Trading Imbalances

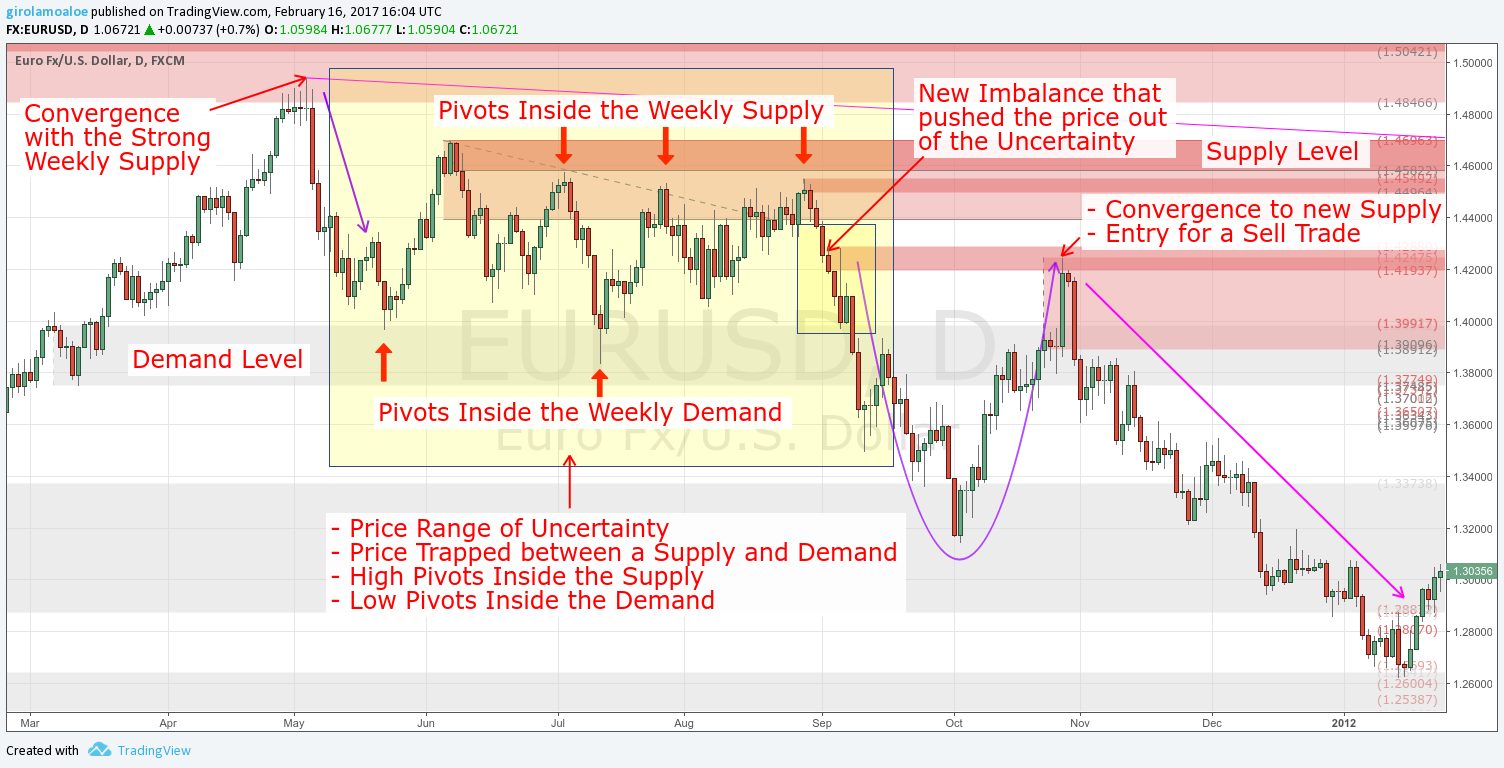

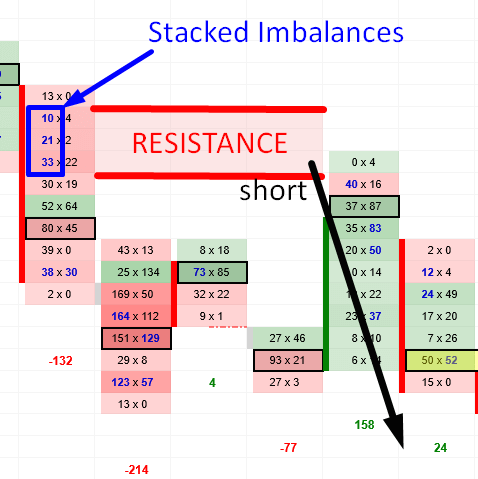

Order imbalances exist when orders to buy or sell a security far outweigh the current supply.

