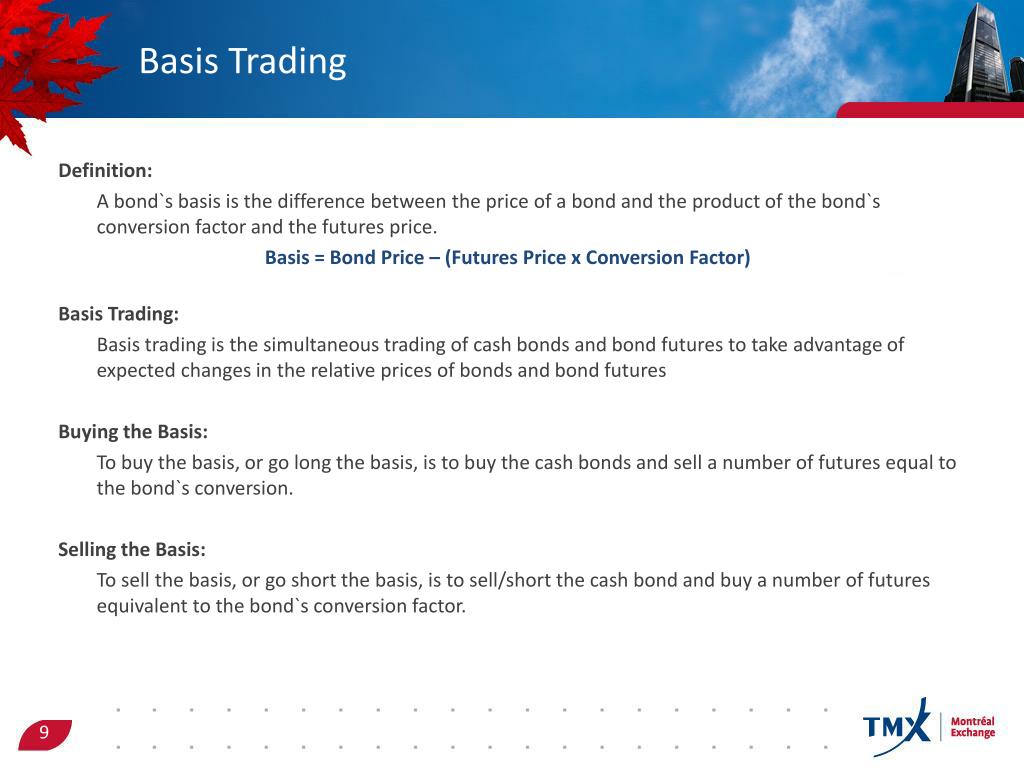

Basis Trading

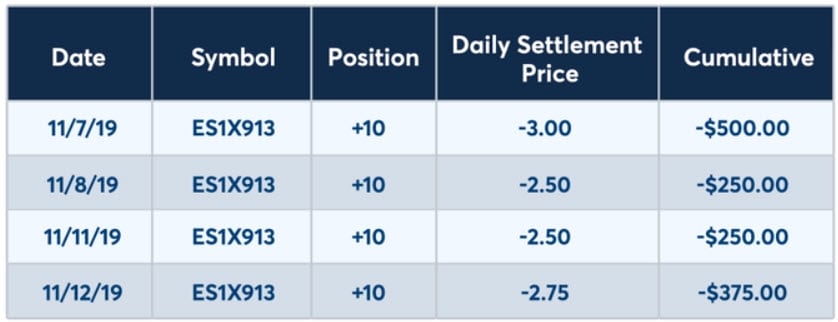

