Abc Trading Pattern

Encyclopedia of chart patterns pictured on the left has a complete discussion of measured moves.

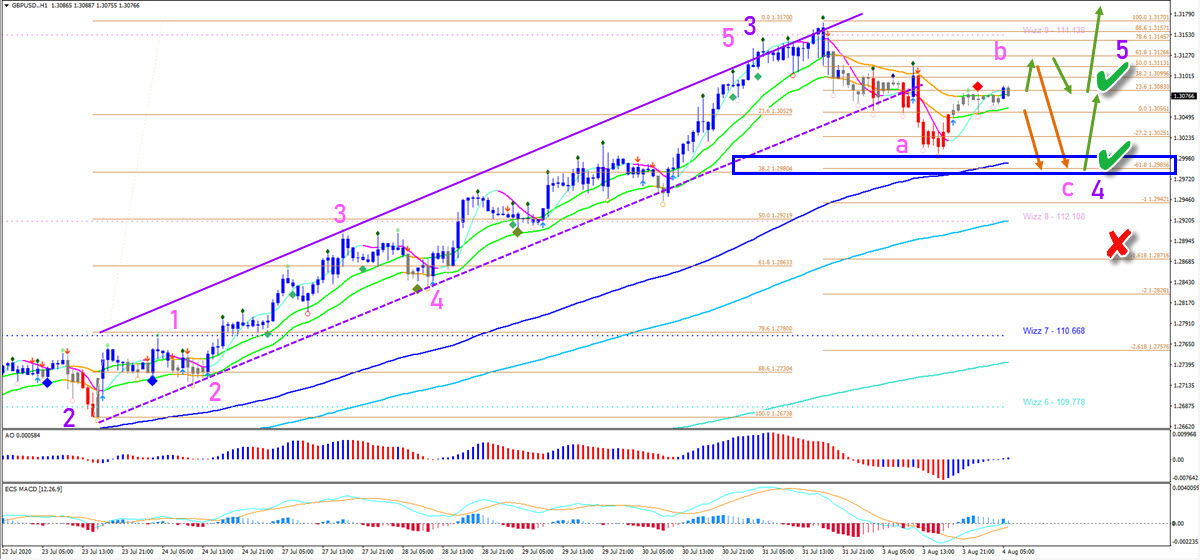

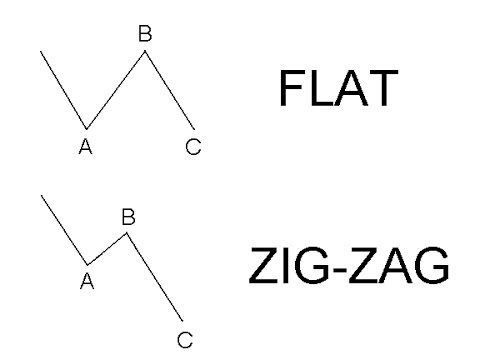

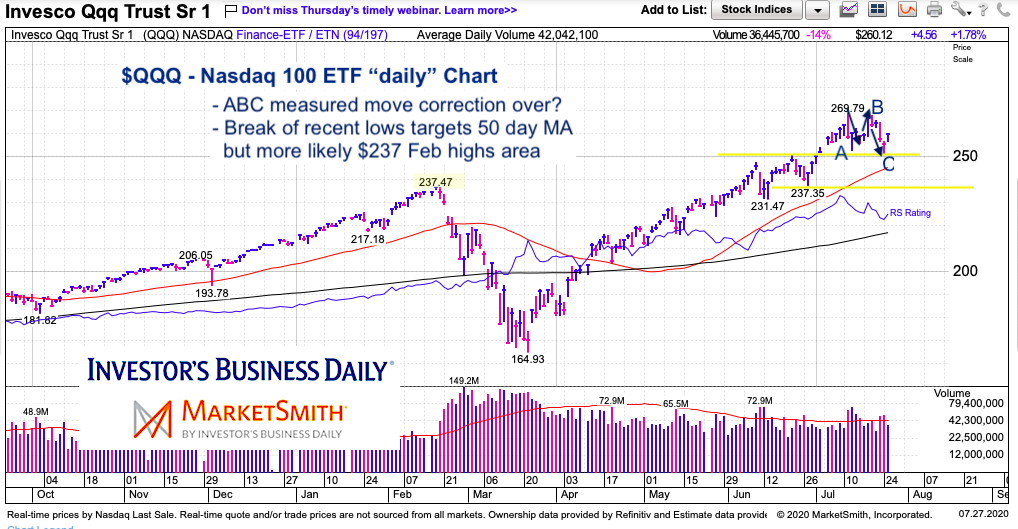

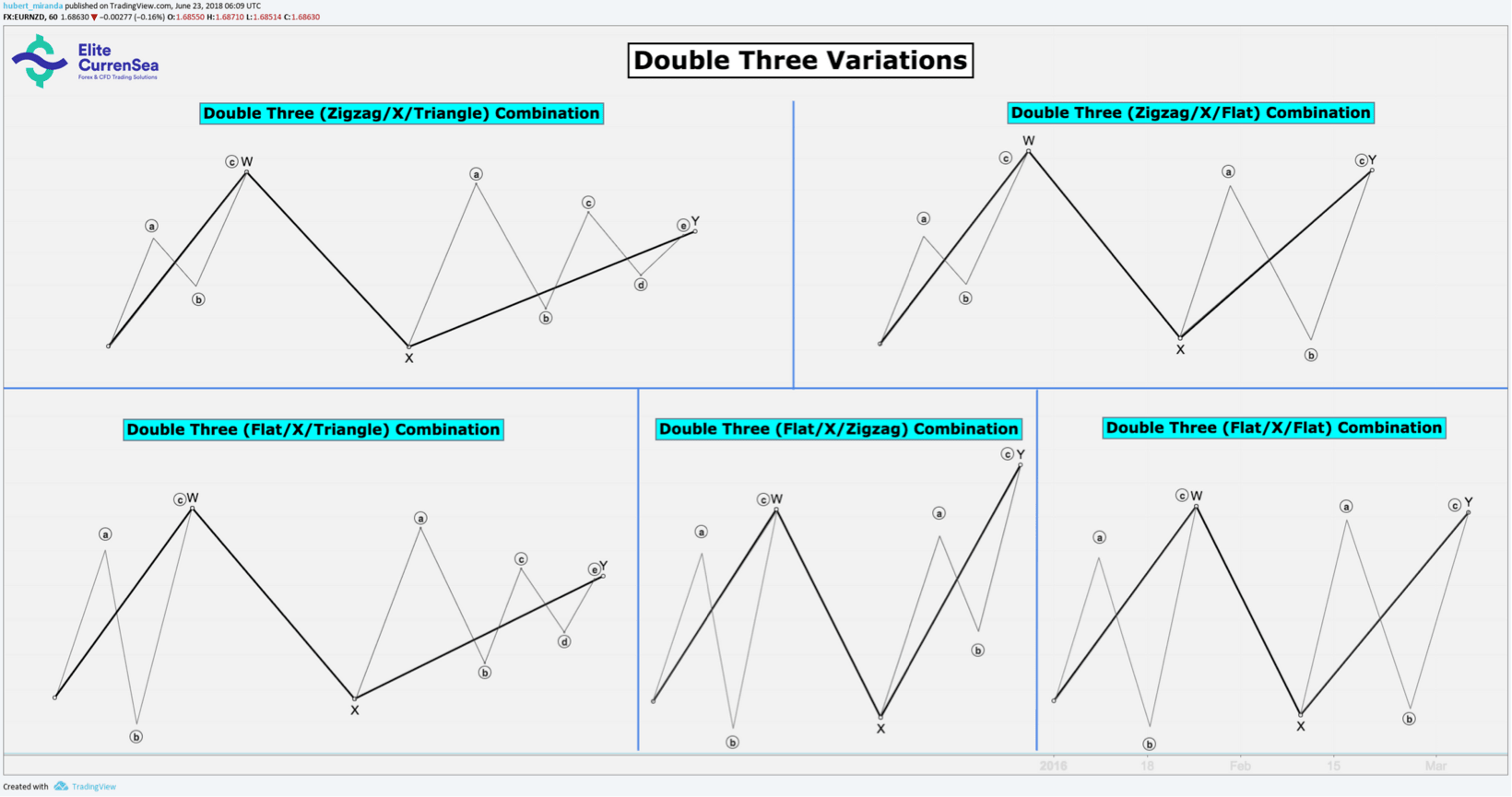

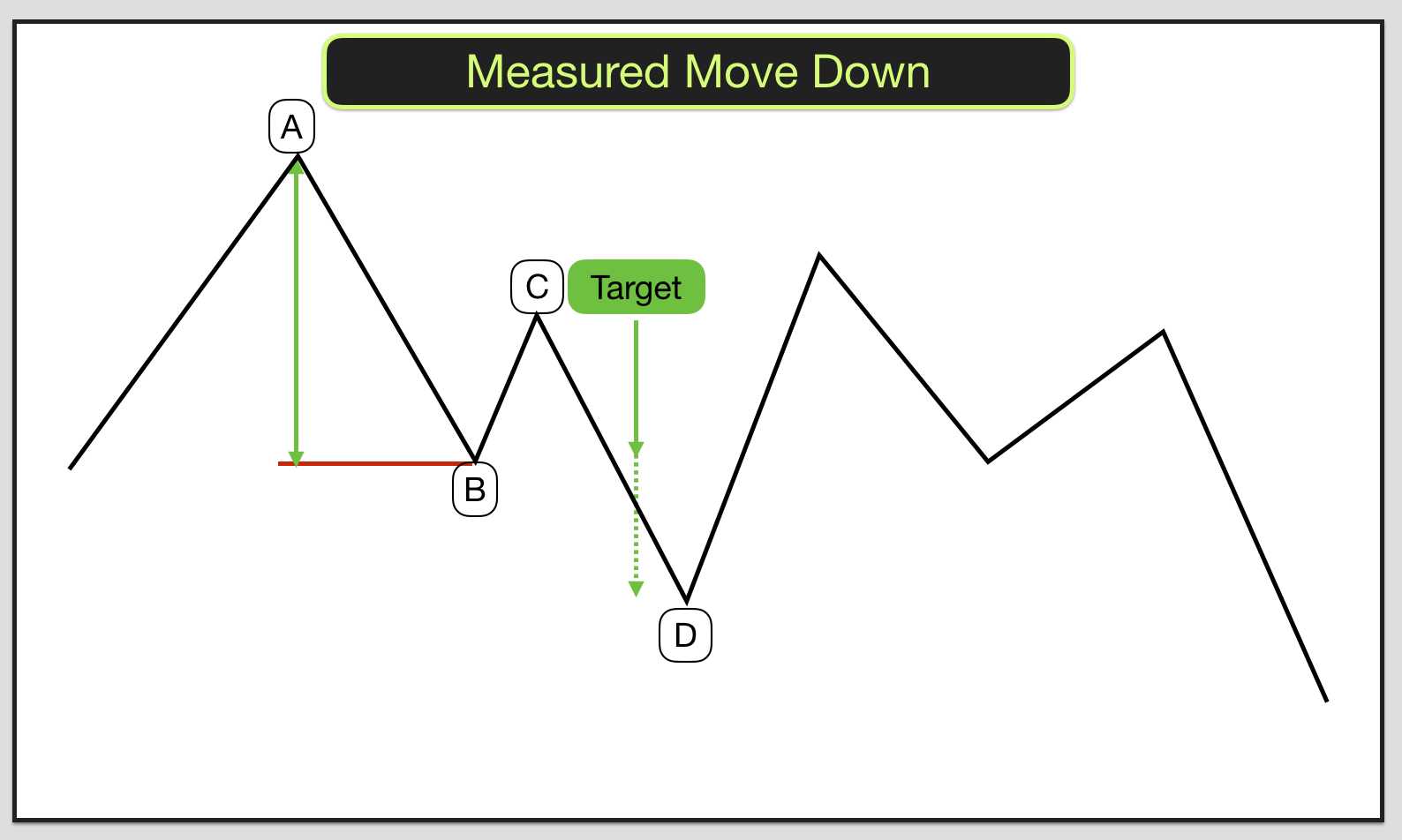

