Trading On A Margin

When things go according to plan these investors make a lot of money.

Trading on a margin. The reality is that margin trading is an inherently risky strategy that can transform even the safest blue chip stock purchase into a high stakes gamble. A margin account is a standard. Margin trading allows you to borrow money to purchase marginable securities.

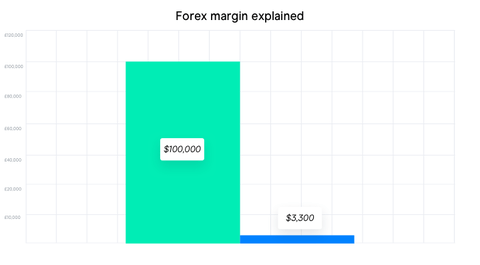

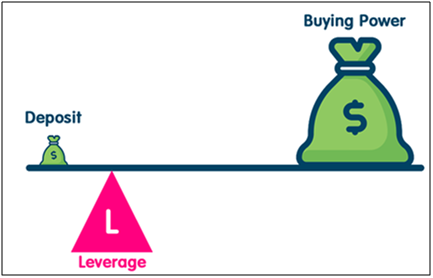

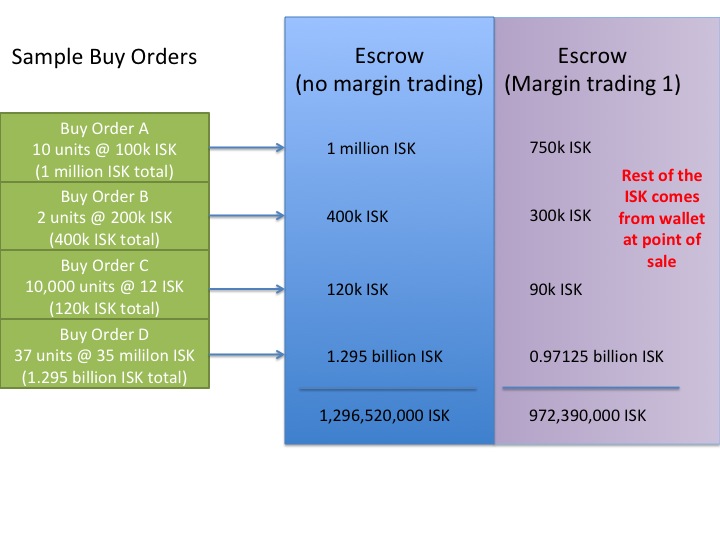

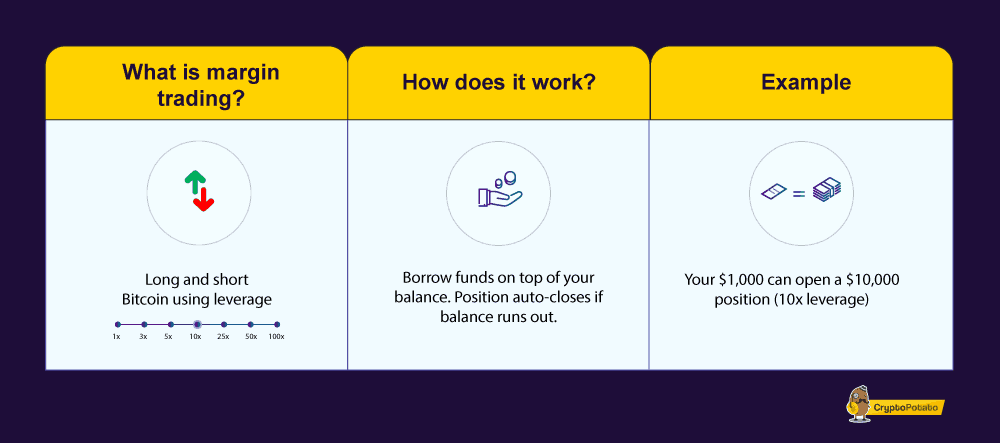

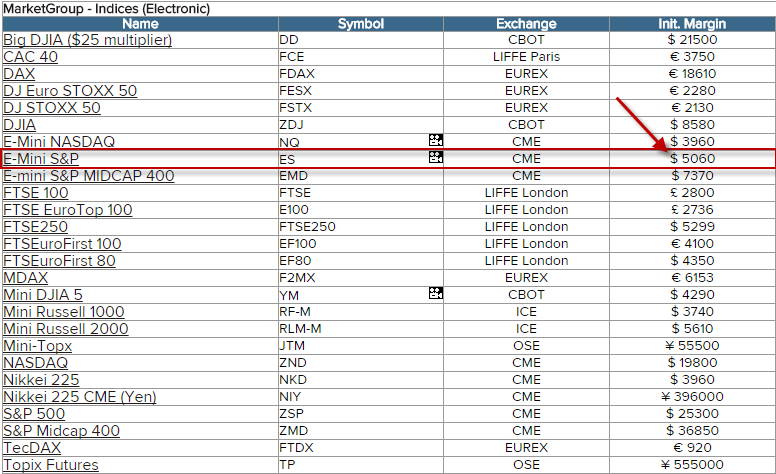

Margin trading refers to the practice of using borrowed funds from a broker to trade a financial asset which forms the collateral for the loan from the broker. For example if you are trading on a 50 to 1 margin then for every 1 in your account you are able to trade 50 in a trade. Margin trading also refers to intraday trading in india and various stock brokers provide this service.

