Option Trading Calculation

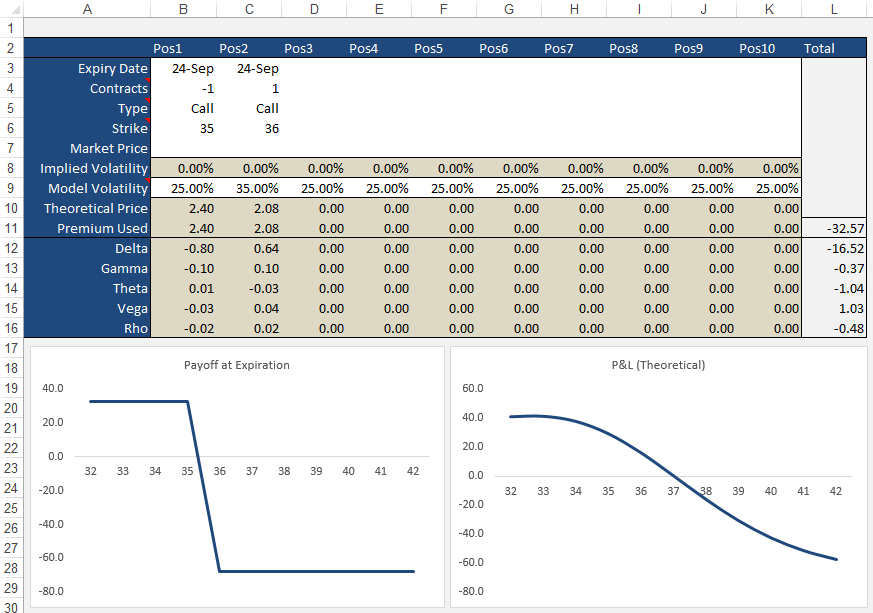

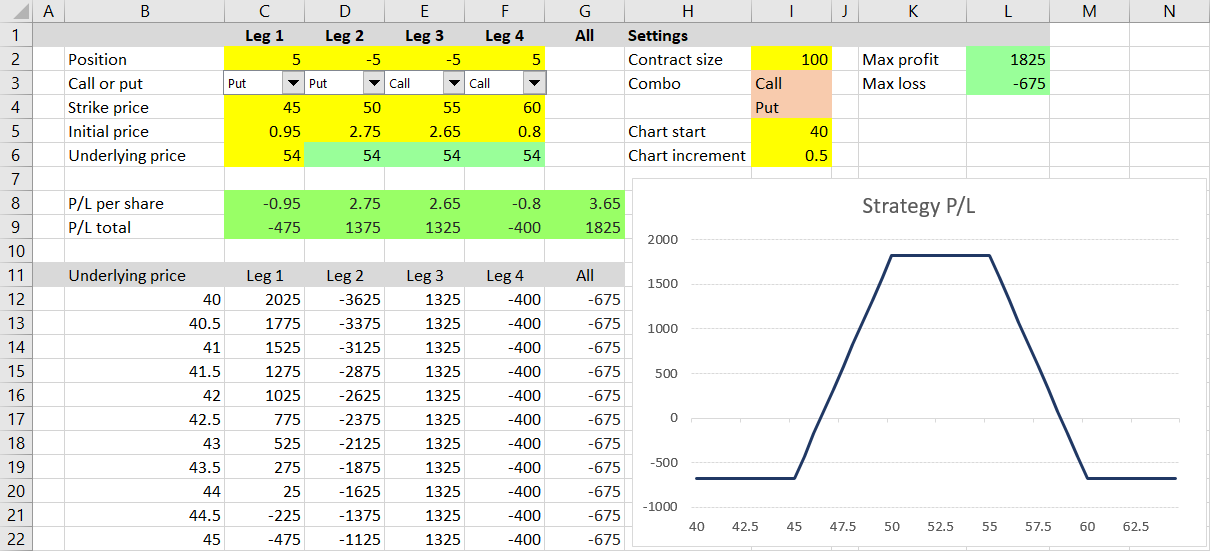

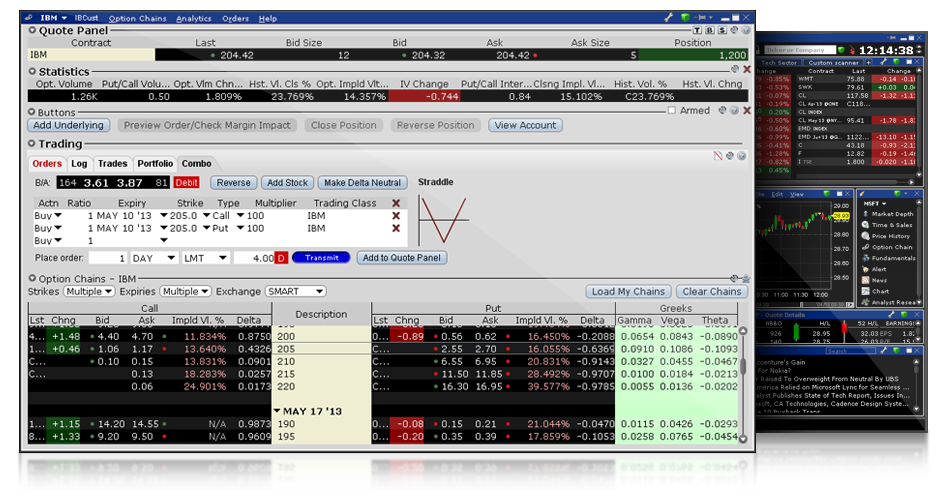

