Options Day Trading Rules

What is a pattern day trader.

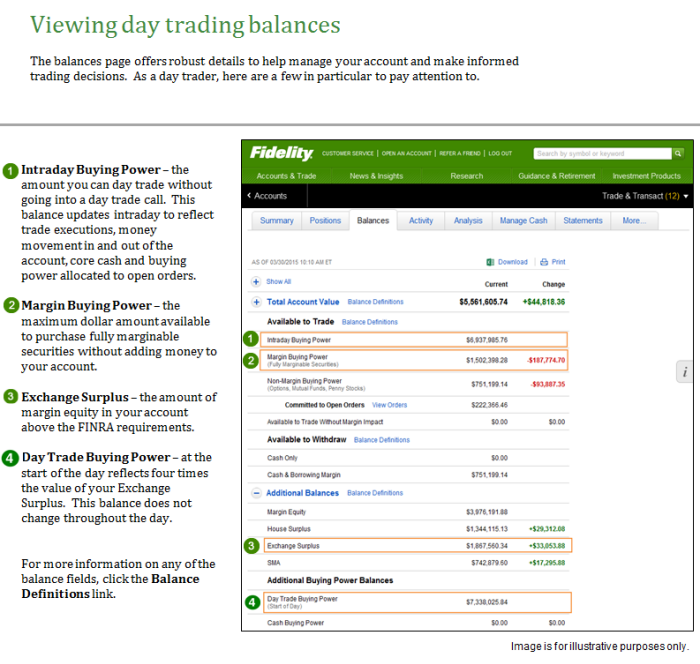

Options day trading rules. Call deltas range from 0 to 1 and put deltas range from 0 to 1. You re not considered a pattern day trader. These prevent pattern day traders from operating unless they maintain an equity balance of at least 25 000 in their trading account.

Stocks and stock markets. This rule states that active day traders need to have 25 000 in their accounts at the end of the trading day. Securities and exchange commission sec has imposed restrictions on the day trading of u s.

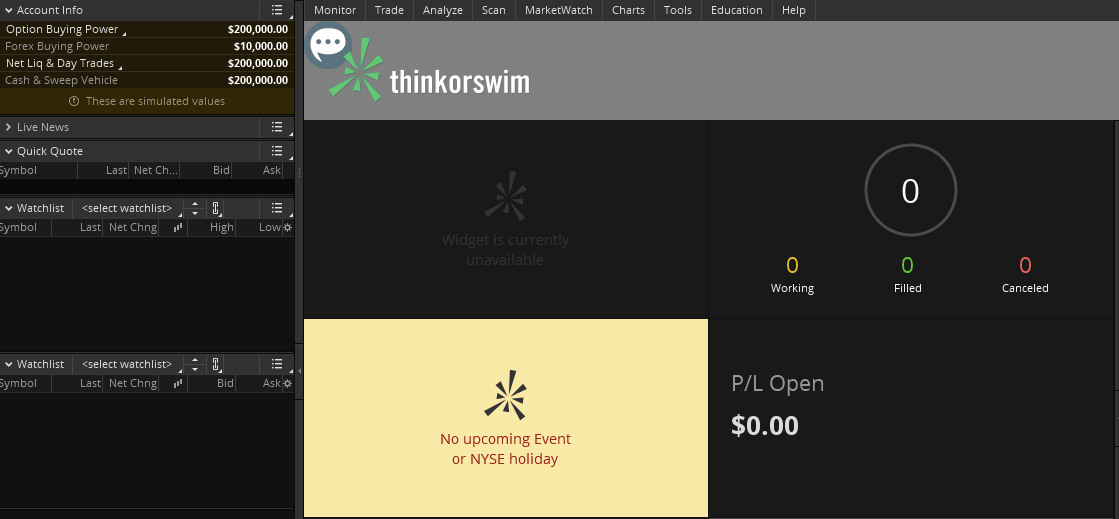

The good news however is that options trades settle overnight. Gamma is a second order affect that attempts to quantify delta error. Options trading and the pdt rule you can day trade securities such as stocks as much as you want using a cash account though you have to wait two days for trades to settle if you run out of cash.

