Definition Of Trading Options

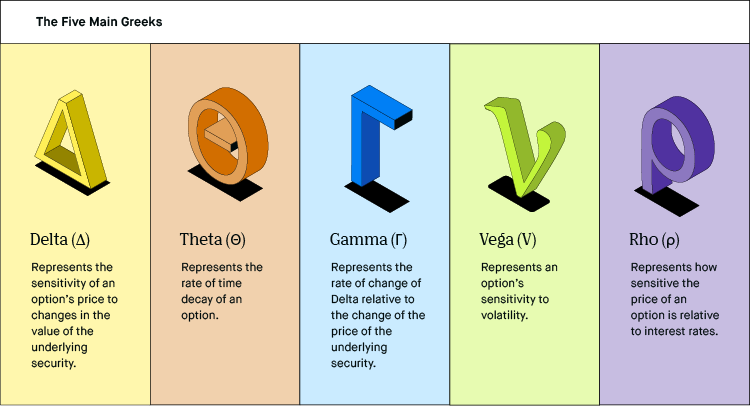

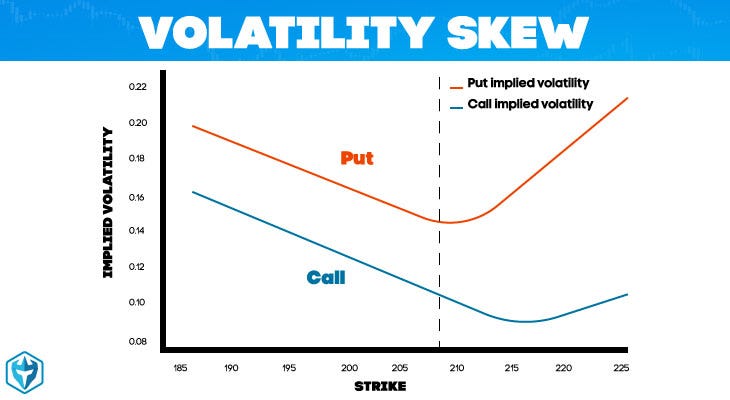

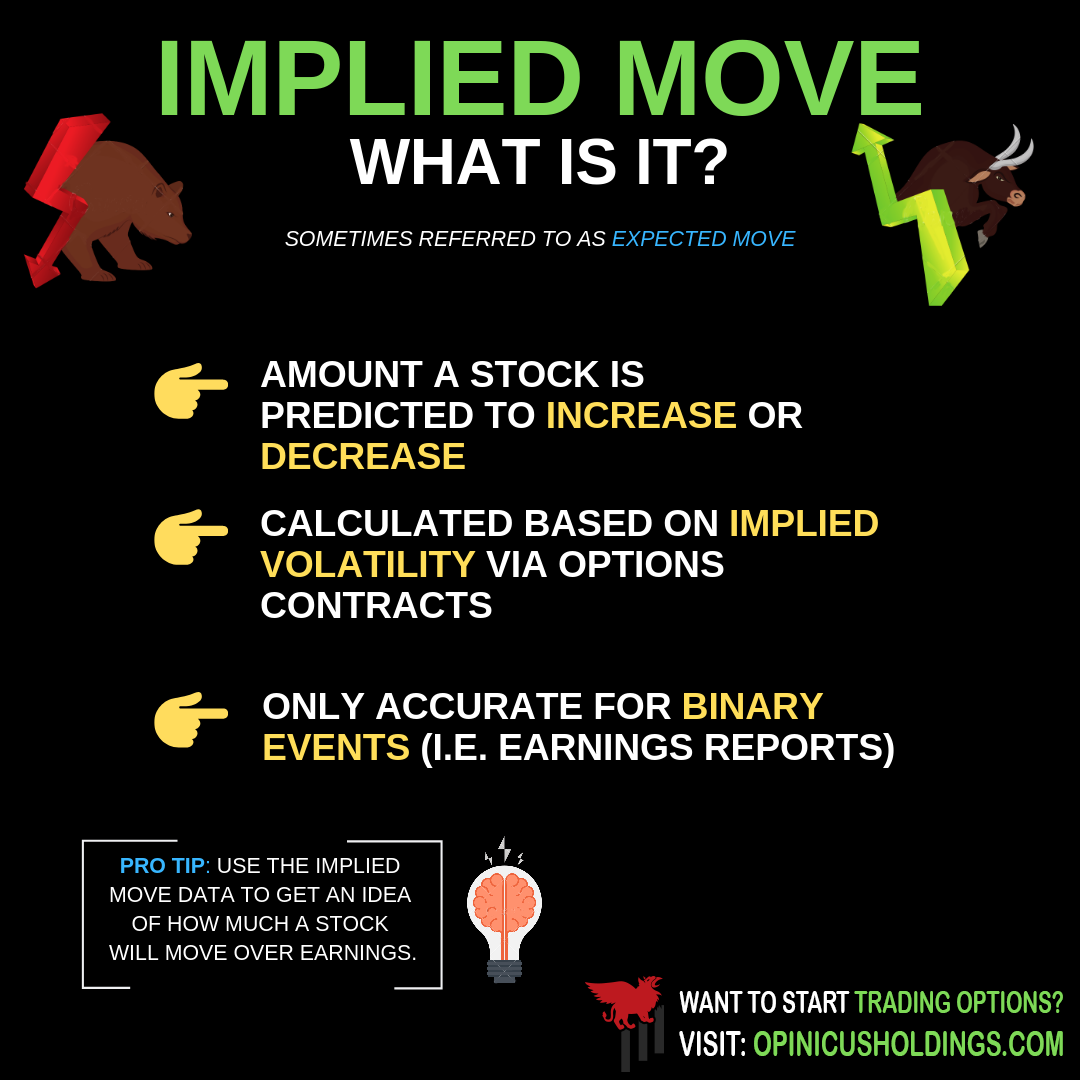

Volatility in options trading refers to how large the price swings are for a given.

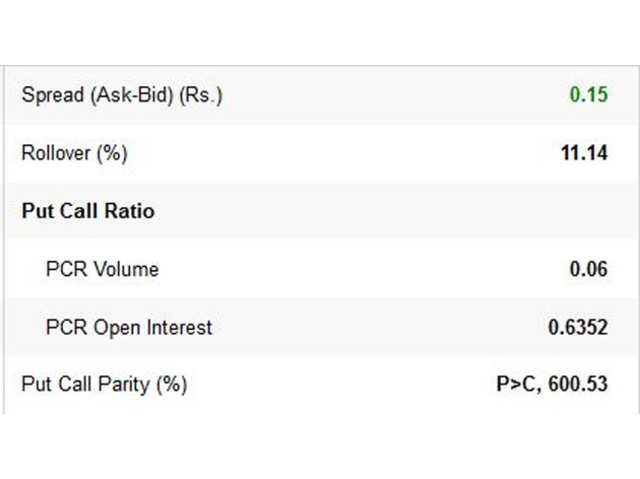

Definition of trading options. An options contract offers the buyer the opportunity to buy or sell depending on. European option an option that may only be exercised on expiry. American option an option that may be exercised on any trading day on or before expiration.