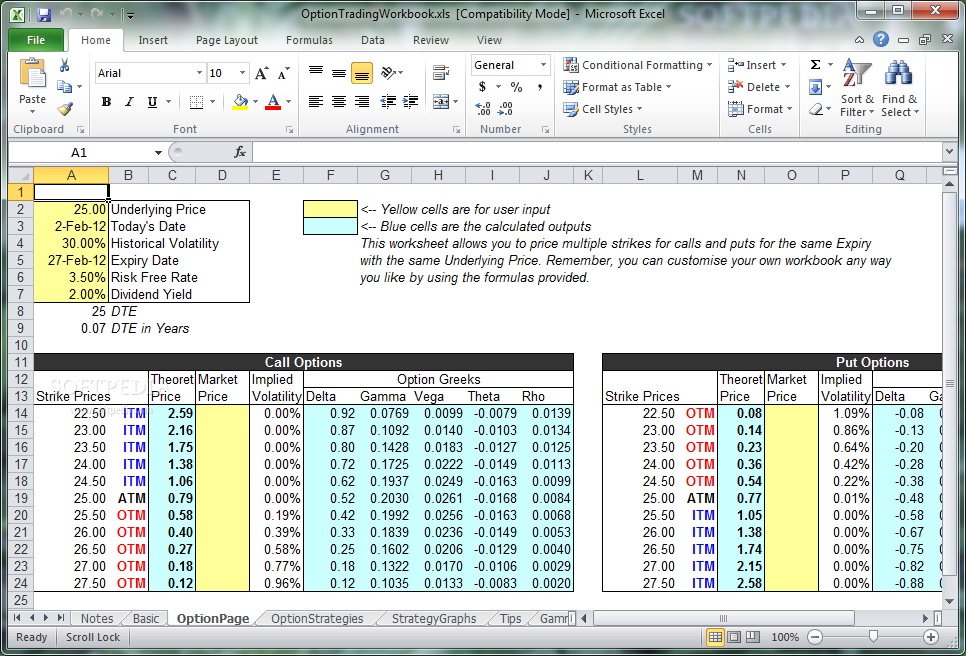

In addition you can easily make the following calculations which many option traders find useful.

