Strategy In Forex Trading

Traders must determine how large each position is to control for the amount of.

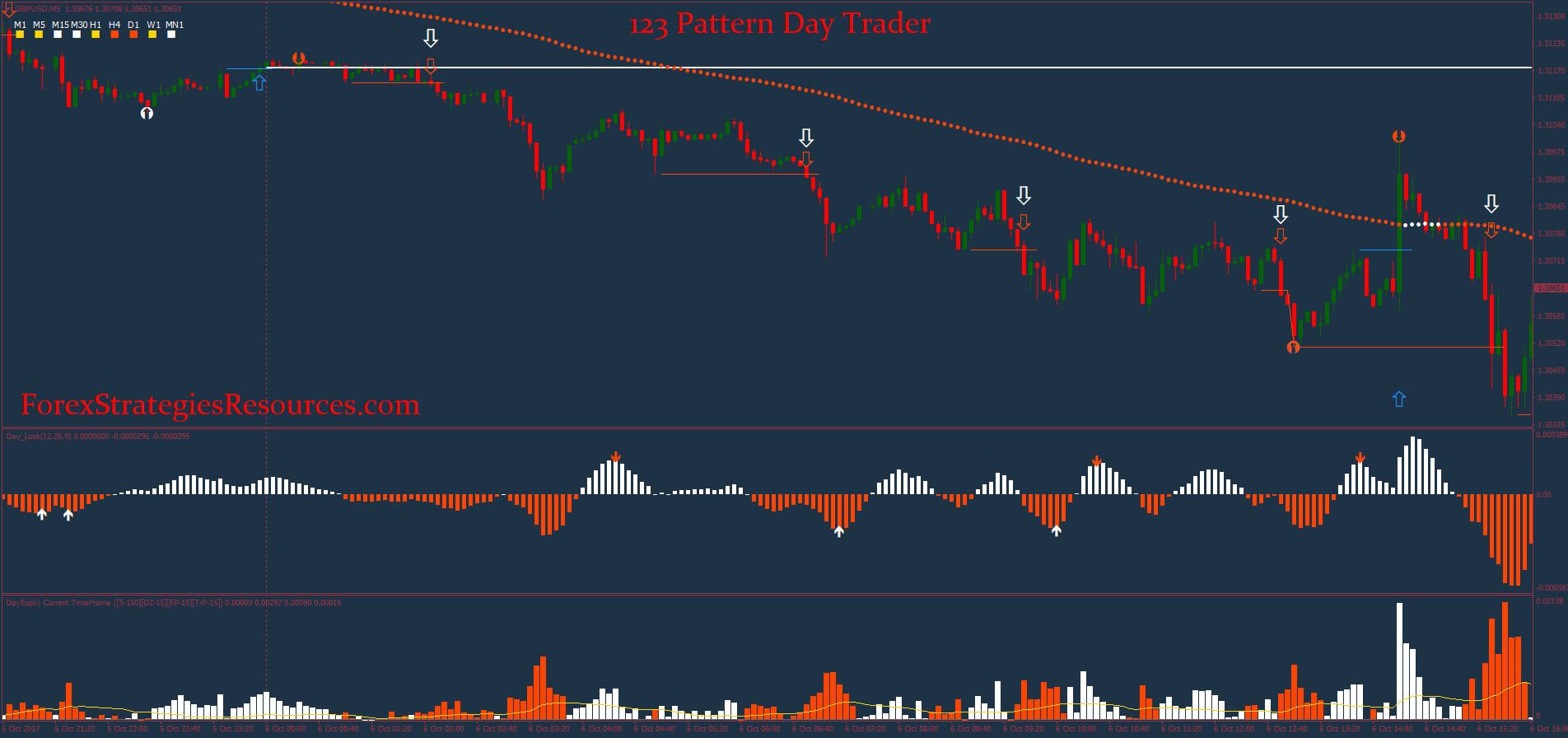

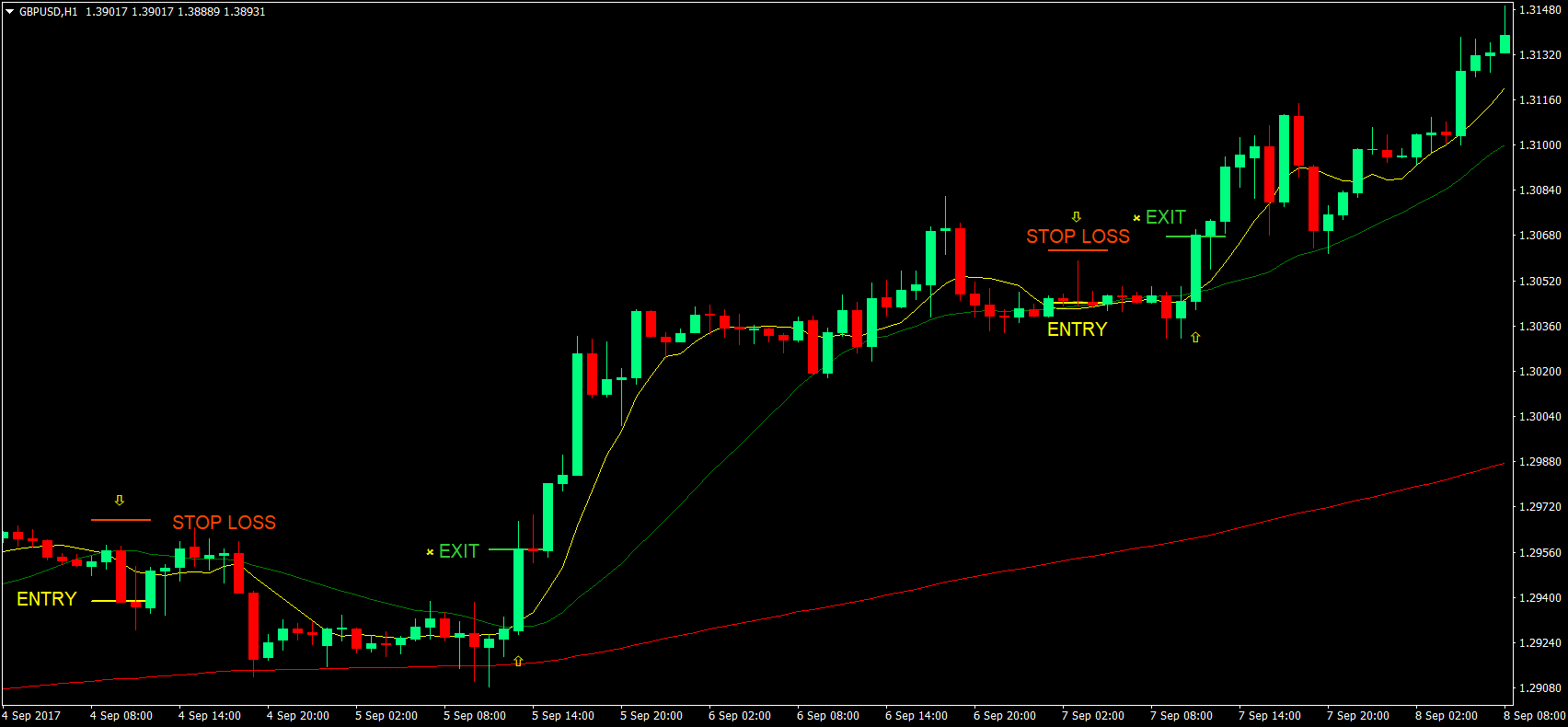

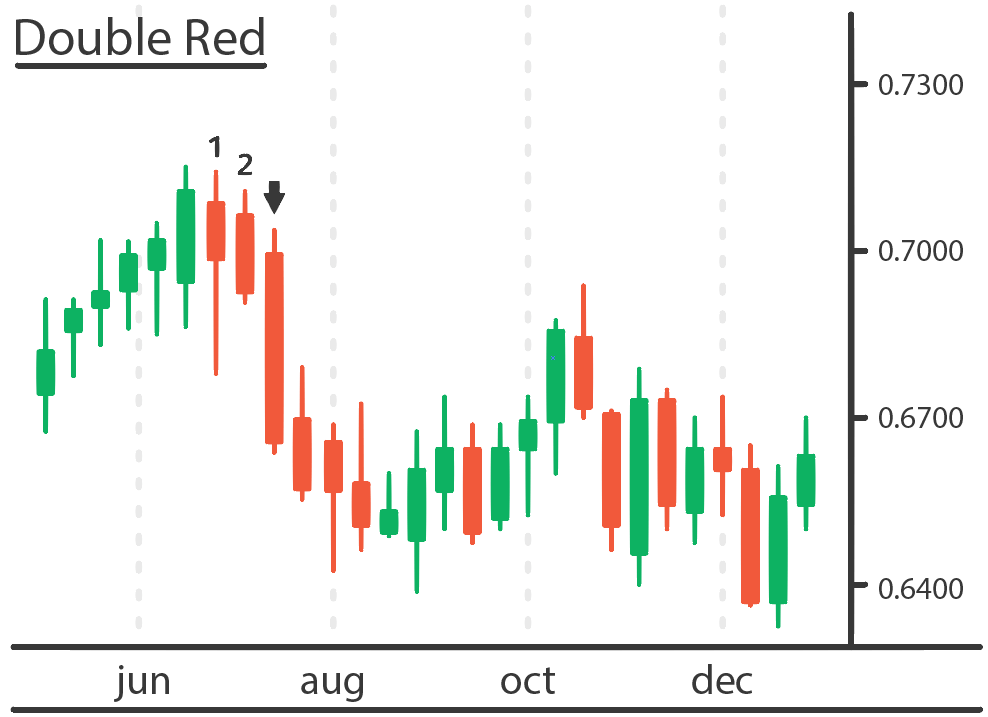

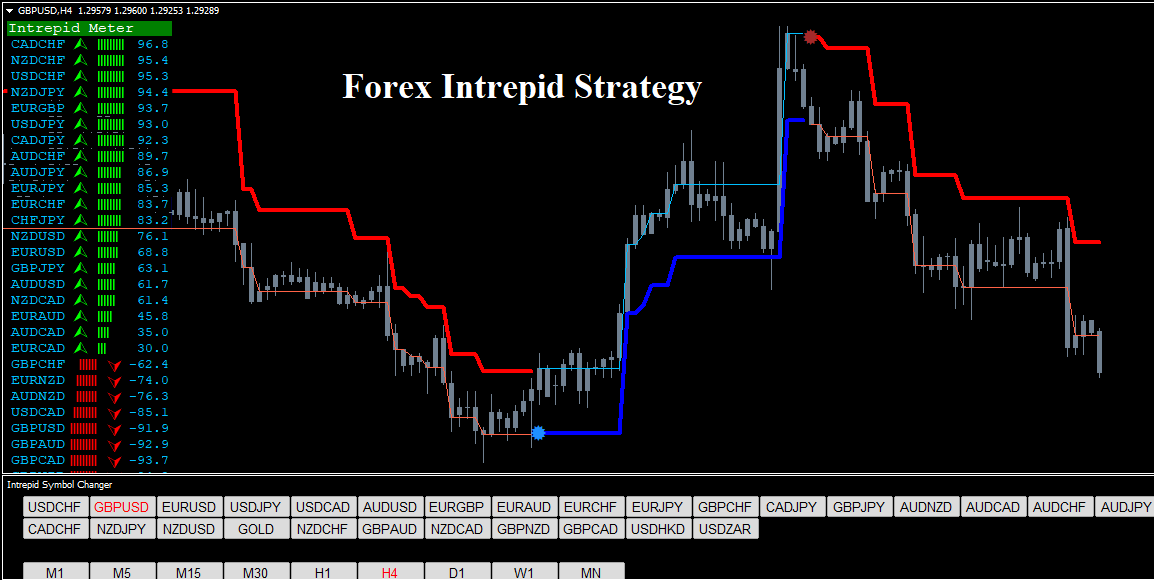

Strategy in forex trading. In order to determine the upward or downward movement of the volume traders should look at the trading volume bars usually presented at the bottom of the chart. What s the pattern that occurred before the breakout. Your main weapon of profit is the order flow a list of the buy sell orders in the specific market.

Price action trading involves the study of historical prices to formulate technical trading. It s a momentum breakout strategy that only requires up to no more than 15 minutes of your time. Forex volume trading strategy volume shows the number of securities that are traded over a particular time.

