What Is Carry Trading

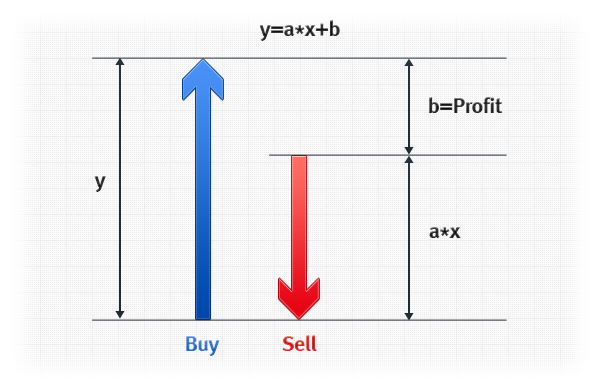

A carry trade is a trading strategy that involves borrowing at a low interest rate and investing in an asset that provides a higher rate of return.

What is carry trading. The term carry trade without further modification refers to currency carry trade. While you are paying the low interest rate on the financial instrument you borrowed sold you are collecting higher interest on the financial instrument you purchased. It takes its origins from the financial concept of a carry the cost or profit associated with holding a particular asset over some period of time.

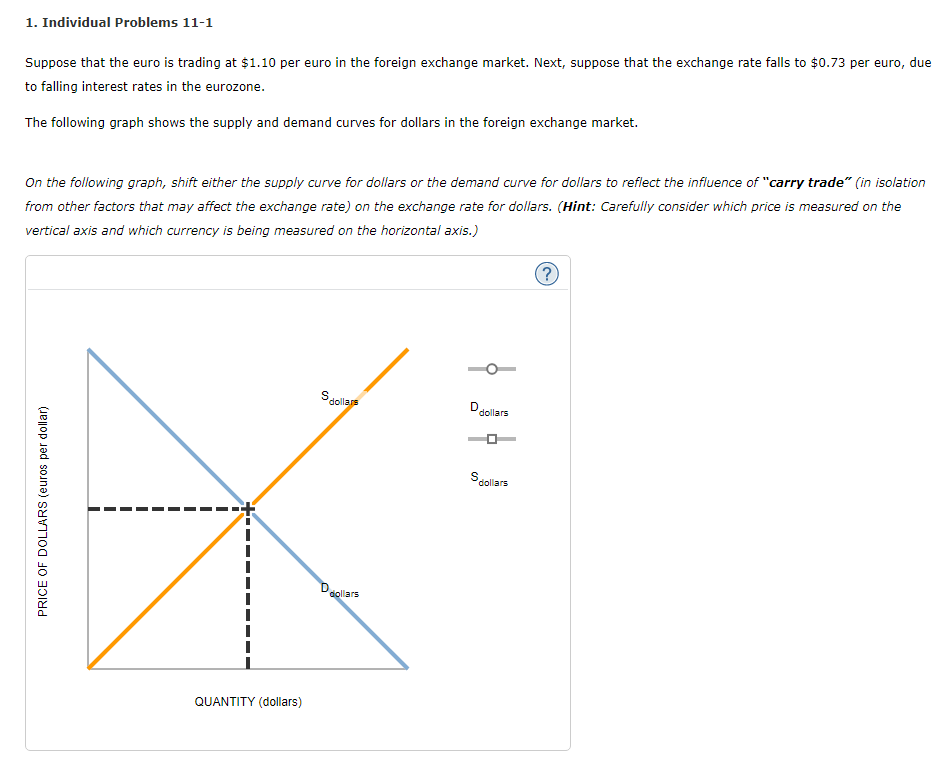

For each day that you hold that trade your broker will pay you the interest difference between the two currencies as long as you are trading in the interest positive direction. The currency carry trade is an uncovered interest arbitrage. A carry trade involves borrowing or selling a financial instrument with a low interest rate then using it to purchase a financial instrument with a higher interest rate.

A carry trade is when you buy a high interest currency against a low interest currency. Carry trade for the bond market this refers to a trade where you borrow and pay interest in order to buy something else that has higher interest. When it comes to currency trading a carry trade is one where a trader borrows one currency for instance the usd using it to buy another currency such as the jpy.