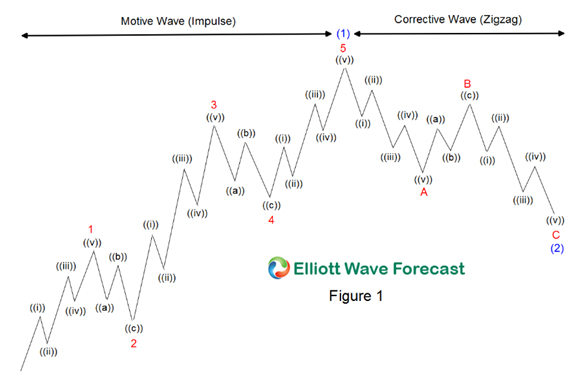

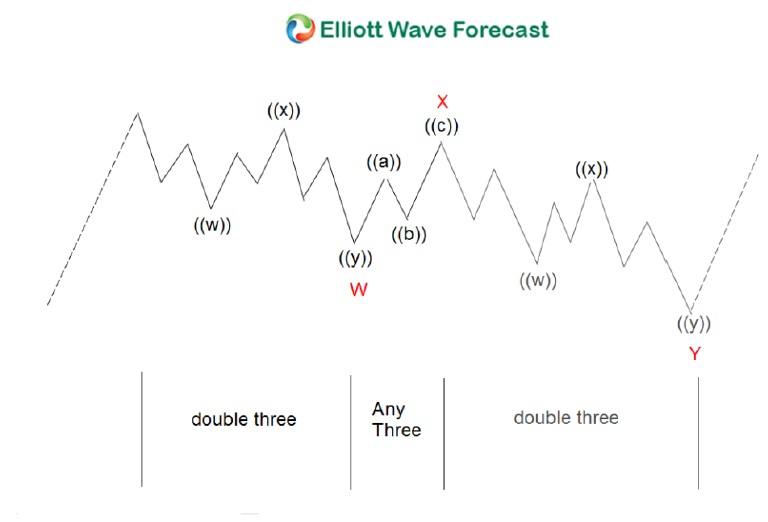

Abc trading pattern. The abc pattern is traded in the trend direction of ab from c to d. If measured moves are unfamiliar then click the associated link for more information. The simple abc correction is a measured move downchart pattern nested inside a measured move up.

