Llc For Trading Stocks

Once organized under state law an llc can do many of the same.

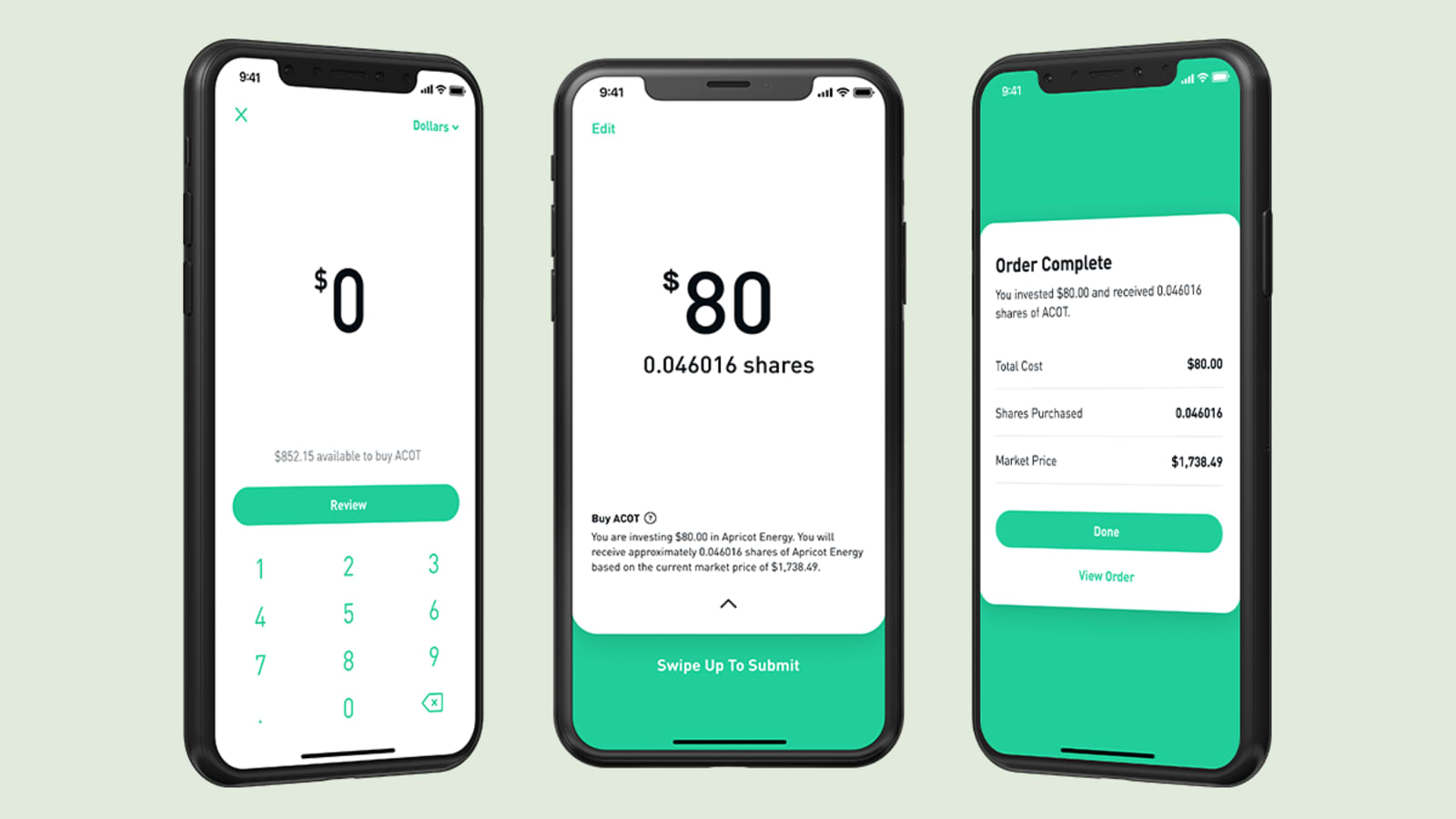

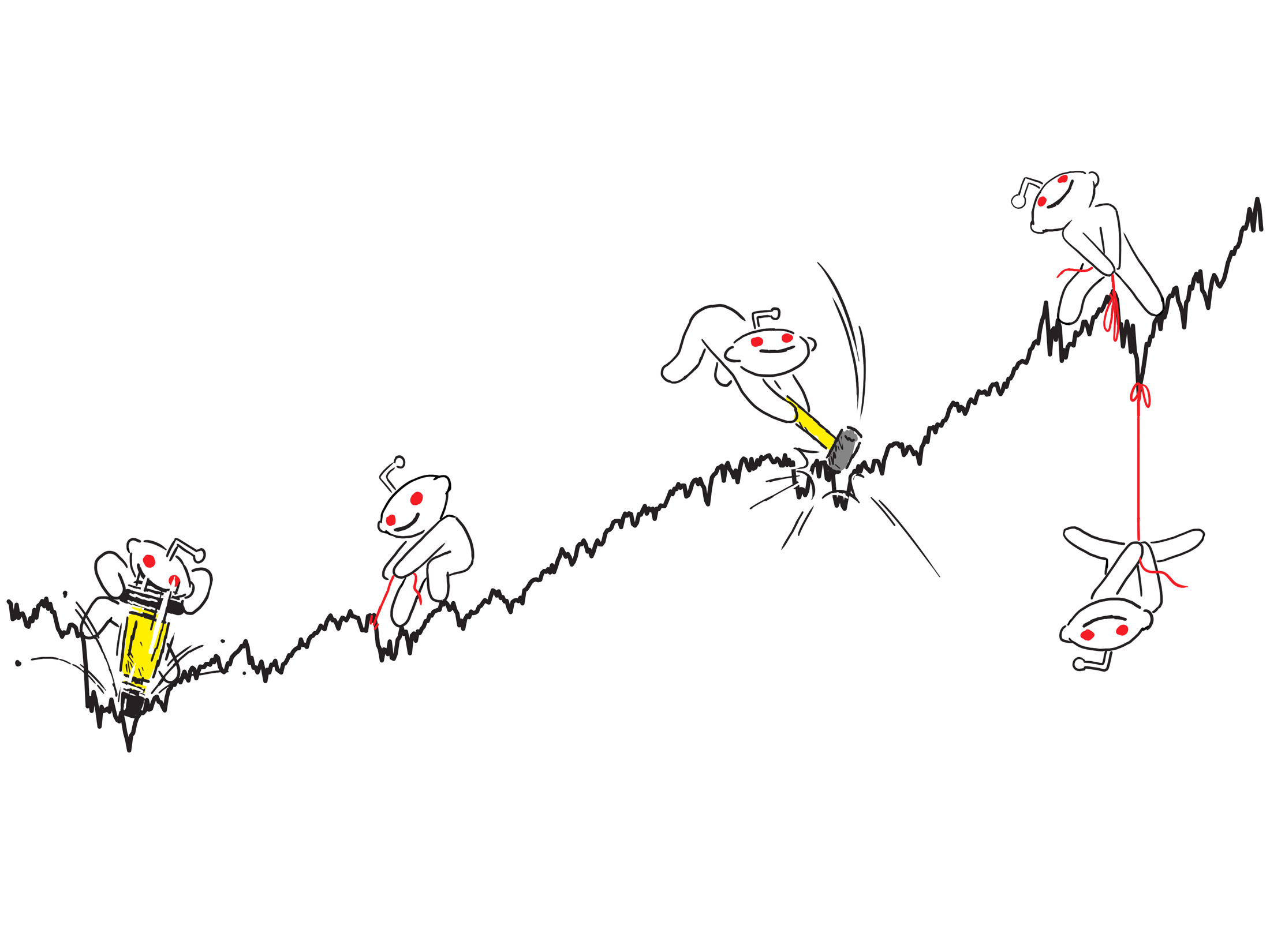

Llc for trading stocks. Make sure it. One of the more interesting uses of an llc is to allow groups of people to pool their money together to invest. With a sole proprietorship a trader eligible for trader tax status.

As trading gains typically. More entity trading account definition and functions. Establish an operating agreement that defines the llc s operations.

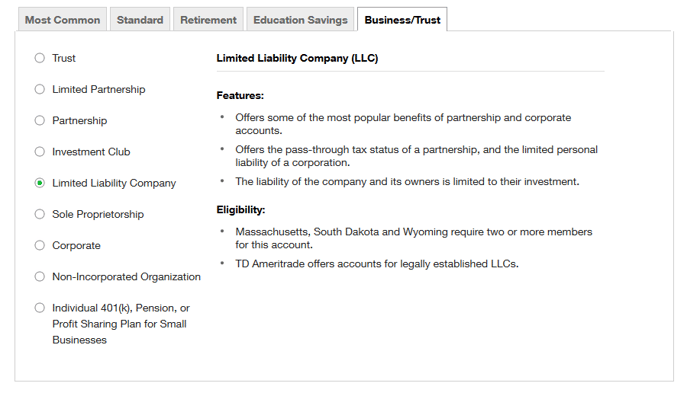

As with many aspects of llcs or limited liability companies whether it is advisable to be using an llc to day trade depends on the circumstances of your particular business. As an ordinary shareholder of say microsoft stock you have no liability for any debts of microsoft. An llc can buy stocks just like any individual naturally the first step to buy stocks on behalf of an llc is to form the company.

But before you can do this you must. Answer if all you re doing is trading stocks on the national exchanges and not buying majority interests in companies and running them yourself or through a manager then you don t need an llc. In addition the trading income from an llc is not subject to self employment tax.

