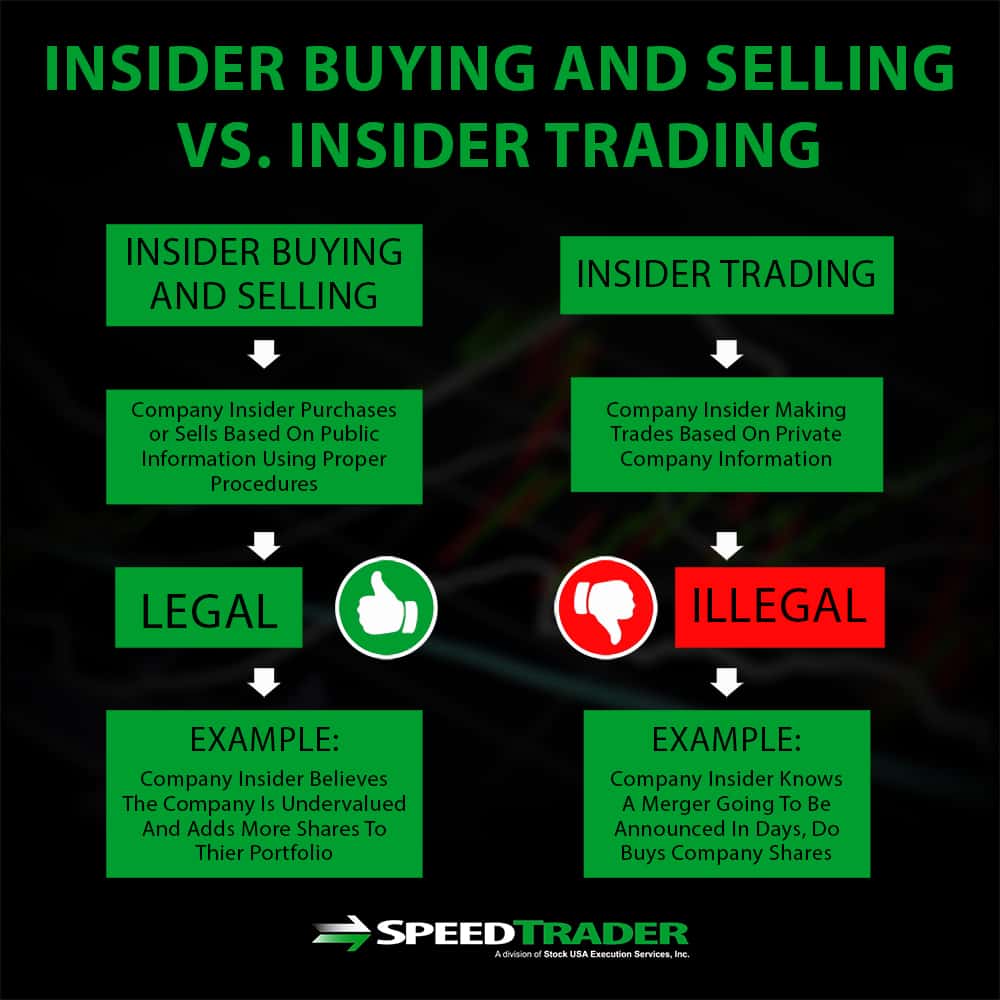

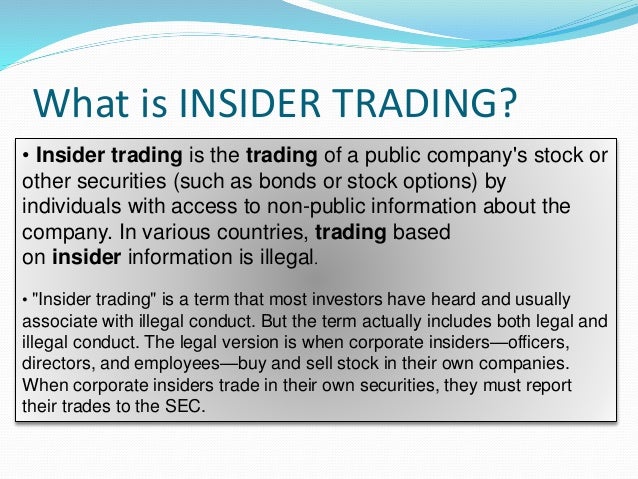

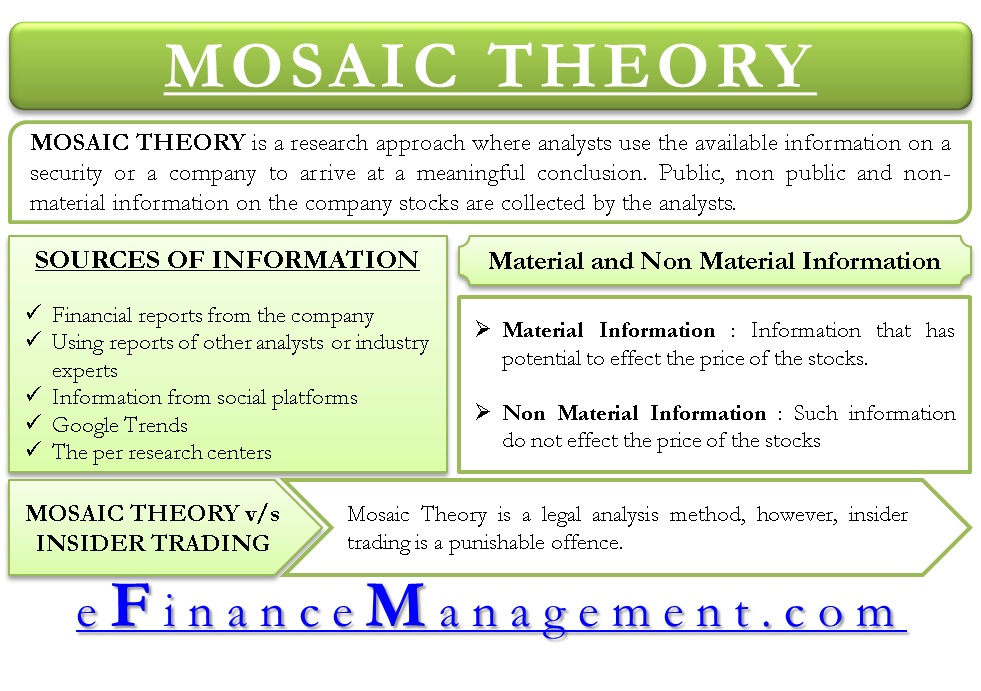

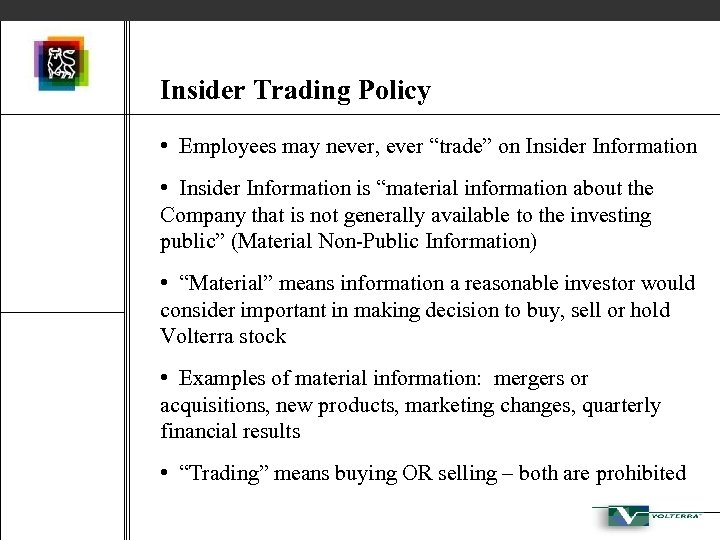

While the term is typically associated with illegal activity insider trading can actually be done legally depending on when the investor makes the trade.