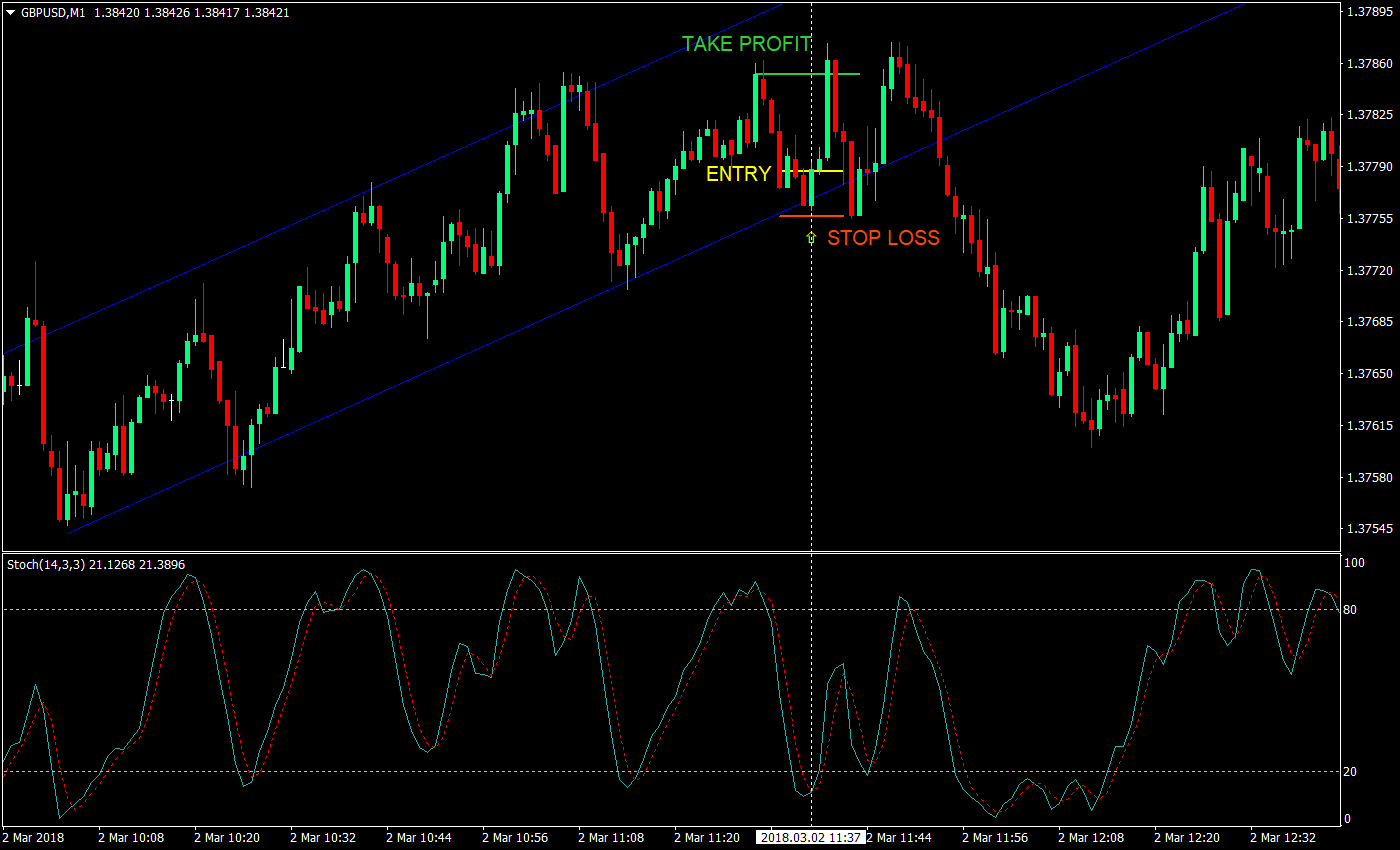

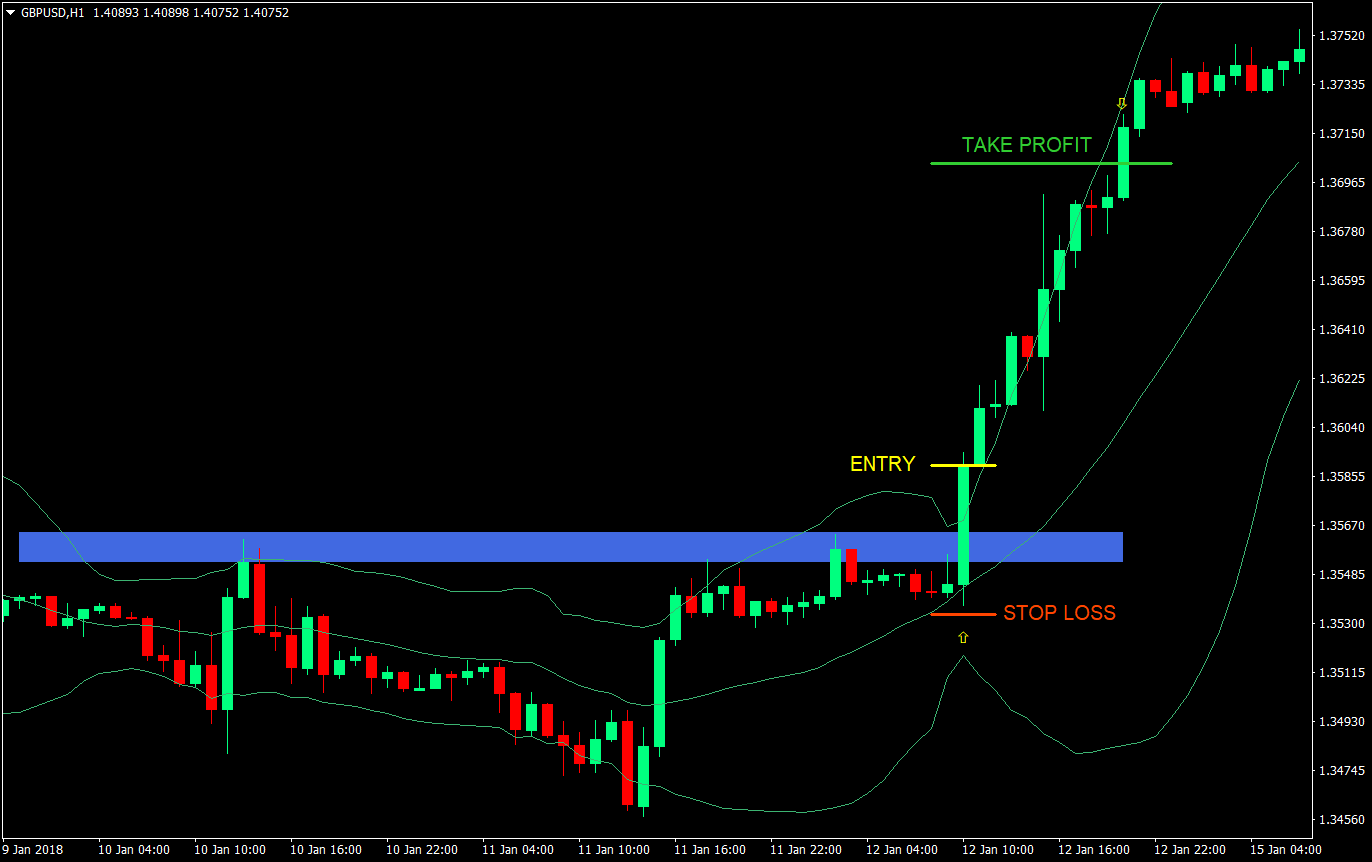

Beginners and experienced forex traders alike must keep in mind that practice knowledge. The london daybreak strategy probably the best forex strategy for trading the opening bell the london daybreak strategy is a day trading strategy that takes advantage of the london open trading range. Range trading includes identifying support and resistance points whereby traders will place.

