Cdf Trading

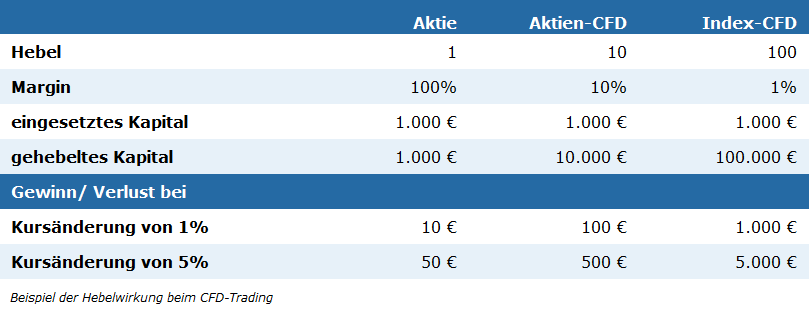

Cfds are complex instruments and come with a high risk of losing money rapidly due to leverage.

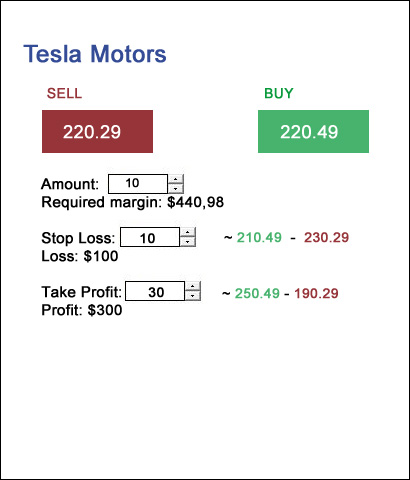

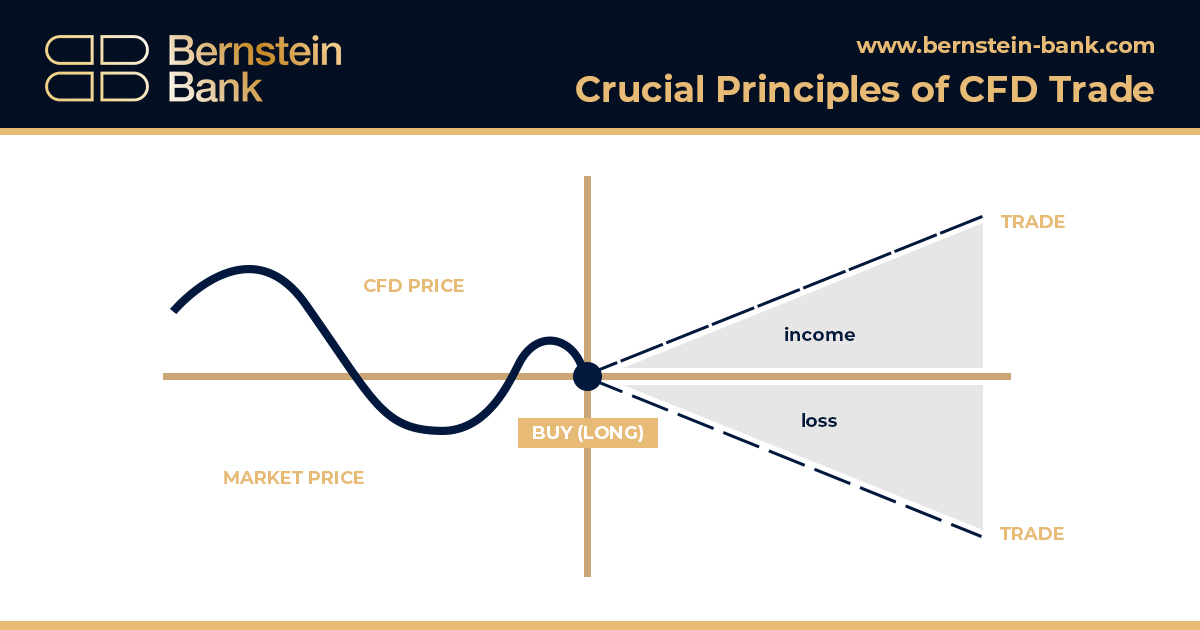

Cdf trading. If the spread is 5 cents the stock needs to gain 5 cents for the position to hit the break even price. This is known as buying or going long. A cfd trade will show a loss equal to the size of the spread at the time of the transaction.