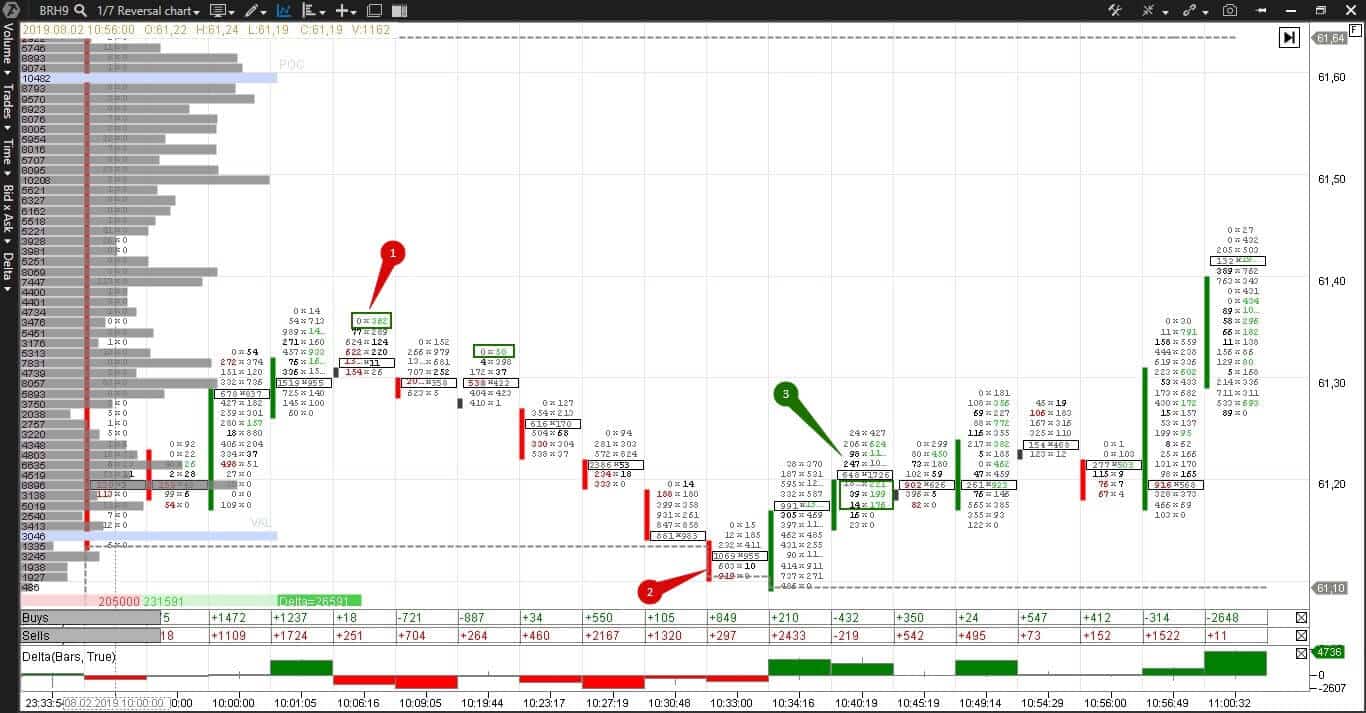

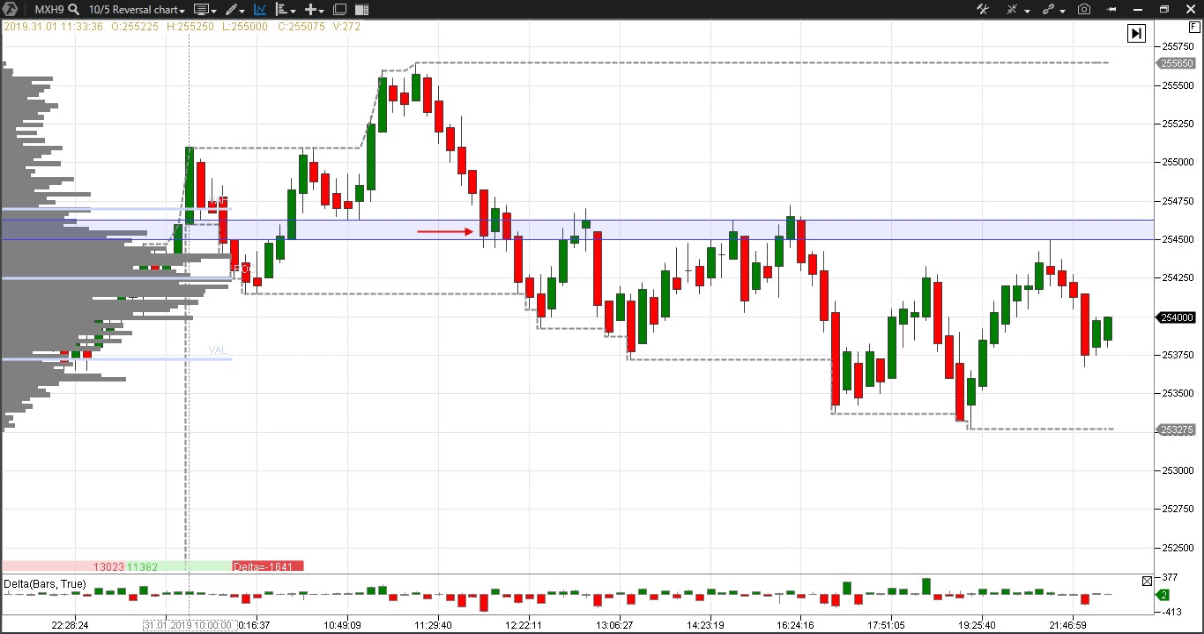

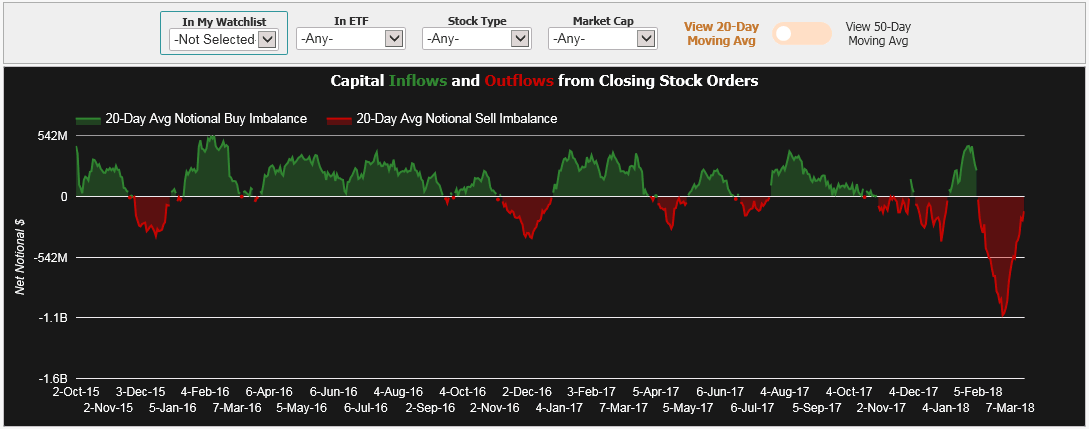

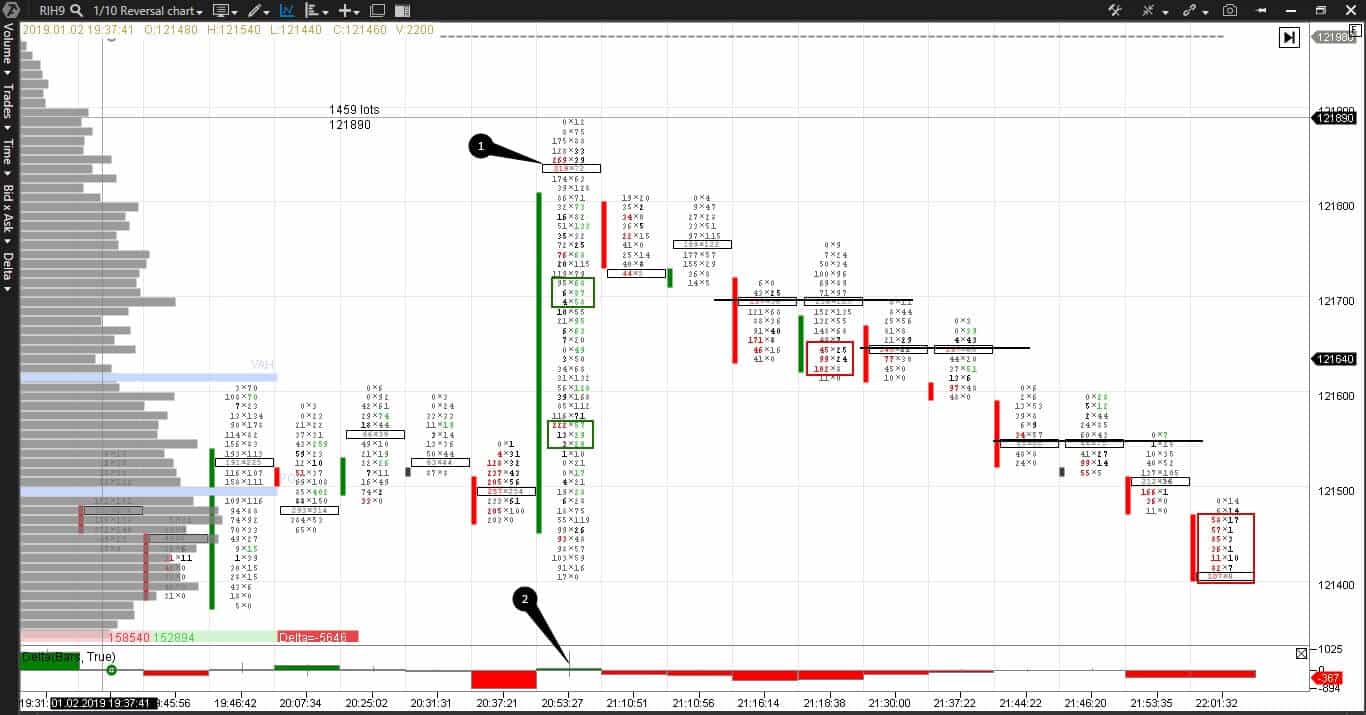

