Daily Trading Income

Then we will take a look at how to generate passive income through different trading techniques including from stocks.

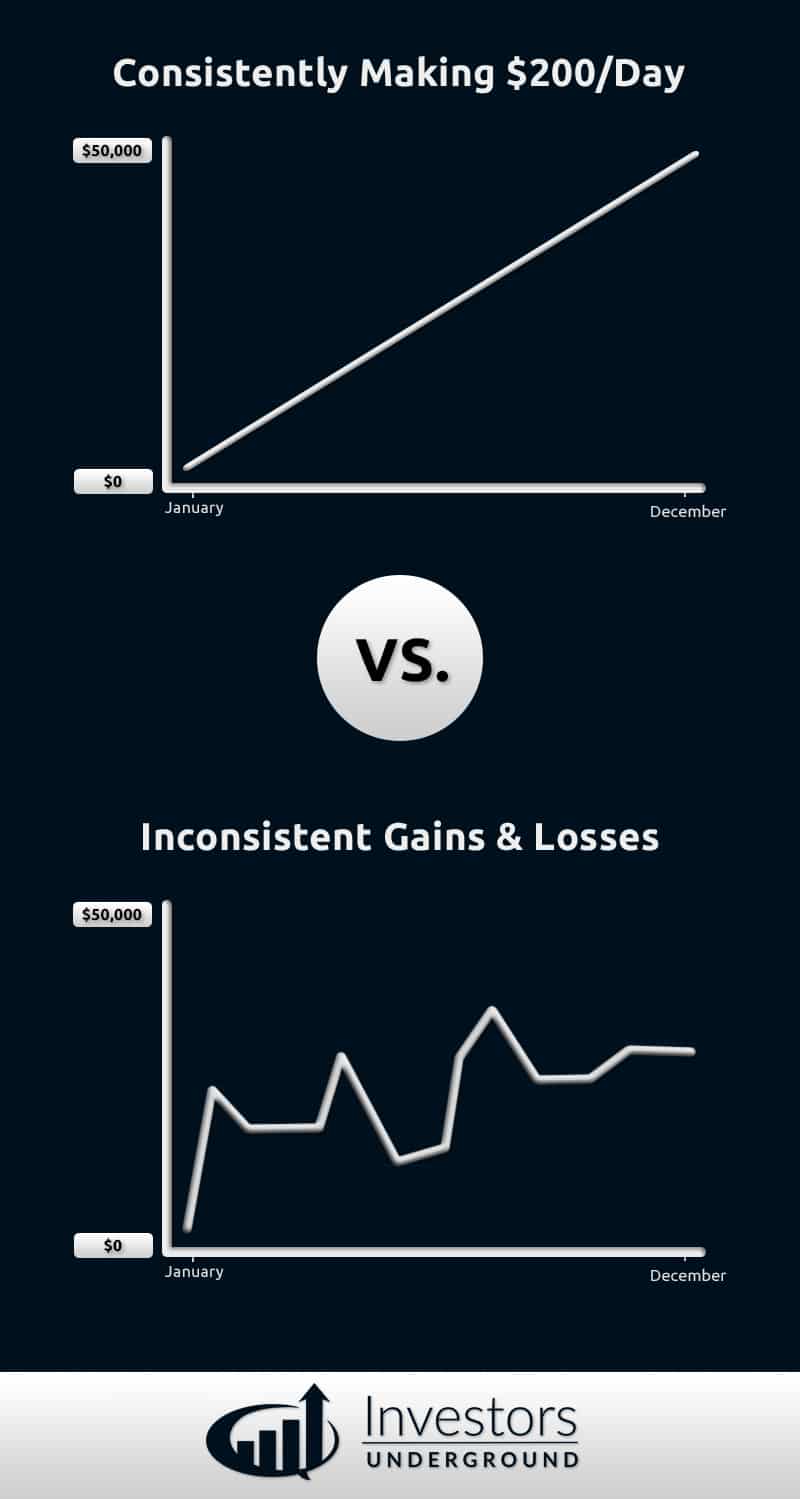

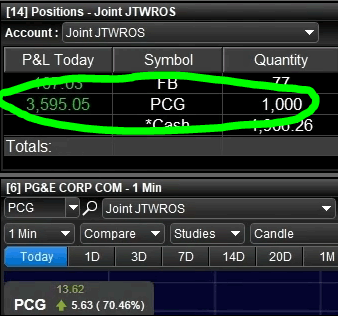

Daily trading income. However can it also become reality. To answer that question the differences between active and passive income will first be explored. Your gross profit would be 24 750 13 500 11 250.