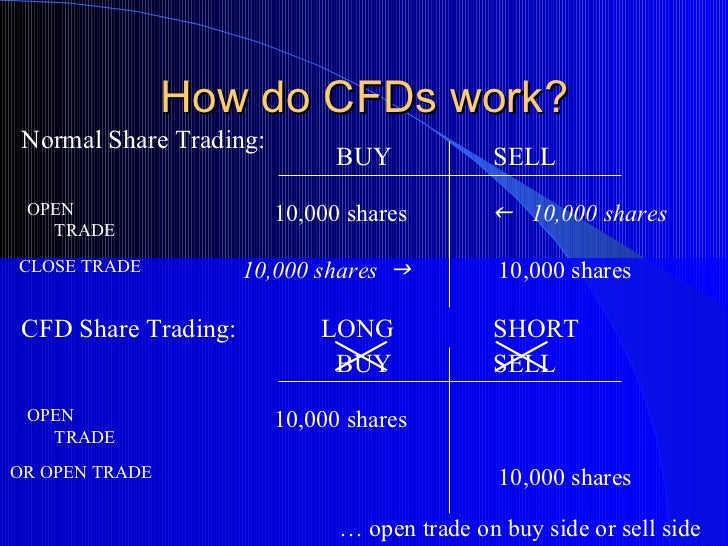

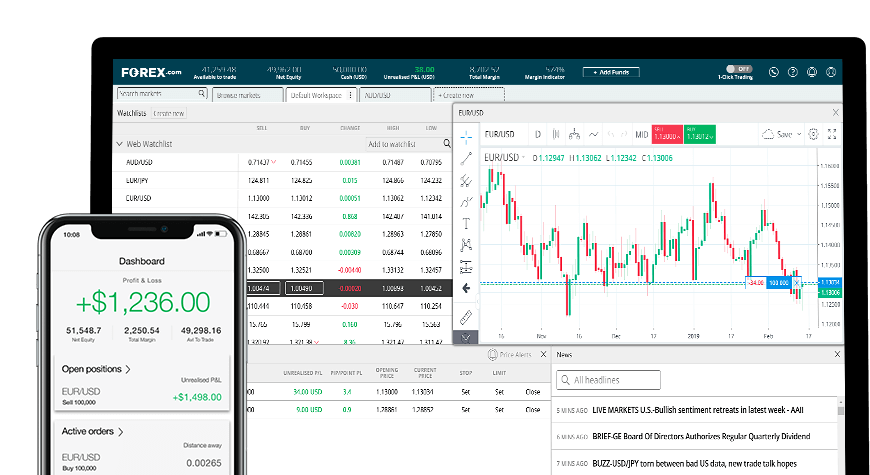

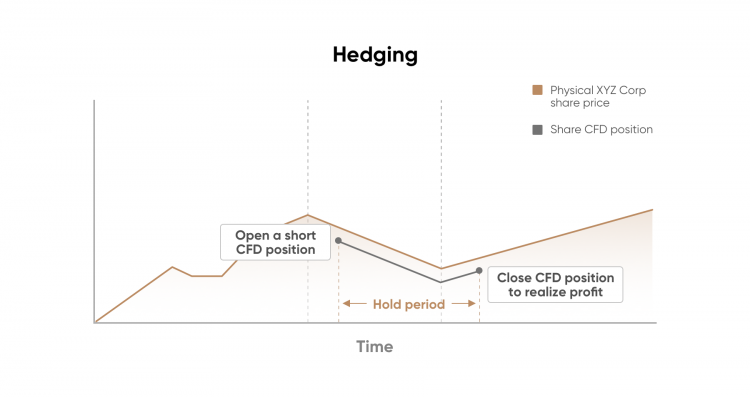

Cfd trading enables you to speculate on the rising or falling prices of fast moving global financial markets or instruments such as shares indices commodities currencies and treasuries. Cfd trading allows you to profit from both a rising or falling market. 75 of retail investor accounts lose money when trading cfds with this provider.

