Day Trading Rules Cash Account

What are day trading rules for a cash account.

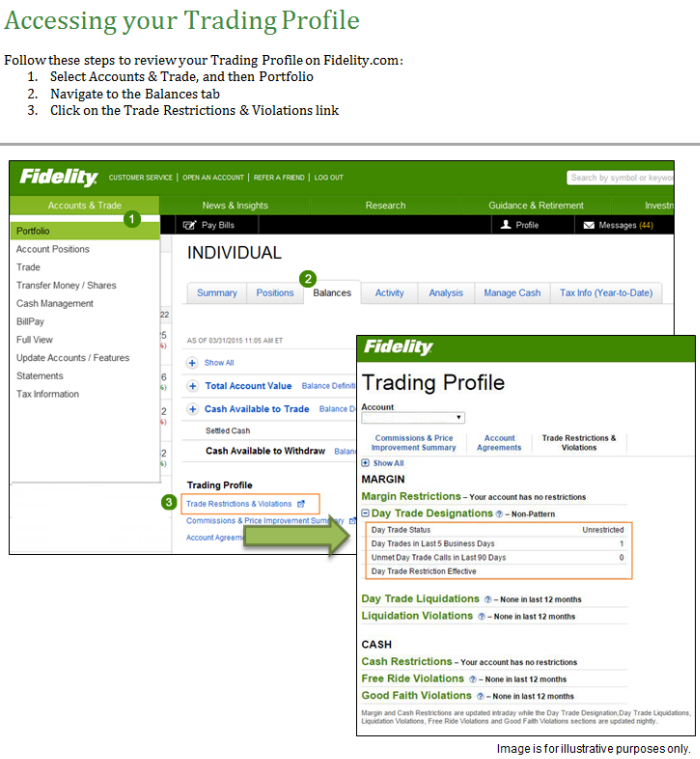

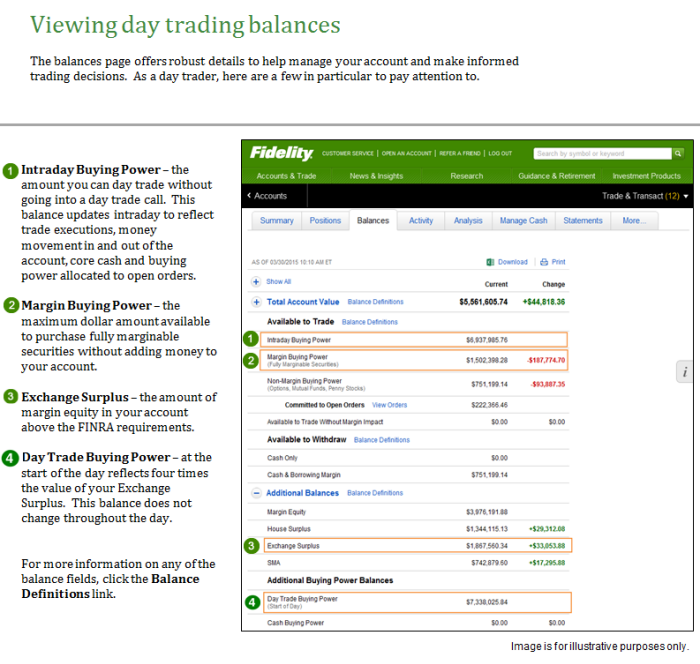

Day trading rules cash account. In this lesson we will review the trading rules and violations that pertain to cash account trading. The rules imposed on a cash account are intended to protect individual investors. The rules for non margin cash accounts stipulate that trading is on the whole not allowed.