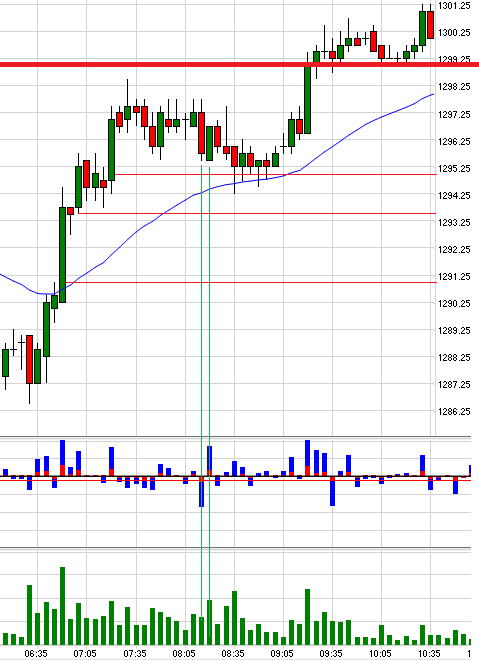

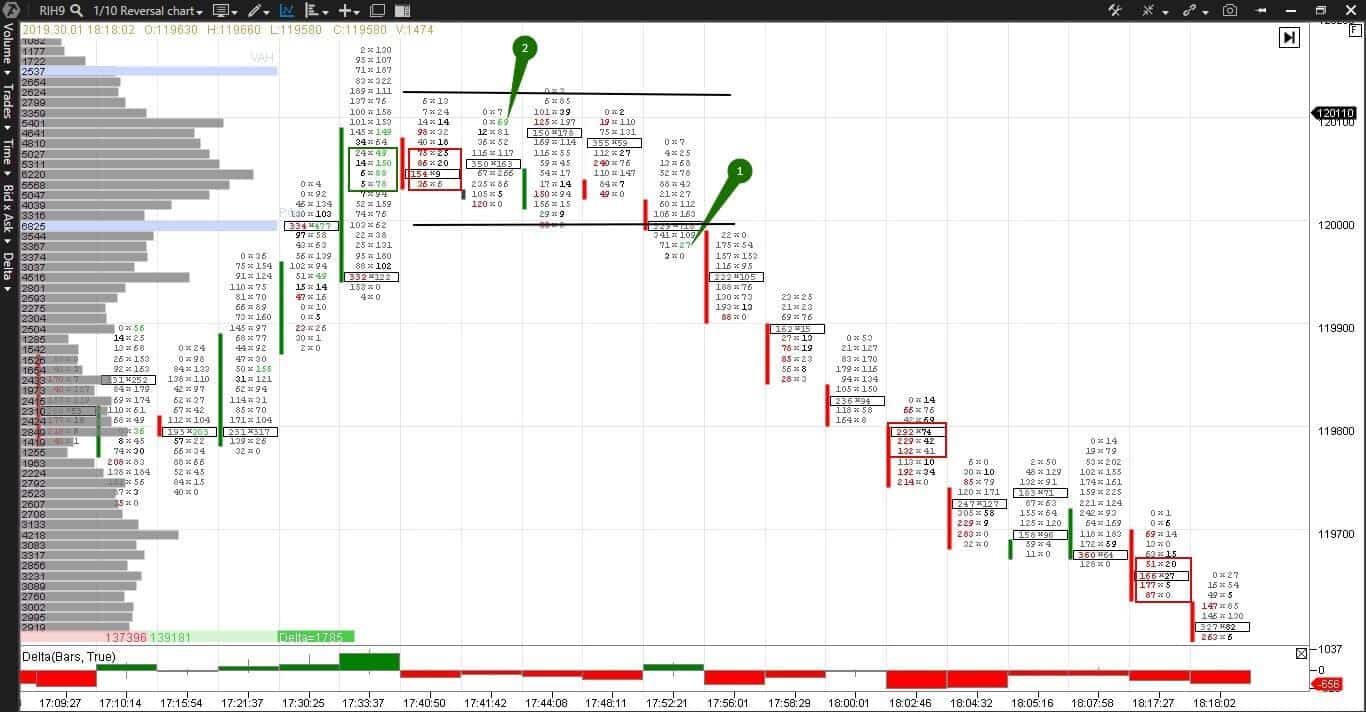

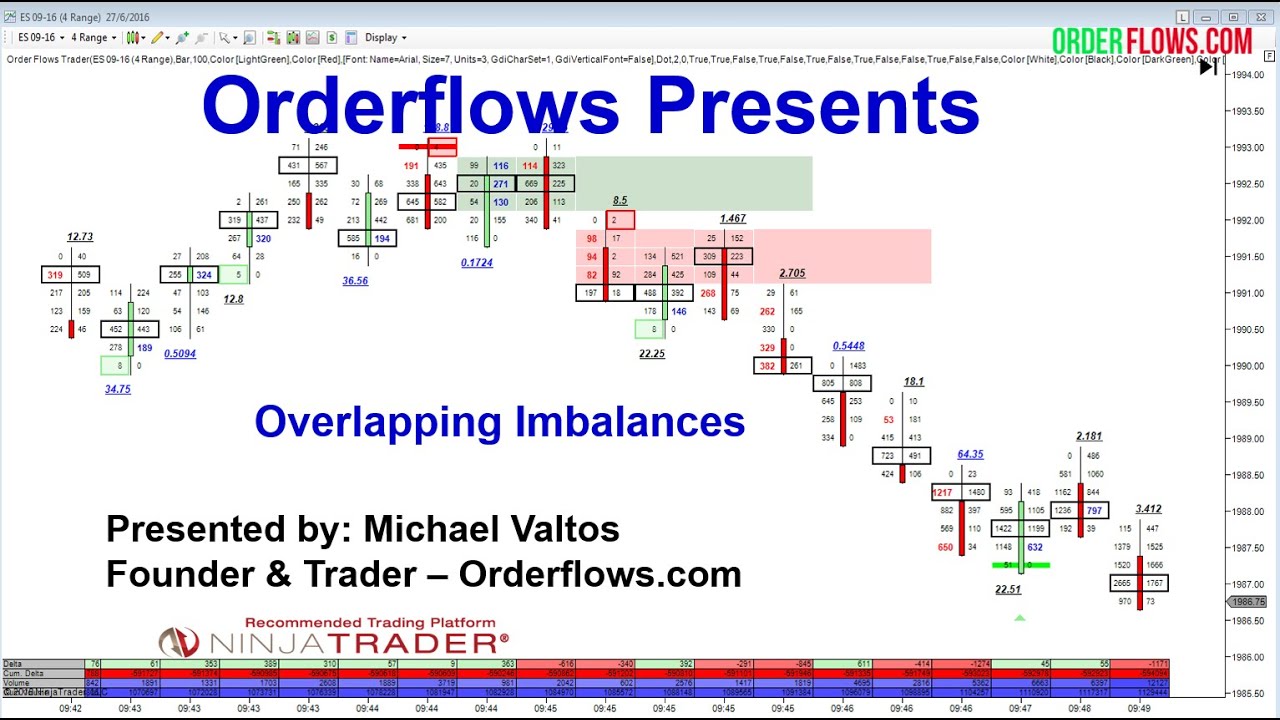

Trading imbalances. The following platforms have the features to trade order flow imbalances. There is a substantial risk of loss in futures trading. The order imbalances feed is available for.

The monthly imbalance service provided hereunder has four components. An order imbalance is when one side of the trade buy or sell meaningfully outweighs the other side. Imbalance is absence of balance between buy and sell orders.