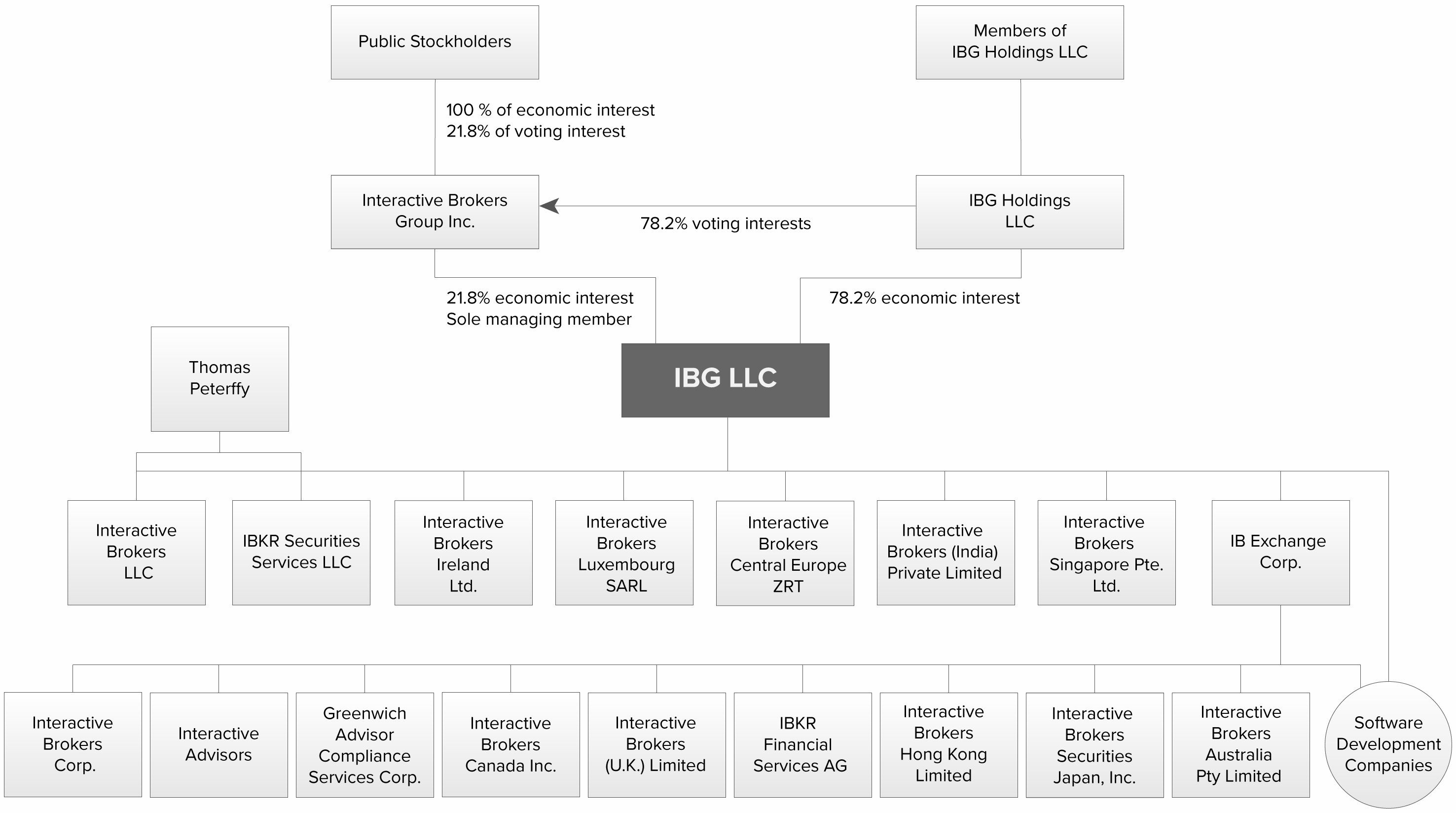

Active traders who elect to be taxed as s corporations can arrange employee benefit plan ira health insurance premium deductions. Limited liability is a type of liability that does not exceed the amount invested in a partnership or limited liability company. Multi member llc and an smllc can elect s corp tax treatment within 75 days of inception.

You might be able to do this online. There are three aspects to the decision as to whether or not to use an llc to day trade or use an llc to trade stocks. Obtain your ein tax id number from the internal revenue service.

An llc is a business entity created under state law that may shield you from personal liability. File documents to form your llc with your state and pay the filing fee. And having only one class of stock.

If you actively trade securities futures forex or crypto consider setting up a trading business to maximize tax benefits. It can also be used to invest in other things such as real estate.

/GettyImages-983820708-acea3aa443734b5b957c69453268c5e3.jpg)

:format(png)/cdn.vox-cdn.com/uploads/chorus_image/image/44261098/Screen_Shot_2014-12-02_at_10.33.48_AM.0.0.png)

/limited-liability-company-on-the-sticky-notes-with-bokeh-background-1158519140-44f25af400984f9a9433816c92076223.jpg)

/is-it-possible-to-make-a-living-trading-stocks-3140573_final_AC-01-5c06fa1fc9e77c0001ade06b.png)