Is Day Trading Illegal

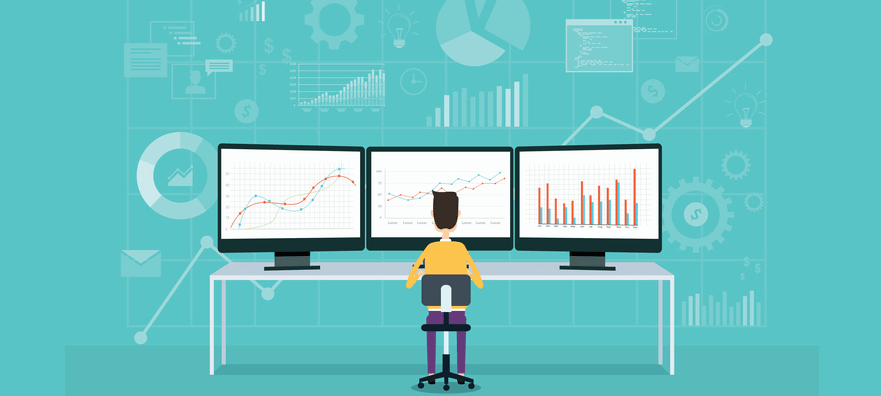

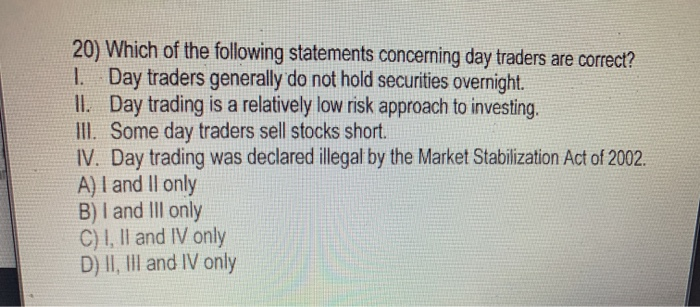

The pattern day trader rule is a finra based regulation that only applies to pattern day traders using margin accounts.

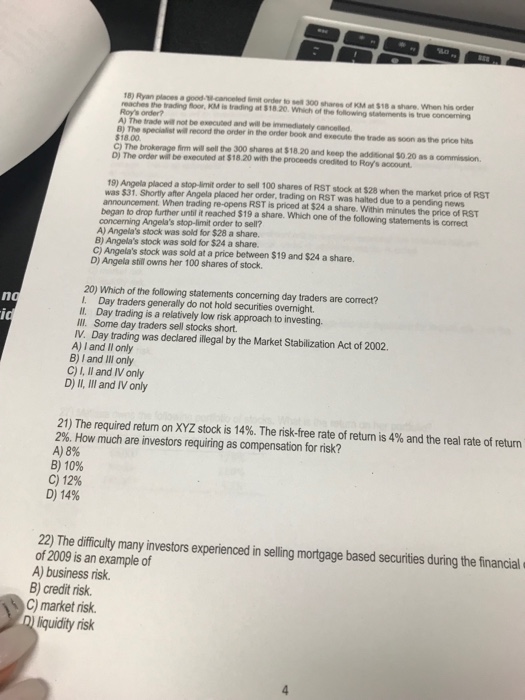

Is day trading illegal. Securities and exchange commission sec has imposed restrictions on the day trading of u s. While day trading is neither illegal nor is it unethical it can be highly risky. The financial industry regulatory authority finra in the u s.

These prevent pattern day traders from operating unless they maintain an equity balance of at least 25 000 in their trading account. Yes you can get in and out of trades a million times a day if you want to. In the roaring twenties just about everyone could score in a bucket shop.

Taking advantage of small price moves can be a lucrative. Unfortunately some traders have confused this rule with day trading as a whole being illegal. Day trading is not illegal.

Most individual investors do not have the wealth the time or the temperament to make money and to sustain the devastating losses that day trading can bring. Day trading is extremely risky and can result in substantial financial losses in a very short period of time. No pattern day trading is not illegal.

Customers were doing no more than placing a bet on whether certain stocks would rise or fall. Day trading is the act of buying and selling a financial instrument within the same day or even multiple times over the course of a day. You must meet certain requirements to day trade from your brokerage account or be a member of an llc and there are a few other ways.

This rule limits trading for margin based day traders that have less than 25 000 in their accounts. Many were illegal and not unlike off track bettering shops. Stocks and stock markets.