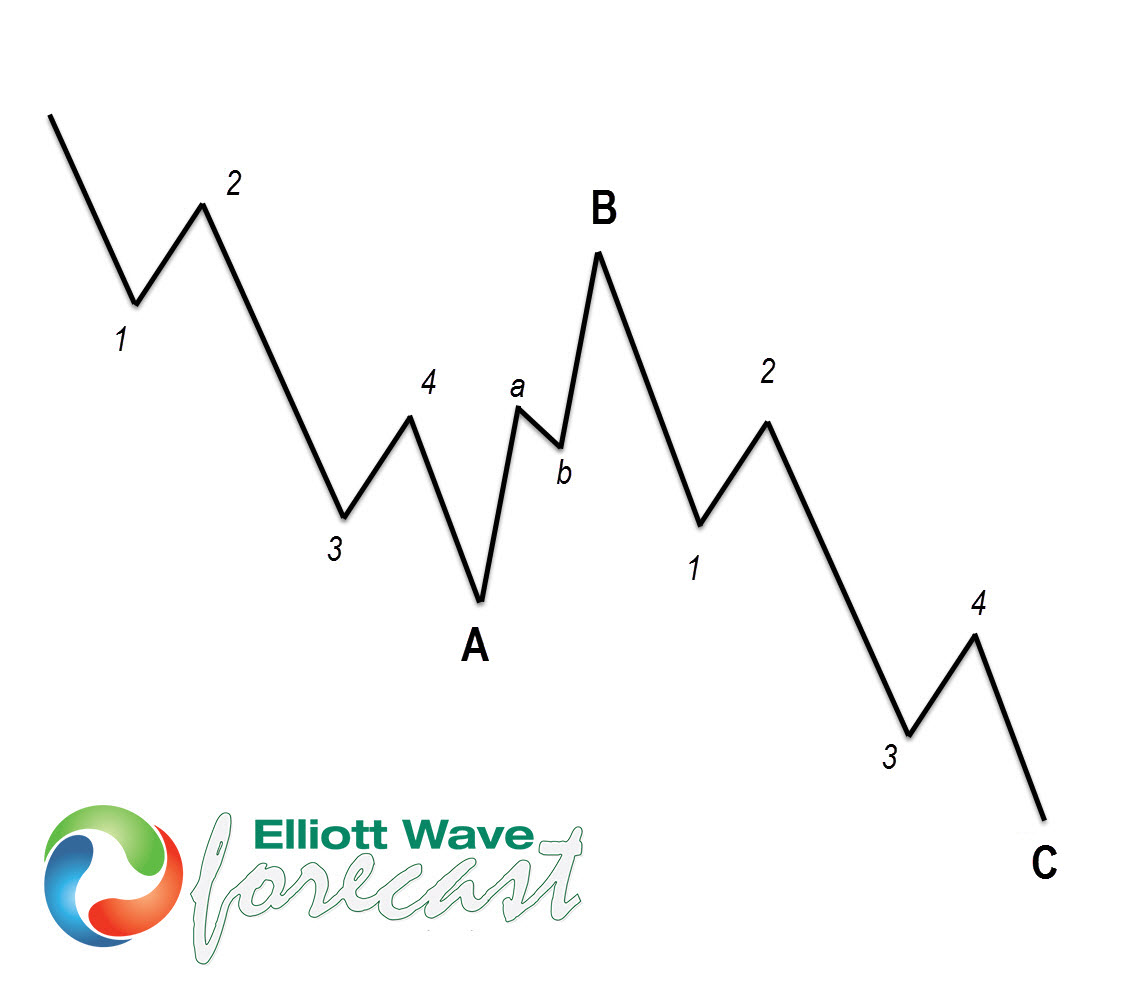

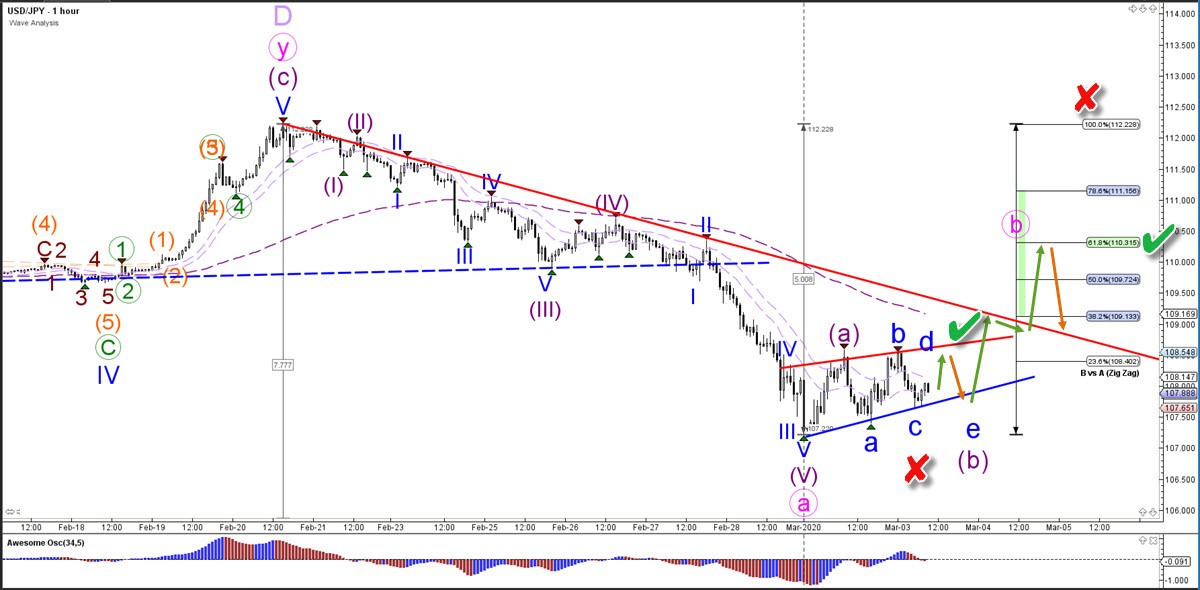

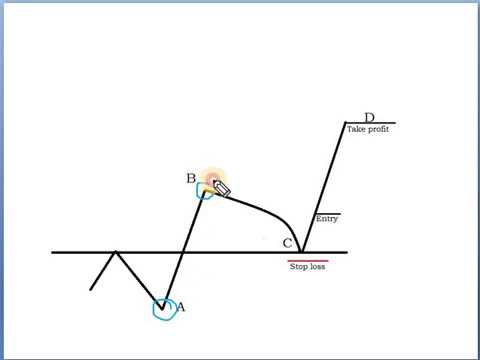

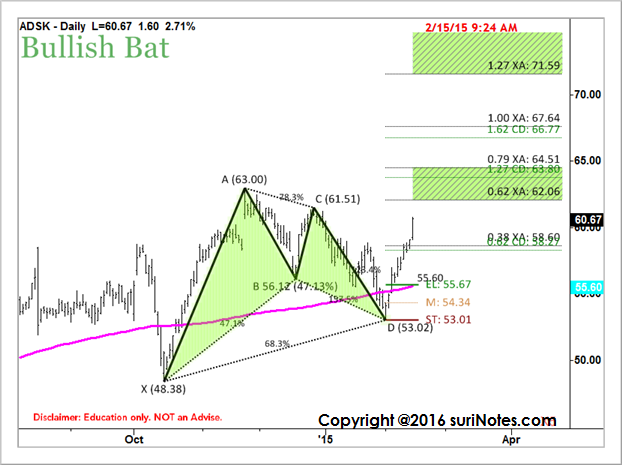

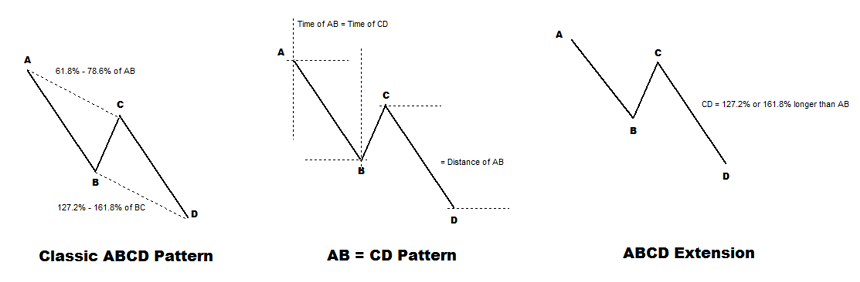

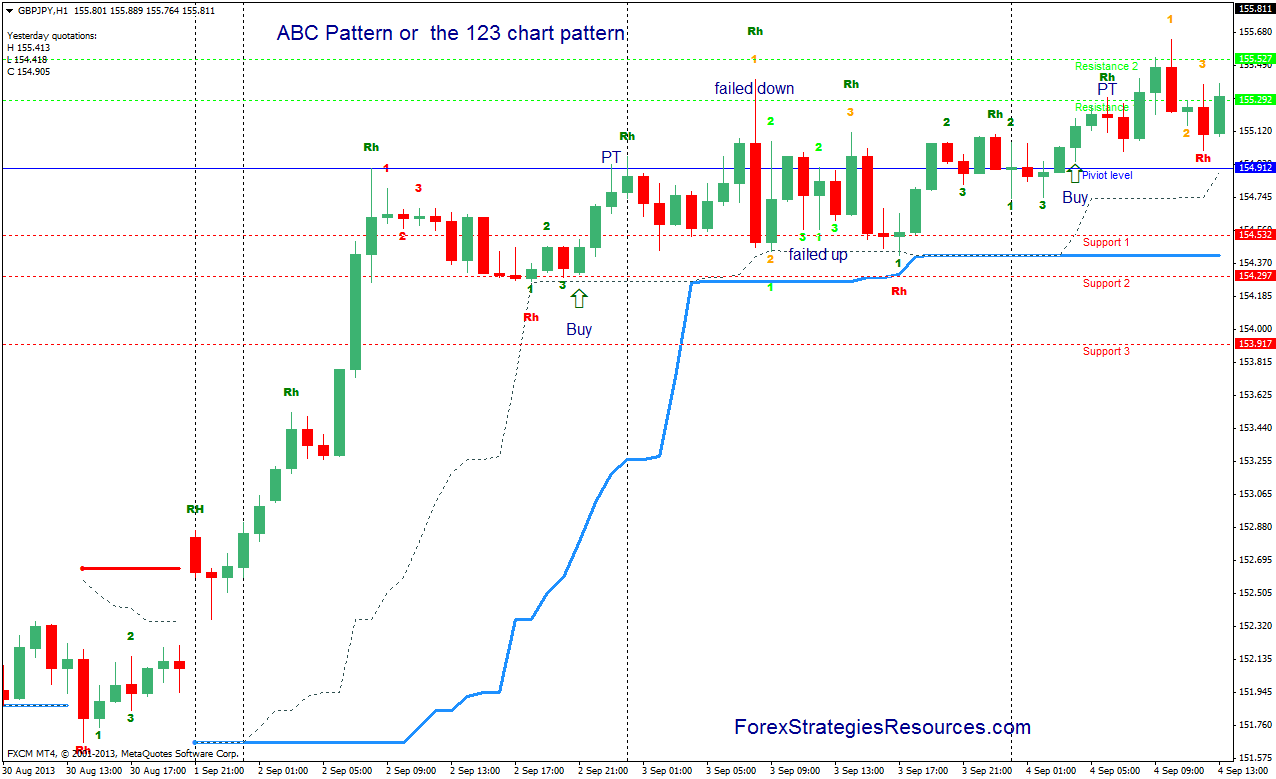

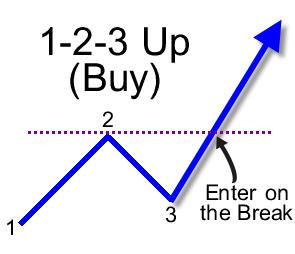

The 123 pattern is a reversal chart pattern which occurs very frequently and has a very high success ratio. The c point must retrace to either a 0 618 or 0 786 and the bc projection is either 1 27 or 1 618. Abc pattern or the 123 chart pattern.