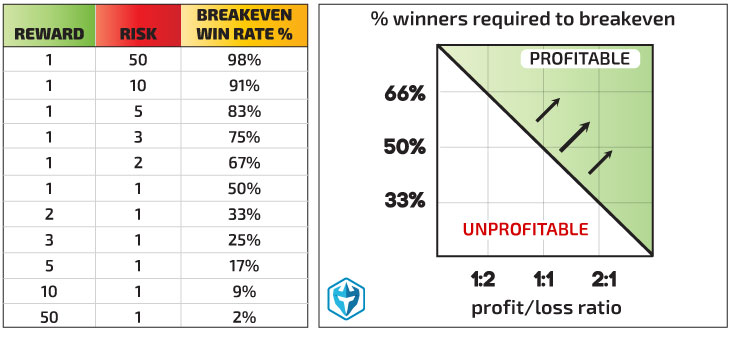

To the irs the money you make as a day trader falls into different categories with different tax rates different allowed deductions and different forms to fill out. Taxing your income from day trading income seems like a straightforward concept but little about taxation is straightforward. Our second video below shows an example of how we trade options during the day in under 60 seconds.

Making passive income by day trading online in 2020 may sound like the dream. Taxes on income will vary depending on whether you re classed as a trader or investor in the eyes of the irs. You make 3 750 but you still have commissions and possibly some other fees.

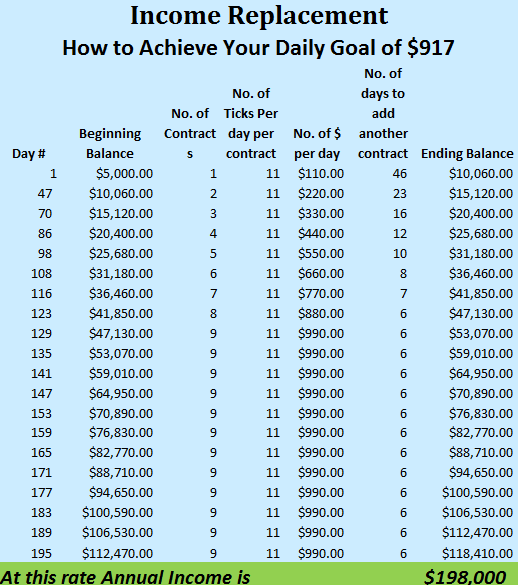

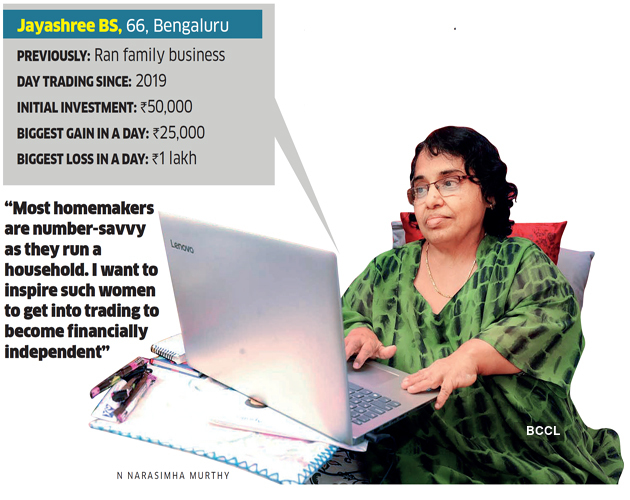

Low cash requirement it s safe to say that if you want to generate a decent income as a day trader you need to start with tens of thousands of dollars or get very lucky. The amount of capital you need depends on if you want to make day trading your full time income or just a side hustle to make a couple extra dollars here and there. Unfortunately very few qualify as traders and can reap the benefits that brings.

Assume you average five trades per day so if you have 20 trading days in a month you make 100 trades per month. Watch our video on day trading options for income. We teach you how to day trade stocks options and futures live in our trade rooms daily.

That s because of leverage see above. Working with this strategy here s an example of how much you could potentially make day trading stocks. Day trading and taxes are inescapably linked in the us.

A high degree of volume indicates a lot. However you can start with much less money if you trade options instead of stocks. The minimum equity requirement for a pattern day trader is typically 25 000 or 25 of the total market value of the stock whichever is greater.

Therefore an account with 30 000 has 120 000 of.

/is-it-possible-to-make-a-living-trading-stocks-3140573_final_AC-01-5c06fa1fc9e77c0001ade06b.png)

/daytradingsetup1-596cf9333df78c57f4aaf265.png)

:max_bytes(150000):strip_icc()/GettyImages-891634254_2400-acea07b464d94bedbd2d7b38f7c55e27.png)

/day-trading-versus-swing-trading-58d2b0783df78c5162052d77.jpg)

%2C445%2C291%2C400%2C400%2Carial%2C12%2C4%2C0%2C0%2C5_SCLZZZZZZZ_.jpg)

/qqq-a-5bfc36bf46e0fb0083c2fecf.png)

:max_bytes(150000):strip_icc():saturation(0.2):brightness(10):contrast(5)/186819711-56a22da93df78cf77272e59c.jpg)

/part-time-day-trader-56a22dcf5f9b58b7d0c786a7.jpg)