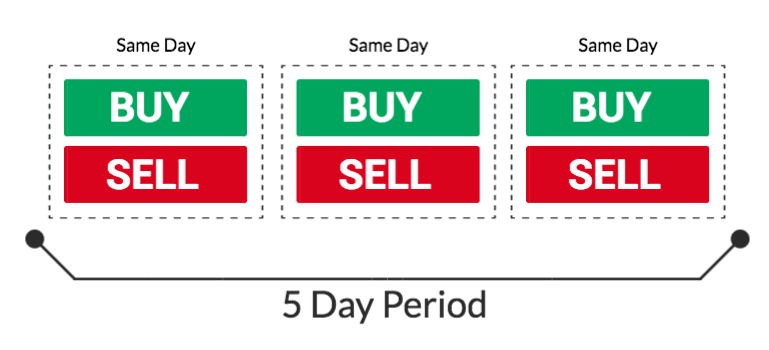

In options a day trade is defined as entering an options contract and then closing it out on the same day. Join up with a day trader firm. Existing sale conditions note the sale of an.

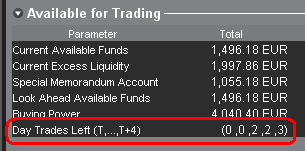

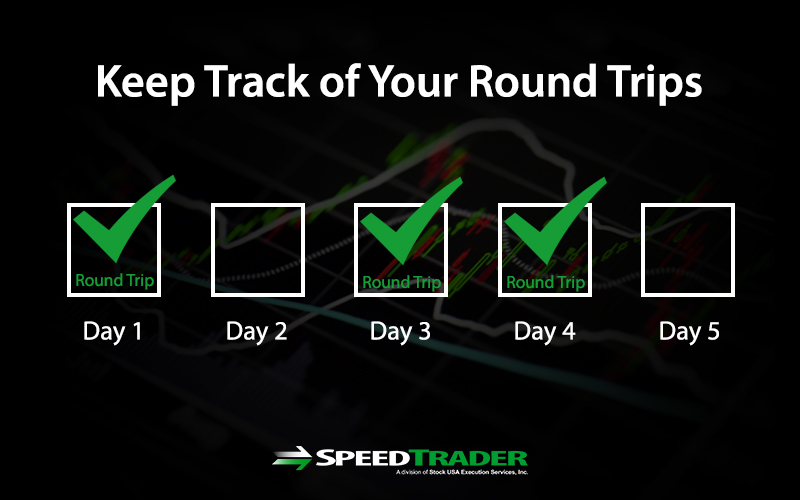

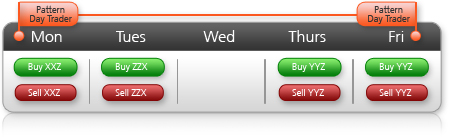

Day trading loopholes make only three day trades in a five day period. It s important you are aware of the rules for day trading options in your country and markets. Day trade a stock market outside the u s.

I know what you are thinking. You ll have to do this with a broker that s also outside the u s. In short if you make three or fewer day trades in a rolling five day period you can have less than 25 000 in your account.

Once you ve met these criteria and are considered a pattern trader there are certain rules and stipulations you must follow. The day trading margin rule applies to day trading in any security including options. In essence you need 25 000 in your margin account at all times or you can t trade more than 3 times in 5 consecutive trading days.

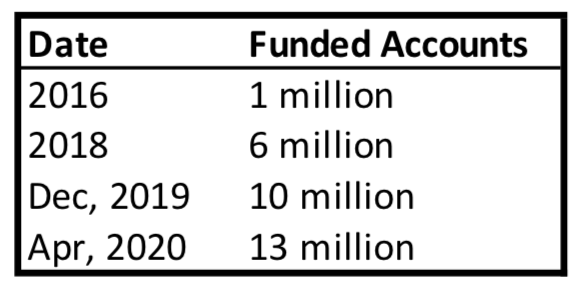

The rules stipulate that if you meet the pattern day trader criteria trade more than four times in five business days you must hold an account with at least 25 000. When you exceed the day trade limit you will be tagged as a pattern day trader. It s called the pattern day trader pdt rule.

For example if a call option has a delta of 0 70 it means a 1 change in the value of the underlying will result in a 0 70 change in the value of the option. If the total value of. For example in the us there are finra day trading rules on options.

The pdt rule only comes into effect when the net liquidation value goes below the required amount of 25 000. That s less than one day trade per day which is less than the pattern.

/day-trading-tips-for-beginners-on-getting-started-4047240_FINAL-e9aa119145324592addceb3298e8007c.png)

/chart-1905224_1920-a337342257d040e98bb4040792c5a7dd.jpg)

/DayTradingChartsandPatterns22-1713356e5c8c447691593574eebd9e60.png)

/daytradingsetup1-596cf9333df78c57f4aaf265.png)

:max_bytes(150000):strip_icc():saturation(0.2):brightness(10):contrast(5)/1percentriskrule-5670abb65f9b586a9e07d1f6.jpg)

:max_bytes(150000):strip_icc()/BuyingCalls-7ff771dfbc724b95b8533a77948d7194.png)