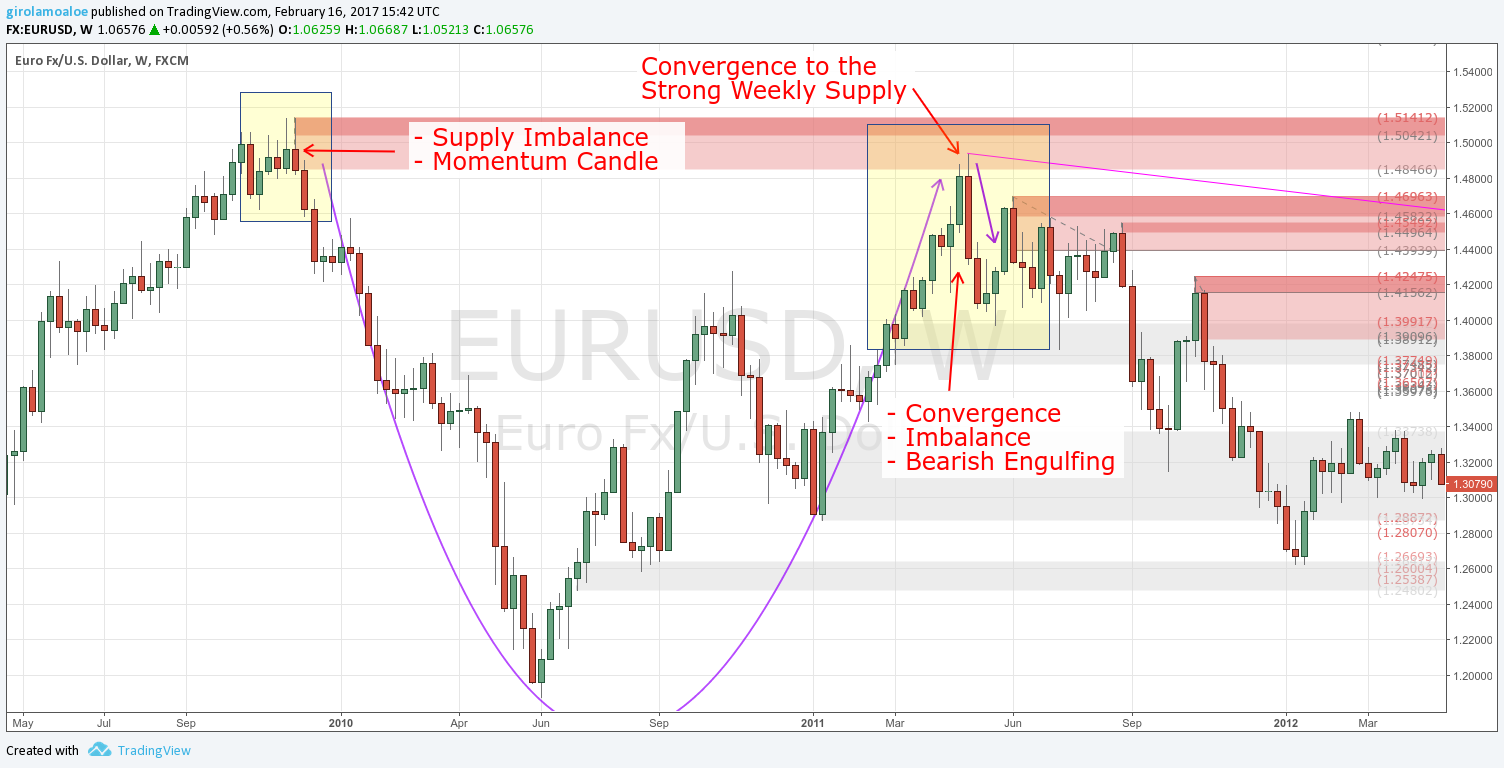

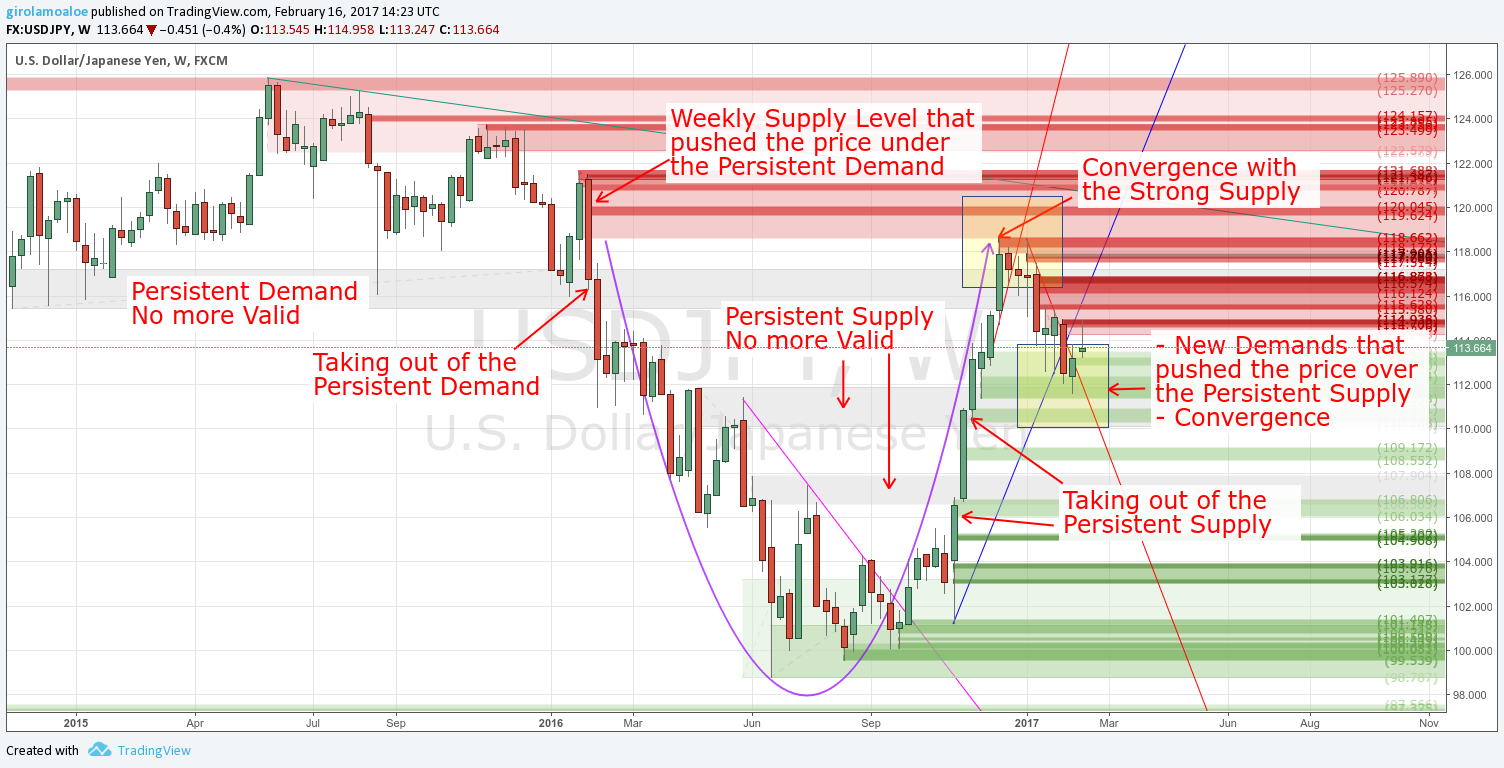

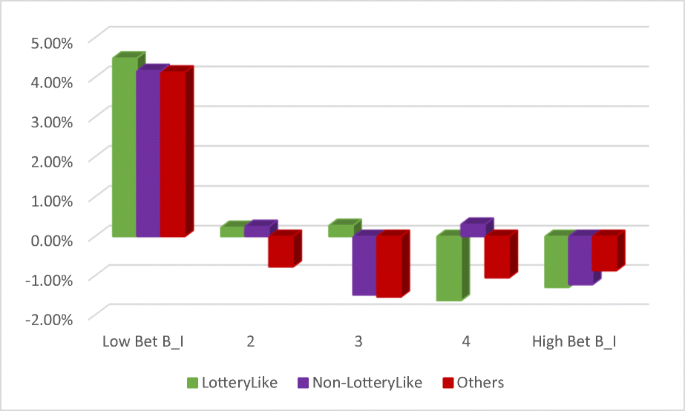

Imbalance trading a no charge balancing service standby procurement and buy back. As a consequence of supply and demand a significant imbalance in one direction is bound to affect the price of that security. Except during any period of system curtailment of transportation service as described in rule no.