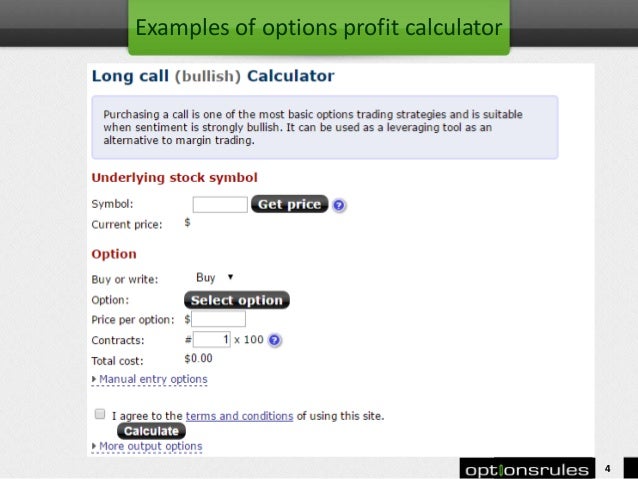

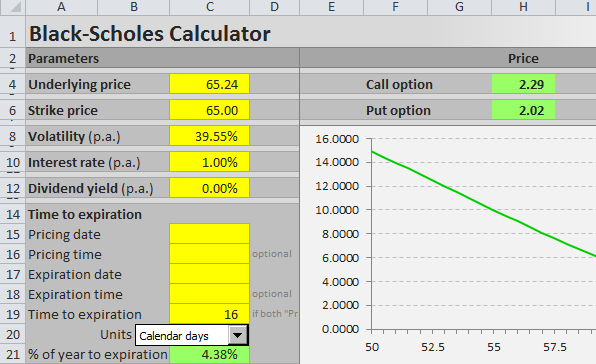

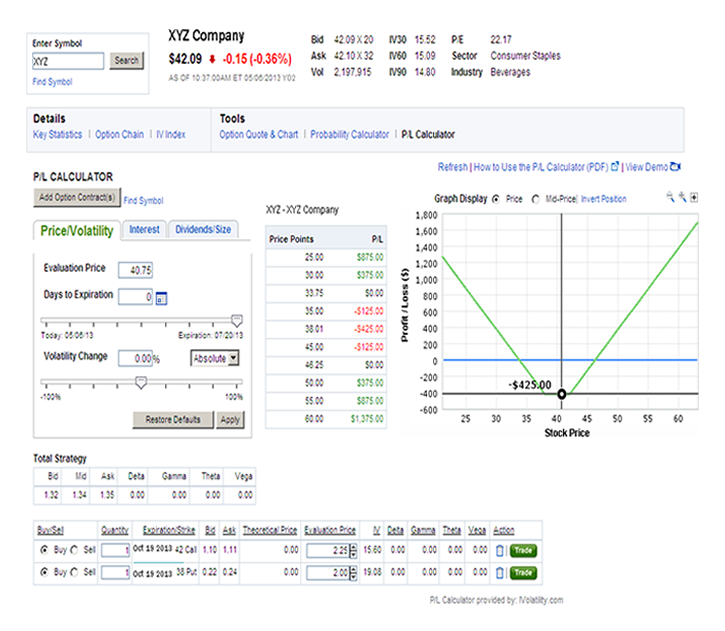

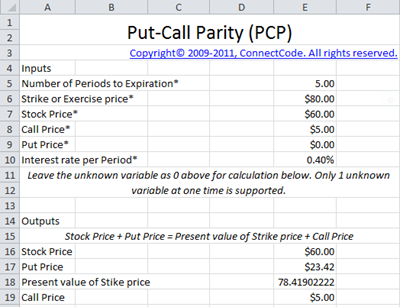

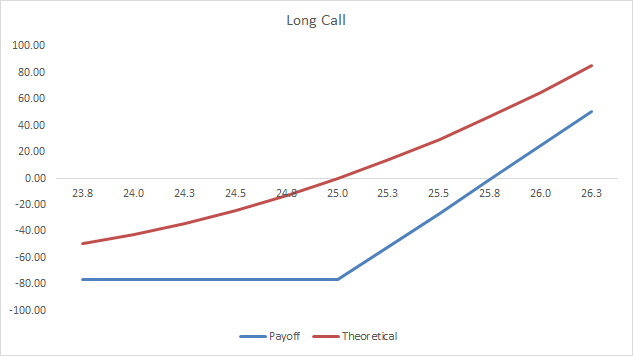

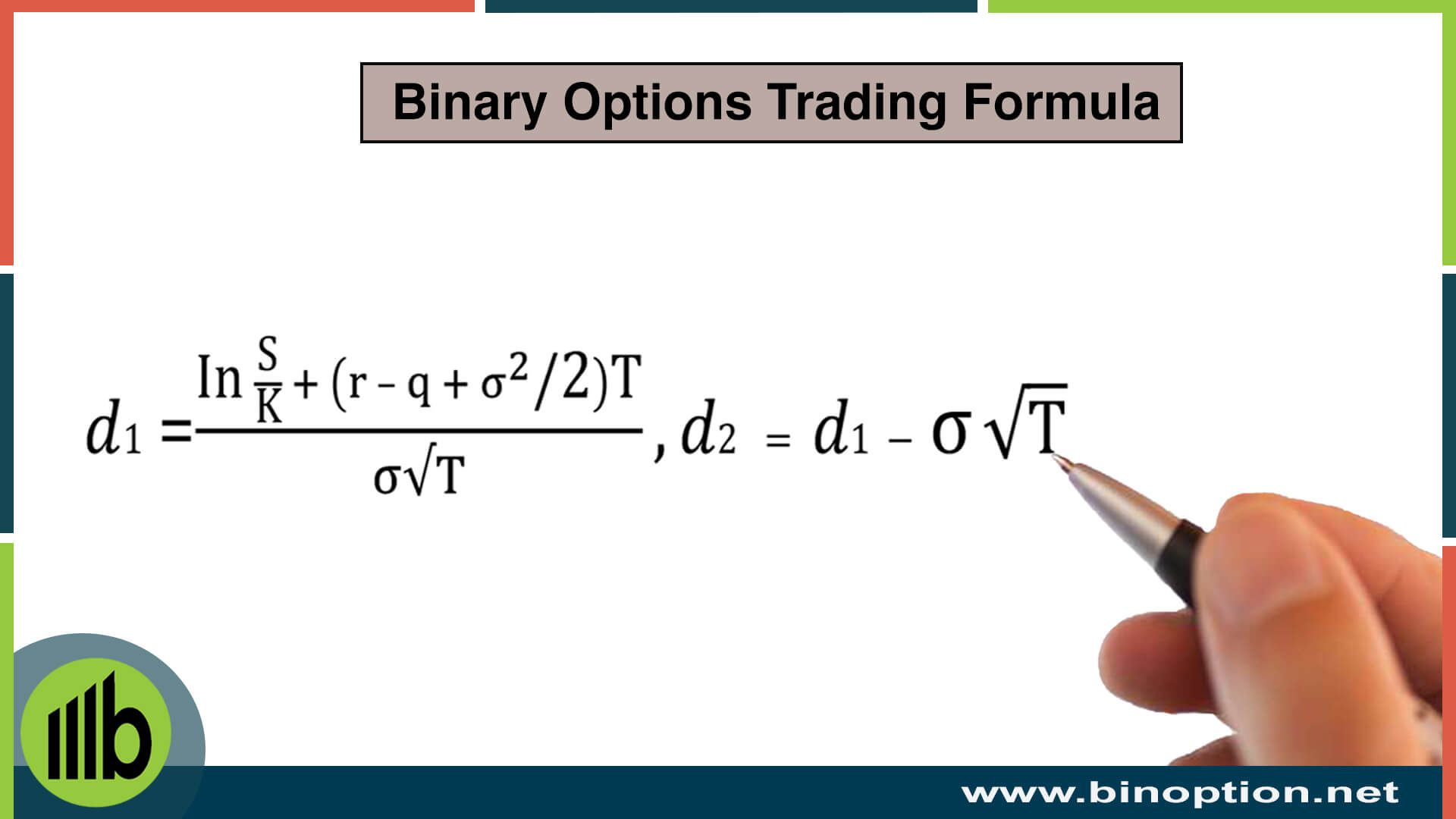

