Volcker Rule Proprietary Trading

This is called proprietary trading.

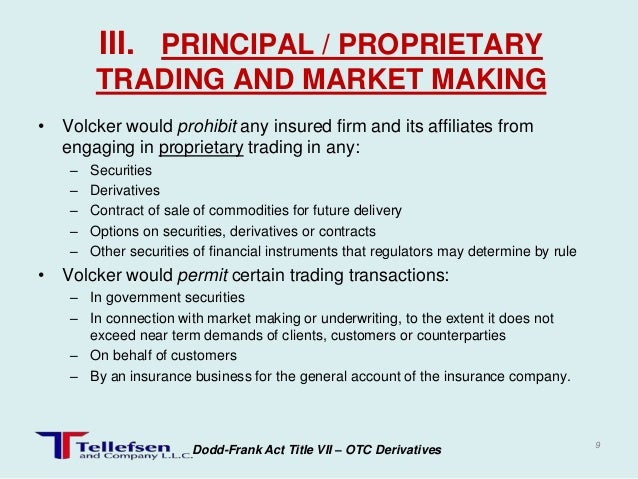

Volcker rule proprietary trading. Named after former federal reserve chairman paul volcker the volcker rule disallows short term proprietary trading of securities derivatives commodity futures and options on these instruments for banks own accounts under the premise that these activities do not benefit banks customers. Emerging from the nation s experience in the great depression the great recession and everything in between the volcker rule a part of the dodd frank wall street reform and consumer protection act of 2010 was aimed at preventing federally insured banks from engaging in proprietary trading or controlling hedge funds or private equity funds. By statute july 21 2014 extended to july 21 2015 with two one year extensions possible on application.