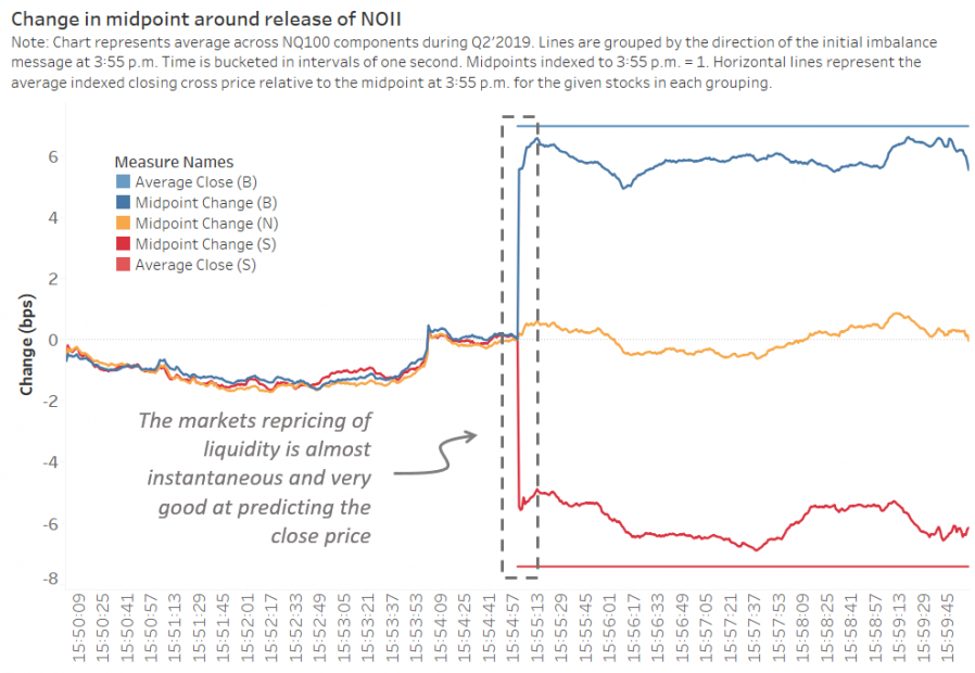

Imbalances can move securities to the upside or downside but most imbalances get worked out within a few minutes or hours in one daily session. Smaller less liquid securities can have imbalances. Imbalances the order imbalances feed provides a real time publication of buy and sell imbalances sent at specified intervals during auctions throughout the trading day for all listed securities.