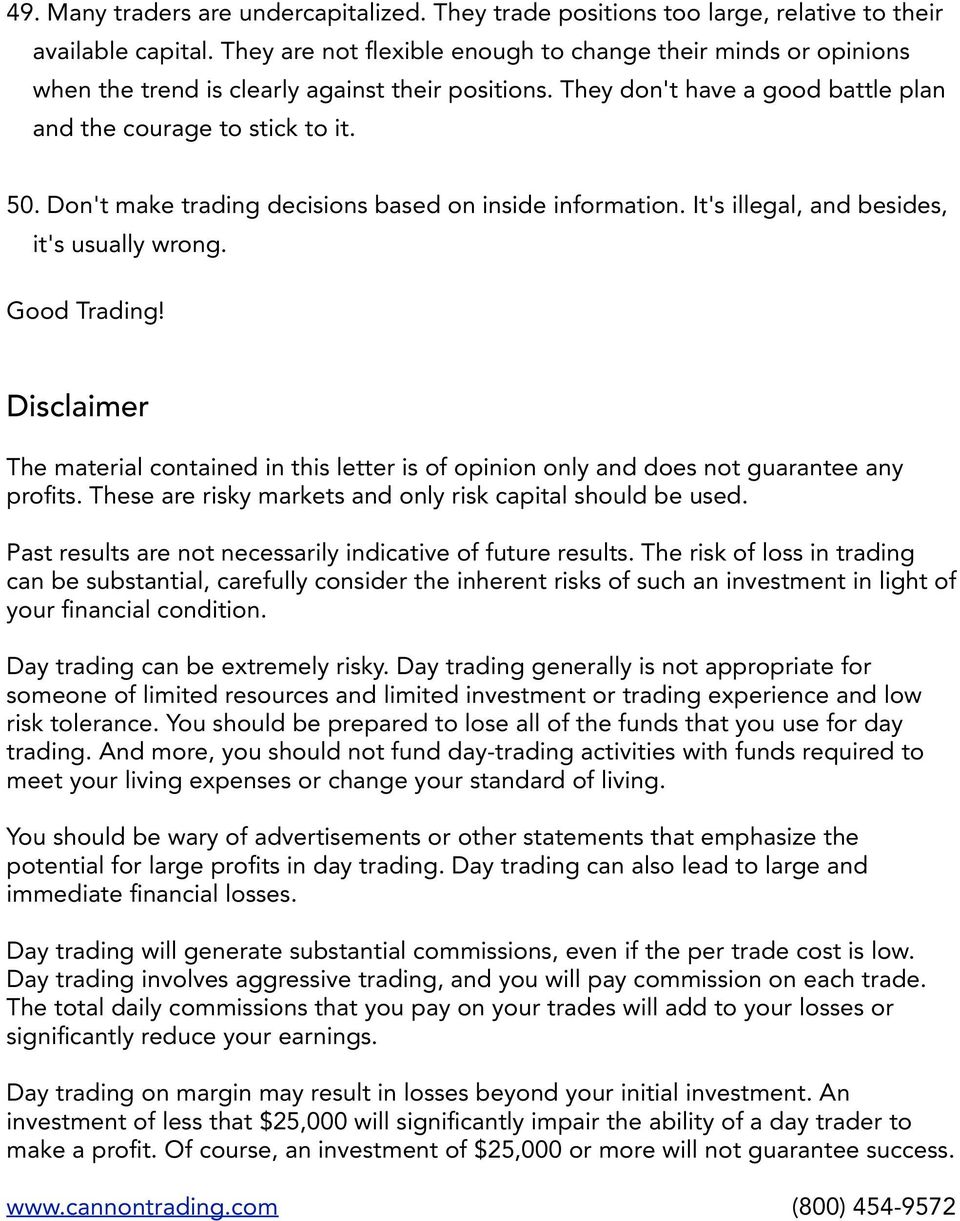

Your dollars at risk. We also have warnings and tips about online trading and day trading. As long as you don t have insider information which would be insider trading and that may be what you are thinking is illegal.

Day trading is extremely risky and can result in substantial financial losses in a very short period of time. They don t forbid margin accounts or trading with accounts that have less than 25 000 of capital but they try to regulate them as much as possible. Established the pattern day trader rule which states that if you make four or more day trades opening and closing a stock position within the same day in a five day period and those day trading activities are more than 6 of your total trading activity in that five day period you re considered a day trader and must maintain a minimum account balance of 25 000.

If you are a day trader or are thinking about day trading read our publication day trading. Few mom and pop day traders can succeed in today s highly efficient hft ago driven market. The us government portrays it as being extremely risky and thus they created the pdt rule to protect the capital of investors.

/stock-market-fluctuations-5955e0f63df78cdc29b6dce5.jpg)

/GettyImages-490556036-1f443237f9864342b101cd301a12aeec.jpg)