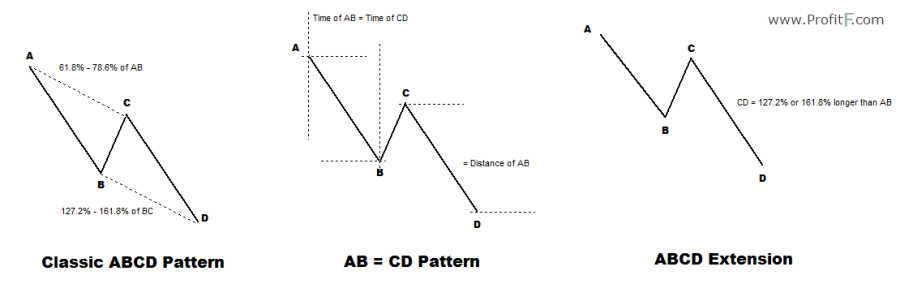

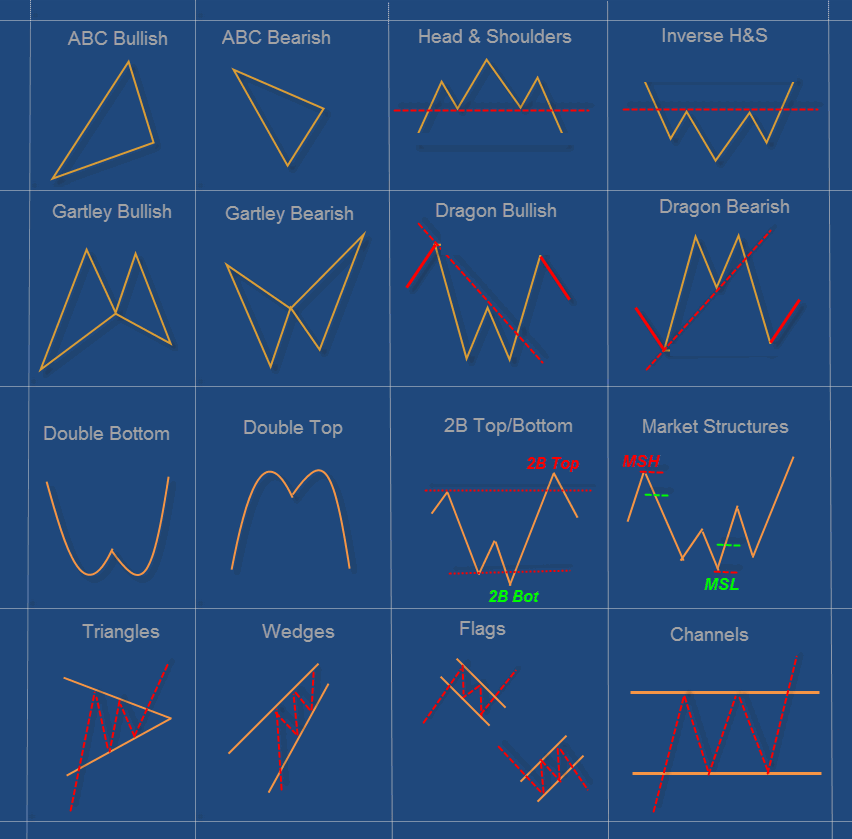

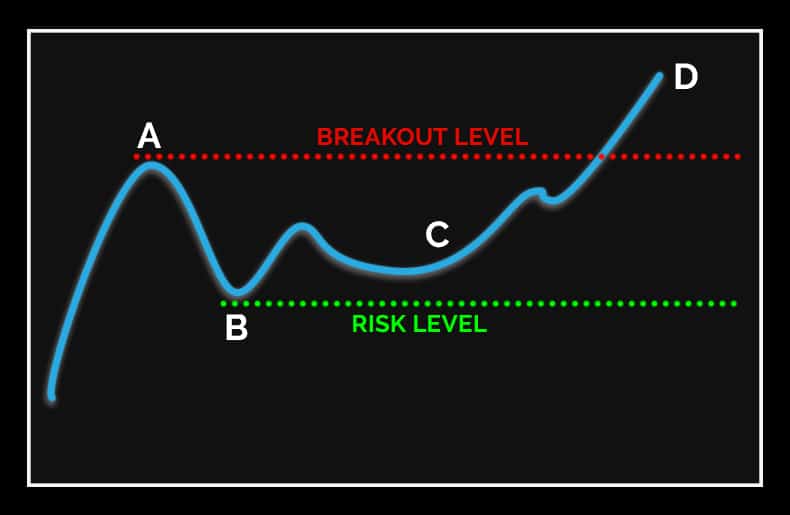

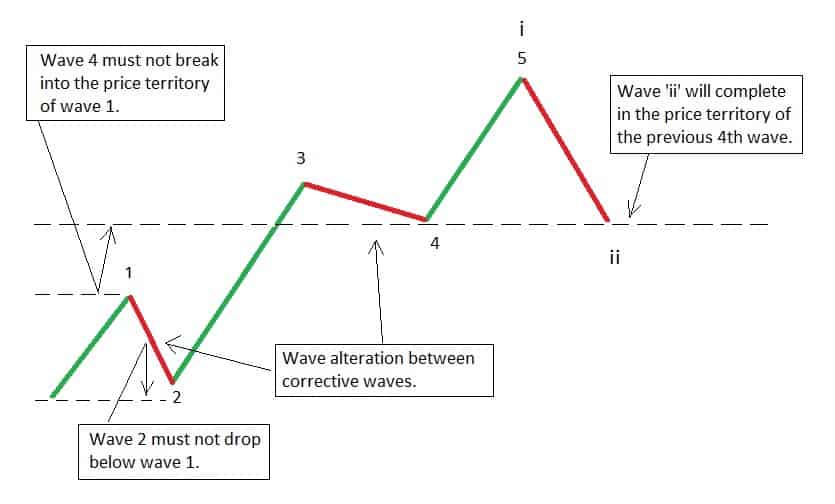

The pattern can be used to predict either a bullish or bearish reversal depending on the orientation. Why is the abcd pattern important. What is the abcd trading pattern the abcd pattern is an easy to identify chart pattern that consists of two equivalent price legs.

