Gapping Trading Strategy

In this tutorial you will learn how to trade identify and interpret the gap and go pattern the right way.

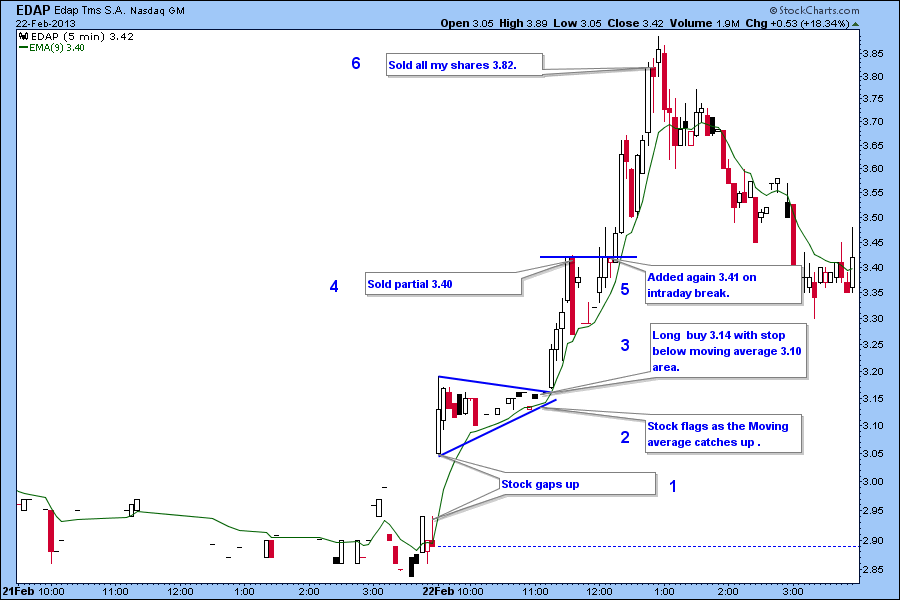

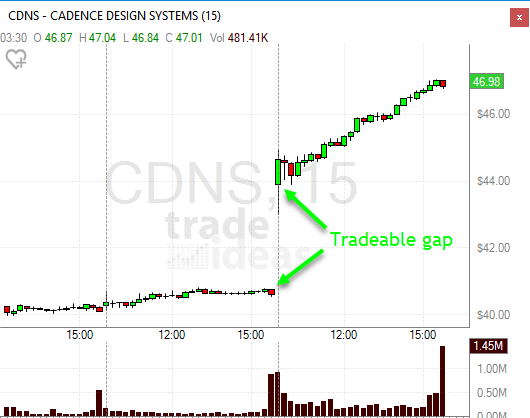

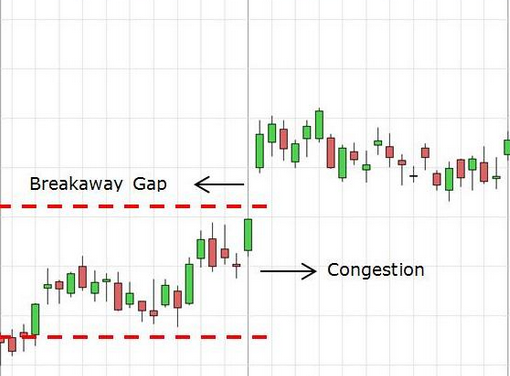

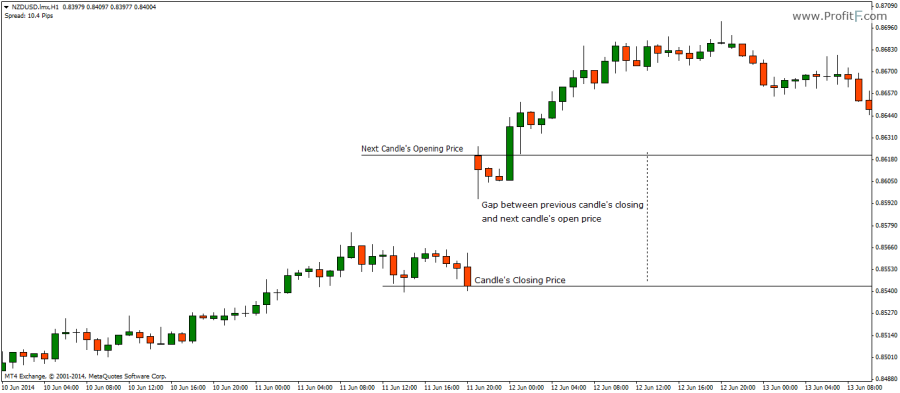

Gapping trading strategy. Gap trading is a simple and disciplined approach to buying and shorting stocks. Gaps represent big supply demand imbalances and are a favorite set up for more experienced traders in particular. A momentum stock trading strategy 1 scan for all gappers more 4 2 hunt for catalyst for the