Trading With Moving Averages

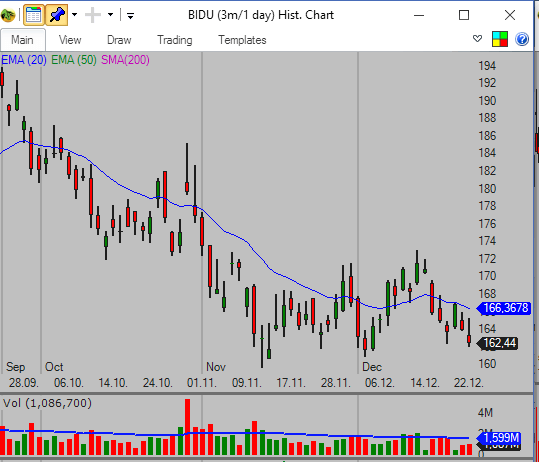

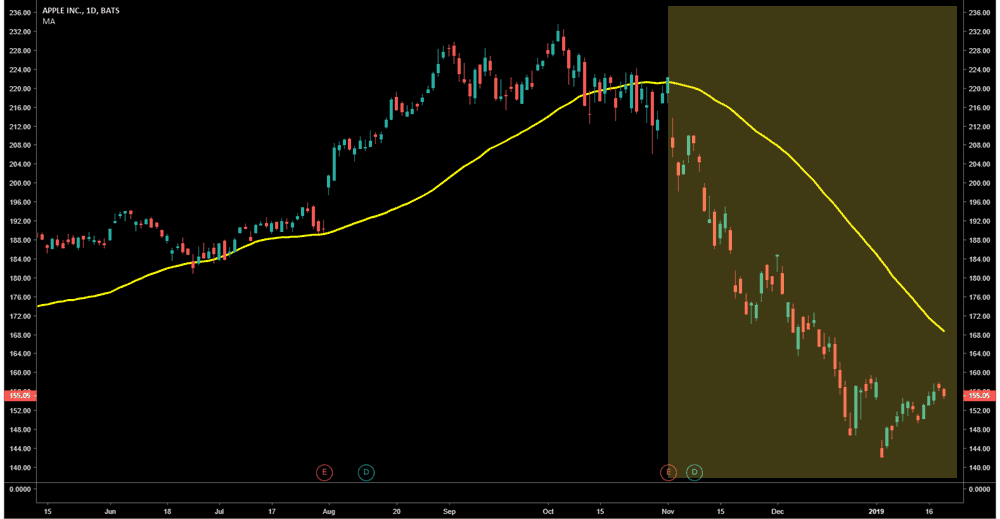

The moving average ma is a simple technical analysis tool that smooths out price data by creating a constantly updated average price.