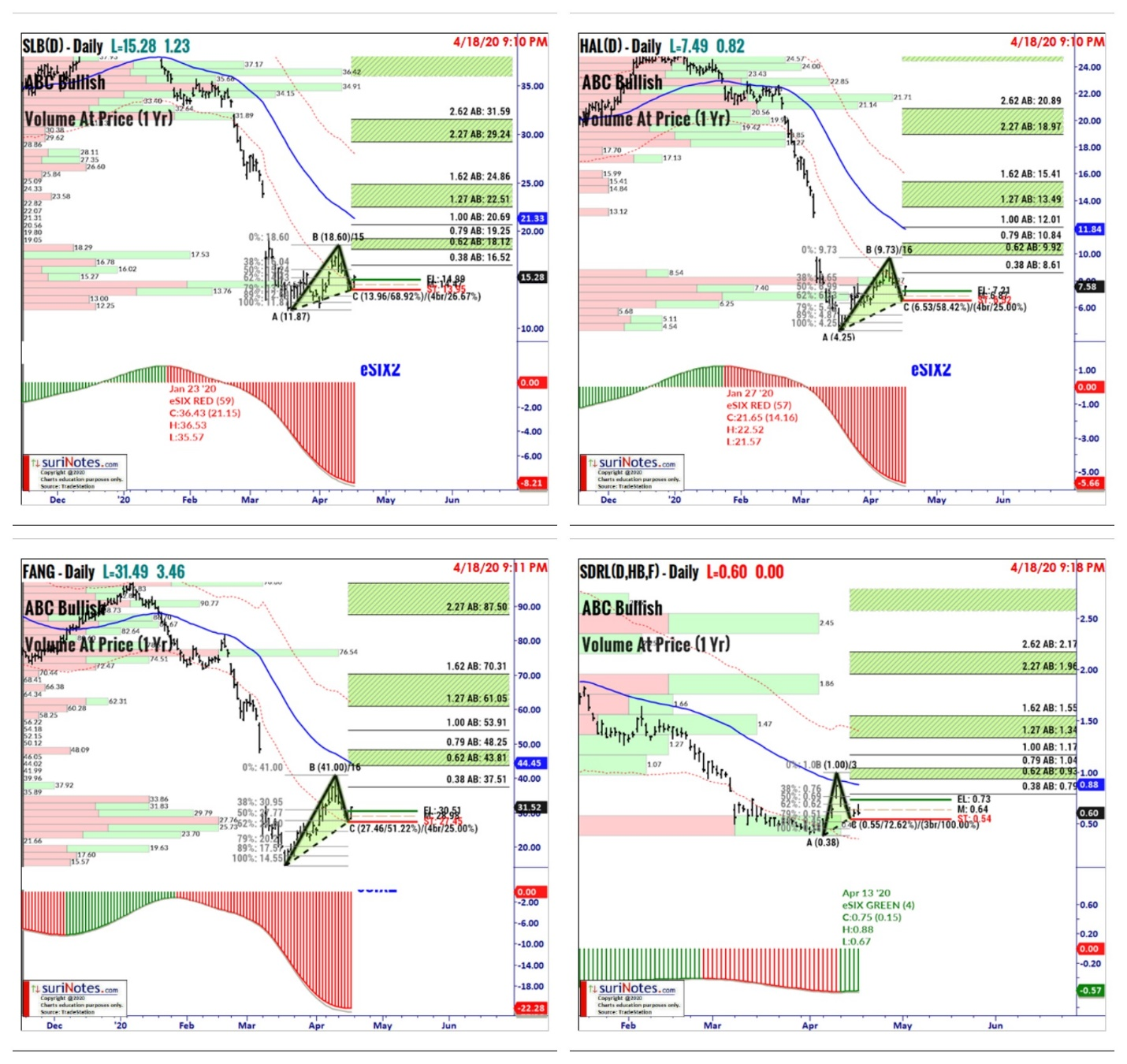

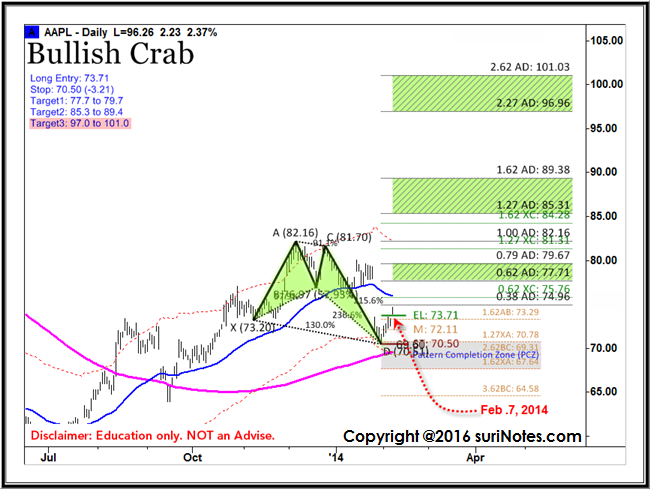

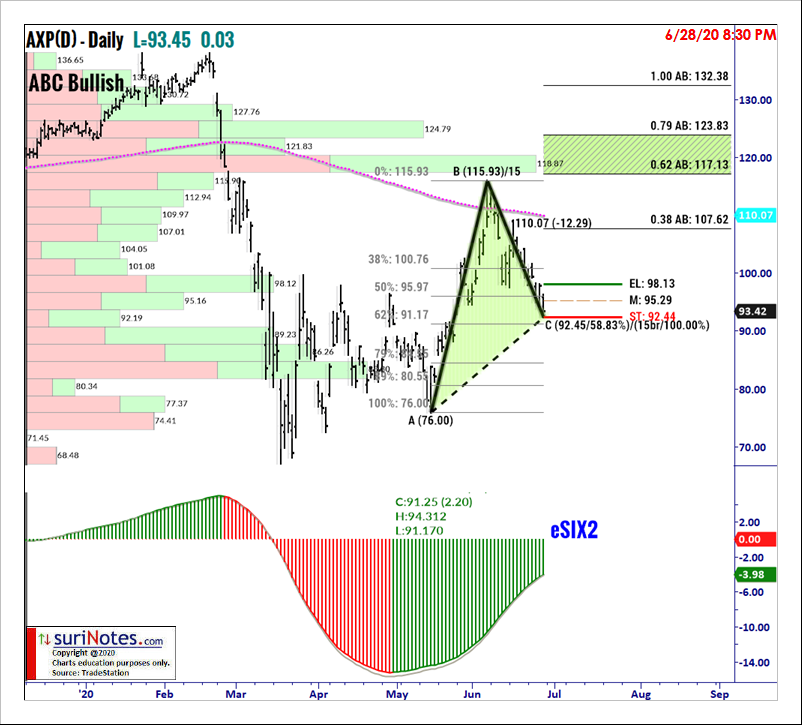

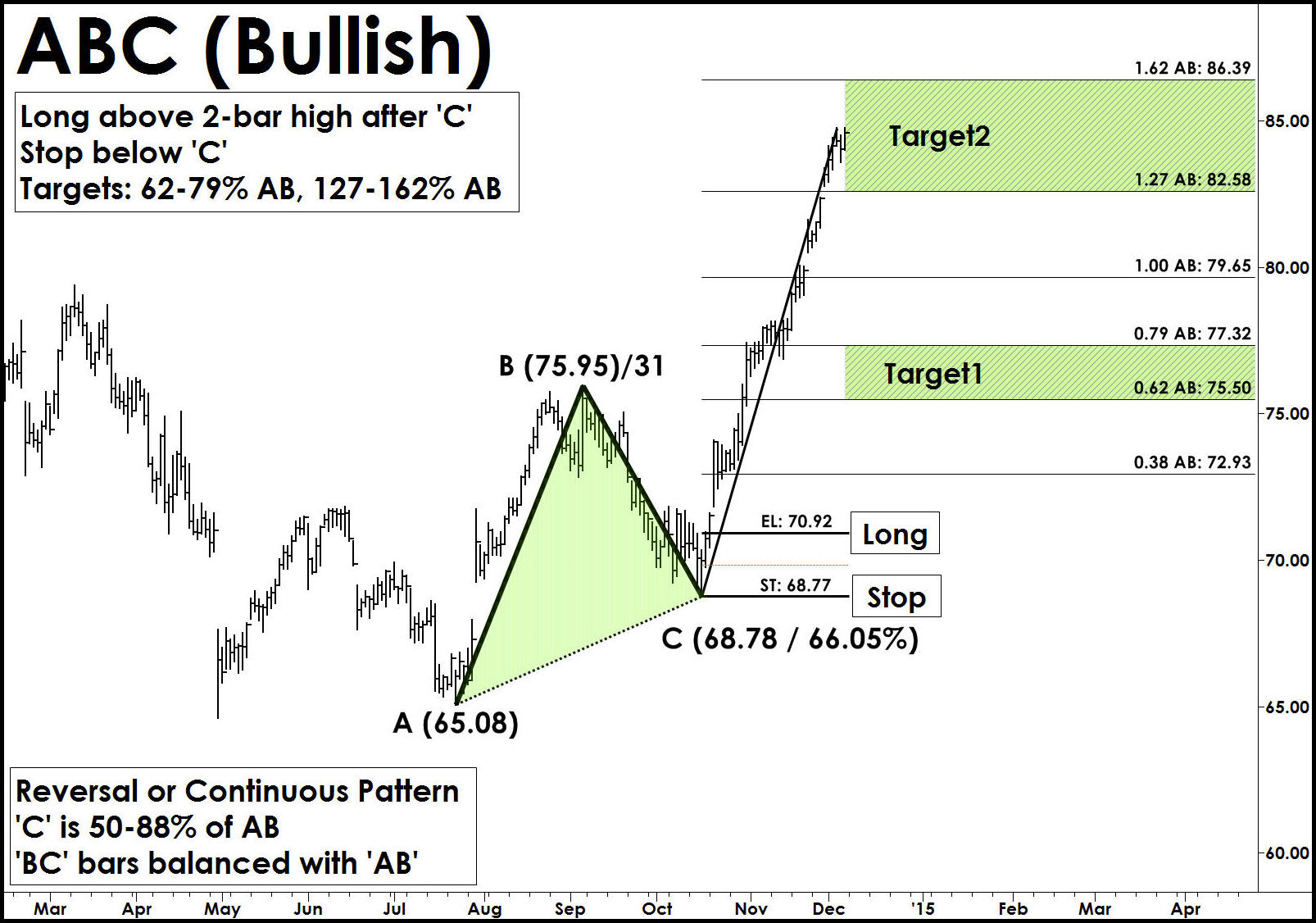

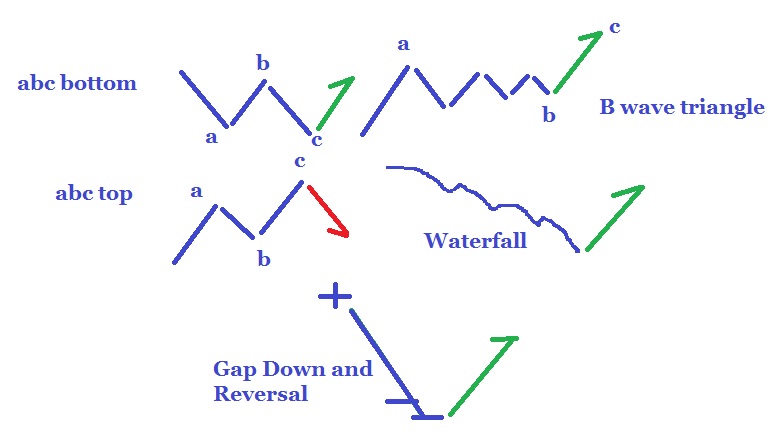

Know your abcs below show both abc bullish and abc bearish formations with using trade information in tradestation software. Let us get started. It is a harmonic pattern that helps traders predict when the price of a stock is about to change direction.