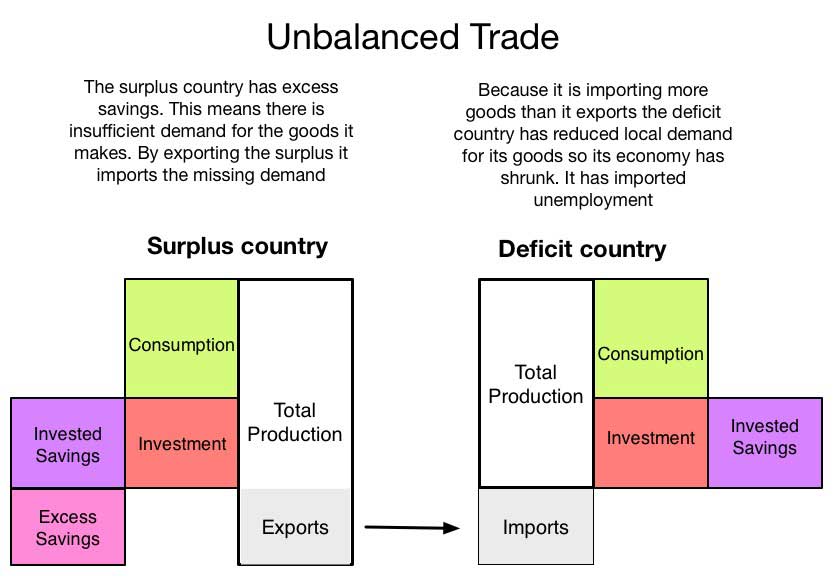

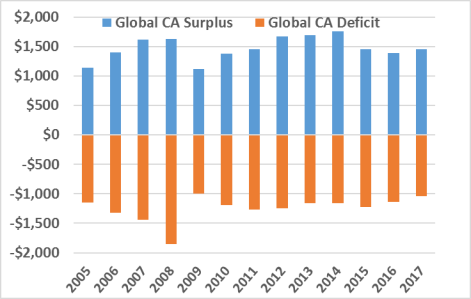

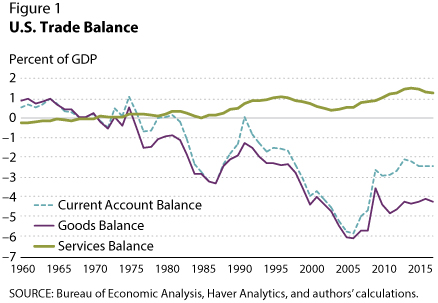

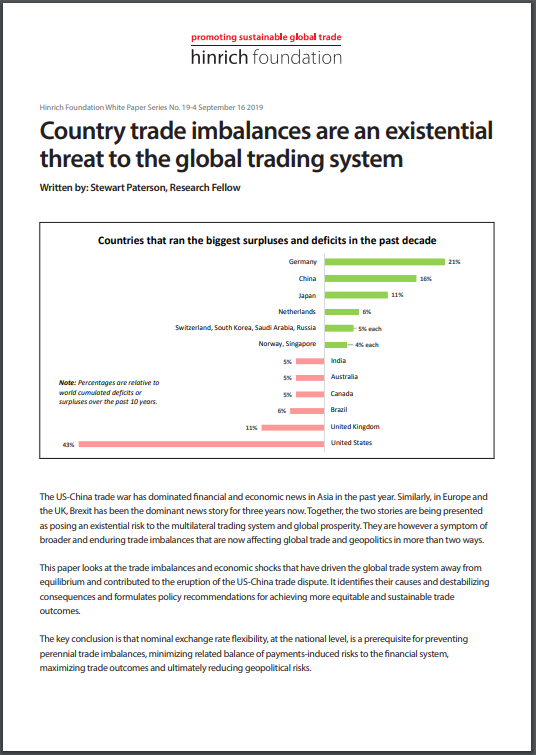

If exports exceed imports it is sometimes called a favourable balance of trade. Includes all those visible and invisible items exported from and imported into the country in addition to exports and imports of merchandise. Under the imbalance trading service customers may locate other customers with offsetting imbalances and trade these quantities to avoid imbalance charges standby procurement or buy back.

Storage imbalance trading 10. If imports are greater than exports it is sometimes called an unfavourable balance of trade. The us trade deficit narrowed to usd 50 7 billion in june 2020 from a revised one and a half year high of usd 54 8 billion in the previous month and compared to market expectations of usd 50 1 billion.

Trade imbalances can serve as potential profit opportunities and show positions with an especially high amount of risk. In everyday life non correspondence or inequality is called disbalance. It is a specific term which is used in trading only.