Cfd Trading How To

75 of retail investor accounts lose money when trading cfds with this provider.

Cfd trading how to. When using a cfd you can trade on many different global markets. The concerns over the leveraged otc product combined with the increased regulatory scrutiny following the 2008 financial crisis have resulted in the sec taking a dim view of cfd products. Cfd trading is banned and illegal for citizens from the usa.

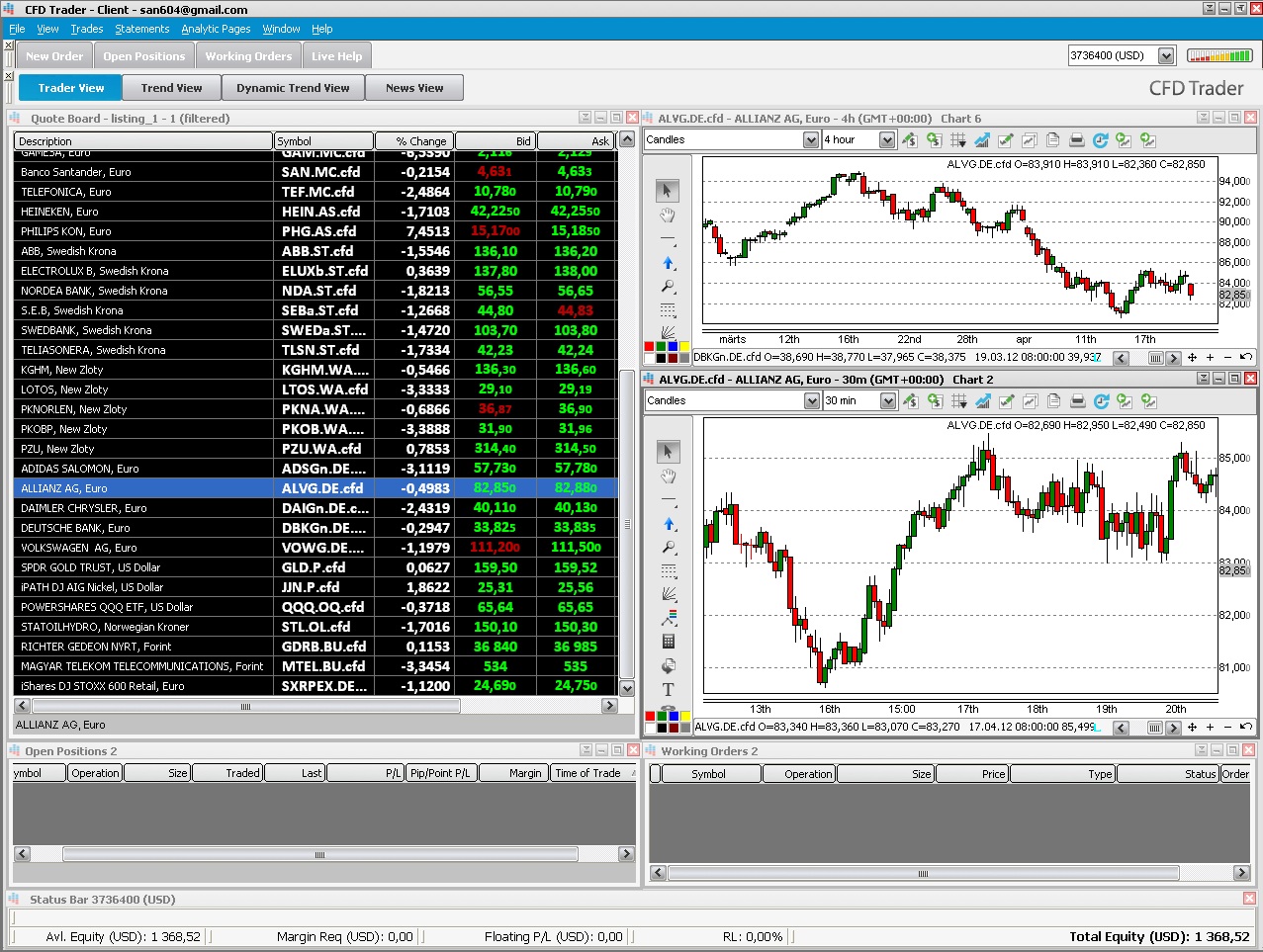

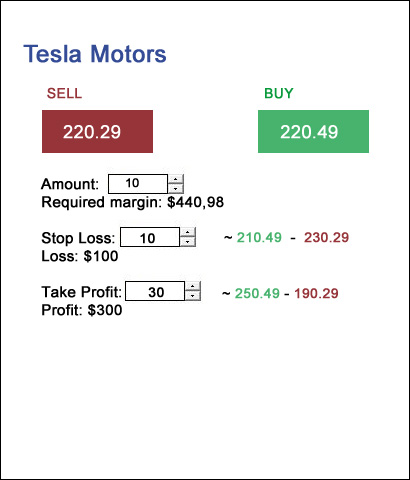

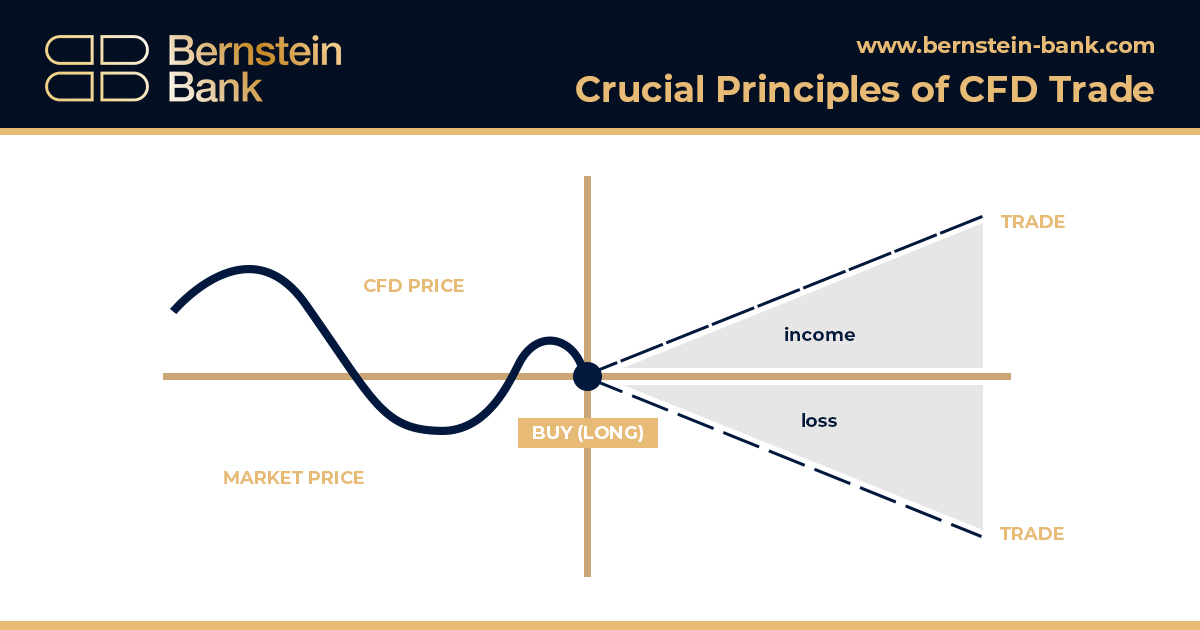

Etoro is a multi asset platform which offers both investing in stocks and cryptoassets as well as trading cfds. If your prediction turns out to be correct you can buy the instrument back at a lower price to make a profit. Click buy if you think the price will increase in value or sell if you think the market will fall in.