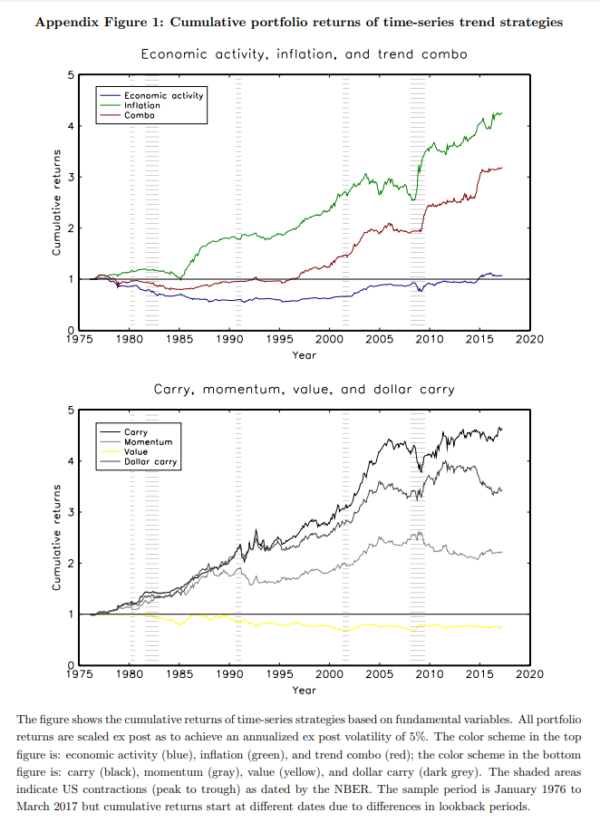

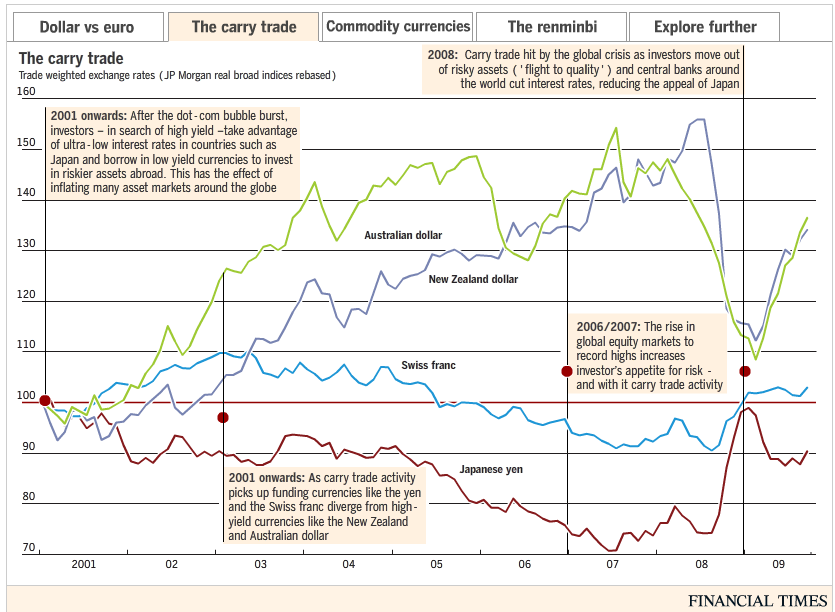

Investors borrow low yielding currencies and lend invest in high yielding currencies. For example with a positively sloped term structure short rates lower than long rates one might borrow at low short term rates and finance the purchase of long term bonds. A carry trade is a trading strategy that involves borrowing at a low interest rate and investing in an asset that provides a higher rate of return.

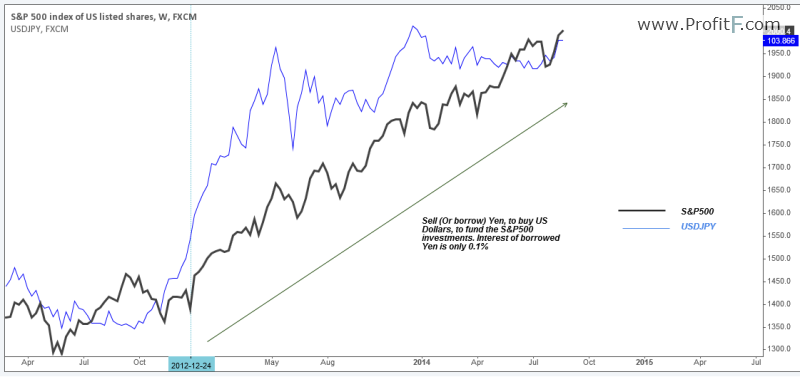

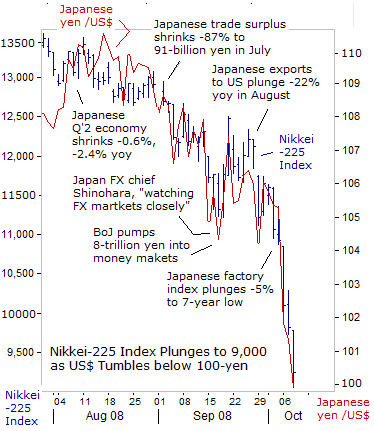

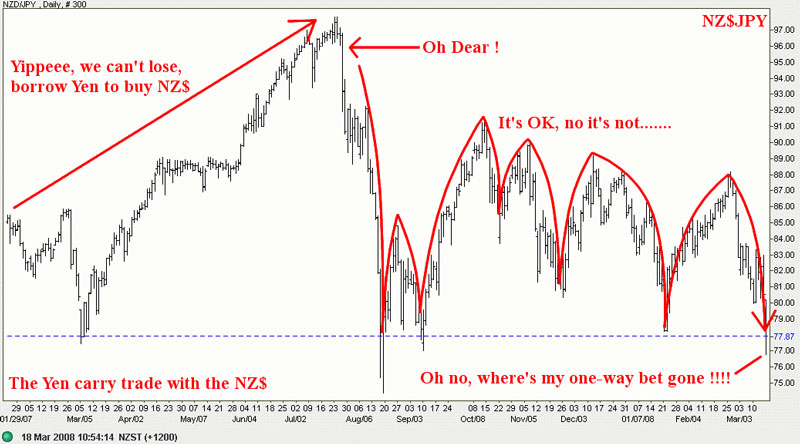

The classic example is the currency carry trade borrowing in low interest rate currencies like yen converting to high interest rate currencies like australian dollar and investing. The carry trading is a strategy in which an investor sells a certain currency with a relatively low interest rate and buy another currency with a higher interest rate. While the trader pays a low interest rate on the borrowed sold currency they simultaneously collect higher interest rates on the currency that they bought.

Carry trading is one of today s most popular online trading strategies. Carry trading means buying an asset with a high payout and shorting a similar asset with a low payout. A carry trade happens when a person sells or borrows an asset with a low interest rate in order to purchase another asset with a higher interest rate looking to profit from the underlying interest rate difference.

:max_bytes(150000):strip_icc():saturation(0.2):brightness(10):contrast(5)/foreign-exchange-1076728392-6a922db856944a8f953dfec721b14a78.jpg)