Volatility Trading Strategies

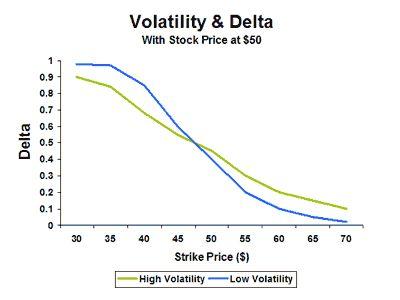

Type of option call or put known.

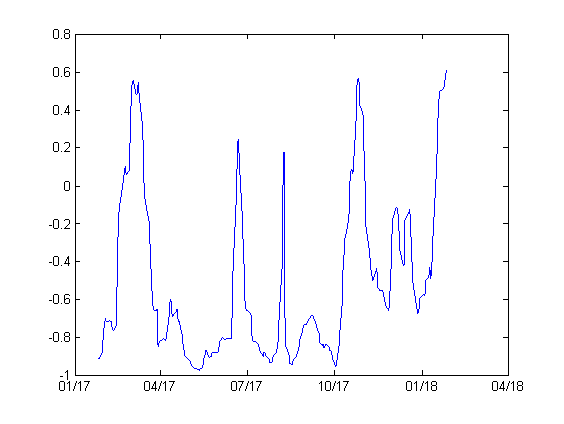

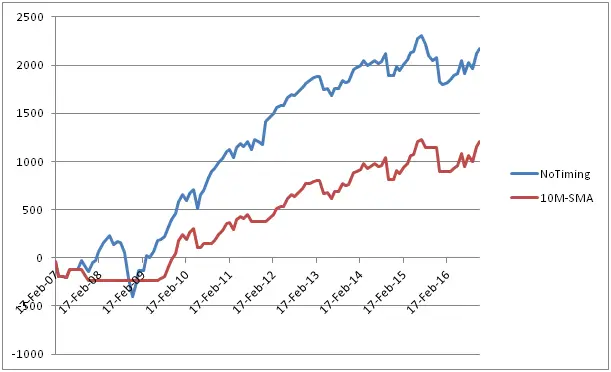

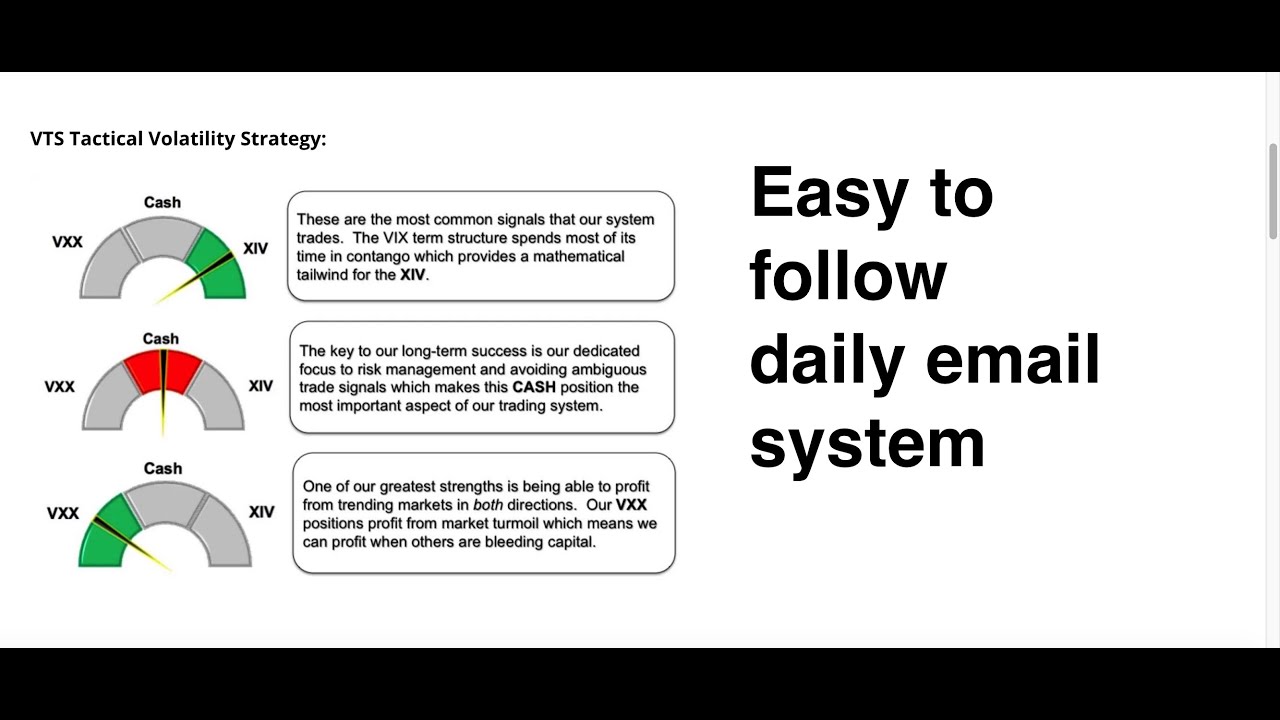

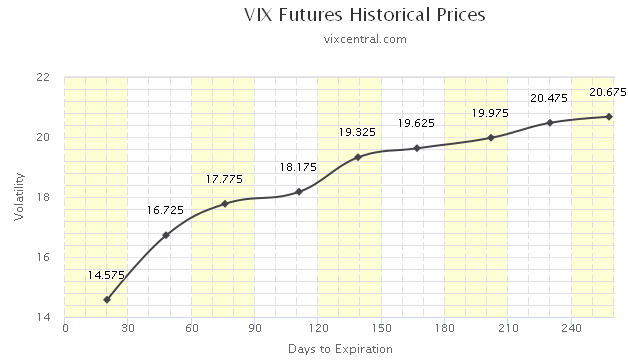

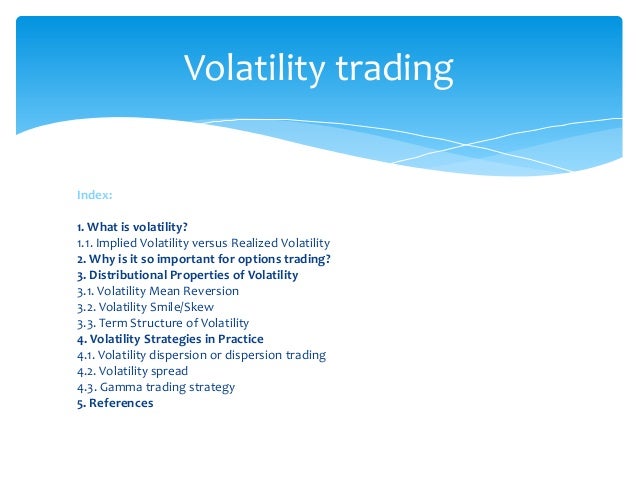