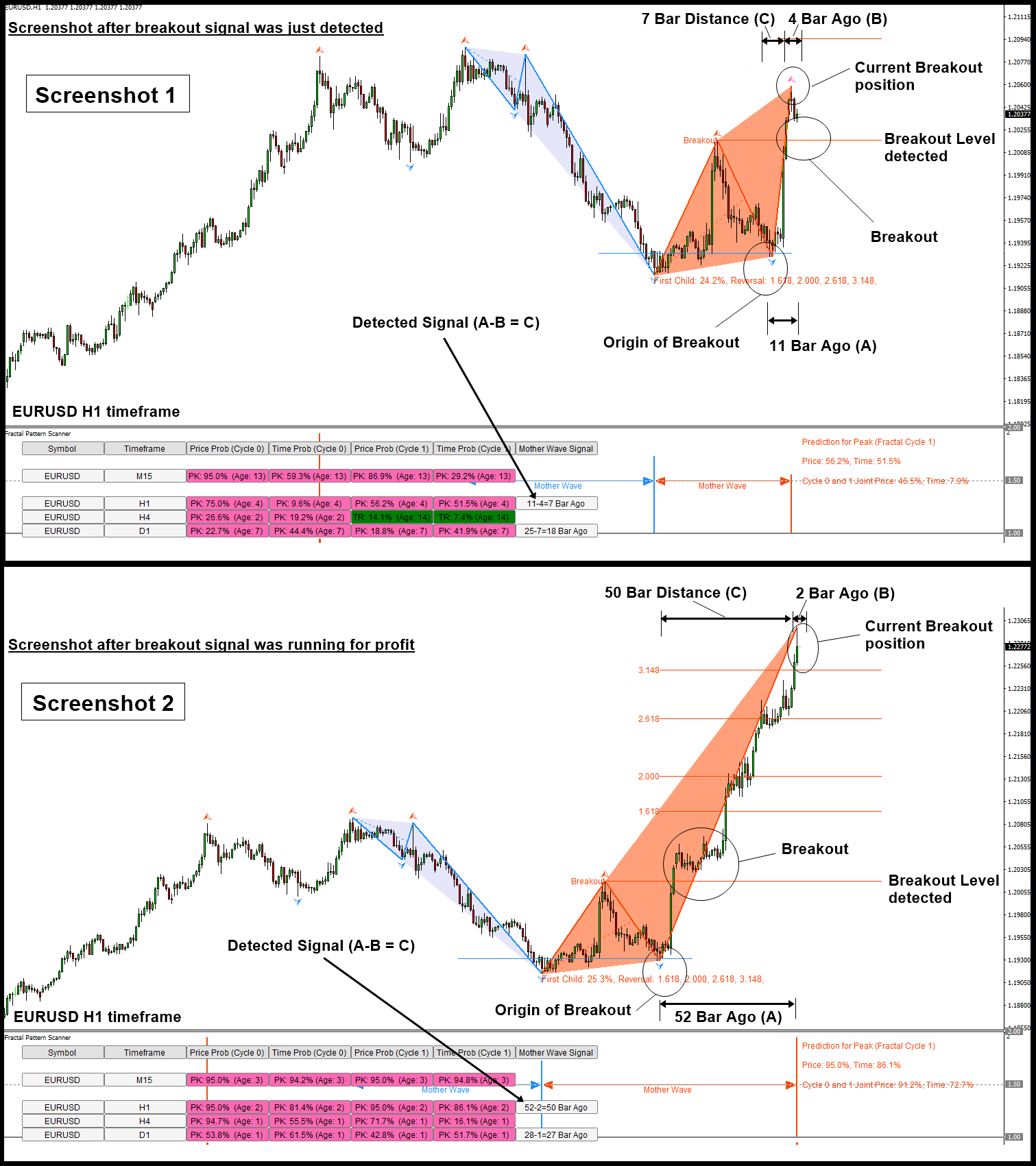

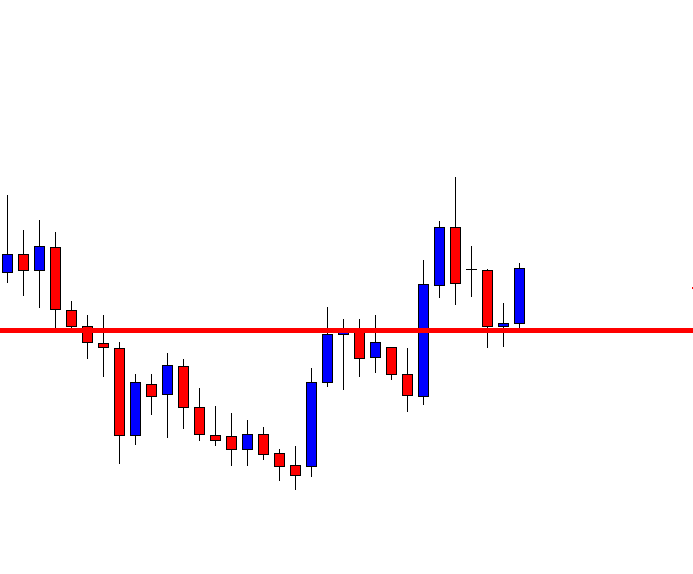

The abc pattern is one of the most consistent trading patterns in the financial market. A leading indicator that helps determine where when to enter and exit a trade. The ab cd pattern is easy to identify on charts and consists of 2 equivalent price legs.

A visual geometric price time pattern comprised of 3 consecutive price swings or trends it looks like a lightning bolt on price chart. The abcd pattern ab cd is one of the classic chart patterns which is repeated over and over again. This is a daily chart.

The abcd pattern shows perfect harmony between price and time and is also referred to as measured moves. One of the things that most traders do not realize is that you will have an opportunity to not only trade the entire abc pattern but a vast majority of the time you will be as or more profitable. It offers an excellent risk reward as well as a high winning percentage.

123 s occur at the end of trends and swings and they are an indication of a change in trend.

:max_bytes(150000):strip_icc()/dotdash_Final_Make_Money_With_the_Fibonacci_ABC_PatternJan_2020-5d08cd44eaea4ae192e08c1f68758b8f.jpg)

.png)