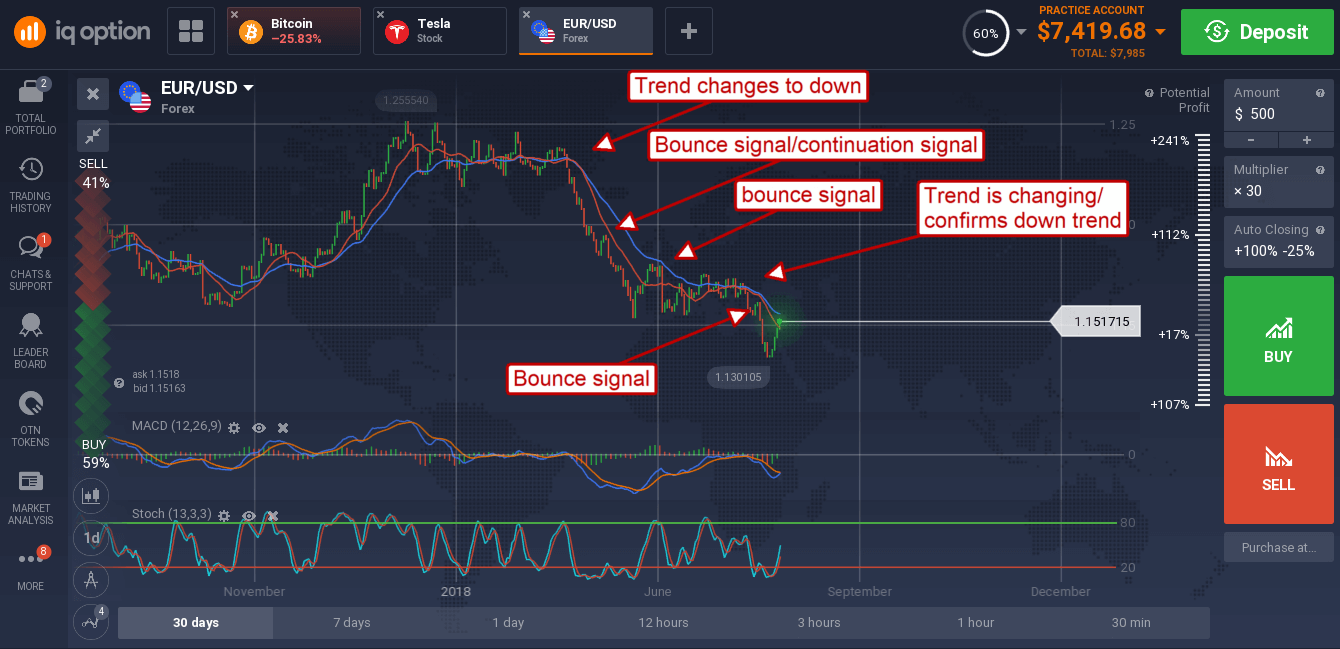

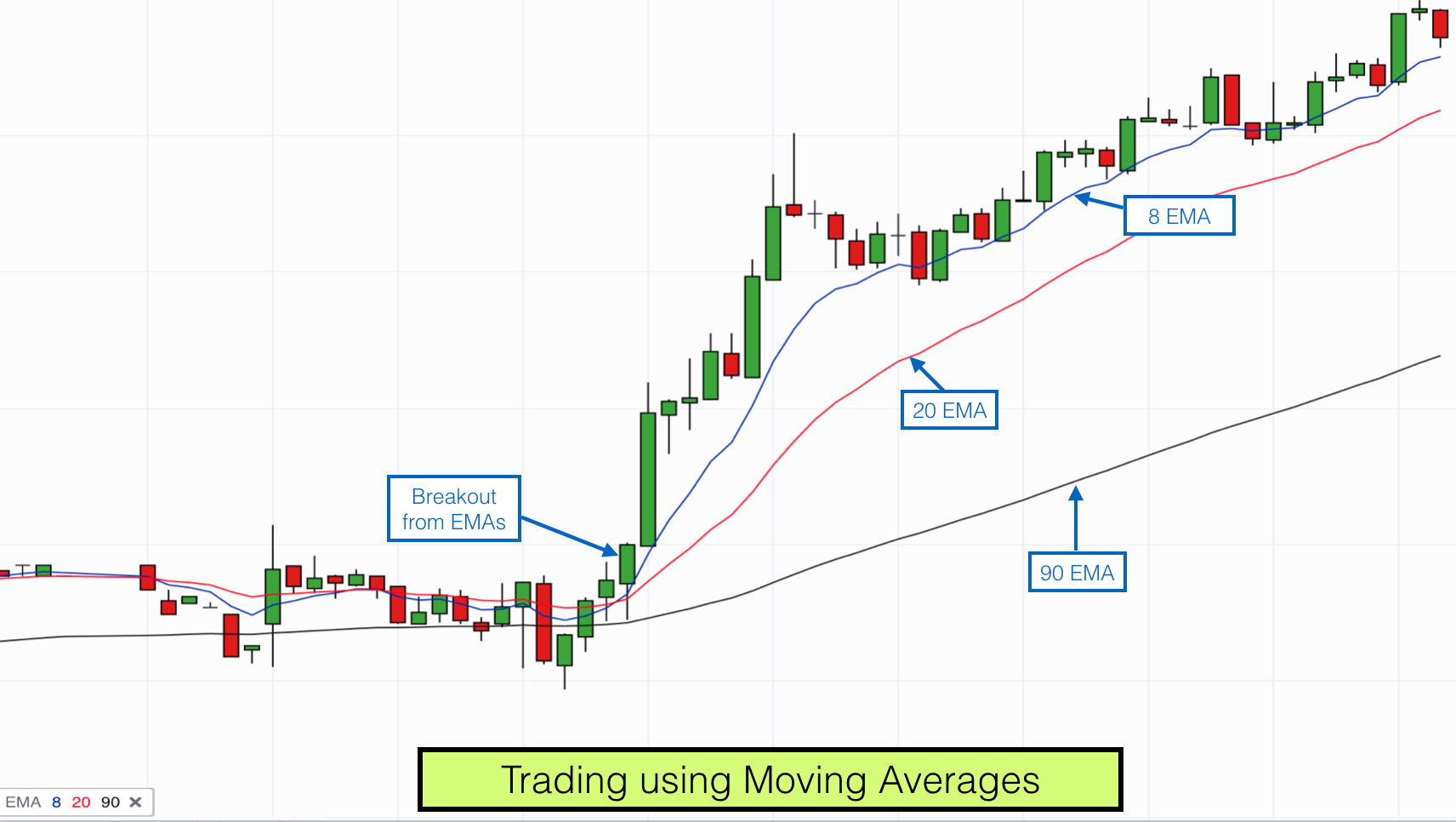

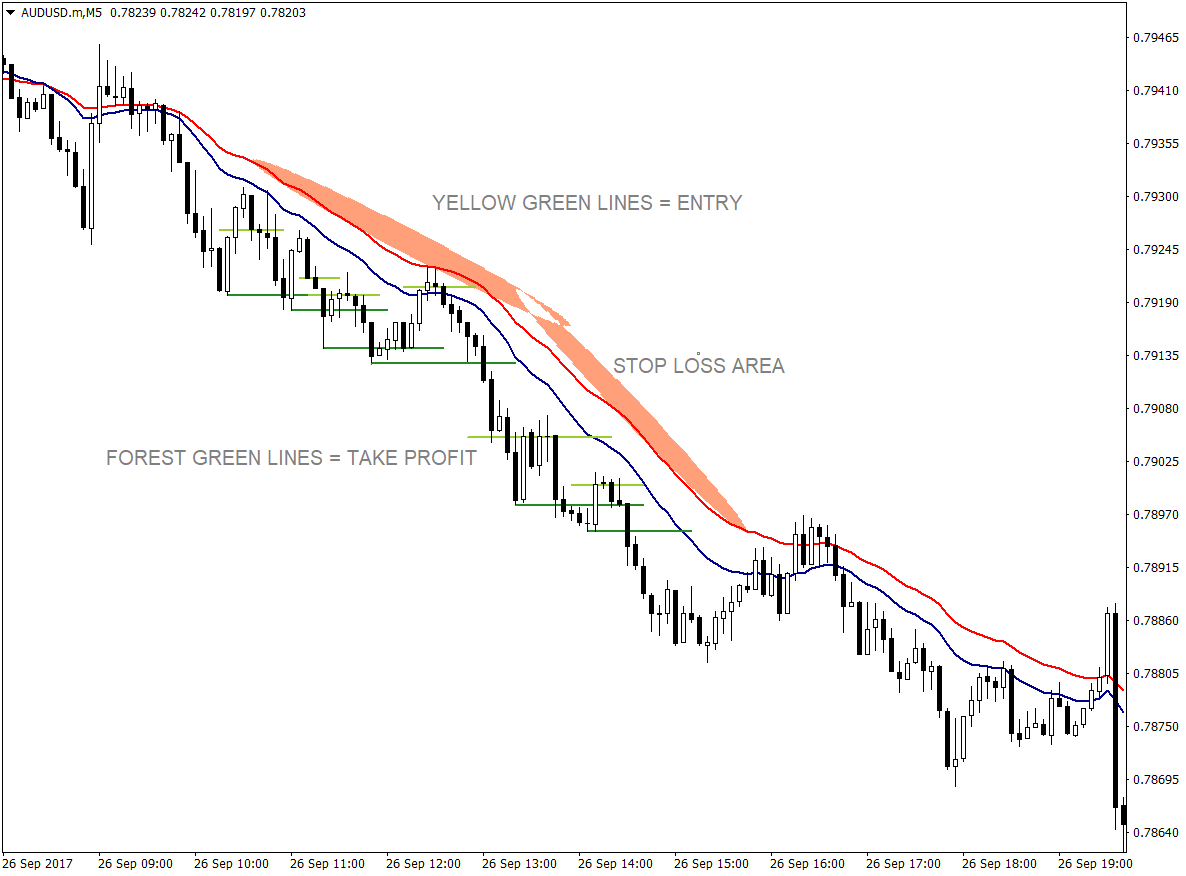

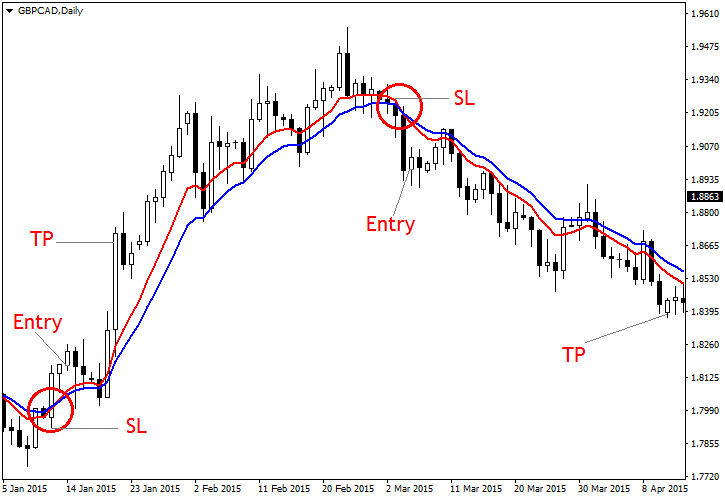