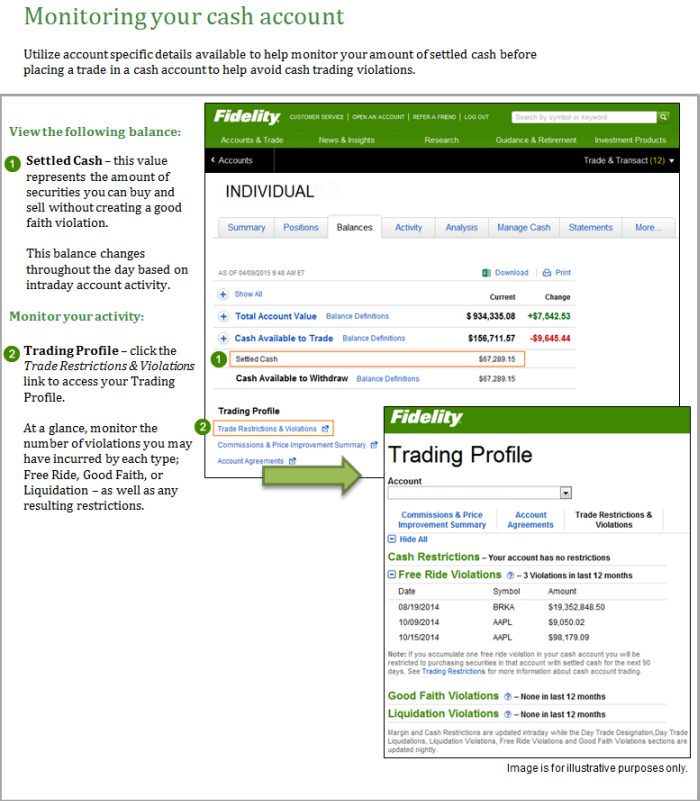

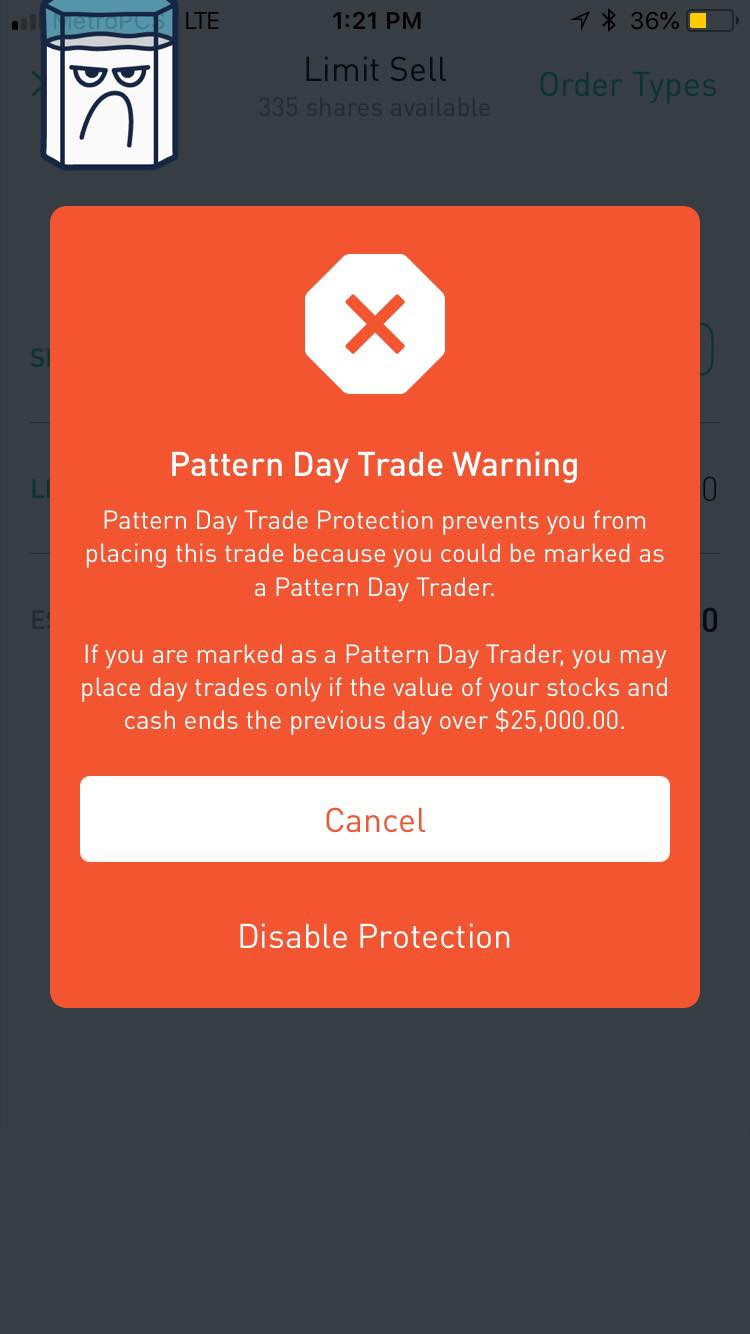

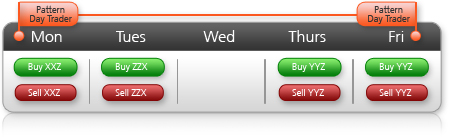

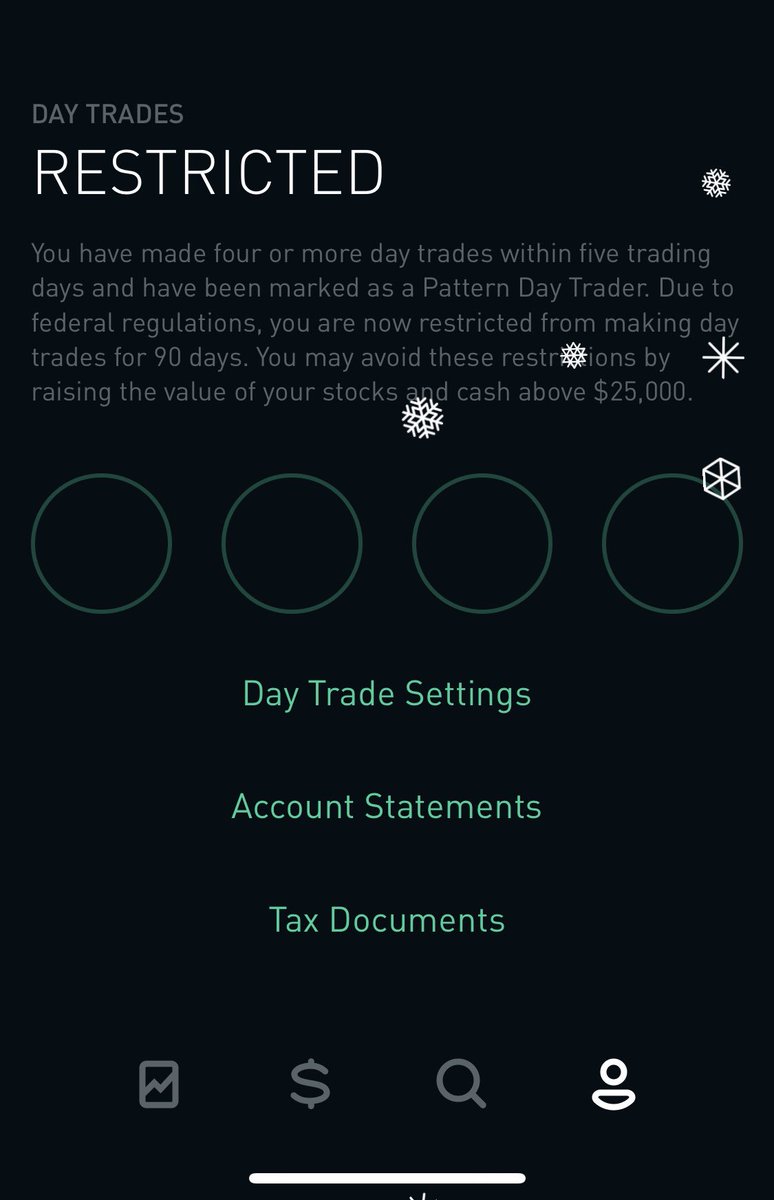

The sec has stated in order to day trade you must have a minimum of 25 000 dollars in your account and your account must have a pattern day trader status. Learn to trade stocks futures and etfs risk free. Day trades can occur in a cash account only to the extent the trades do not violate