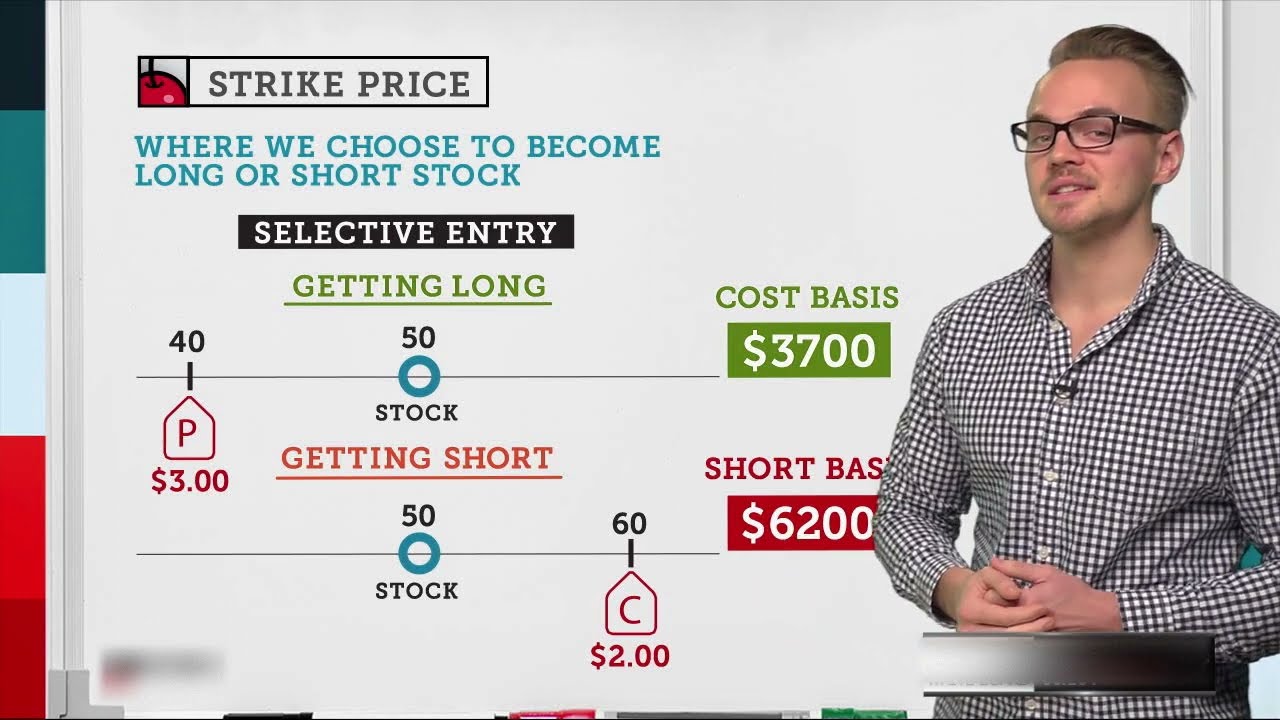

There are two types of options. Options are classified into a number of styles the most common of which are. A call and a put.

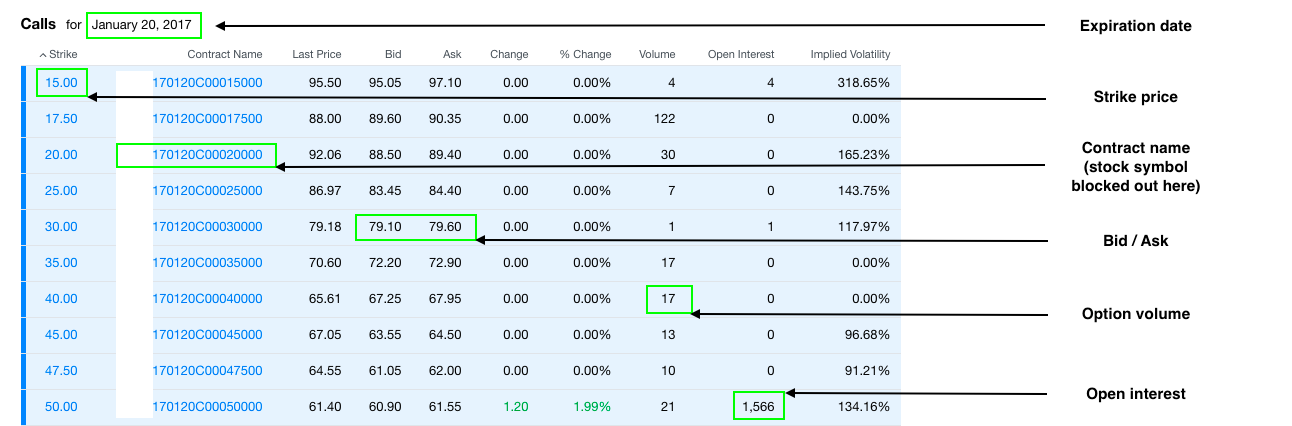

Options trading terms and definitions options contract definitions. A stock option gives an investor the right but not the obligation to buy or sell a stock at an agreed upon price and date. Puts which is a bet that a stock will.