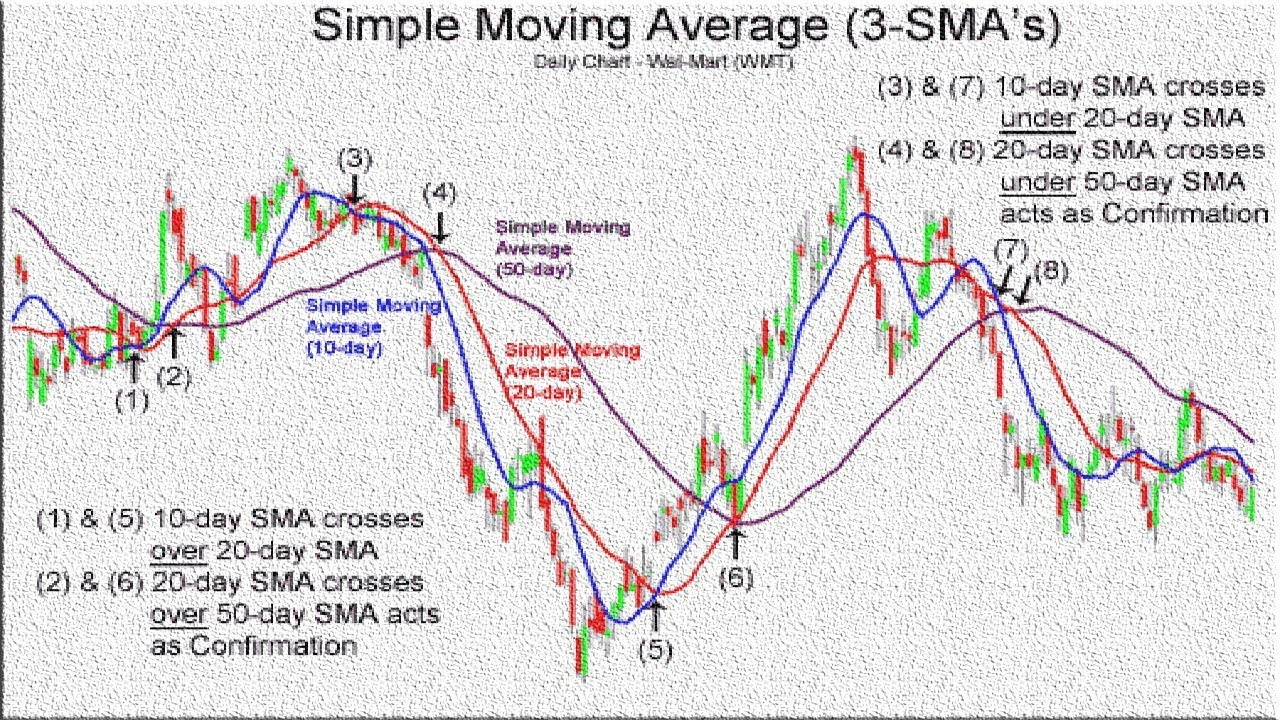

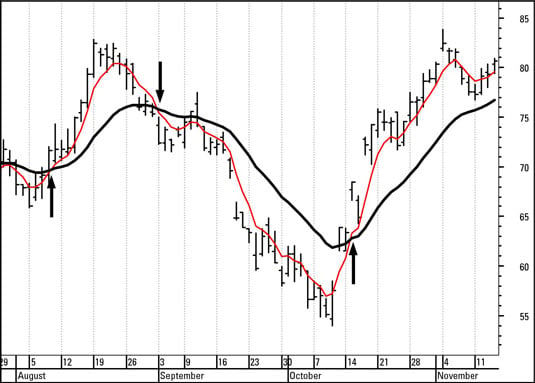

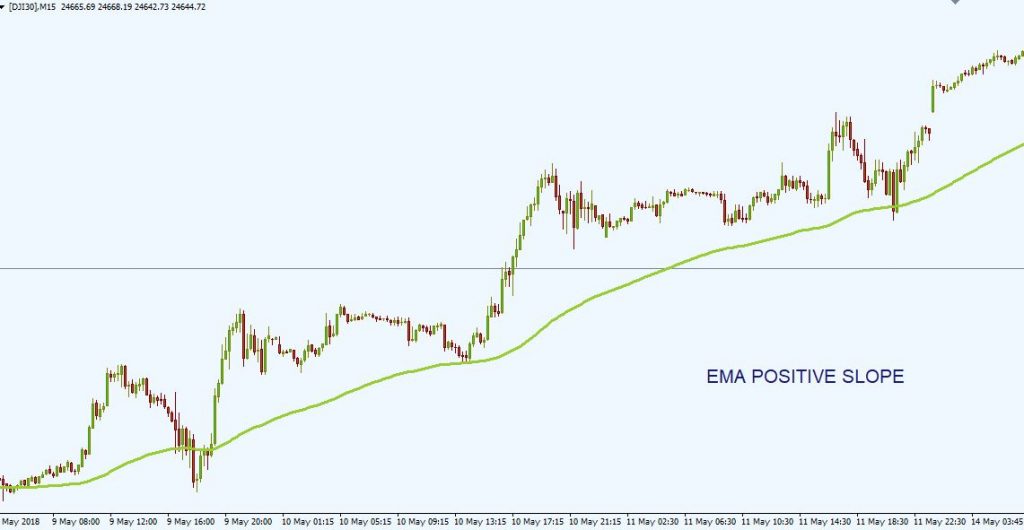

Trading with moving averages. Moving average trading is a strategy that identifies trends and reversals. 5 8 and 13 bar simple moving averages offer perfect inputs for day traders seeking an edge in trading the market from both the long and short sides. Since the market relies on the bulls and bears battling it out you can use moving averages to find momentum as well as support and resistance.