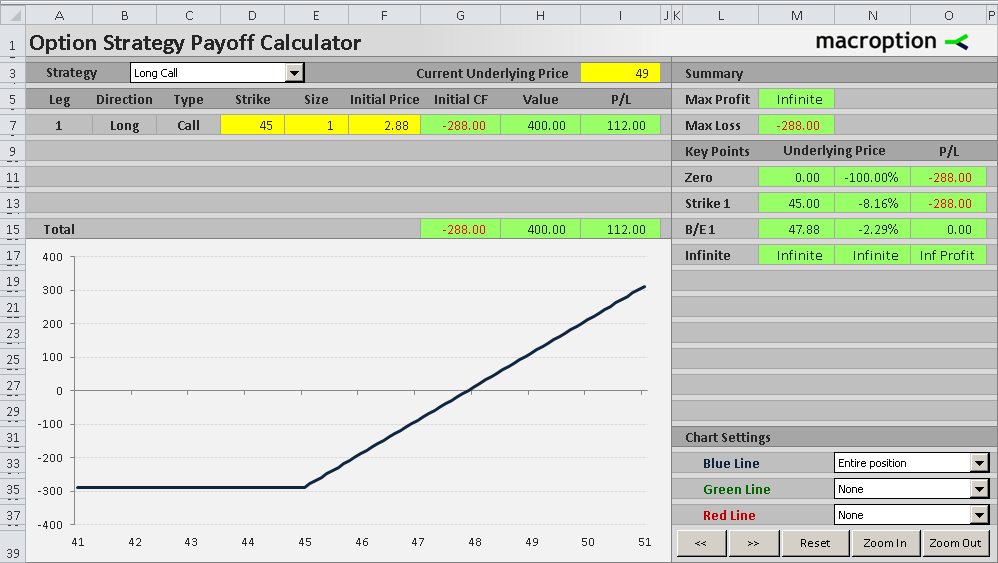

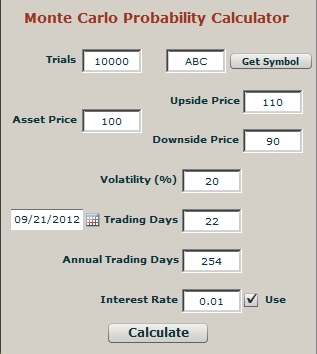

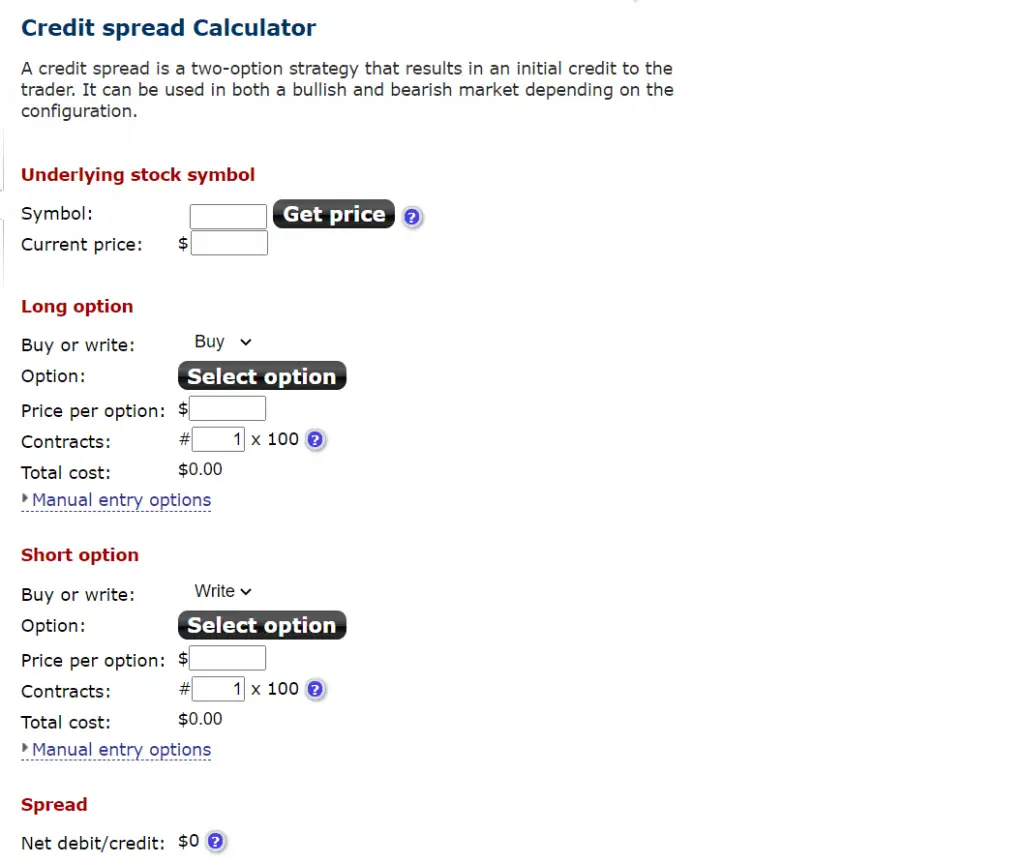

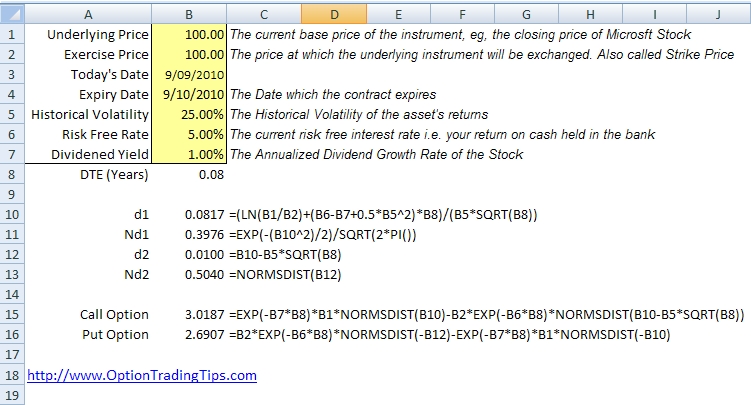

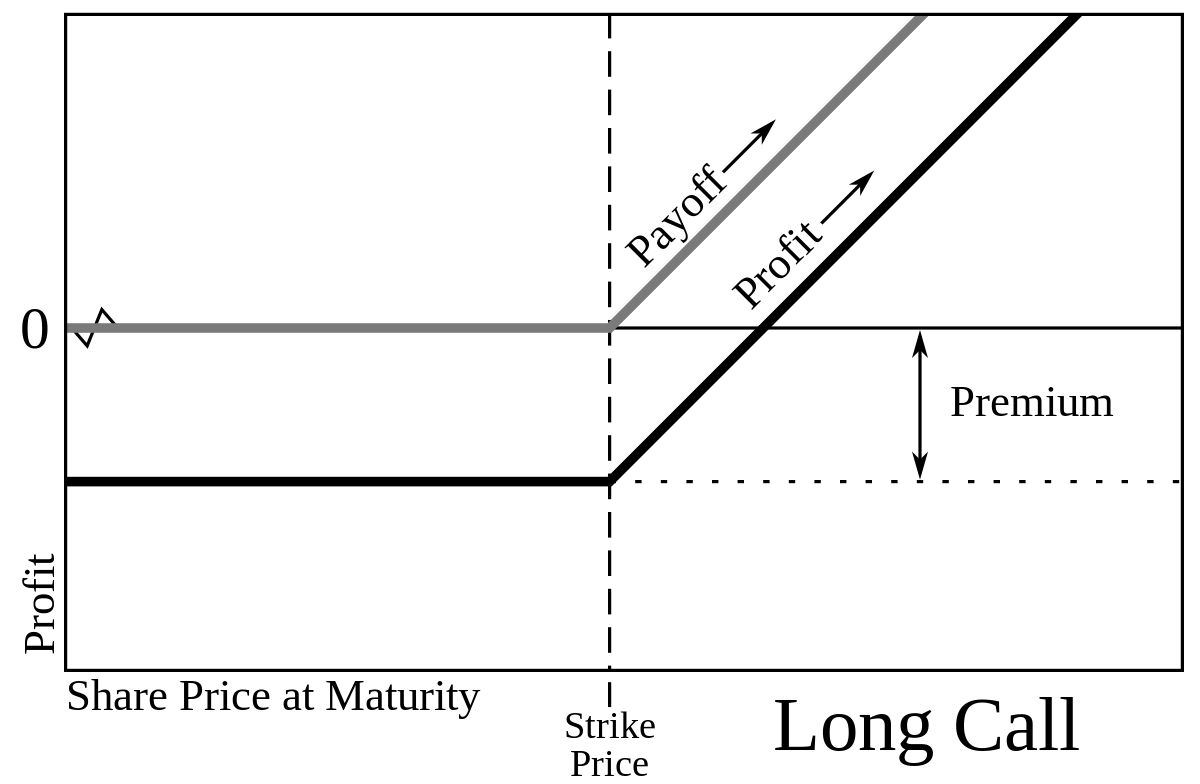

Option trading calculation. This can also be used to simulate the outcomes of prices of the options in case of change in factors impacting the prices of call options and put options such as changes in volatility or interest rates. Long call bullish calculator purchasing a call is one of the most basic options trading strategies and is suitable when sentiment is strongly bullish. The equity and index option strategies available for selection in this calculator are among those most widely used by investors.