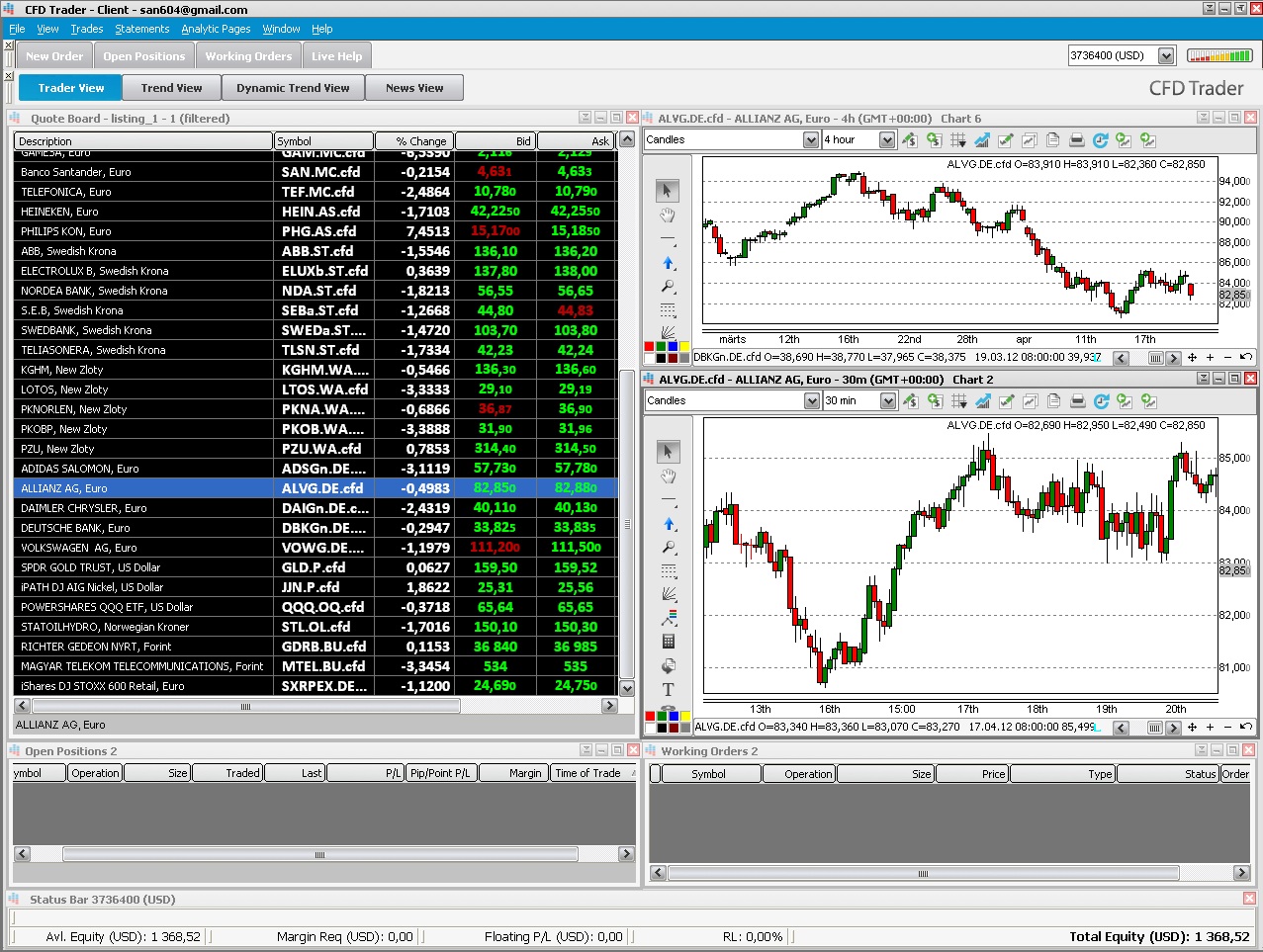

Cfd trading is banned and illegal for citizens from the usa. When you trade cfds you are entering into an agreement to exchange the difference in the price of an asset from the point at which the contract is opened to when it is closed. Start trading in 3 easy steps.

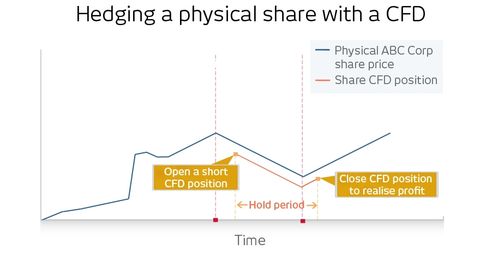

The concerns over the leveraged otc product combined with the increased regulatory scrutiny following the 2008 financial crisis have resulted in the sec taking a dim view of cfd products. This means you can use cfds to mimic investing in an asset by opening a long buy position. With that said traders from other countries can buy and sell cfds on us markets.

In finance a contract for difference cfd is a contract between two parties typically described as buyer and seller stipulating that the buyer will pay to the seller the difference between the current value of an asset and its value at contract time if the difference is negative then the seller pays instead to the buyer. Nirgendwo anders als an der börse werden täglich viele milliarden euro umgesetzt. Cfd handel für anfänger und cfd trading lernen unser ratgeber cfd handel für anfänger und cfd trading lernen vermittelt ihnen das notwendige fachwissen um schnell mit cfd trading strategien durchstarten zu können.

A contract for difference cfd is a popular form of derivative trading. A contract for differences cfd is an arrangement made in financial derivatives trading where the differences in the settlement between the open and closing trade prices are cash settled. Cfd trading is the buying and selling of contracts for difference via an online provider.