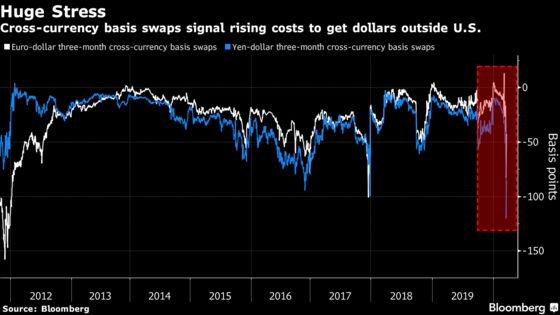

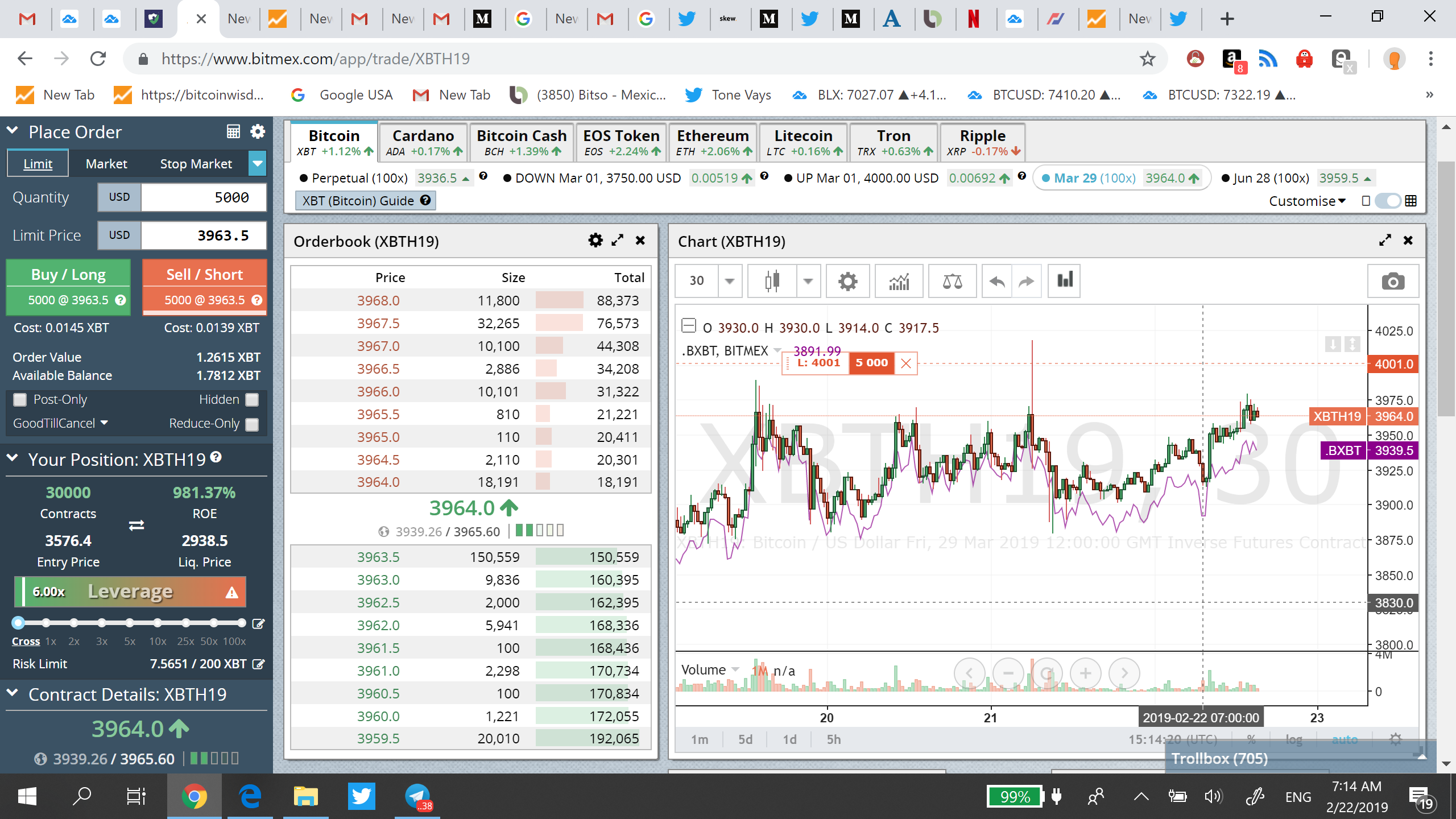

A significant risk of basis trading leverage.