gap earnings news pr etc 3 mark out pre market highs and high of any pre market flags 4 prepare order to buy the pre market highs once the market opens 5 at 9 30am as soon as the bell rings i buy.

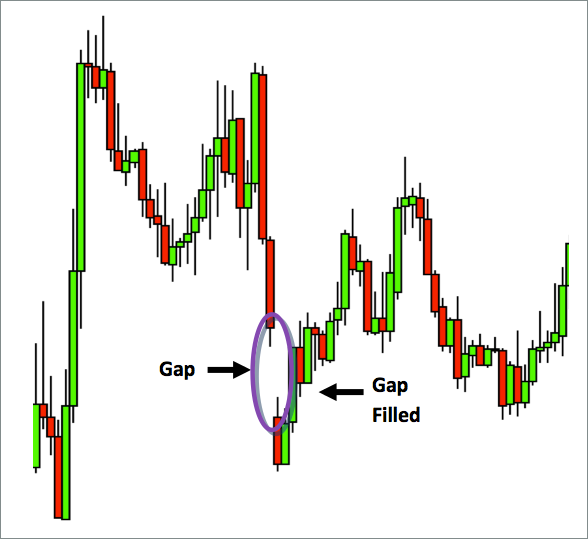

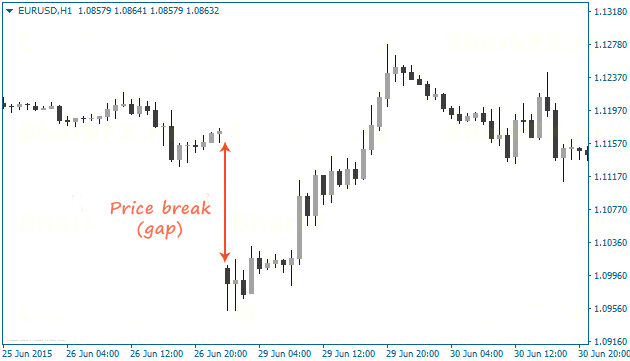

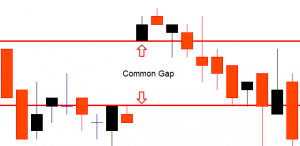

Essentially one finds stocks that have a price gap from the previous close then watches the first hour of trading to identify the trading range. How do you know if a stock will gap up. And when you play them on gaps you re taking a lot of the guesswork out of which penny stocks to pick.

