Options And Futures Trading

While the world of futures and options trading offers exciting possibilities to make substantial profits the prospective futures or options trader must familiarize herself with at least a basic.

Options and futures trading. Options on the s p 500 index are among the most popular and widely used by investors speculators and hedgers. There will only be one futures price for a stock for one contract. Options are leveraged instruments i e they allow traders to amplify the benefit by risking smaller amounts than would otherwise be required if trading the underlying asset itself.

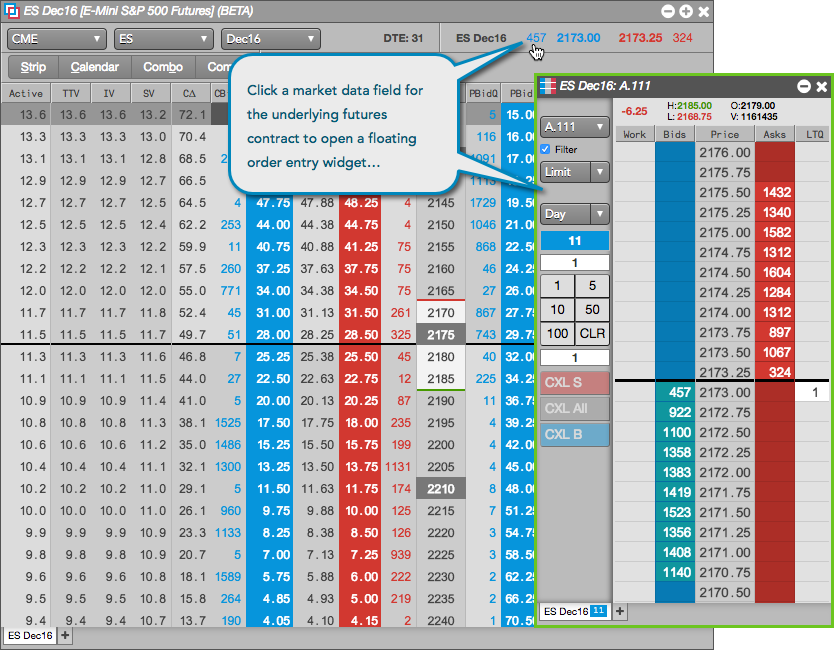