Basis trading. Basis trading is done when the investor feels that the two instruments are mispriced relative to one other and that the mispricing will correct itself so that the gain on one side of the trade will more than cancel out the loss on the. Basis trading is most common in relation to financial derivatives or commodities. What is basis trading.

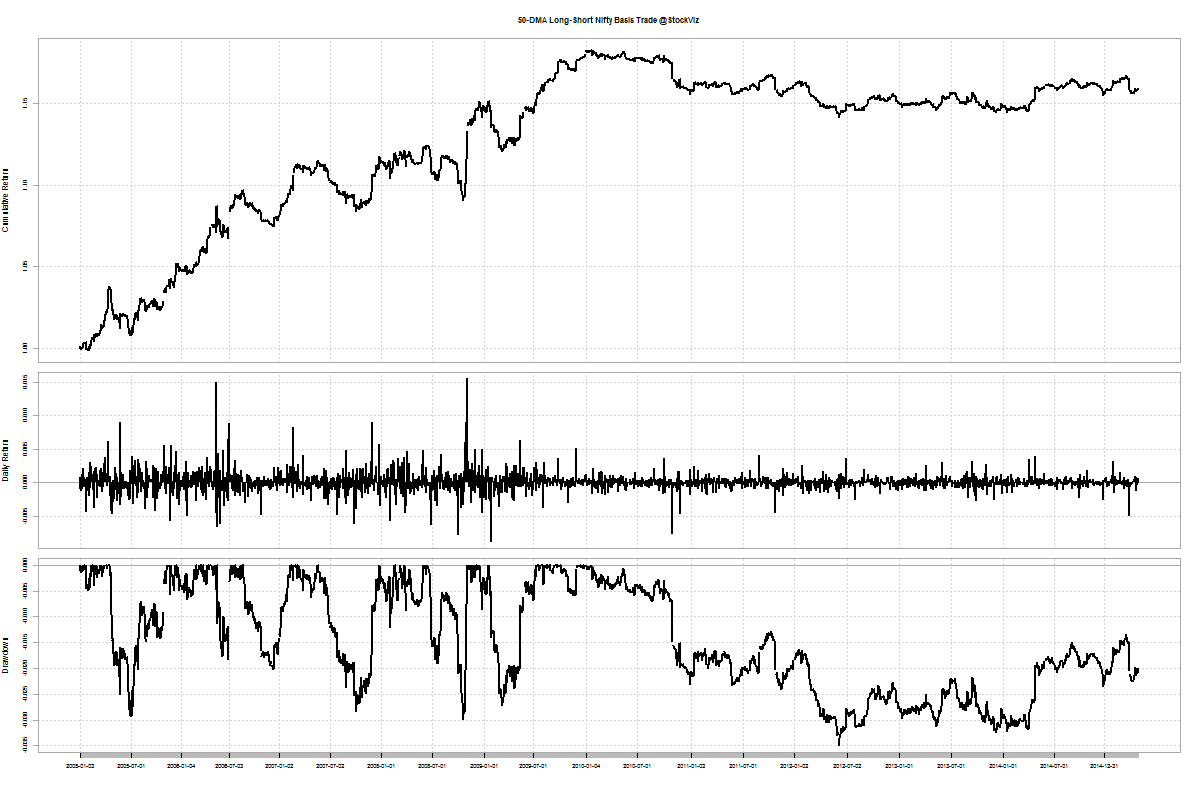

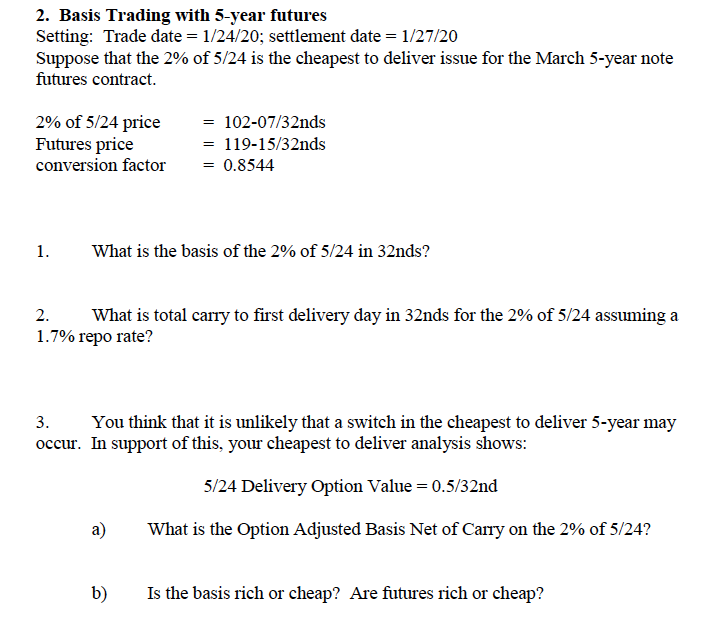

Sometimes referred to as a cash and carry trade this type of arbitrage position has a lot of potential to reap big rewards if the timing is right. Basis trading is undertaken when the investor feels one security is priced too high or too low relative to the price of another security. Carry out basis transactions including the execution of buy basis sell basis and spreading activities.

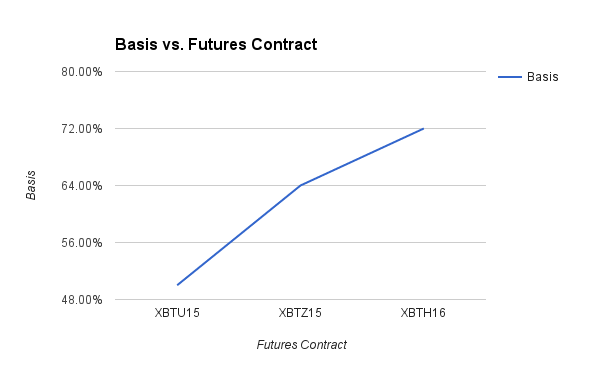

So the basis is 33 cents. Basis trading is a financial trading strategy which consists of the purchase of a particular financial instrument or commodity and the sale of its related derivative for example the purchase of a particular bond and the sale of a related futures contract. More specifically it is the difference between today s local cash price and today s futures price of the futures contract with maturity closest to the present time.