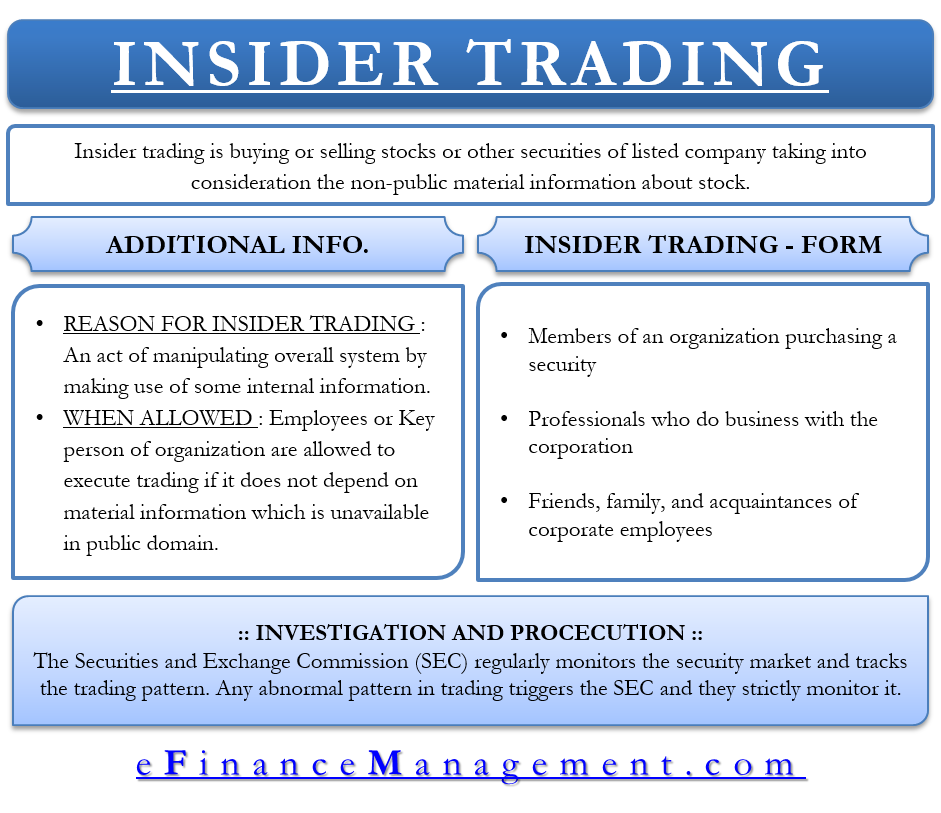

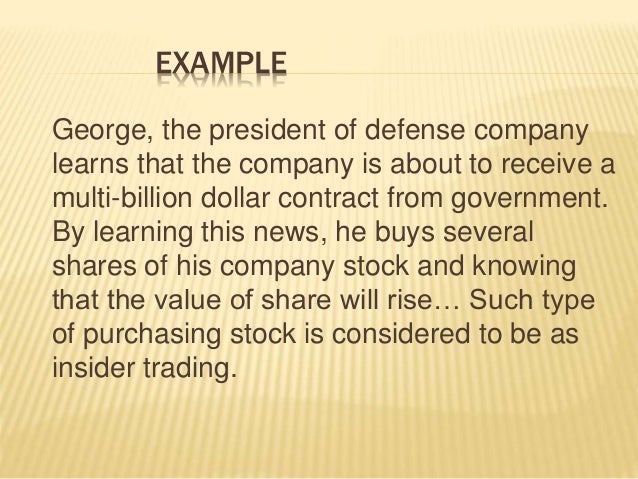

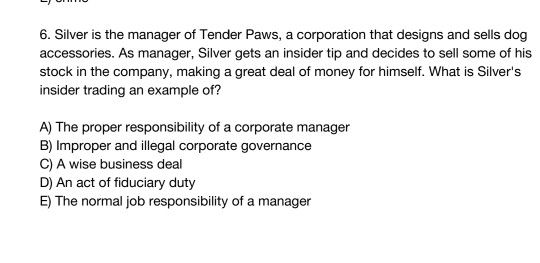

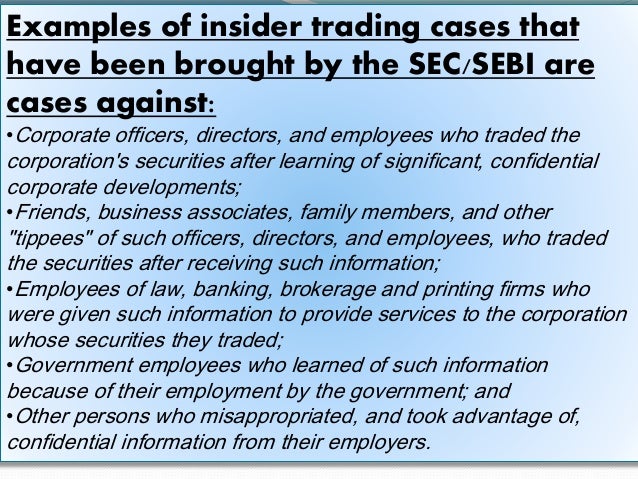

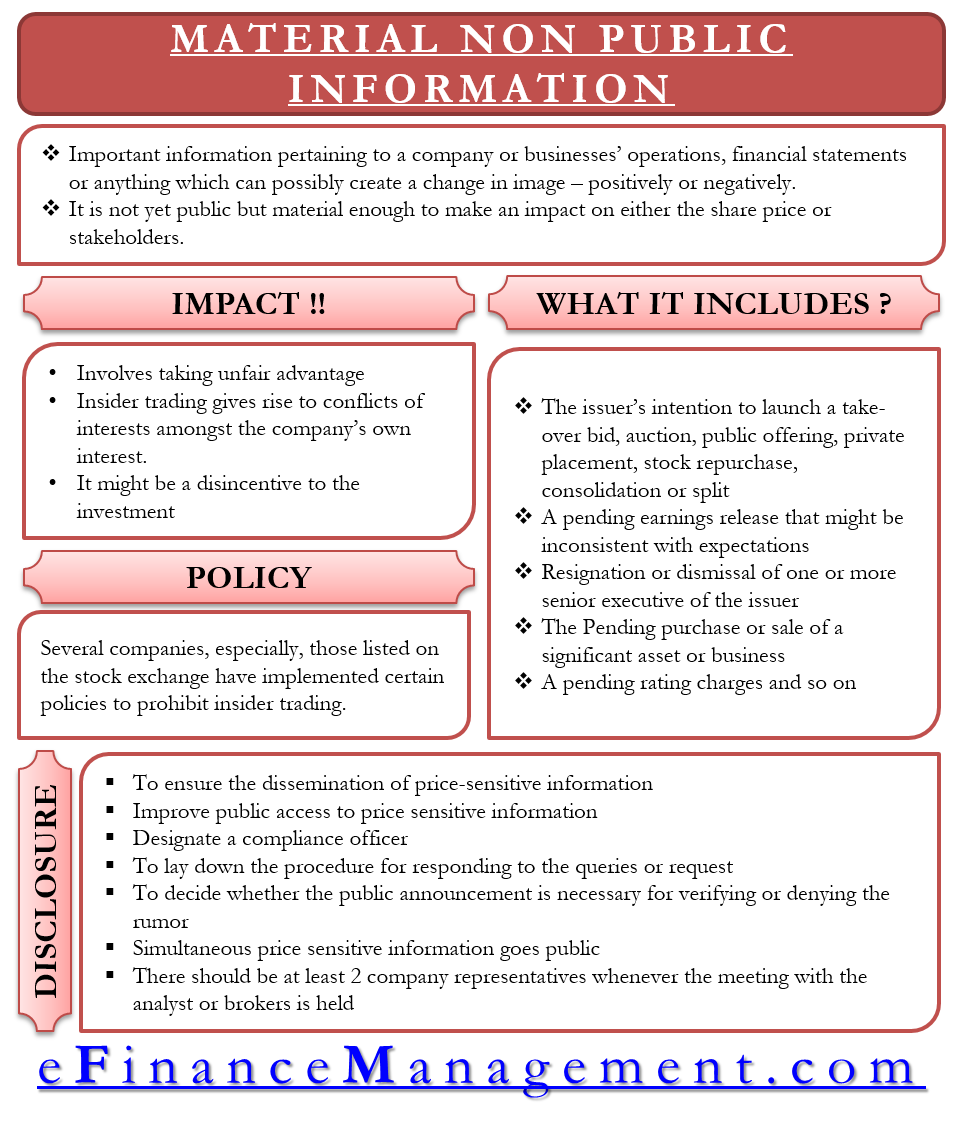

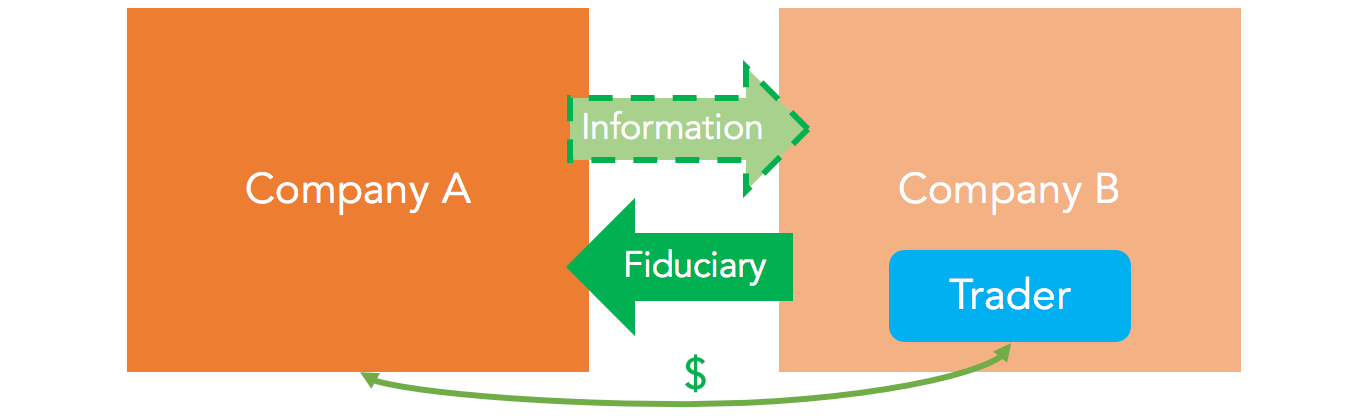