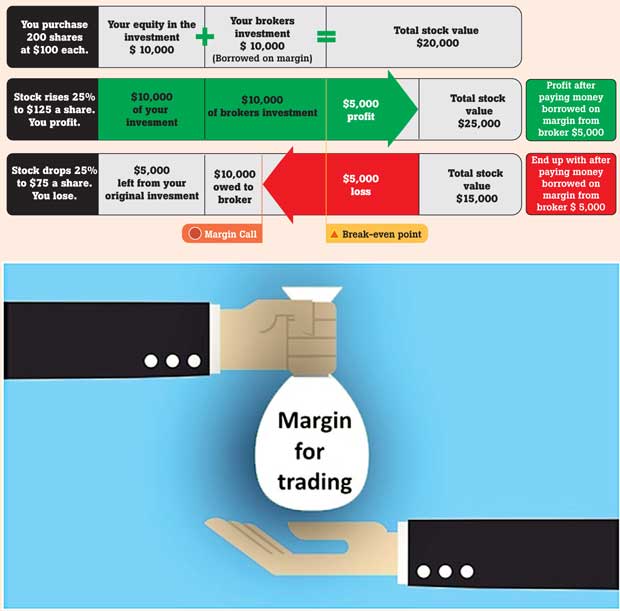

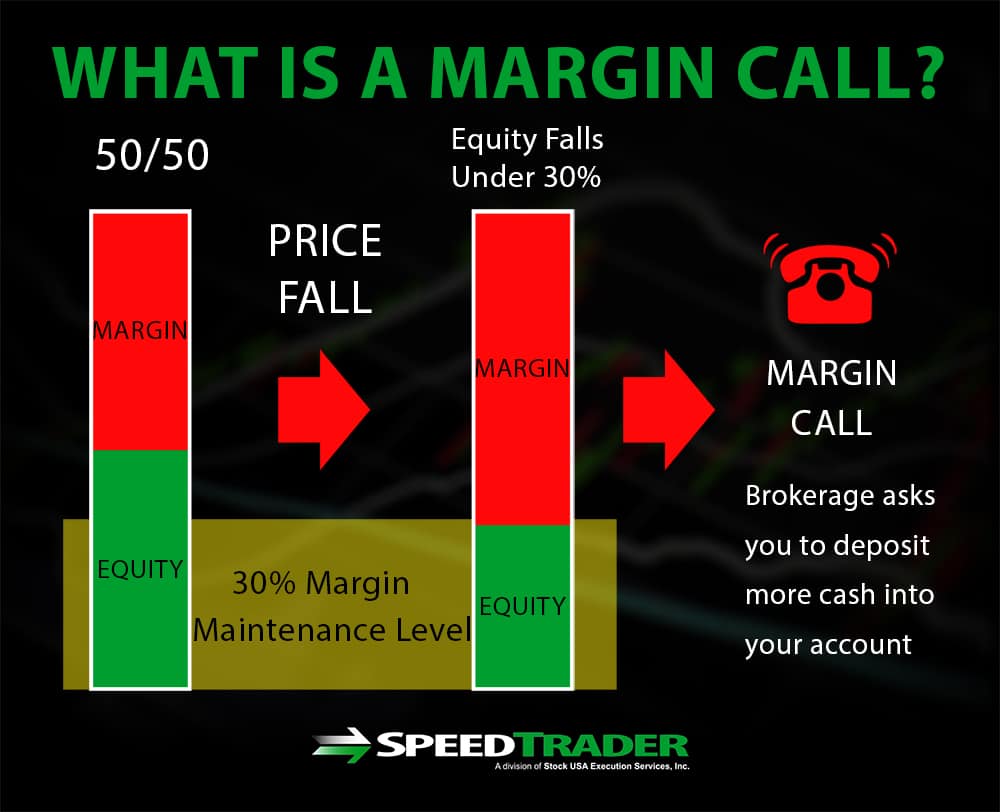

Margin is basically an act of extending credit for the purposes of trading. Conversely if the stock moves against you you could potentially lose more than your initial investment. In the stock market margin trading refers to the process whereby individual investors buy more stocks than they can afford to.

It allows aggressive traders both individuals and institutions to buy more shares than they could otherwise afford. If the stock price goes up your earnings are potentially amplified because you hold more shares. This style of trading is seen as one that offers high reward but as with most types of trading it does come with risks.

In the forex world brokers allow trading of foreign currencies to be done on margin. Trading on margin involves specific risks including the possible loss of more money than you have deposited. Margin trading has become a popular term across many different trading markets and in recent times it has become very highly regarded in the emerging cryptocurrency market.