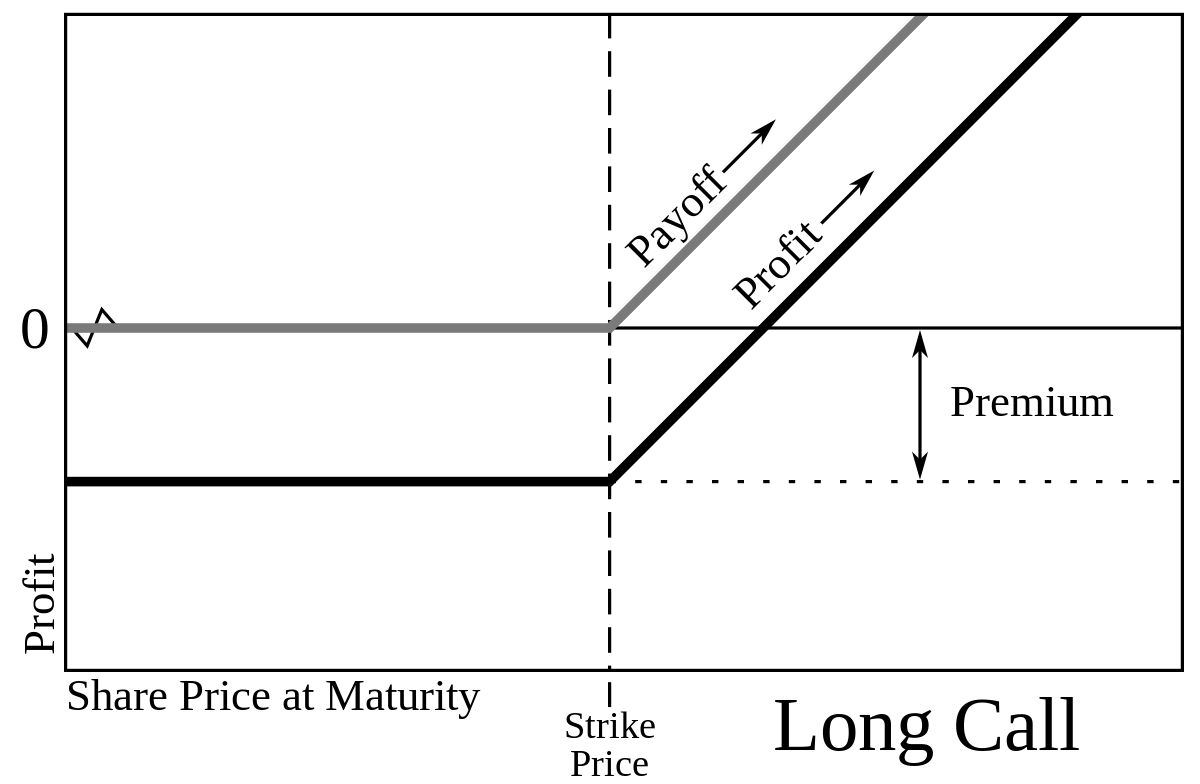

Key takeaways an option is a contract giving the buyer the right but not the obligation to buy in the case of a call or sell in. Terms to describe. The price of an option called the premium is composed of.

That period could be as short as a day or as long as a couple of years depending on the type of option contract. An options contract that gives you the right to buy stock at a set price within a. Options are contracts that give option buyers the right to buy or sell a security at a predetermined price on or before a specified day.

An option trading under parity is trading at a discount. Time value and in at out. Options are contracts that give the owner the right to buy or sell an asset at a fixed price for a specific period of time.

Call up a stock quote and you get the current market share price of the company the. Options are similar to futures in that they are often based upon the same underlying instruments and have similar contract specifications but options are traded quite differently. People use options for income to speculate and to hedge risk.

Options are financial instruments that are derivatives based on the value of underlying securities such as stocks. Many day traders who trade futures also trade options either on the same markets or on different markets. Fortunately there are only two types of standard option contracts.

Options are known as derivatives because they derive their value from an underlying asset. Also used as a point of reference an option is sometimes said to be trading at a specific distance over parity or under parity. What is options trading.

:max_bytes(150000):strip_icc()/OPTIONSBASICSFINALJPEGII-e1c3eb185fe84e29b9788d916beddb47.jpg)

/shutterstock_318403496.jpgoptionstrading-5c36153746e0fb00017f9287.jpg)

:max_bytes(150000):strip_icc()/10OptionsStrategiesToKnow-03-762dd3eb350a4e0daffdb7626ffcf6d4.png)

:max_bytes(150000):strip_icc()/call-and-put-options-definitions-and-examples-1031124-FINAL-5bfd786646e0fb0026474cd7.png)

/shutterstock_97670996-5bfc47c3c9e77c0051862960.jpg)

/BeginnersGuidetoCallBuying2-c1fe9d54ba0e4afd819e61159f100d29.png)

/10OptionsStrategiesToKnow-01-5cbad2a9fe294e679f467f3ebc57890d.png)

/dotdash_Final_Call_Option_Definition_Apr_2020-01-a13f080e7f224c09983babf4f720cd4f.jpg)

%20during%20a%20specific%20period..jpg)