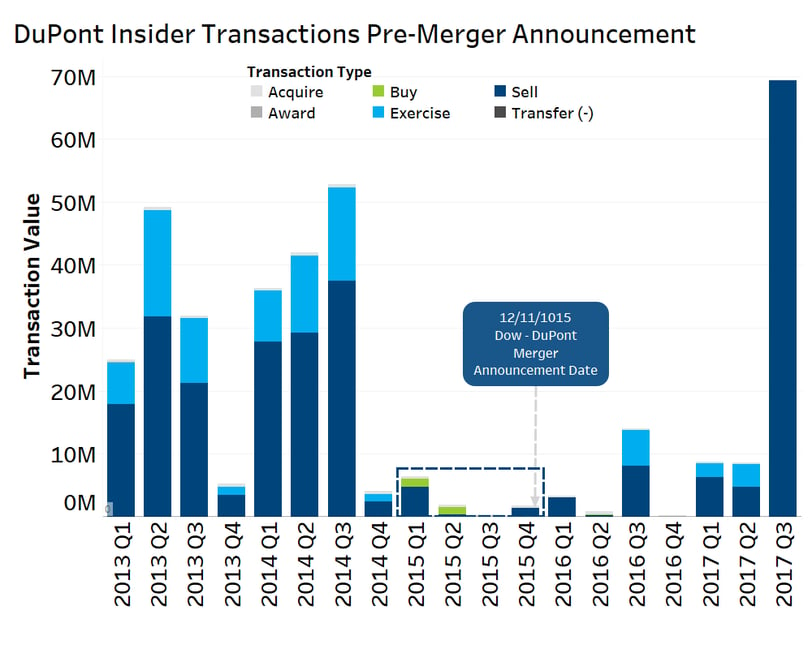

What is insider trading example. A ceo of a corporation buys 1 000 shares of stock in the corporation. Insider trading is the buying or selling of a publicly traded company s stock by someone who has non public material information about that stock throughout the entire history of the u s. Insider trading can also arise in cases where no fiduciary duty is present but another crime has been committed such as corporate espionage.