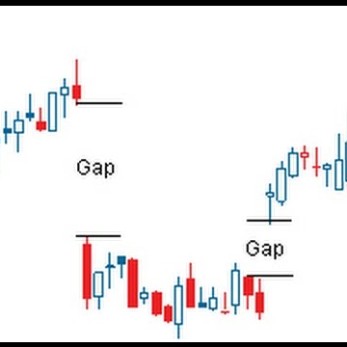

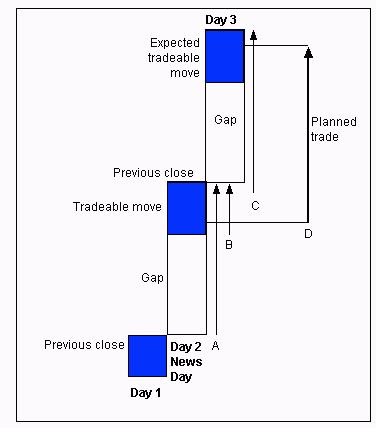

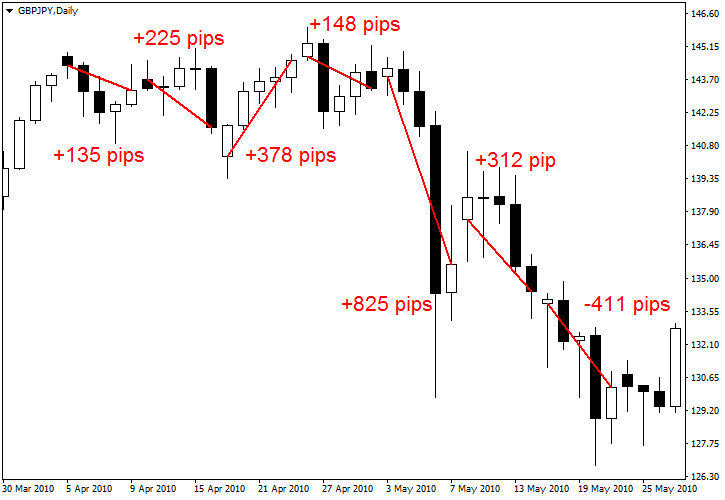

Contrarians may use a fading strategy to exploit gapping. Gapping trading strategies buying the gap up. Novice gaps are the ultimate picture of novice greed in the market.

Traders could take a trade in the opposite. Gap up long in a downtrend market when gap up opening the volume should be heavy to go higher. Rising above that range signals a buy while falling below it signals a short.