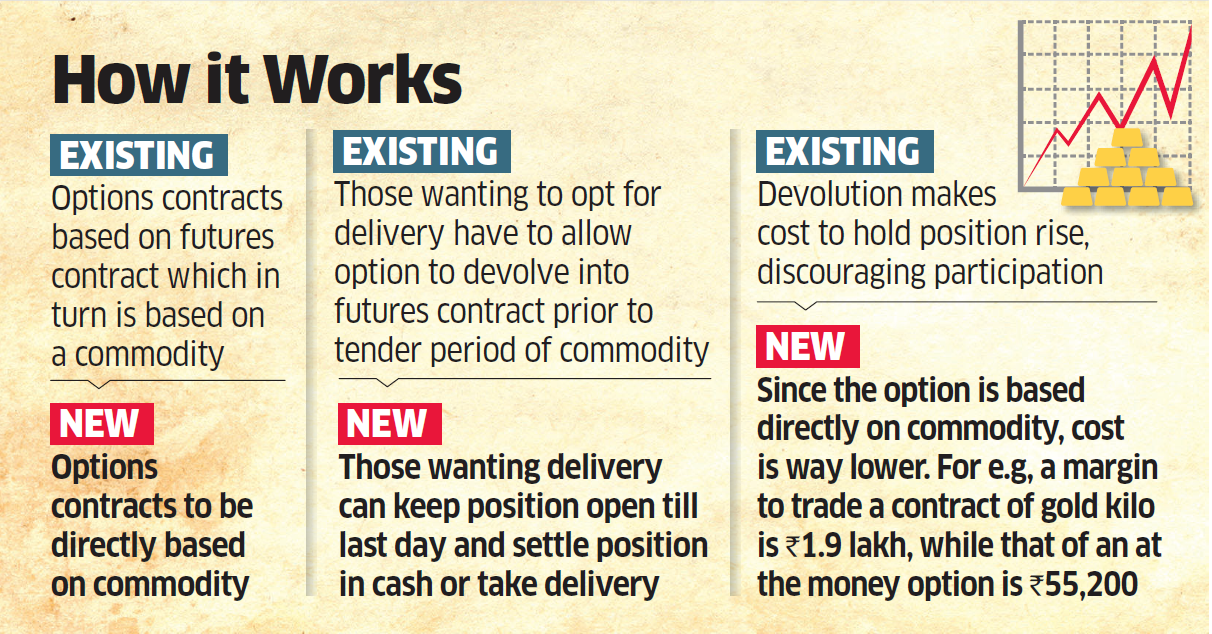

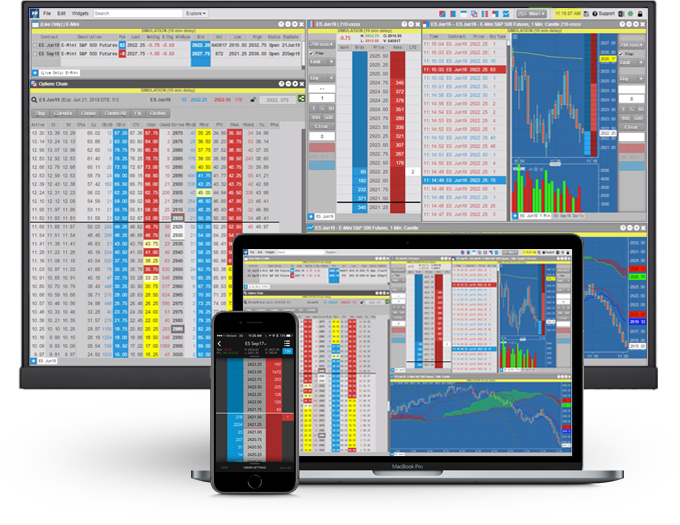

The underlying asset for s p 500 options are futures that track this benchmark index. Futures contracts make more sense for day trading purposes. Unlike stock options futures options have extended trading hours so you can trade around the clock.

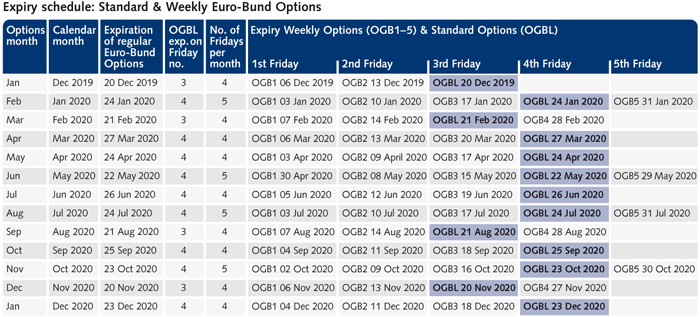

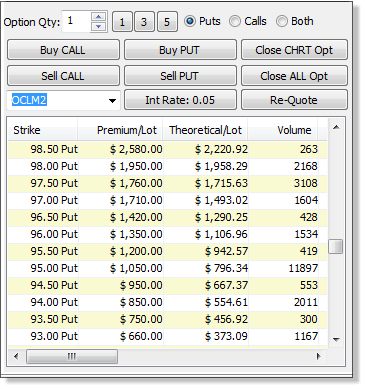

Deploy futures options strategies to benefit from directional or neutral outlooks or volatility expansions with managed risk. An option gives the buyer the right but not the obligation to. All f o contracts will expire on the last thursday of the month.