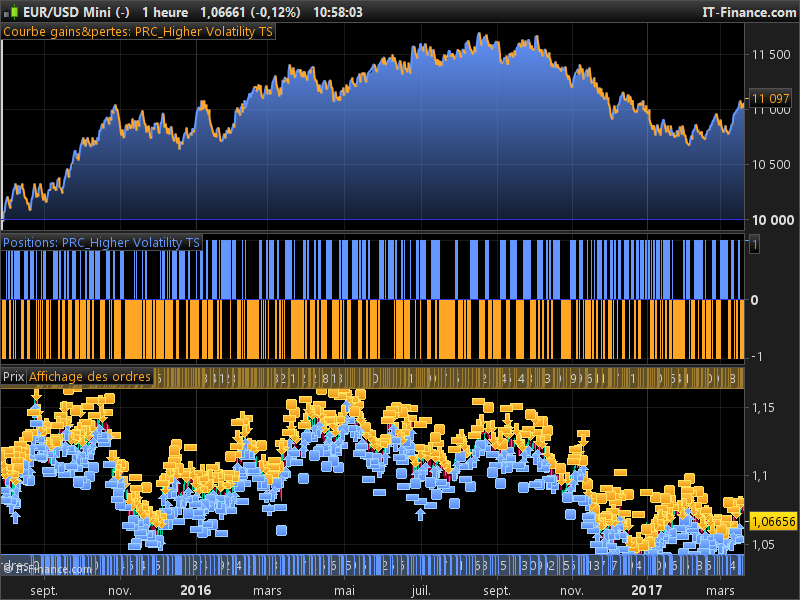

Volatility trading strategies. V olatility t rading s trategies home. The strategy enables the trader to profit from the underlying price change direction thus the trader expects volatility to increase. Strategies for trading volatility with options.