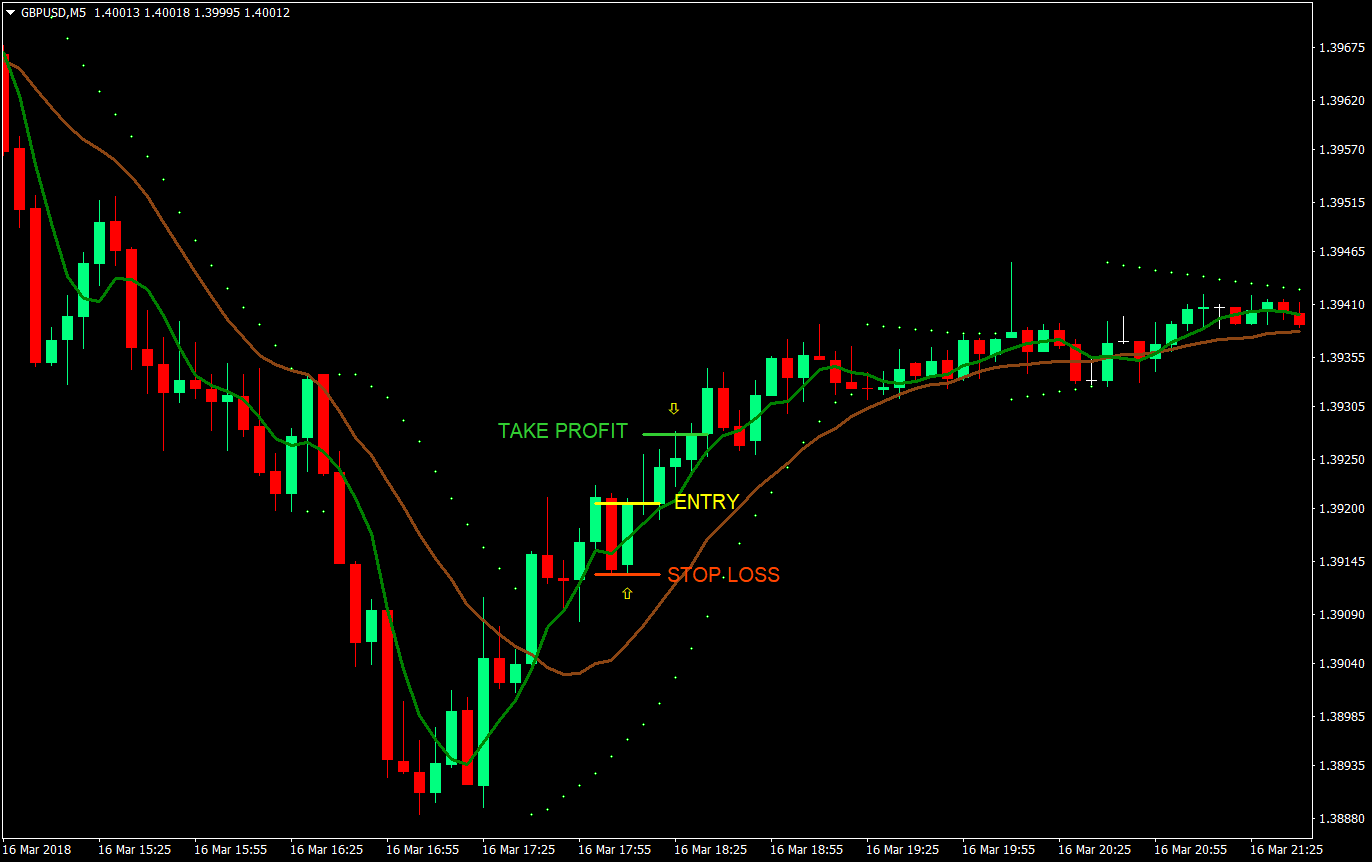

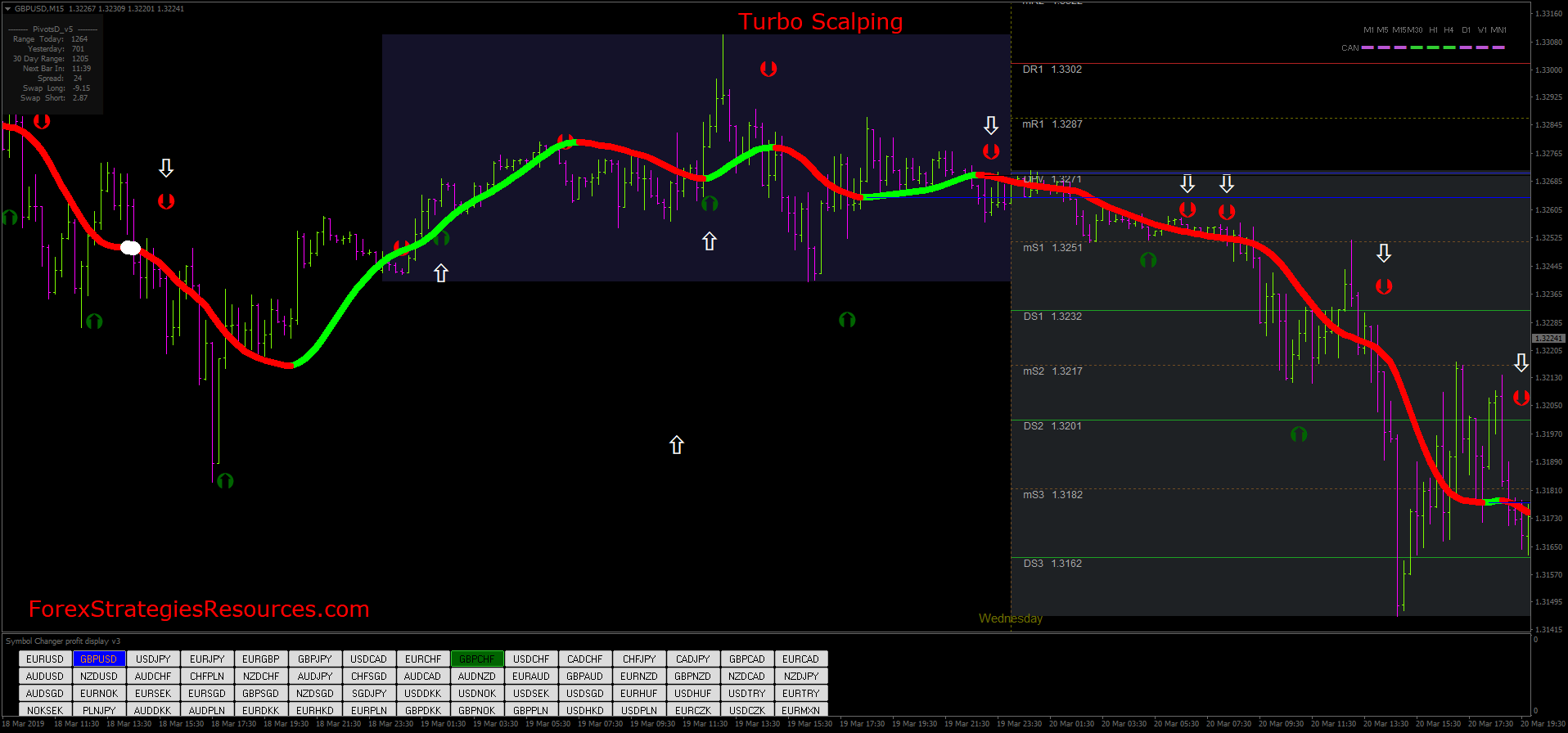

Top 8 forex trading strategies and their pros and cons 1. This forex trading strategy works with a very short time frame where you can hold your trades for not more than seconds or minutes. Learn how to draw support and resistance.

