Day Trading How To

Then practice a strategy over and over again.

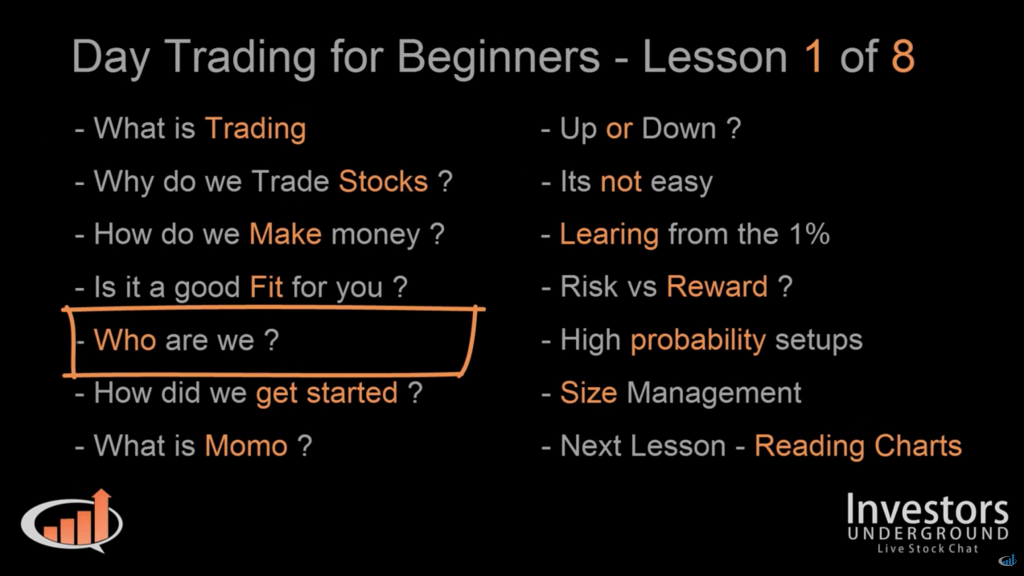

Day trading how to. The more a stock moves the more profit a trader can make or lose in a single trade. A route to the s p500 buffett s favourite index so before we get to those exciting stocks one of the stocks we hear about often in south africa is the vanguard s p500. In addition to knowledge of basic trading procedures day traders need to keep up on the latest.

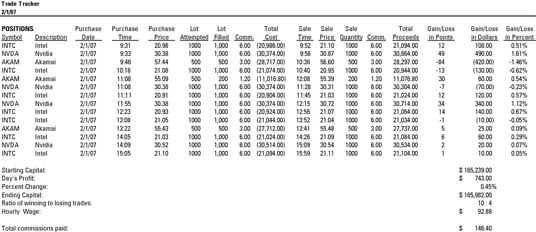

Focus on winning with one strategy before. Day trading is buying and selling securities in the same day. Consider your risk by looking at each trade as well as each day.