the free riding prohibition of federal reserve board s regulation t.

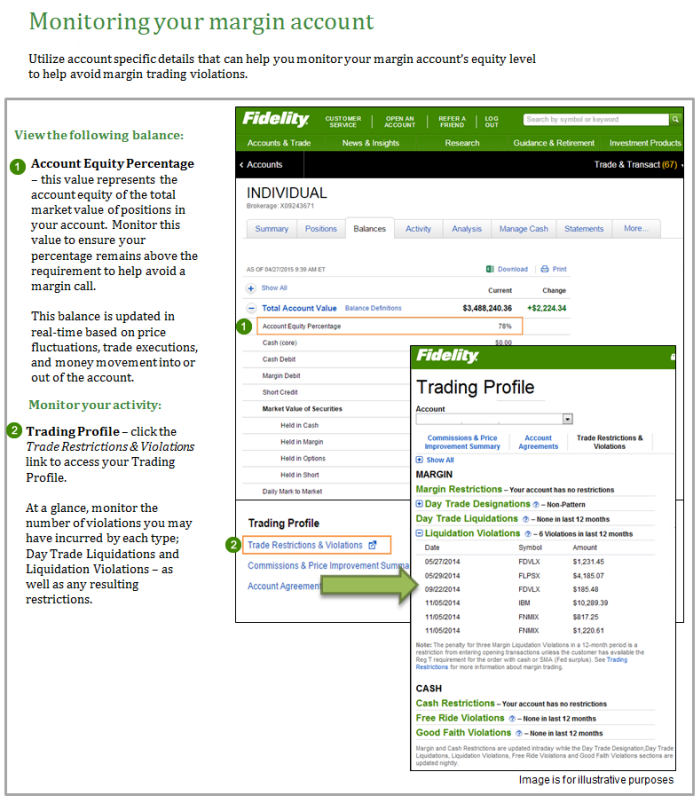

As the term implies a cash account requires that you pay for all purchases in full by the settlement date. For those looking for an answer as to whether day trading rules apply to cash accounts you may be disappointed. In general failing to pay for a security before you sell the security in a cash account violates the free riding prohibition.