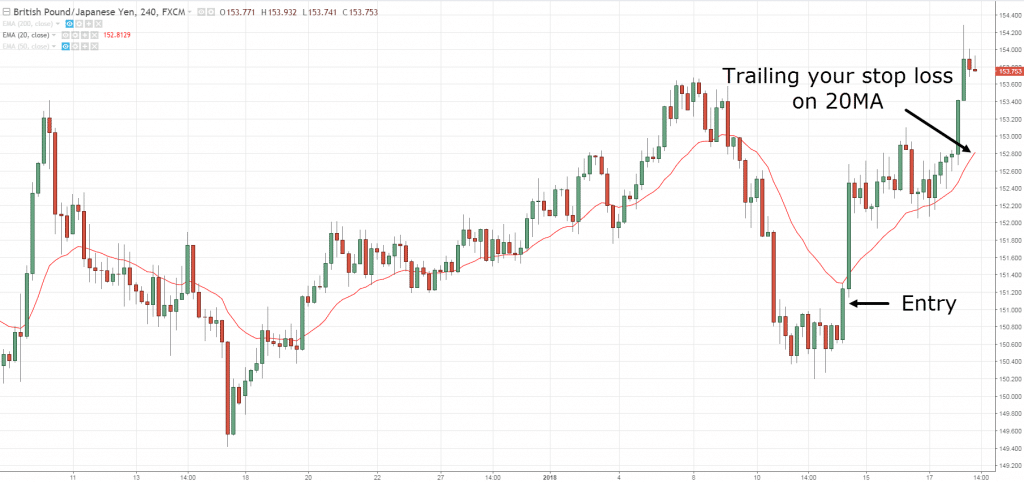

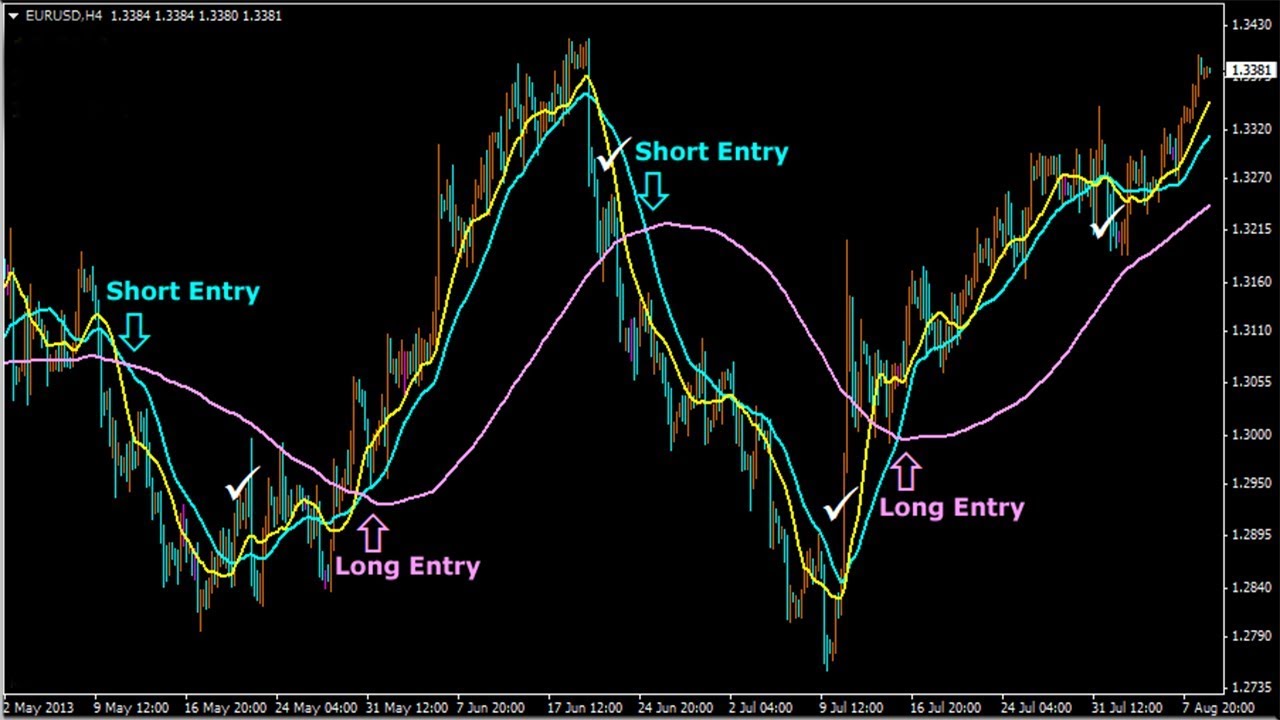

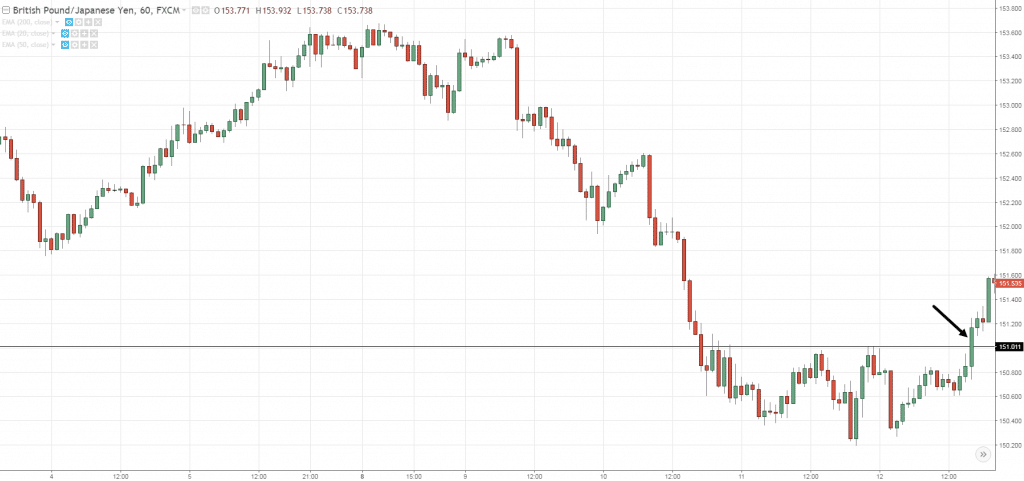

Trend trading is a popular longer term forex trading strategy that involves following the prevailing trend or directional movement in the market for a particular currency pair. Learn how the price reacts at support and resistance sr. There are several different components to an effective forex trading strategy.

Higher volume higher degree of intensity or pressure. Define your trading timeframe. If you re a scalper you are only concerned with the current market and how you use it to your advantage.

Traders must determine what currency pairs they trade and become experts at reading those currency.