Steven Cohen Insider Trading

Cohen who was earlier accused of failing to prevent massive insider trading at his firm has agreed in a settlement with the government not to.

Steven cohen insider trading. Two former employees were charged with insider. Michael steinberg a high level portfolio manager who was close to cohen and mathew martoma a former portfolio manager. Cohen s former hedge fund sac capital came to dominate share trading on wall street before it pleaded guilty to insider trading charges in 2013 and.

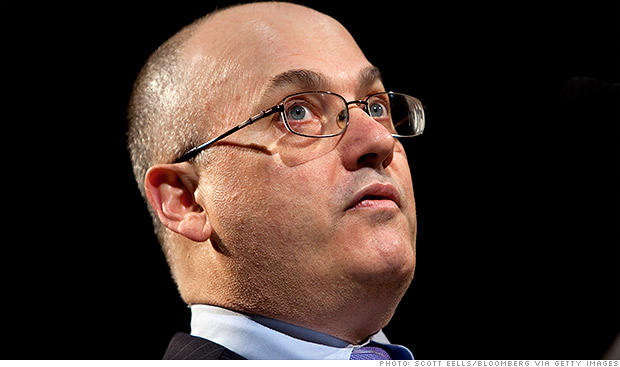

He had just brought insider trading charges against two s a c. Washington billionaire hedge fund manager steven a. Cohen and top managers at his former hedge fund sac capital advisors were implicated in an insider trading scandal that came to light in 2010.

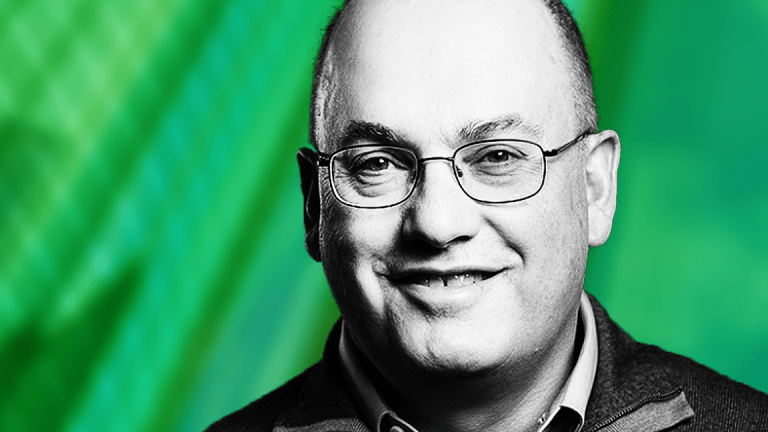

For such sceptics steven cohen is exhibit a. Steven cohen settles insider trading case with sec steven steve cohen chairman and chief executive officer of sac captial advisors lp speaks during the robin hood veterans summit in new york. Capital advisors pleaded guilty to insider trading and agreed to pay 1 8bn in fines 900m in forfeiture and 900m in fines in one of the biggest criminal cases against a hedge fund.

Cohen closed his hedge fund sac capital partners as part of the firm s guilty plea. Steven cohen and his legendarily successful firm sac capital advisors have attracted attention from government agencies for years. As the wall street journal reported regulators have suspected that cohen s success partly stemmed from insider trading sac capital has been in the news twice in the last week.

The firm later changed its name to point72. Accordingly cohen s failure to reasonably supervise forms a basis under sections 8a 3 c and 8a 4 of the act 7 u s c. In insider trading settlement steven cohen will be free to manage outside money in 2 years steven a.

/cdn.vox-cdn.com/uploads/chorus_asset/file/19438449/1141804529.jpg.jpg)