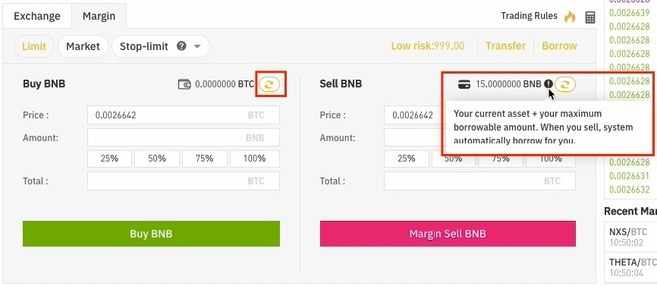

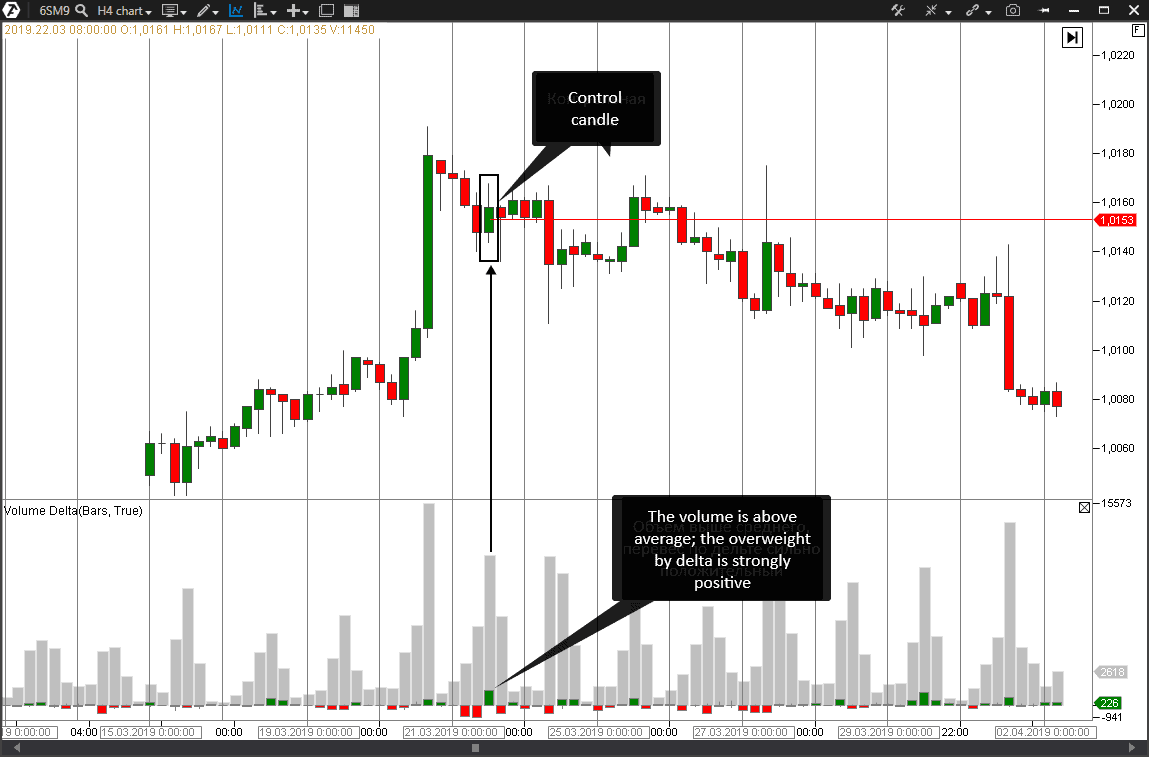

When combined with proper risk and money management trading on margin puts you in a better position to take advantage of market opportunities and investment strategies. This has both its drawbacks and advantages. Margin trading is trading while using your broker s funds to support the trade.

Margin trading also allows for. Margin trading involves buying and selling of securities in one single session. Trading on margin buying securities on margin allows you to acquire more shares than you could on a cash only basis.

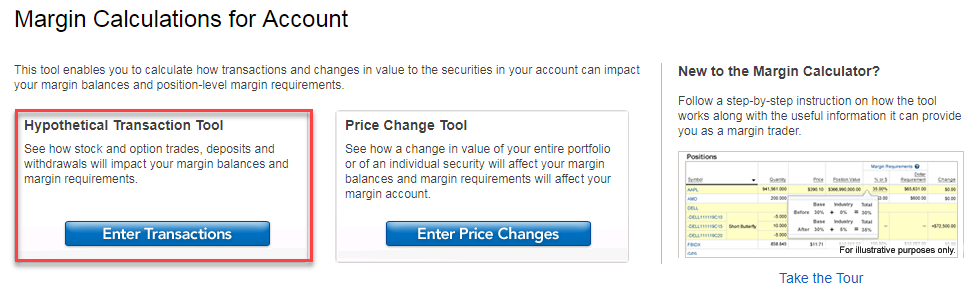

Leverage magnifies the possible risks and rewards of a particular trade. A decline in the value of securities that are purchased on margin may require you to provide additional funds to your trading account. Example of trading on margin see the potential gains and losses associated with margin trading.

/chart-1905224_1920-a337342257d040e98bb4040792c5a7dd.jpg)