Identify basis patterns and evaluate basis risk. Because of this the profit on one side of the trade should more than cancel out the loss on the opposite side of the trade. Basis is the difference between the cash price paid for your grain and the nearby chicago board of trade futures price.

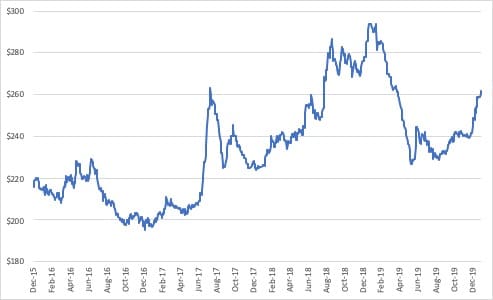

Basis trading is all about playing the extremes of the cash and futures market. The basis is the difference between the spot price of a commodity and a futures contract that expires two or more months. Leverage is simply the use of borrowed financing or borrowed capital to.

Livestock basis is computed by subtracting the futures price from the cash price. What is basis basis is the difference between the futures price and your local cash price. In the futures market basis represents the difference between the cash price of the commodity and the futures price of that commodity.

Converse in the language of basis trading. Basis is often called the voice of the market because it s an indication of whether or not the market wants your grain. Basis is the difference between cash price and futures price.

Key takeaways basis trading attempts to benefit from changes in the basis of futures contract prices. For example if the may futures contract is trading at 2 96 and the cash price is 2 63 the cash price is 33 cents under may 2 63 2 96 33 cents. Do proper and accurate basis calculations.

A narrow or improving cash basis is a signal that the market wants your grain. Basis trading trading instruments.