Hedge Fund Trading

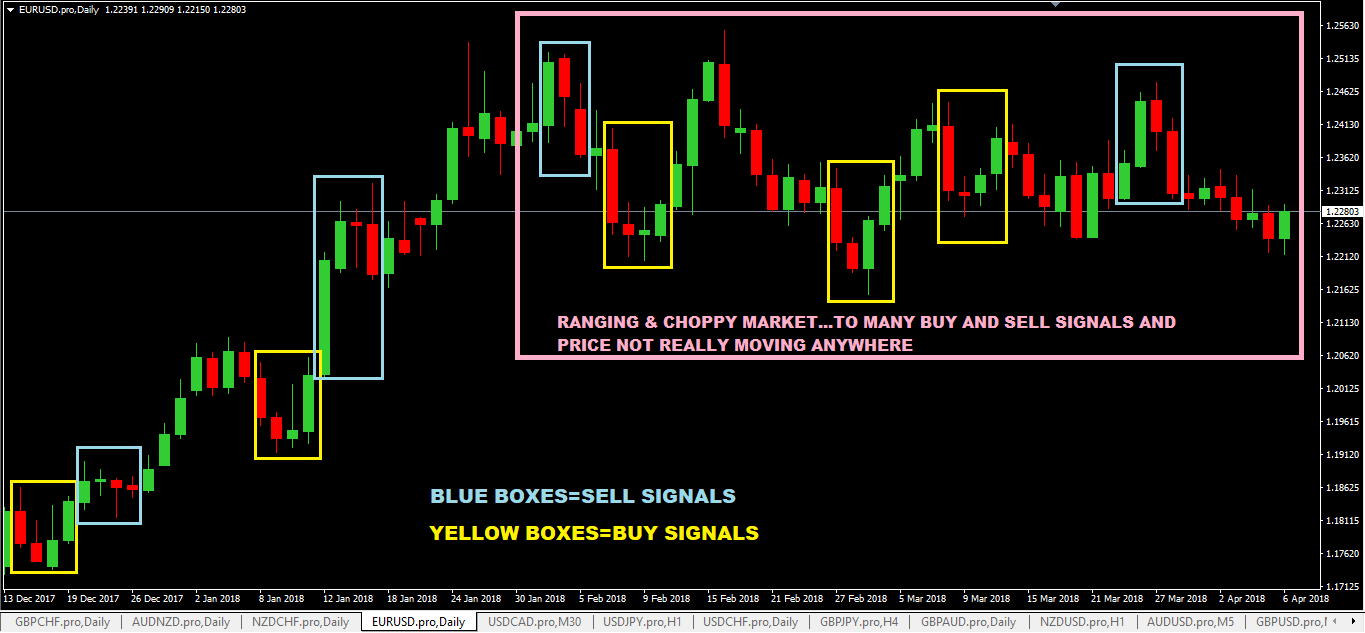

You can trade any currency pairs with it.

Hedge fund trading. The very name hedge fund derives from the use of trading. Hedge funds have been attractive to ultra high net worth individuals and organizations seeking to boost returns with esoteric and complex trading strategies. You are supposed to use it as a swing trading system meaning you let your trades run for days with an aim to make hundreds of pips in profits.

Rather it is a pooled investment structure set up by a money manager or registered investment advisor and designed to make a return. Hedge funds invest in a variety of financial markets using pooled funds collected from investors. A hedge fund isn t a specific type of investment.

Most hedge fund managers you know trade using other people s funds. Hedge fund managers are hampered in their efforts to raise funds by regulations that prevent them from publicly advertising a specific fund. A popular hedge fund method to generate large returns is purchasing securities on margin.

One of the most high profile insider trading cases involves the galleon group managed by raj rajaratnam. While most hedge funds are both. Because of its use of complex techniques financial regulators typically do not allow hedge funds to be marketed or made available to.

They can however set up informational websites that. They use numerous different trading strategies to boost their performance and the return for their investors. A margin account is borrowed money from a broker that is used to invest in securities.

A number of hedge funds have been implicated in insider trading scandals since 2008. Your source of funds is another important thing you must think about when trading like a hedge fund manager. 1 this pooled investment structure is often organized as either a limited partnership or a limited liability company.

This trading system is a 100 price action trading system and it is based on the daily chart. What is this hedge fund trading system.

:max_bytes(150000):strip_icc()/etfs-5bfc2b85c9e77c0026306387.jpg)