How Options Trading Works

Here s nerdwallet s guide to how option trading works.

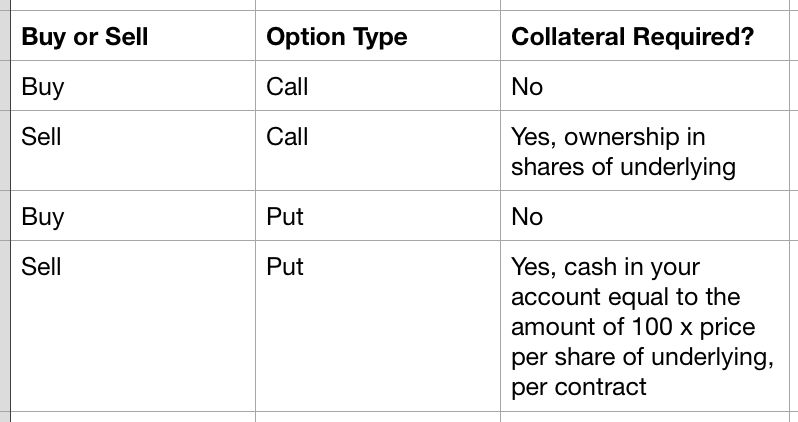

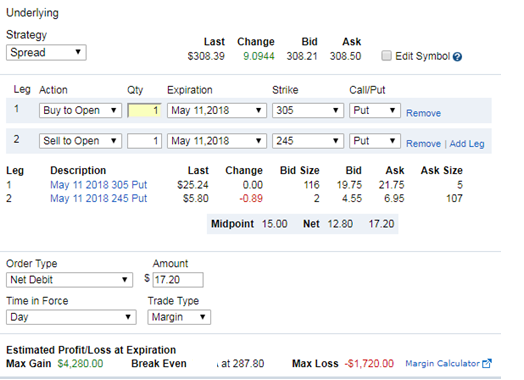

How options trading works. Puts calls strike prices premiums. Consider the core elements in an options trade 1. If you buy an option you are not obligated to buy or sell the underlying instrument.

With straddles long in this example you as a trader are expecting the asset like a stock. Predict how high or low the stock price will move from its current price an option remains valuable only if the stock. Index options give the investor the right to buy or sell the underlying stock index for a defined time period.

So you only have to pay pennies on the dollar. An option is a contract giving the buyer the right but not the obligation to buy in the case of a call or sell in the case of a put the underlying asset at a specific price on or before a. You simply have the right to.

You re paying for the right to buy or sell shares at a certain price on a certain date. Trading options involves buying or selling a stock at a set price for a limited period of time. If you have long asset investments like stocks for example a covered call is a great option for you.

When you buy options you re not buying shares of a company. Since index options are based on a large basket of stocks in the index investors can. Options give you the right to buy or sell an underlying instrument.

:max_bytes(150000):strip_icc()/OPTIONSBASICSFINALJPEGII-e1c3eb185fe84e29b9788d916beddb47.jpg)

:max_bytes(150000):strip_icc()/BuyingPuts-d28c8f1326974c16807f23cb32854501.png)

:max_bytes(150000):strip_icc()/call-and-put-options-definitions-and-examples-1031124-FINAL-5bfd786646e0fb0026474cd7.png)

/shutterstock_318403496.jpgoptionstrading-5c36153746e0fb00017f9287.jpg)

:max_bytes(150000):strip_icc()/shutterstock_97670996-5bfc47c3c9e77c0051862960.jpg)

:max_bytes(150000):strip_icc()/10OptionsStrategiesToKnow-01-5cbad2a9fe294e679f467f3ebc57890d.png)

:max_bytes(150000):strip_icc()/10OptionsStrategiesToKnow-03-762dd3eb350a4e0daffdb7626ffcf6d4.png)