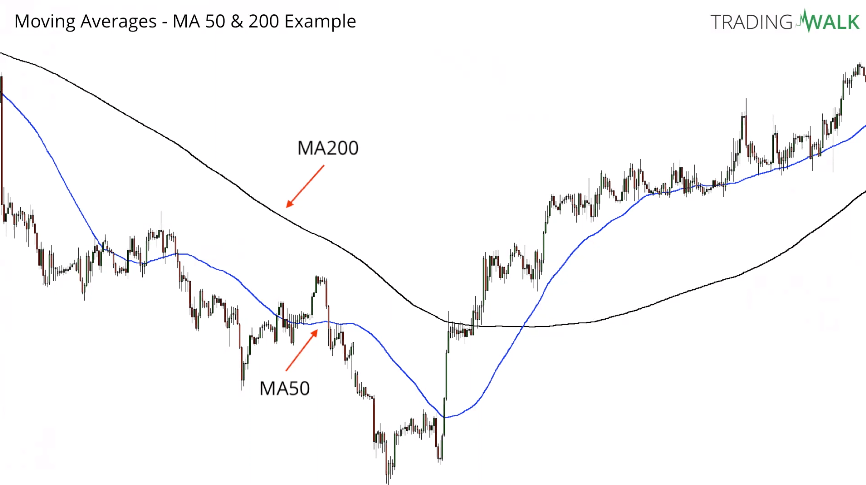

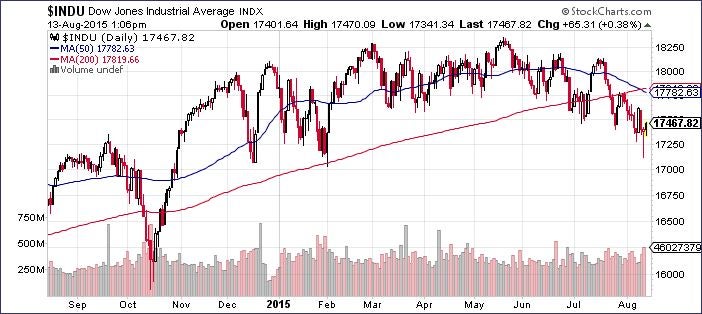

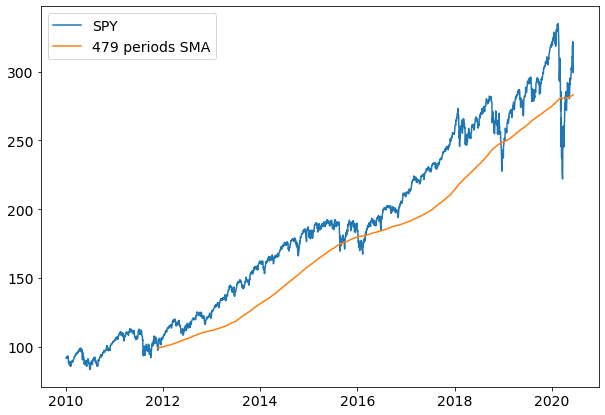

Like after a downtrend buying on a break back over the 250 day moving average then more as the 200 day moving average is retaken. It can function as not only an indicator on its own but forms the very basis of several others. The moving average is an extremely popular indicator used in securities trading.

The average is taken over a specific period of time like 10. To scale into a position. A trade can be scaled into as key moving averages are retaken.

Day trading as well as swing trading can benefit from moving averages. Moving averages moving averages are price based lagging or reactive indicators that display the average price of a security over a set period of time. A moving average is a good way to gauge momentum as well as to confirm trends and define areas of support and resistance.

:max_bytes(150000):strip_icc()/MovingAverageBounce_7-57a56bb73df78cf459c24b55.png)

.png)