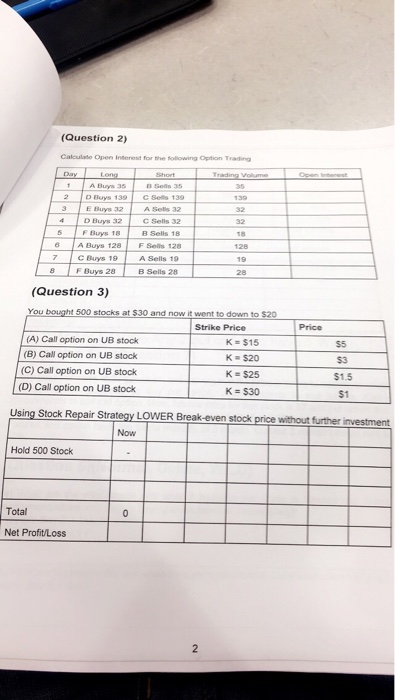

Options trading excel collar a collar is an options strategy which is protective in nature which is implemented after a long position in a stock has proved to be profitable. This calculator will automatically calculate the date of expiration assuming the expiration date is on the third friday of the month. This calculator contains a description of cboe s strategy based margin requirements for various positions in put options call options combination put call positions and underlying positions offset by option positions.

Probability of the option expiring below the upper slider bar. See visualisations of a strategy s return on investment by possible future stock prices. It is implemented by purchasing a put option writing a call option and being long on a stock.

Copies of this document may be obtained from your broker from any exchange on which options are traded or by contacting the options clearing corporation 125 s. This tool can be used by traders while trading index options nifty options or stock options. Enter the following values.

Calculate the rate of return in your cash or margin buy write positions. Get covered writing trading recommendations by subscribing to the option strategist newsletter. It can be used as a leveraging tool as an alternative to margin trading.

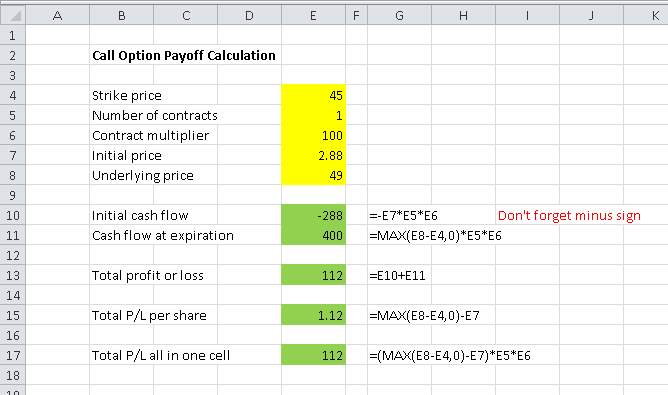

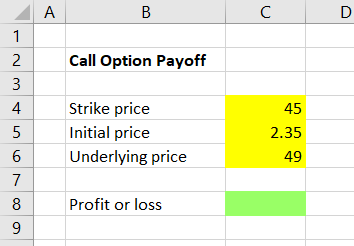

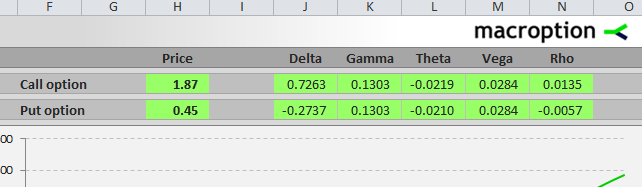

Options involve risk and are not suitable for all investors. Calculate the value of a call or put option or multi option strategies. Free stock option profit calculation tool.

:max_bytes(150000):strip_icc()/dotdash_Final_Options_Basics_How_to_Pick_the_Right_Strike_Price_Feb_2020-01-acdb55c99d224a48afe733fe552c796e.jpg)

:max_bytes(150000):strip_icc()/call-and-put-options-definitions-and-examples-1031124-FINAL-5bfd786646e0fb0026474cd7.png)

/BlackScholesMerton-56a6d22e3df78cf772906866.png)