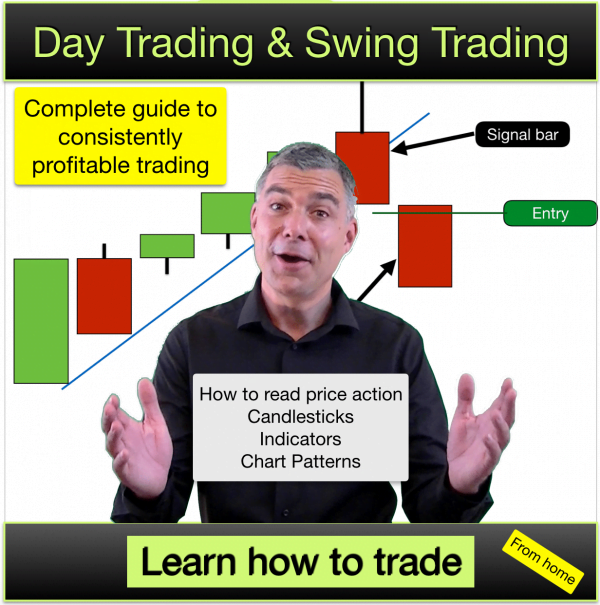

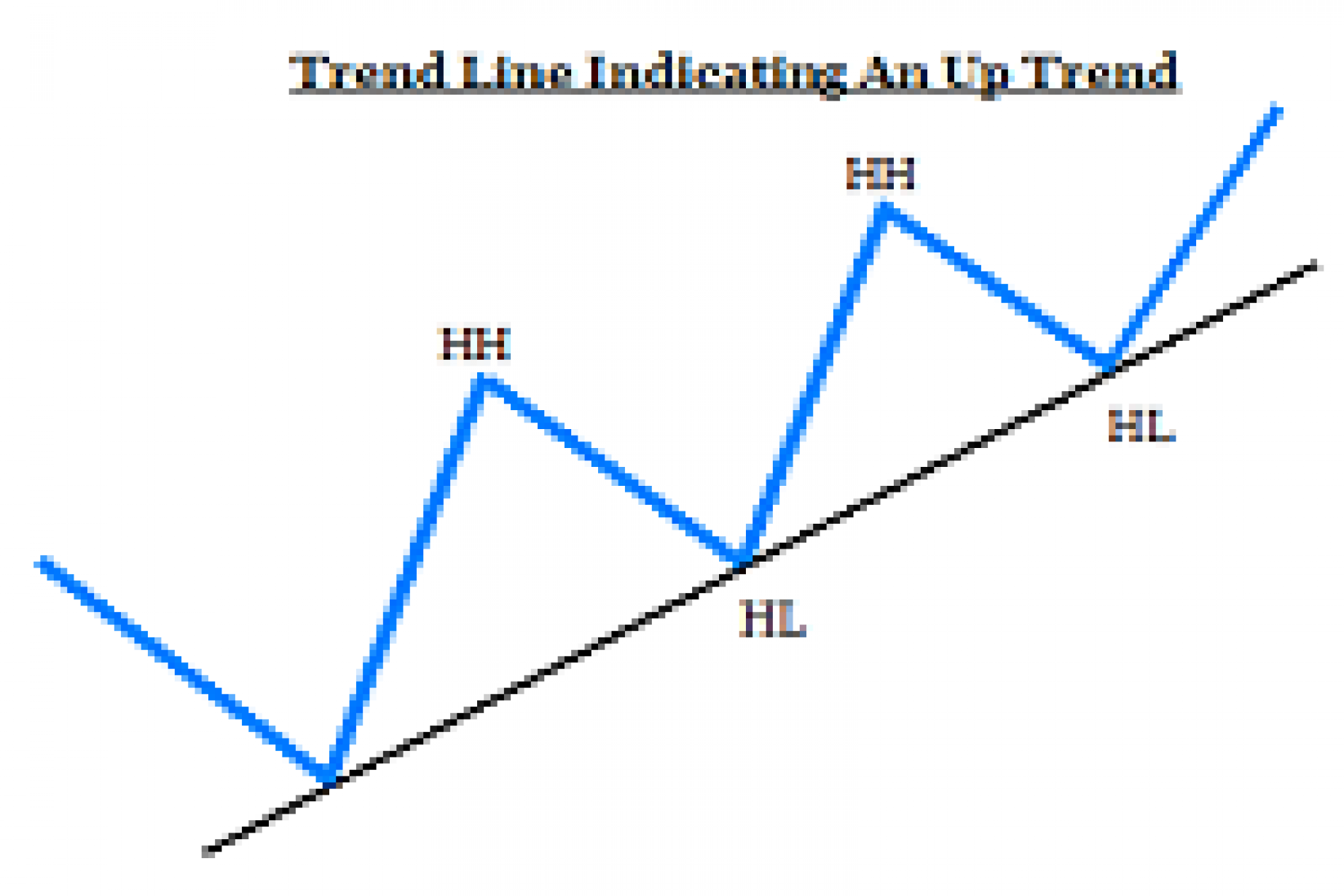

And that s because it s recommended by the so called sage of omaha warren buffett. In order to find potential day trading opportunities you need to focus on chart based technical analysis. You only need to have one good price action pattern that repeats every day to have success as a day trader.

Fundamental and technical analysis. Day trading is normally done by using trading strategies to capitalise on small price movements in high liquidity stocks or currencies. Then set yourself up with the right equipment and software.

Day trading works by capitalizing on short term price movements in a stock through the active buying and selling of shares. Day traders seek volatility in the market. Assess how much capital you re willing to risk on each trade.

10 day trading strategies for beginners 1. Without short term price movement volatility there is no opportunity. Many successful day traders risk less.

Learn about day trading. Day trading is normally done by using trading strategies to capitalise on small price movements in high liquidity stocks or currencies.

:max_bytes(150000):strip_icc()/DayTradingChartsandPatterns22-1713356e5c8c447691593574eebd9e60.png)

/how-to-improve-your-day-trading-in-three-steps-57b2720c3df78cd39ca1bb9a.jpg)

/day-trading-versus-swing-trading-58d2b0783df78c5162052d77.jpg)

:max_bytes(150000):strip_icc()/minimum-capital-required-to-start-day-trading-forex-1031370_FINAL1-0fd72348a80a4951b802a7df8b988713.png)