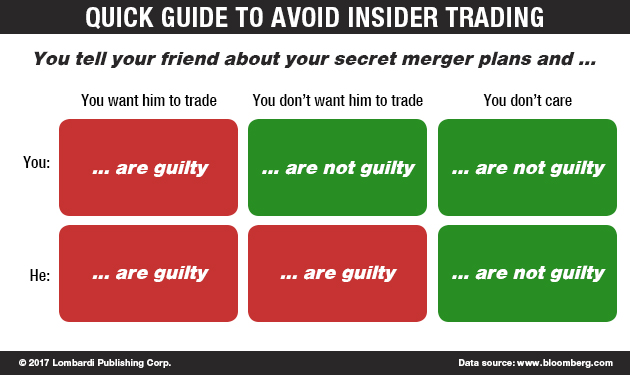

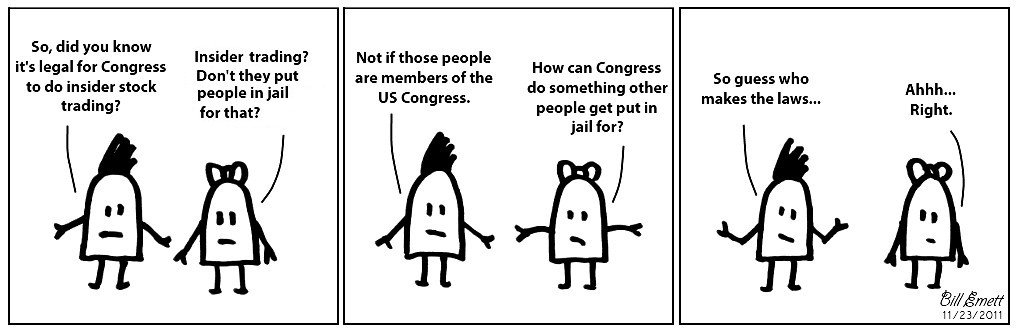

The last word is trading meaning when an individuate security. This is known as tipper tippee liability. The 1987 movie wall street demonstrated this example in a way that helped educate americans on the nature and consequences of securities fraud.