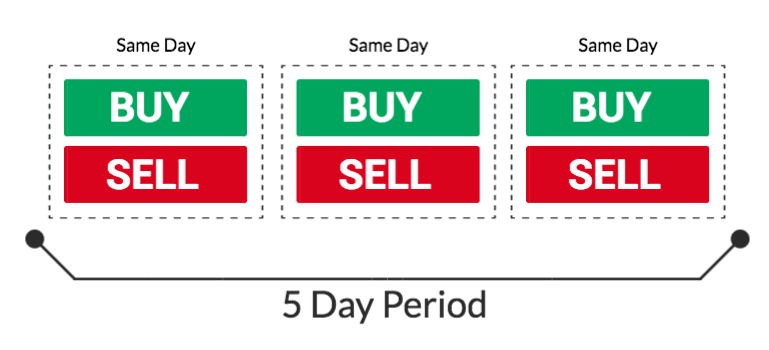

Make only three day trades in a five day period. Day trade a stock market outside the u s. So what are your options if you do not have either of the aforementioned and want to day trade without margin.

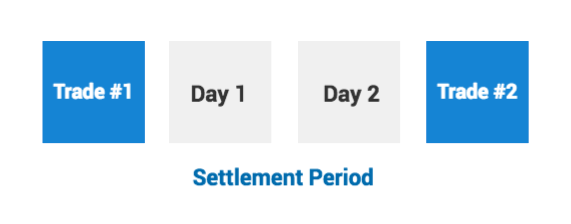

Traders are subject to the three day clearing rule which means after a trader with a cash account sells. You re also limited to three day trades within a rolling five day trading period. For example if you bought 1 000 shares of abc stock on monday for 10 000 you would need to have 10 000 in cash available in your account to pay for the trade on settlement date.

You ll have to do this with a broker that s also outside the u s. Not all foreign stock. The rules are the rules.

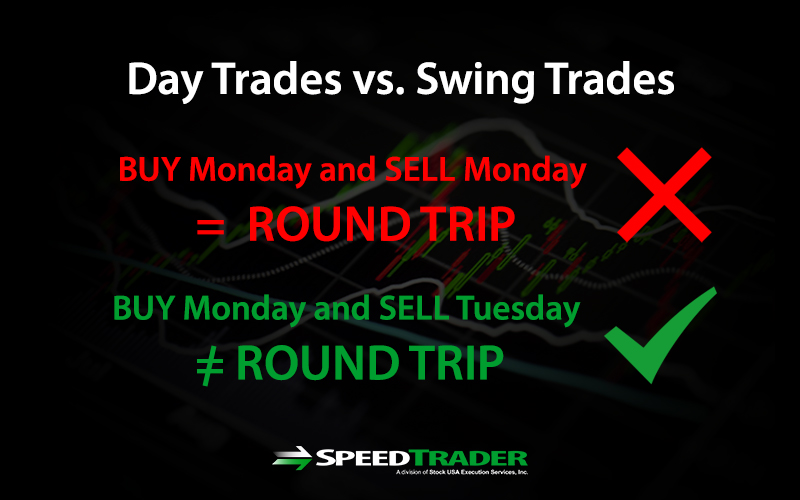

So if you buy an option on monday and sell it on tuesday then those funds won t clear until wednesday. A day trade is considered buying and selling the same stock on the same trading day. They are allowed only to the extent that the trades do not violate the free riding prohibitions of federal reserve board s regulation t.

Day trading in a cash account is generally prohibited. An investor using a cash account is not allowed to borrow funds from his or her broker dealer in order to pay for transactions in the account trading on margin. A cash account is a type of brokerage account in which the investor must pay the full amount for securities purchased.

:max_bytes(150000):strip_icc()/chart-1905224_1920-a337342257d040e98bb4040792c5a7dd.jpg)

:max_bytes(150000):strip_icc()/GettyImages-1130771124-070f9c6e45b74a539bbd2c0adcf7a67a.jpg)

:max_bytes(150000):strip_icc()/wealthfront-vs-etrade-core-portfolios-3cf44d7f34e846d6993d425e0d9f3888.jpg)

:max_bytes(150000):strip_icc():saturation(0.2):brightness(10):contrast(5)/1percentriskrule-5670abb65f9b586a9e07d1f6.jpg)

:max_bytes(150000):strip_icc():saturation(0.2):brightness(10):contrast(5)/CashAccountsandMarginAccounts-565977b43df78c6ddf4d7440.jpg)

/day-trading-versus-swing-trading-58d2b0783df78c5162052d77.jpg)