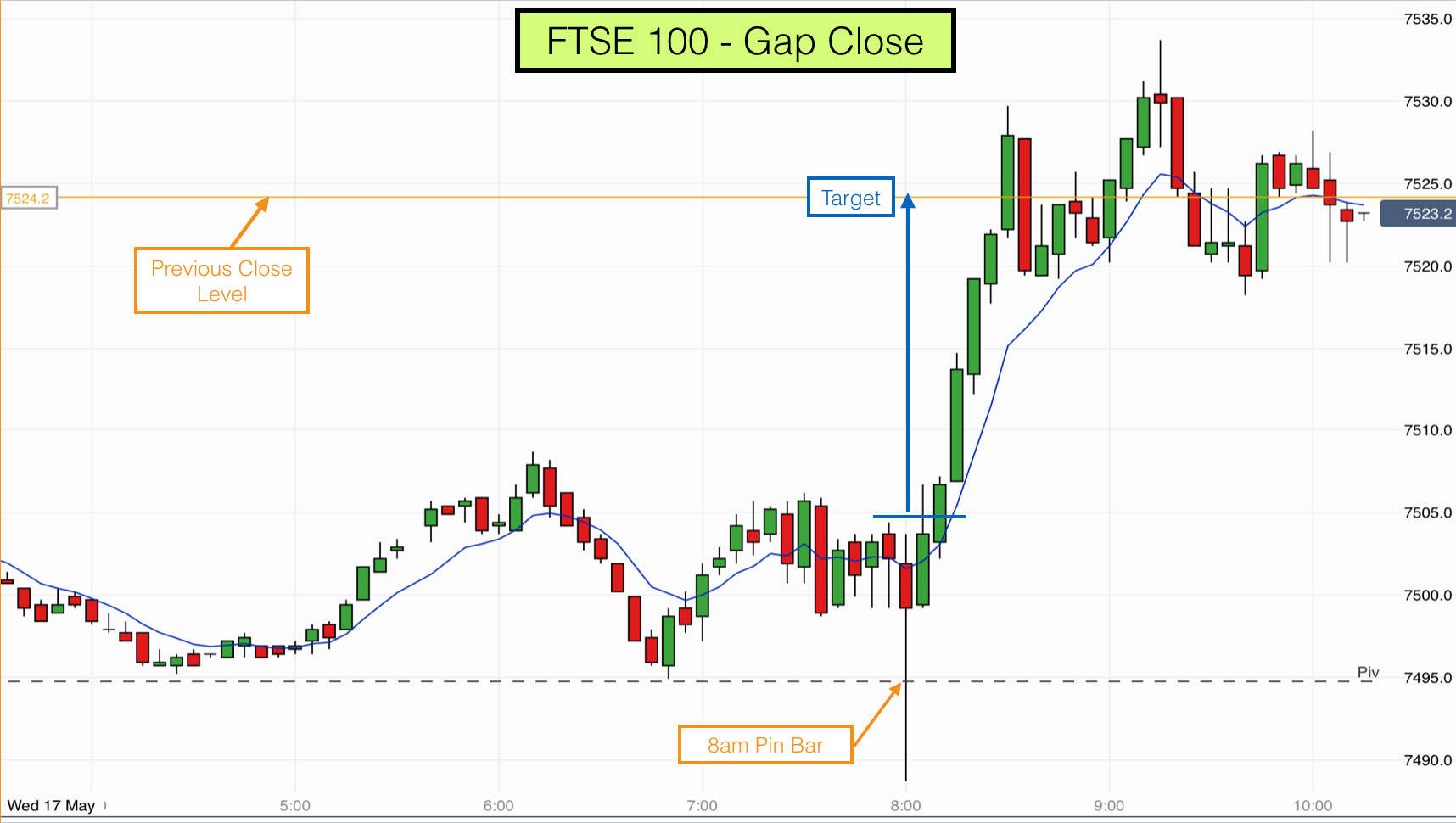

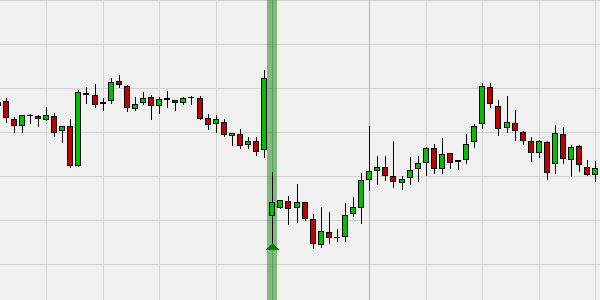

Morning gap definition the morning gap is one of the most profitable patterns that many professional day traders use to make a bulk of their trading profits. If smart money is active they supported by volume wait and see if the market trades above its opening prices after the morning pullback it indicate gap was real then go long or you can enter from a. Gaps as an investing signal.

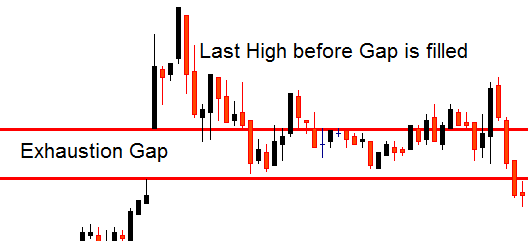

Penny stocks can bring in profit margins that few blue chip stocks can. Day traders often refer to this strategy as the gap and go a position could be taken on the day. Exhaustion gaps and continuation gaps predict the price moving in two different directions be sure you.

Here are four rules for better understanding gaps and exploiting their high profit potential. The gap and go strategy is one of the most powerful day trading strategies during market open. Once a stock has started to fill the gap it will rarely stop because there is often no immediate support or resistance.

If done right it can be so effective that you can finish your trading day after 30 60 minutes of trading. The best gap to play penny stocks on is the upward continuation gap. The morning gap is a byproduct of built up trading activity that occurs overnight due to an economic number earnings release or company specific news event.

Why do i make gaps such an important part of our education program.

:max_bytes(150000):strip_icc()/gapping-cfa7f9c4b72642bfada9ef4e076add71.jpg)

:max_bytes(150000):strip_icc()/googlgap-5c5b0b9b46e0fb0001849afe.png)

/PlayingtheGap22-b74a16eb4de4467da30401c685653ef8.png)

:max_bytes(150000):strip_icc()/upgapsidebysidewhitelinesdailystockchartexample-9949280923f341709f3e7f955a25d2a5.jpg)