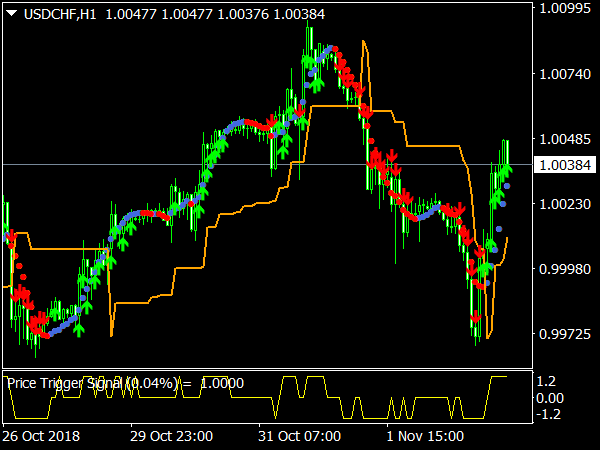

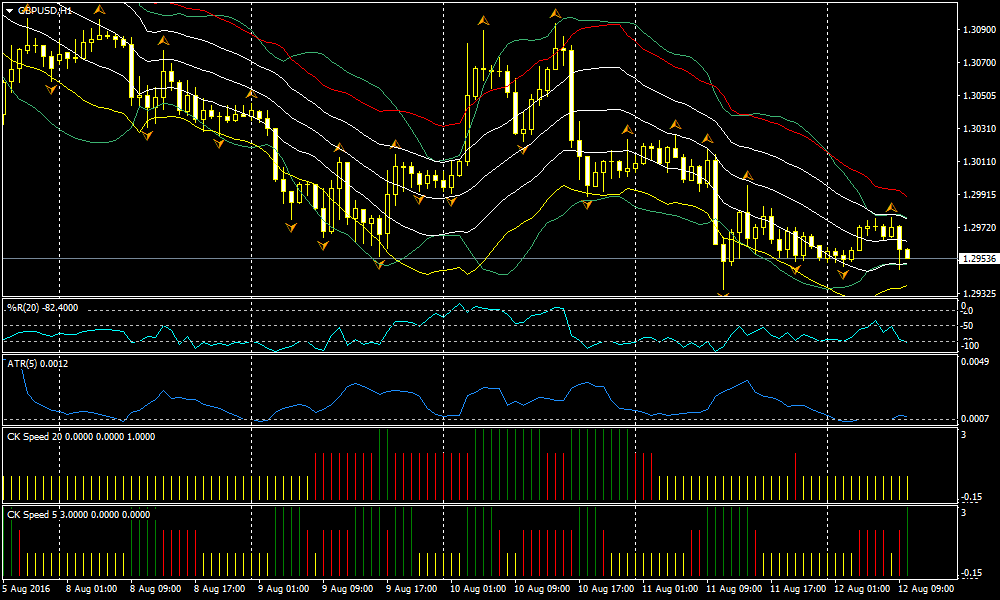

Strike price known. Popular trading strategies to trade volatility include the straddle strategy which can be utilised either with pending orders or options and the short straddle strategy. 1 for example suppose a trader buys a call and a put option.

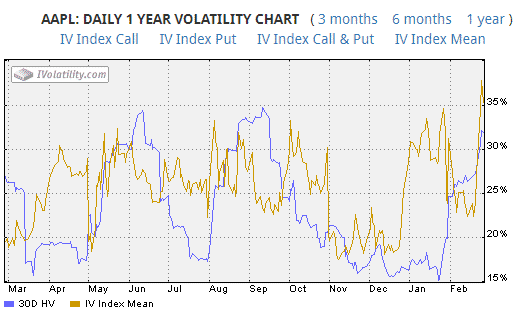

High vol neutral strategies include iron condors and long butterfly spreads. Risk free interest rate known. Trading options is more than just being bullish or bearish or market neutral.

Almost every volatility trading strategy can be characterised as one of the following 6 ideas. In essence traders place pending orders above or below a consolidation zone to catch a potential breakout rise in volatility in either direction. Dividends on the underlying known.

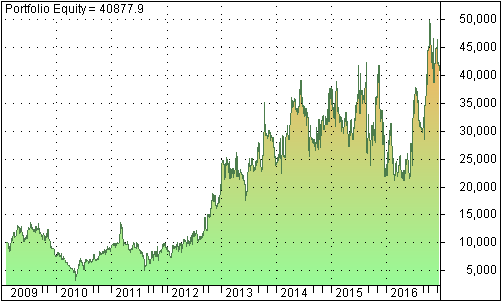

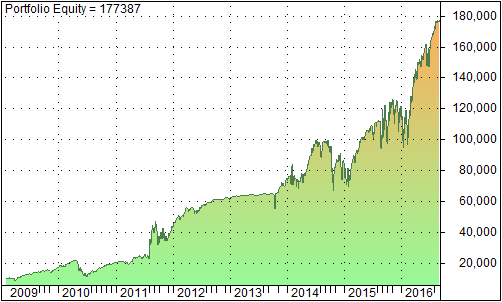

High vol bearish strategies include short call vertical spreads and unbalanced butterfly spreads. At volatility trading strategies we make it clear from the outset our goal is to outperform passive investing to ensure that people are getting maximum value.

/ProfitFromVolatility1-4f68837d0ec244df8eb775a9e65bcf40.png)

/ProfitFromVolatility1-4f68837d0ec244df8eb775a9e65bcf40.png)

/ProfitFromVolatility1-4f68837d0ec244df8eb775a9e65bcf40.png)

:max_bytes(150000):strip_icc()/ImpliedVolatility_BuyLowandSellHigh2-2f5a33f6dde64c808b4d4775a258d3d7.png)