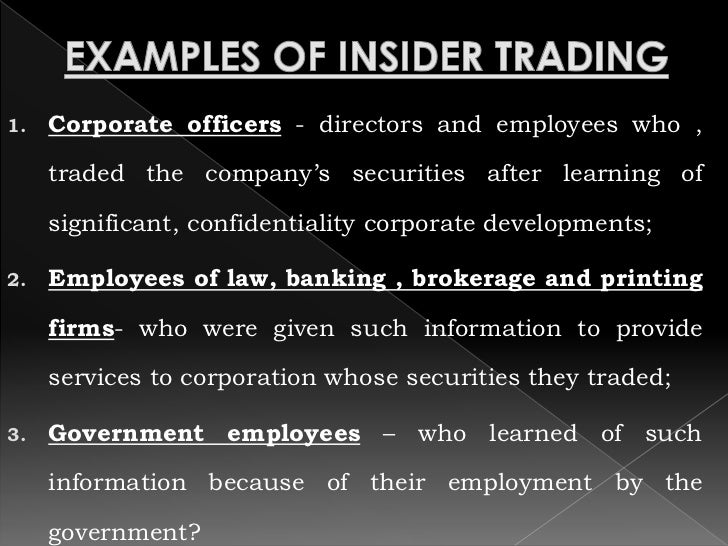

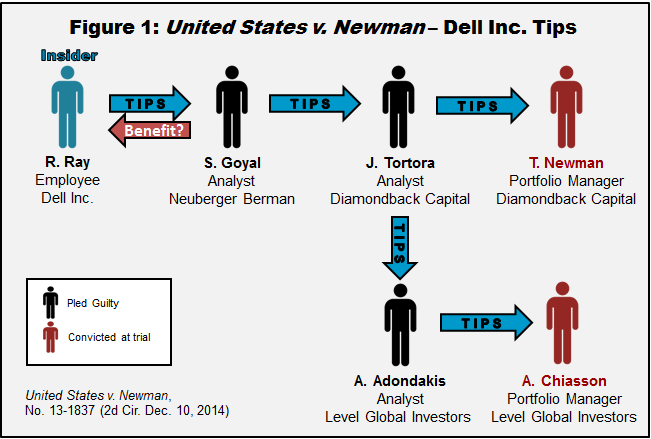

Examples of illegal insider trading cases examples of illegal conduct include tipping the information securities trading by the person tipped and securities trading by individuals who misappropriate such information. Insider trading is the buying or selling of a publicly traded company s stock by someone who has non public material information about that stock material nonpublic information is any information. The first word is insider meaning when an individual is inside a company or an individual works for a business i e.

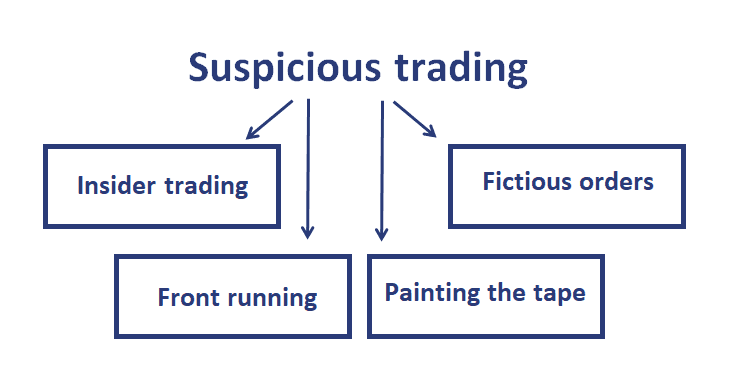

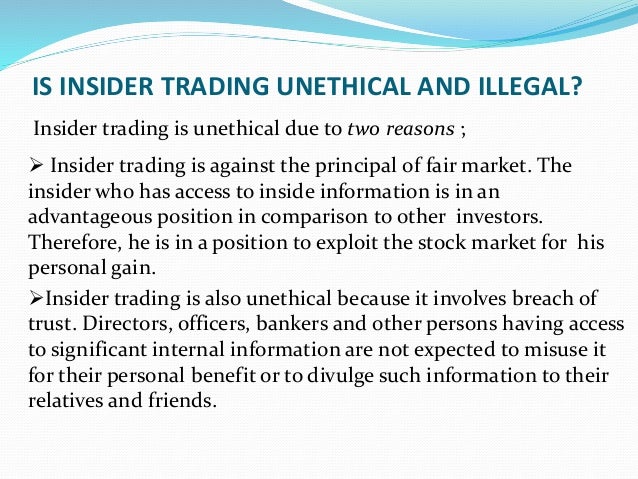

The stereotypical example of insider trading involves a cloak and dagger campaign where someone inside a company is intentionally passing information to an outsider who then places trades. The definition of an insider can differ significantly under different jurisdictions. Detailed rules regarding insider trading are complicated and generally vary from country to country.

For example an organized crime ring that infiltrated certain financial or legal institutions to systematically gain access to and exploit and use private information might be found guilty of such trading among other charges for the related crimes. The trade is reported to the securities and exchange commission. The term insider trading is used to describe the buying and selling activities of an individual who has information about a stock that has not been made public.

If an insider gives an outsider material nonpublic information or a tip this becomes insider trading when the outsider acts on it. Examples of insider trading that are legal include.

/GettyImages-490556036-1f443237f9864342b101cd301a12aeec.jpg)

/what-is-a-conflict-of-interest-give-me-some-examples-398192_FINAL-5bd9cf3c46e0fb005138da62.png)