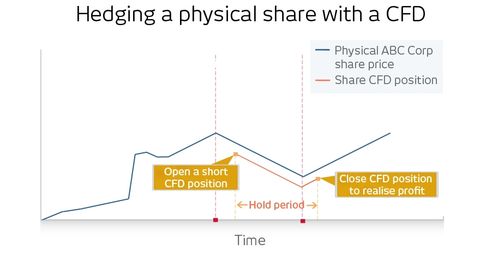

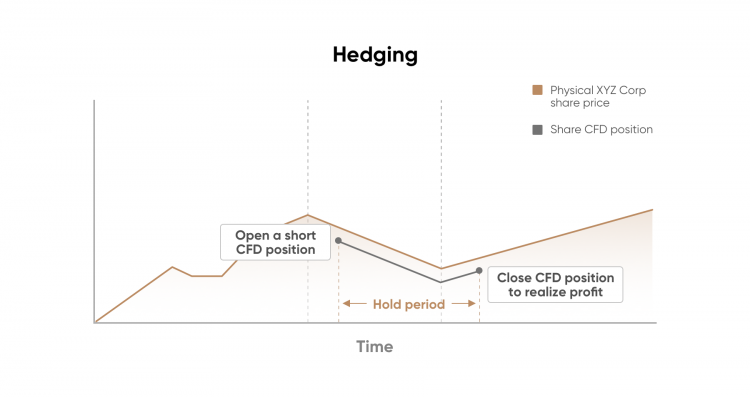

A contract for differences cfd is an agreement between an. Some of the main features of cfd are leverage hedging margin and short and long trading. But the finer details can often be a little more complicated especially since platforms and functionality vary from provider to provider.

Trading cfds offers several major advantages that have increased the instruments enormous popularity in the past decade. If you are incorrect and the value rises you will make a loss. The key concepts are spreads deal sizes.

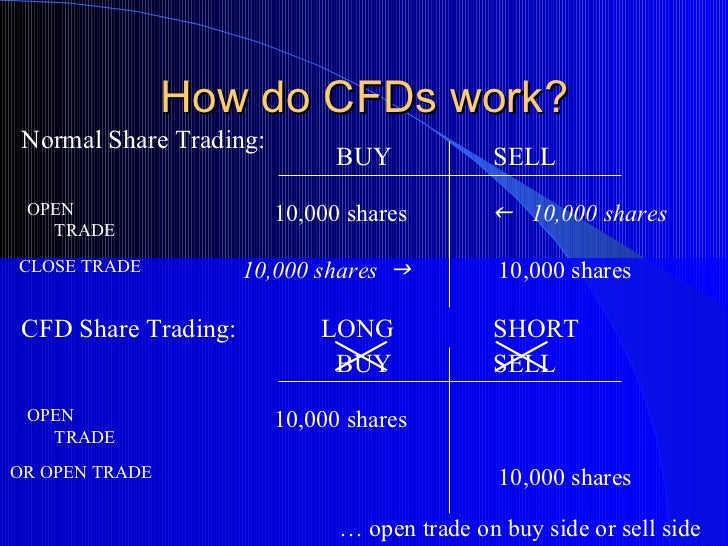

Cfds are traded in the base currency of the market. Cfd trading steps when you trade cfds contracts for difference you buy a certain number of contracts on a market if you expect its price to rise and sell them if you expect it to fall. In cfd trading one can invest in price movements in any direction.

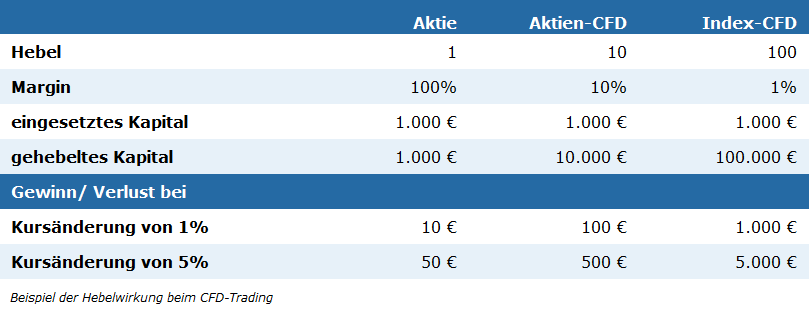

Cfd trading is a leveraged product which means you only need to have a small percentage of the overall trade value known as margin in your account in order to open the trade. To compute the profit or loss earned from a cfd profession you multiply the bargain dimension of the position complete number of agreements by the worth of each contract shared per point of motion. Decide which market you want to trade on.

Decide to buy or sell. With the organization of the features there are some key concepts used in cfd which would help us to understand how does cfd trading works. That means not only can you profit from the price going higher but you can also profit when the price moves lower.

Generally speaking the larger the value of your trade the more margin required. These include markets such as stock indices forex pairs gold and many other asset classes. Cfd trading enables you to sell short an instrument if you believe it will fall in value with the aim of profiting from the predicted downward price move.

When trading a cfd you have the ability to go long or short.