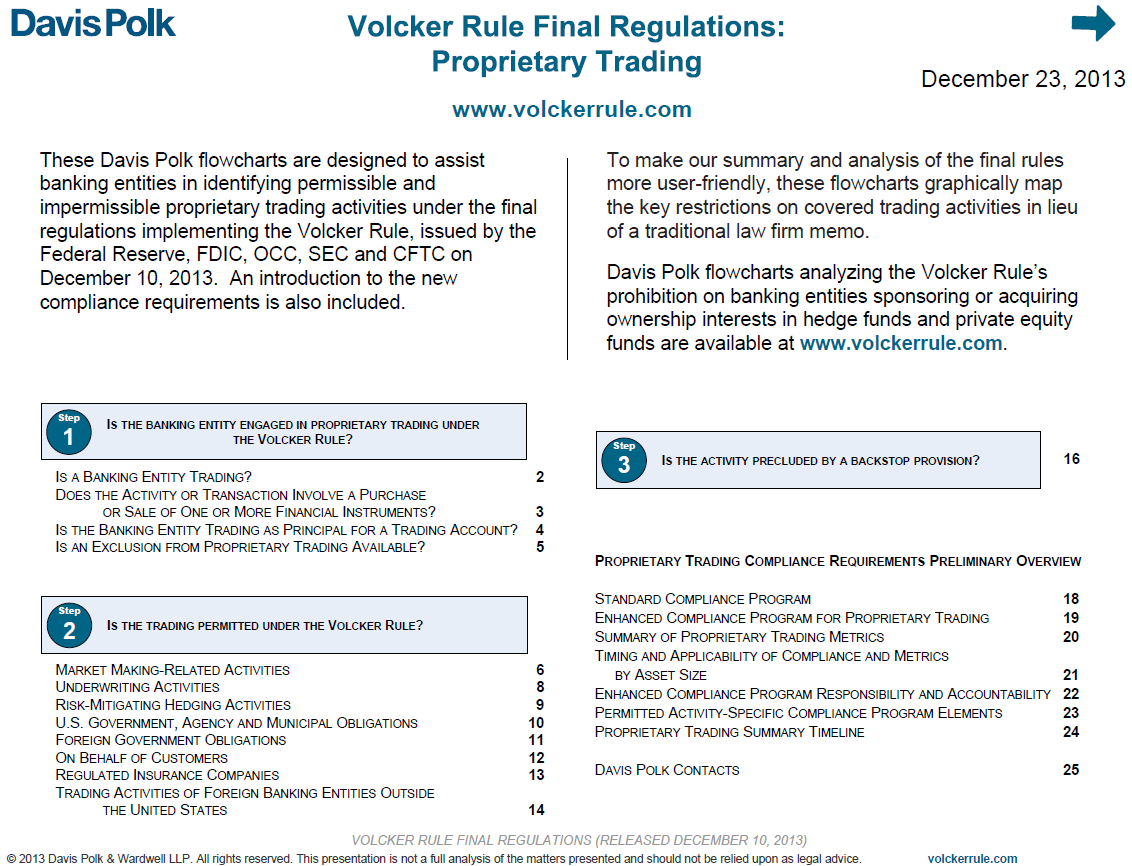

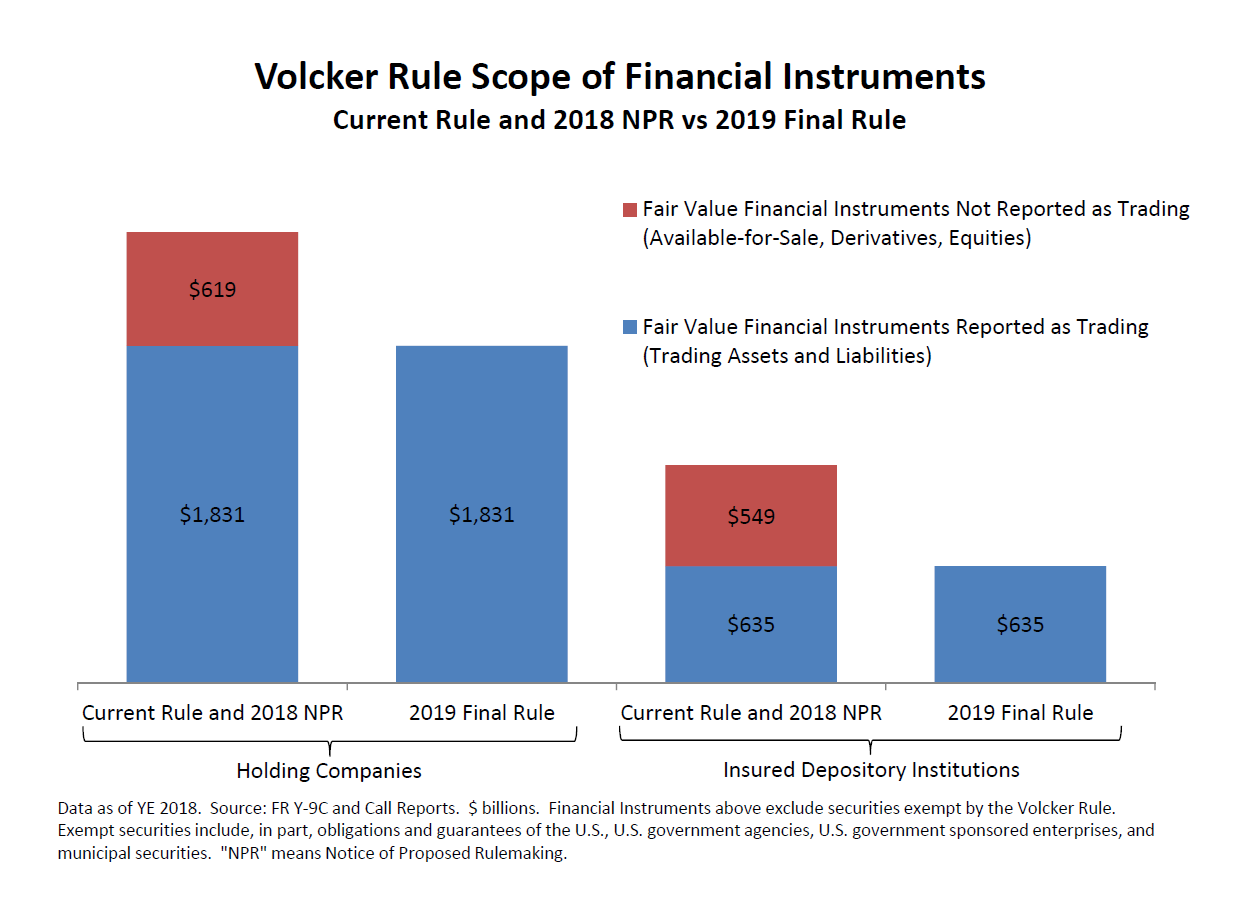

Volcker rule proprietary trading prohibition a banking entity be may not engage in proprietary trading. The volcker rule generally prohibits banking entities from engaging in proprietary trading or investing in or sponsoring hedge funds or private equity funds. Like the proposal the final rule modifies three areas of the rule by.

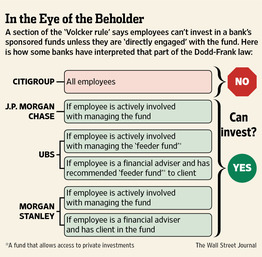

It limits their investment in and relationships with hedge funds or private equity funds. Bank ceos must annually attest in writing that their firm is complying with the rule. Proprietary trading is defined by the rule as a bank serving as a principal of a.

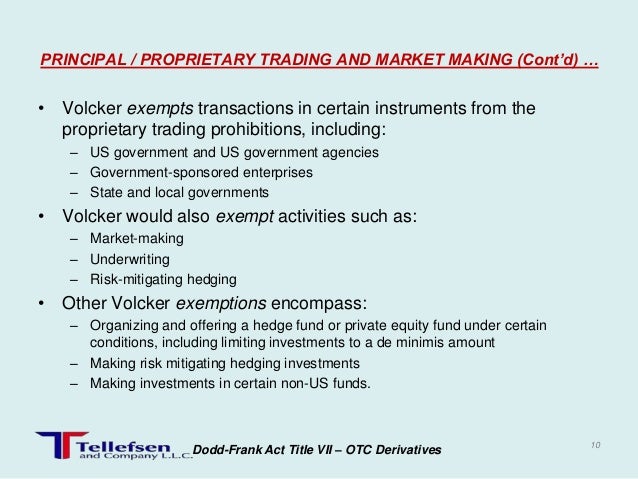

Under the volcker rule banks can no longer trade securities derivatives commodities future and options for their own account. The volcker rule as enacted generally prohibits banking entities from engaging in proprietary trading as the regulators stated in their opus this week. The volcker rule generally prohibits banking entities from engaging in proprietary trading and from acquiring or retaining ownership interests in sponsoring or having certain relationships with a hedge fund or private equity fund.

Status statutory effective date. But the law goes on to provide exemptions for such things as trading on behalf of customers risk mitigating hedging activity and underwriting and market making activities. Streamlining the covered funds portion of rule.

/paulvolker-4564456672a14893a51cf94308f862e5.jpg)

:max_bytes(150000):strip_icc():saturation(0.2):brightness(10):contrast(5)/GettyImages-84673297-79e345bb018f41e88e2c8840fd3bc8cf.jpg)