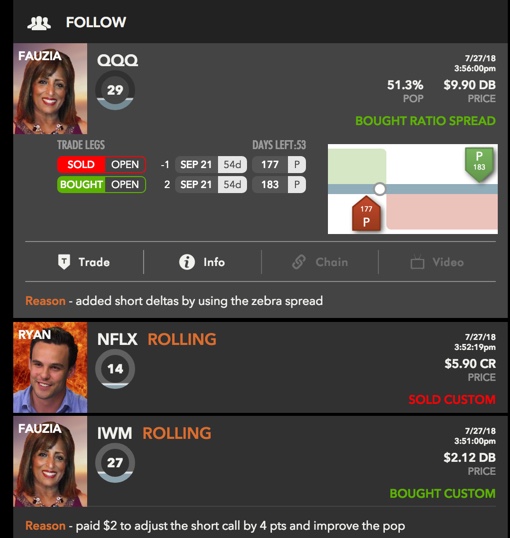

To trade options you need a margin approved brokerage account with access to options and futures trading. Options and futures are traded in contracts of 1 month 2 months and 3 months. Most people think of the stock market when they hear the term day trader but day traders also participate in the futures and foreign exchange forex markets some day traders buy or sell options but traders who focus on the options market are more likely to be swing traders who hold positions for days or weeks not fractions of a single trading day.

We have extended trading hours. If one expects. The basics of futures options futures options.

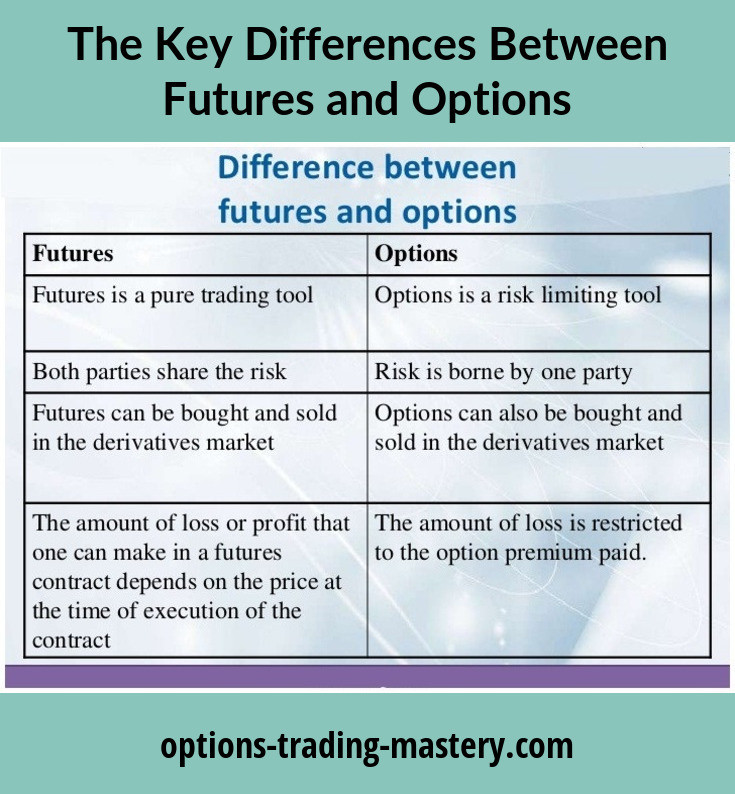

The price the buyer pays and seller receives for an option is the premium. An option is the right not the obligation to buy or sell a futures contract at a designated strike. Futures will trade at a futures price which is normally at a premium to the spot price due to the time value.

Futures contracts move more quickly than options contracts because options only move in correlation to the futures contract.

/GettyImages-1007257652-5bec683746e0fb00518e34f7.jpg)

:max_bytes(150000):strip_icc()/BuyingCalls-7ff771dfbc724b95b8533a77948d7194.png)

/10OptionsStrategiesToKnow-01-5cbad2a9fe294e679f467f3ebc57890d.png)